China Tourism Trends: Morgan Stanley Highlights Growth Potential

China tourism trends are gaining momentum as foreign visitors return to the nation in increasing numbers, a change that has captured the attention of analysts and investors alike. A recent report by Morgan Stanley highlights how inbound tourism growth could propel China’s tourism revenue forecasts to exceed $2 trillion over the next decade. This revival is largely fueled by a surge in interest from global travelers, facilitated by relaxed travel restrictions and expanded visa-free access. Coupled with the emergence of Chinese airlines like Air China, which is poised to benefit significantly from this influx, the tourism landscape in China appears more promising than ever. As international demand for travel to China increases, stocks related to the tourism sector, particularly in aviation, are becoming hot topics for investors, reflecting optimism in a market that continues to evolve post-pandemic.

Exploring the recent resurgence in travel to China reveals an exciting period for the sector, as the nation invites a wave of international tourists back. The revival of inbound travel, spurred by the easing of restrictions and the adaptation of services, indicates a stronger future for travel-related revenues. Analysts are optimistic about the impact of this influx on the domestic airline scene, with companies like Air China set to gain from heightened tourist activity. Furthermore, enhanced payment systems and tourist-friendly services are making the country more accessible than ever to overseas visitors. With projections suggesting substantial growth in tourism revenue, it’s clear that China’s tourism dynamics are shifting towards a more favorable outlook.

Emerging Trends in China Tourism

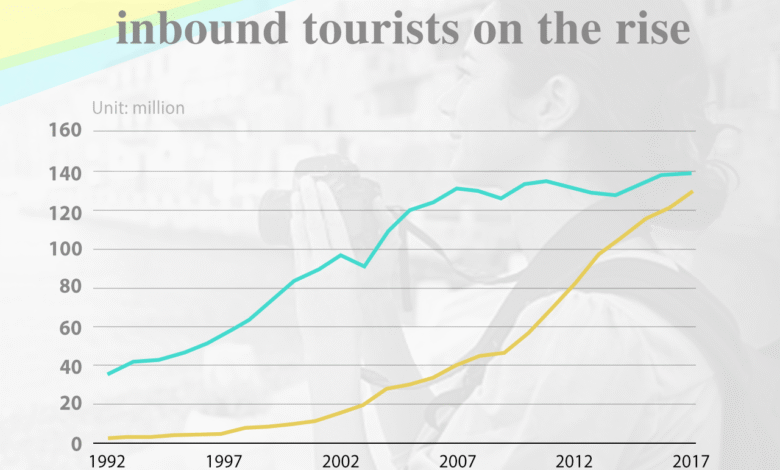

The tourism landscape in China is witnessing a significant transformation as international travel resumes following the pandemic. Analysts from Morgan Stanley project that inbound tourism revenue could reach a staggering $2 trillion over the next decade, marking a sharp recovery and a surge in travel-related activities. This rebound is particularly evident in the first quarter of 2023 when China recorded its highest influx of inbound tourists in years, indicating a long-awaited revival of interest in the country’s rich cultural heritage and diverse attractions.

Moreover, the return of foreign tourists is closely tied to recent policy changes that streamline travel to China. The implementation of visa-free travel for citizens of over 30 European nations and select areas in Asia and Latin America enhances accessibility, making China a more attractive destination. Additionally, the transition towards better payment systems for international credit card users signifies a commitment to improving the travel experience for foreign visitors, which is expected to further boost inbound tourism growth.

Chinese Airlines and Tourism Recovery

As inbound tourism surges, the Chinese airline industry stands poised for substantial growth, particularly firms like Air China, which Morgan Stanley identifies as a strong investment opportunity. The airline sector benefits directly from increased travel, as more international travelers means more flights and enhanced capacity utilization. With the gradual easing of restrictions and renewed public confidence in travel, airlines are likely to see a significant uptick in passenger numbers, which have already surpassed pre-pandemic levels by June 2023.

The optimism around Chinese airlines is further backed by a favorable supply-demand dynamic that promises to enhance profit margins. Analysts at Morgan Stanley maintain a positive outlook on airline stocks due to the expected shift in international travel demand, despite ongoing challenges in the domestic market. This dual-focus approach not only positions these airlines for recovery in a competitive landscape but also signals a broader economic revival linked to the tourism sector.

Visa Policies and International Travel

The recent changes in visa policies represent a crucial component driving the recovery of inbound tourism in China. The expansion of visa-free travel options for tourists from various regions is pivotal in attracting foreign visitors, fulfilling their eagerness to explore China’s unique culture and attractions. The convenience of traveling without the burden of acquiring a visa also encourages spontaneous travel decisions, which are essential in tapping into international tourist markets.

