China Selling U.S. Treasuries: A New Trend Emerging

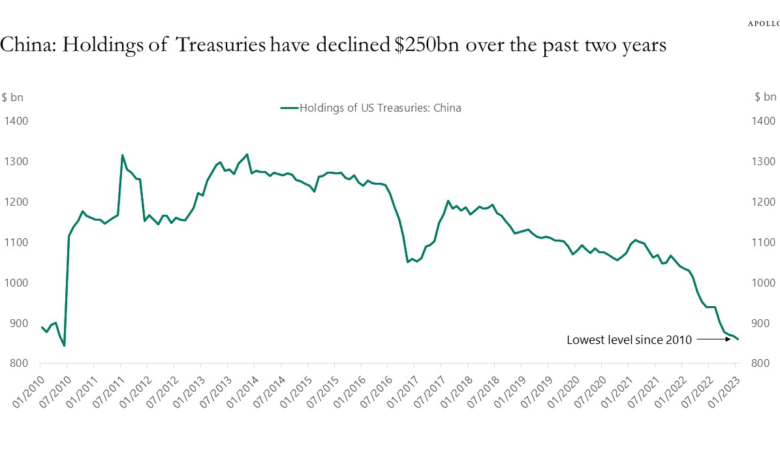

In recent months, China selling U.S. Treasuries has captured the attention of analysts and investors alike, particularly as it marks a significant decline in China U.S. Treasury holdings. The latest data reveals that China’s investments in U.S. debt have plummeted to their lowest level since March 2009, now totaling $756.3 billion, amidst the uncertainties of a changing global economic landscape. This trend of divestment aligns with a broader Chinese debt strategy influenced by the ongoing trade war impact, suggesting a recalibration of foreign investment in U.S. debt as tensions rise. The reduction in U.S. Treasury holdings, highlighted by a nearly $19 billion cut in March, raises concerns about the ramifications for the U.S. debt crisis and its implications on the global market. As the situation continues to evolve, the implications of China’s actions on American fiscal health and international relations remain critical topics for discussion.

As the economic relationship between the two superpowers shifts, the focus on recent actions by China regarding American bonds becomes increasingly important. The maneuvering of Chinese assets indicates a strategic pivot away from traditionally held U.S. securities, reflecting evolving financial tactics in response to contemporary geopolitical stresses. This divestment is part of a broader narrative around global investment dynamics and how foreign entities, particularly those from China, adapt their portfolios to mitigate risks associated with U.S. financial products. A comprehensive understanding of this transition can illuminate the changing perceptions of perceived safety in U.S. debt amidst a backdrop of trade tensions and economic uncertainties. Observers are keenly analyzing whether this trend will alter the landscape of international finance and equity in the ongoing economic dialogue.

China’s Strategic Shift in U.S. Treasury Holdings

Recent reports reveal China has significantly reduced its U.S. Treasury holdings, bringing its total down to $756.3 billion. This reduction is noteworthy as it marks the lowest level of investments in U.S. debt since March 2009. The trend seems to be influenced by a variety of factors including ongoing trade tensions and the changing landscape of global finance. As the trade war persists, China’s decision to divest from U.S. treasuries raises questions about the effectiveness and stability of U.S. debt as a safe investment for foreign powers.

China’s strategy surrounding its U.S. Treasury holdings reflects a broader policy shift in its approach to foreign investments. Analysts suggest that by decreasing its reliance on American debt, the Chinese government aims to mitigate risks associated with potential retaliations from the U.S. regarding unfavorable trade negotiations. This move can be interpreted as part of a calculated approach to allocate resources towards more stable assets, such as commodities and gold, thereby diversifying China’s portfolio and reinforcing its economic resilience amid rising uncertainty.

Impact of Trade War on Foreign Investment in U.S. Debt

The ongoing trade war between the U.S. and China has had far-reaching impacts on foreign investment in U.S. debt. China’s gradual sell-off of U.S. Treasuries exemplifies a significant turning point in how foreign investors approach American securities. The trade policies introduced under the Trump administration have cast a shadow over the U.S. debt market, compelling investors to reconsider their exposure and portfolio strategies. This has resulted in a notable decline in the share of treasury issuance held by foreign buyers, dropping from 57% in 2008 to just 32% currently.

Such figures underscore a potential crisis of confidence regarding the U.S.’s capability in managing its debt amid economic fluctuations. With major players like China reducing their investments in U.S. Treasuries, it raises critical questions about the future of foreign support for American debt. This shift not only highlights the volatility of the current geopolitical climate but also indicates the increasing attractiveness of alternative investments within a diversifying global market.

The Role of China’s Debt Strategy in Global Markets

China’s approach to managing its U.S. Treasury holdings is an essential aspect of its broader debt strategy, which aims to minimize exposure to American financial markets while exploring more secure alternatives. By decreasing its treasury holdings, China is signaling its intent to navigate the complexities of global economics more prudently. Economic analysts have observed that the Chinese government is increasingly advocating for a transition towards investments that provide greater stability, which is particularly pertinent in the context of fluctuating trade relations with the U.S.

This strategy does not only reflect China’s desire to safeguard its financial interests but also demonstrates a shift in global economic power dynamics. As investors look for alternatives to U.S. debt, the implications extend beyond trade tensions to encompass a re-evaluation of how countries view and manage foreign investment. China’s movements within this arena may influence other nations’ strategies, particularly as they seek to balance risks associated with holding U.S. securities amidst a potential U.S. debt crisis.

Declining Trust in U.S. Debt Among International Investors

The consistent decline in foreign investment in U.S. Treasuries, particularly from China, reveals a growing distrust among international investors in the U.S. government’s handling of its escalating debt crisis. Following decades of steady foreign investment, the current trend illustrates not just a reaction to trade policies but a fundamental reassessment of the inherent risks attached to U.S. debt. This loss in confidence is palpable, especially given the potential repercussions if the U.S. fails to manage its fiscal responsibilities effectively.

As countries reevaluate their portfolios in light of changing geopolitical dynamics, the implication of reduced foreign participation in the U.S. debt market may lead to increased volatility. Investors may seek to allocate resources to other regions or sectors perceived as more stable, reflecting a broader shift in the global economic landscape. The full ramifications of this trend may not emerge immediately, but the current trajectory indicates that significant changes are on the horizon for both the U.S. economy and its position in the world.

Long-Term Implications of China’s U.S. Treasury Divestment

China’s recent actions in selling off portions of its U.S. Treasury holdings may signal longer-term shifts not only in its investment strategies but also in global financial practices. As China reduces its stakes in American debt, it might be setting precedents for other countries looking to diversify their investment portfolios away from U.S. securities. This could ultimately reshape the landscape of international finance, as countries seek to hedge against potential risks tied to U.S. policies and economic performance.

Moreover, the ongoing adjustments in China’s approach to U.S. Treasuries carry implications for global markets. If more nations follow suit, U.S. debt could face mounting pressure, potentially leading to increased borrowing costs for the American government. The longevity of these trends, and their impact on the status of the dollar as the world’s reserve currency, will depend significantly on how the U.S. navigates its economic policies and international relations moving forward.

Analyzing Chinese Analysts’ Perspectives on U.S. Debt

Chinese analysts have been vocal about the need for a strategic shift away from U.S. Treasury holdings, advocating for diversification into safer commodities like gold. Their insights provide a crucial lens through which to understand the motivations behind China’s recent reductions in American debt. Many analysts emphasize the importance of creating a more balanced investment landscape that minimizes exposure to risks associated with U.S. economic fluctuations and political decisions.

The sentiment among these analysts reflects broader concerns regarding the stability of U.S. debts amid current trade tensions. Their critiques suggest a strategic understanding of the changing investment climate and underline the need for a more robust Chinese debt strategy that prioritizes safety and resilience over traditional reliance on U.S. treasuries. Such perspectives contribute to the growing discourse on the necessity of adapting financial strategies to ensure long-term security in an unpredictable global economy.

Exploring the Relationship Between Trade War and Foreign Debt Dynamics

The intersection between the U.S.-China trade war and the dynamics of foreign debt is crucial for understanding the current financial landscape. As tariffs and trade barriers escalate, foreign investors are reconsidering their engagements in U.S. debt markets, reflecting the inherent risks tied to political decisions. This recalibration is particularly evident in China’s approach to its U.S. Treasury holdings, emphasizing a need to react to changing trade policies that could impact economic stability.

As the trade war continues, the repercussions on foreign investment patterns may lead to a reallocation of investments across borders. Investors may seek to shift funds to markets perceived as more stable, and in doing so, could contribute to a significant transformation in international financial relations. Thus, the ongoing tensions not only affect trade but are intricately linked to the broader framework of global finance, particularly concerning how nations manage their foreign debt portfolios.

Future Prospects of U.S. Treasuries in a Evolving Economic Climate

Looking ahead, the future of U.S. Treasuries may be dictated by a combination of domestic economic policy responses and international investor sentiments. As countries like China adjust their holdings, the implications for the U.S. debt market could be profound, potentially reshaping the landscape of global finance. The question remains whether the U.S. can regain trust among its foreign investors and maintain its preeminent position in the structured debt market.

If trends continue, the U.S. may have to contend with increased borrowing costs and a shrinking foreign base in the treasury market. Such changes could lead to a reevaluation of U.S. fiscal strategies and trade policies, all of which could intersect in complex ways as nations jockey for economic stability in a more competitive global environment. The long-term viability and attractiveness of U.S. treasuries are tied directly to these evolving economic relations and the outcomes of ongoing trade negotiations.