Furthermore, as more countries begin to reintegrate into global tourism dynamics, China’s strategic adjustments in its visa policies and entry requirements position it favorably among competing destinations. With the facilitation of transit arrangements for U.S. citizens as well, expectations are set for robust tourist inflows. Such developments indicate that China is not just passively awaiting tourism’s return but actively crafting policies aimed at revitalizing its tourism economy.

Regional Events Stimulating Inbound Tourism

The recurrence of regional events and conferences in China is playing a vital role in stimulating inbound tourism as well. Recent gatherings, such as the participation of teams from 16 countries at the World Humanoid Robot Games in Beijing, mark a significant return to pre-pandemic business activities that drew international attention. These events not only position China as a hub for innovation and collaboration but also facilitate travel among international delegates, thereby increasing tourist numbers.

Organizations that once hesitated to convene in China are now find these opportunities appealing, leading to a vibrant influx of visitors for business and leisure events. This trend not only enriches the tourism revenue forecasts but also helps in reinforcing China’s status as a global destination for conferences and exhibitions, fostering an environment that encourages both cultural understanding and economic growth.

Long-Term Tourism Revenue Forecasts

Morgan Stanley’s projections for China’s inbound tourism revenue suggest an optimistic future, forecasting that it could contribute significantly to the country’s GDP. The analysts anticipate that by 2034, international visitors could help raise China’s share of the global tourism market to 6%, up from just 2.4% in 2019. This ambitious outlook illustrates the potential for a robust recovery, one that could reshape the economic landscape not just for tourism, but for related industries such as retail, hospitality, and transportation.

However, analysts caution that while recovery is underway, China’s inbound tourism revenue still has a considerable distance to travel to completely restore pre-pandemic levels. With expenditures by international visitors projected at only 0.5% of China’s GDP in 2024, businesses and policymakers must strategize to enhance the country’s appeal globally and implement initiatives that encourage longer stays and higher spending among foreign tourists.

The Role of Technology in Enhancing Travel Experience

The integration of technology has become a pivotal factor in improving travel experiences and accommodating the needs of international visitors in China. Following the pandemic, enhancements to mobile payment systems have made significant strides in easing transactions for tourists. The adaptation of services to accept international credit cards through well-known mobile apps like WeChat Pay and Alipay exemplifies a shift towards greater convenience, indicating that China is taking significant steps to be more welcoming to inbound tourists.

Further technological advancements are likely to play a key role in promoting China’s tourism sector. Increased online marketing, virtual tours, and comprehensive travel guides accessible through mobile devices can enhance tourists’ understanding of local attractions, fostering a sense of accessibility and excitement about visiting. Furthermore, as airlines and hospitality services adopt these technologies, they can provide tailored experiences that cater specifically to the preferences of visiting tourists, thereby enhancing overall satisfaction and encouraging repeat visits.

Capitalizing on Global Trends in Tourism

As global travel trends continue to evolve, China’s tourism sector remains well-positioned to capitalize on such changes. The rise of dual-purpose travel, where individuals seek both leisure and business opportunities, aligns perfectly with the burgeoning offerings within China. Events that cater to both interests can attract a diverse range of international visitors, further promoting the country’s rich offerings and unique cultural experiences.

Morgan Stanley’s analysis highlights the need for stakeholders within the tourism industry to remain attuned to these global shifts, ensuring they adapt strategies accordingly. The positive forecasts for tourism revenue underscore the importance of embracing innovation and enhancing infrastructure to meet the needs of global travelers. By doing so, China can solidify its position as a key player in the worldwide tourism arena.

Investment Opportunities in the Airline Sector

Investing in the airline sector represents a focal point for wealth generation in response to China’s burgeoning tourism revival. Companies like Air China are trending upward as consumer confidence grows and international travel demand increases. Investors looking to capitalize on this trend can benefit from Morgan Stanley’s insights, which advocate for selective investments that lean into the anticipated upward trajectory of the airline industry as it adjusts to meet the needs of a growing influx of tourists.

Moreover, as airlines prepare to expand their capacities to accommodate post-pandemic demands, there may be further growth prospects for investors. Understanding the market dynamics, including competitive positioning and international partnerships, can enhance investment strategies focused on Chinese airlines. The combination of a robust tourism recovery and strategic airline growth presents a compelling narrative for investment in the evolving landscape of international travel.