Frequently Asked Questions

Why is China selling U.S. Treasuries at this time?

China is selling U.S. Treasuries largely due to ongoing trade tensions and the impact of U.S. trade policies. The recent decline in Chinese holdings reflects a strategic shift, as analysts suggest diversifying away from U.S. debt to mitigate exposure to potential risks.

What are the implications of China reducing its U.S. Treasury holdings?

The reduction of China’s U.S. Treasury holdings could signal a lack of confidence in U.S. debt management and may affect global perceptions of the dollar’s stability. It also indicates a potential shift in investment strategies as China reallocates resources to safer assets.

How does the trade war impact China’s U.S. Treasury strategy?

The trade war has directly influenced China’s U.S. Treasury strategy, leading them to reconsider their significant investment in American debt. As tensions rise, China appears to be reducing its holdings, reflecting concerns over economic retaliation and U.S. policy unpredictability.

What does the decline in China’s U.S. Treasury holdings mean for the U.S. debt crisis?

China’s decline in U.S. Treasury holdings may exacerbate the U.S. debt crisis by reducing foreign investment, which historically has supported American borrowing. A decrease in demand from a major holder like China could lead to increased borrowing costs and concerns over the sustainability of U.S. debt.

How has China’s debt strategy changed amid economic pressures?

Amid economic pressures and trade tensions, China’s debt strategy has shifted towards diversification, moving away from U.S. Treasuries to invest in more stable assets like gold. This strategic pivot aims to shield the economy from potential risks associated with U.S. debt.

What does it mean for China to hold $756.3 billion in U.S. Treasuries?

Holding $756.3 billion in U.S. Treasuries means China remains one of the largest foreign investors in U.S. debt, despite recent reductions. This significant amount indicates China’s ongoing reliance on U.S. securities, although the trends suggest a cautious reevaluation of this strategy.

How have U.S. debt management issues affected foreign investment, particularly from China?

U.S. debt management issues, particularly those stemming from political uncertainties and trade disputes, have led to a decline in foreign investment, especially from China. As trust in the U.S. government’s ability to manage debt diminishes, foreign entities are reconsidering their investment strategies, leaning more towards local buyers.

What trends are emerging from China’s selling of U.S. Treasuries?

Emerging trends from China’s selling of U.S. Treasuries include a pattern of divestment over several months, indicating a strategic shift towards reducing U.S. exposure. Analysts suggest this could lead to a further decline in foreign investment in American debt if the trend continues.

What advice are Chinese analysts giving regarding U.S. Treasury investments?

Chinese analysts are advising a diversification of investments away from U.S. Treasuries towards more stable and less risky assets, such as gold and other commodities. This strategy is aimed at reducing exposure to the volatility associated with U.S. debt.

What does the decline in foreign ownership of U.S. Treasuries indicate?

The decline in foreign ownership of U.S. Treasuries, which has dropped from 57% in 2008 to 32%, indicates growing distrust in U.S. fiscal policies and raises concerns about the future stability of the dollar and its role as a global reserve currency.

| Key Point | Details |

|---|---|

| China’s Treasury Holdings | China has reduced its U.S. Treasury holdings to $756.3 billion, the lowest since March 2009. |

| Trend of Selling | This is the third consecutive month of declines in China’s U.S. Treasury holdings. |

| Impact of U.S. Trade Policies | U.S. trade policies under the Trump administration have negatively affected China’s engagement with U.S. debt. |

| Rank of Holders | China has fallen to third place among the largest holders of U.S. Treasuries, behind Japan and the U.K. |

| Recent Sales | In March, China sold nearly $19 billion and in April, $8.2 billion of its U.S. debt. |

| Reasons for Selling | The divestment might indicate a policy shift due to risks associated with trade negotiations. |

| Diversification Strategy | Chinese analysts recommend diversifying away from U.S. assets to safer commodities like gold. |

| Changing Investor Dynamics | Foreign ownership of U.S. Treasuries has decreased, indicating erosion of trust in U.S. debt management. |

Summary

China selling U.S. Treasuries reflects a significant shift in its investment strategy, as recent data highlights a decline in holdings to $756.3 billion, the lowest level in over a decade. This trend, marked by a continuous decrease for three months, raises concerns about the long-term implications for U.S. debt. While some analysts downplay the impact of these changes, the ongoing trade tensions and shifts in foreign investment strategies suggest that China is reevaluating its approach to U.S. securities. The selling activity, driven by U.S. trade policies and a desire for asset diversification, indicates that even though China maintains a considerable amount of U.S. debt, a new financial strategy is emerging amidst escalating global economic uncertainties.