Overcoming Challenges in Domestic Demand

Despite the promising outlook for inbound tourism, challenges within the domestic market remain pertinent. The aviation sector, while thriving on international demand, continues to face headwinds due to fluctuating domestic travel patterns. Analysts emphasize the need for an integrated approach where both international tourism growth and domestic travel strengths can coexist and support each other, creating a more stable environment for growth.

Additionally, the focus should be on developing robust marketing campaigns that appeal to local travelers while ensuring that international tourists feel welcomed and engaged. By addressing these dual requirements, China can bolster overall tourism revenues and build a resilient system capable of weathering both international market fluctuations and domestic demands.

Frequently Asked Questions

What are the latest trends in inbound tourism growth in China?

Recent trends in inbound tourism growth in China indicate a significant resurgence, particularly after the country fully reopened to foreign visitors in January 2023. Analysts at Morgan Stanley predict that this growth could lead to industry revenues reaching at least $2 trillion over the next decade, highlighting an optimistic outlook for tourism revenues and increased international traffic.

How are Chinese airlines expected to benefit from the resurgence in China tourism trends?

Chinese airlines are likely to benefit immensely from the resurgence in China tourism trends as the demand for international travel increases. With a notable growth in the number of inbound tourists surpassing pre-COVID levels, analysts believe that airlines such as Air China are well-positioned to capitalize on the favorable supply dynamics in the industry, enhancing profit margins and overall service capacity.

What are Morgan Stanley’s forecasts for China’s tourism revenue over the next decade?

According to Morgan Stanley’s analysis, tourism revenue in China is forecasted to reach at least $2 trillion over the next decade, fueled by improved inbound tourism growth and an increasing number of international arrivals that continue to rebound significantly.

How has visa policy impacted inbound tourism growth in China?

The recent implementation of visa-free travel programs for travelers from over 30 European countries, as well as certain regions in Asia and Latin America, has positively impacted inbound tourism growth in China. This policy change, along with the lifting of quarantine requirements, has made China a more accessible destination, encouraging a greater influx of tourists.

What role do regional events play in boosting China’s tourism trends?

Regional events and conferences are playing a crucial role in boosting China’s tourism trends. With an increase in international events taking place in mainland China, including conferences attended by global organizations, there is a notable uptick in foreign visitors, which contributes to the overall growth in inbound tourism.

Which stocks are being favored by analysts in light of China’s emerging tourism trends?

Analysts at Morgan Stanley have identified Air China stock as a top pick to capitalize on China’s emerging tourism trends, highlighting that the state-owned carrier is expected to benefit from the expected surge in international travel and improved profit margins.

How does China’s tourism revenue for international visitors compare to pre-pandemic levels?

China’s tourism revenue from international visitors currently represents 0.5% of GDP in 2024, which is significantly lower than the pre-pandemic figure of 1%. This indicates that while recovery is underway, there is still considerable growth potential to reach pre-COVID tourism revenue levels.

What is the significance of Morgan Stanley’s confidence in China’s inbound travel growth?

Morgan Stanley’s increased confidence in China’s inbound travel growth is significant as it reflects a robust analysis of market conditions, suggesting that the strategies being implemented—such as improved payment methods and relaxed travel restrictions—will effectively stimulate international tourism.

How might foreign travelers adapt to payment systems in China as tourism grows?

As tourism in China grows, foreign travelers are expected to adapt to local payment systems due to the facilitation of international credit card transactions through popular mobile payment apps like WeChat and Alipay, catering to a wider demographic of international visitors.

| Key Point | Description |

|---|---|

| Return of Foreign Tourists | Increased inbound travel to China following the pandemic, with expectations of reaching industry revenue of $2 trillion over the next decade. |

| Visa-Free Travel Expansion | China has implemented visa-free travel for citizens from over 30 countries, contributing to increased tourist influx. |

| Mobile Payment Innovations | Enhancements in payment systems allowing international credit cards to be used enhance the travel experience for foreigners. |

| Increased Airline Patronage | With more foreign travelers, airlines like Air China are poised to benefit significantly from the recovery in international travel. |

| Regional Events Boosting Tourism | A rise in conferences and regional events helps to attract international visitors back to China. |

| Future Growth Potential | By 2034, analysts predict an increase in global market share for China’s tourism from 2.4% to 6%. |

Summary

China tourism trends are witnessing a remarkable resurgence as foreign tourists return in increasing numbers, bolstered by initiatives like visa-free travel and enhanced mobile payment solutions. Despite still recovering from pre-pandemic levels, forecasts highlight a promising growth trajectory over the next decade, positioning China as a significant player in the global tourism market.