Cleveland Federal Reserve: Hammack on Inflation and Interest Rates

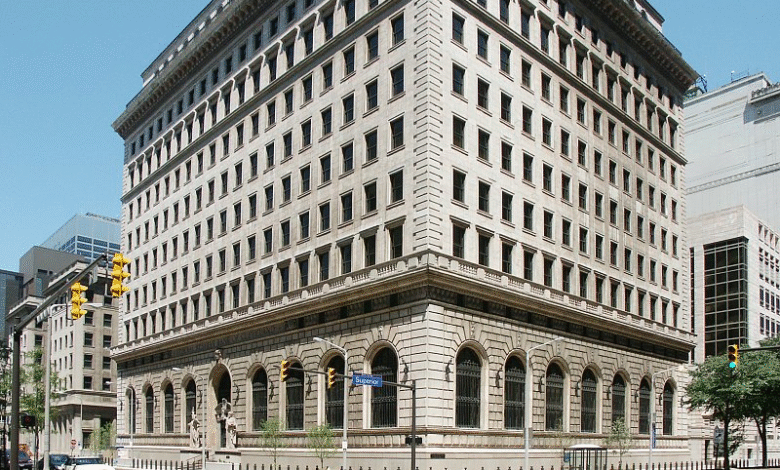

The Cleveland Federal Reserve plays a critical role in shaping the economic landscape of the United States, especially as it navigates the complexities of inflation control and interest rates. President Beth Hammack has voiced her apprehensions about lowering interest rates amidst persistent inflationary threats. In a recent CNBC interview, she emphasized the dangers of an overly accommodative monetary policy, which could lead to renewed inflation pressures. This caution is especially relevant now, as Fed Chair Jerome Powell has hinted that current economic conditions “may warrant” some easing of policy. By maintaining a careful stance, the Cleveland Federal Reserve aims to balance economic growth with the imperative of keeping inflation in check, a challenge that Hammack believes requires a thoughtful approach to monetary policy.

In the heart of the United States’ monetary system, the Federal Reserve Bank of Cleveland is instrumental in influencing financial conditions across the nation. Recently, the bank’s President, Beth Hammack, has expressed significant reservations regarding any potential interest rate reductions, particularly in light of ongoing inflation concerns. Her insights point to the broader theme of economic stability as policymakers grapple with the fine line between stimulating growth and controlling rising prices. Moreover, these discussions occur against the backdrop of comments from the Fed’s chair, Jerome Powell, suggesting possible changes to monetary policy. As the Cleveland Fed remains vigilant in its mission, Hammack’s commitment to a restrictive policy stance highlights the complexities of navigating today’s economic challenges.

Cleveland Federal Reserve’s Stance on Interest Rates

The Cleveland Federal Reserve’s President Beth Hammack recently expressed a cautious approach regarding potential interest rate cuts amidst persistent inflation concerns. During her interview with CNBC, Hammack emphasized the potential risks associated with lowering interest rates too soon, stressing that it could accidentally reignite inflationary pressures that have lingered for several years. This viewpoint starkly contrasts with some market expectations, where there is growing anticipation for rate reductions, particularly after Fed Chair Jerome Powell hinted that current conditions might warrant policy easing. Hammack’s comments reflect a broader discomfort within the Fed regarding a return to accommodative monetary policies.

Hammack’s focus on maintaining a restrictive monetary policy stems from a clear understanding of the current economic landscape, where inflation rates remain uncomfortably high. She pointed out that the Fed has been above its inflation target for four consecutive years, highlighting the urgency to address this situation decisively. By maintaining a cautious stance and not rushing into cutting rates, Hammack aims to ensure that inflation is brought under control before any accommodative measures are entertained. Her perspective underscores the delicate balance that the Cleveland Federal Reserve seeks to achieve in its monetary policy.

Inflation Control and the Role of the Fed

Inflation control remains a top priority for the Federal Reserve, and Cleveland Fed President Beth Hammack is at the forefront of these efforts. With inflation rates trending upward, her commitment to not lowering interest rates reflects a strategic approach to monetary policy that prioritizes long-term stability over short-term relief. By keeping the benchmark funds rate within its current range of 4.25%-4.5%, Hammack supports a framework that aims to restore inflation to target levels while safeguarding the economy against potential volatility.

The Federal Reserve’s broader strategy involves careful monitoring of economic indicators and maintaining a steady course to counteract inflation. Hammack’s stance aligns with the viewpoints of other Fed officials, including Powell, who advocate for a measured approach. This method entails remaining vigilant against inflationary trends while providing the necessary support to ensure a resilient economic recovery. Acknowledging her role in shaping future monetary policy, Hammack has expressed confidence that her insights will contribute to achieving the Fed’s mandates effectively.

Monetary Policy Insights from Beth Hammack

Beth Hammack’s insights into monetary policy offer a glimpse into the strategic thinking at the Cleveland Federal Reserve. Her recent declaration that her view of the ‘neutral’ interest rate is higher than the consensus among her colleagues highlights her independent analysis of current economic conditions. By advocating for a carefully calibrated monetary stance, Hammack illustrates the complexities involved in navigating the challenging landscape of inflation and growth. This perspective emphasizes that a rigid adherence to the minimum of interest rate cuts could jeopardize the hard-fought stability the Fed has worked to achieve.

Furthermore, Hammack’s awareness of her non-voting status this year adds a layer of intrigue to her comments. Though she may not directly influence the immediate decisions made by the Federal Open Market Committee, her proactive engagement in the discourse around interest rates and inflation showcases her commitment to guiding future policies. Her emphasis on maintaining a restrictive stance will likely resonate with her peers as they consider the implications of their decisions in the coming years, particularly as she prepares to take on a voting role in 2026.

Implications for Future Monetary Policy Decisions

The implications of Hammack’s cautious approach to monetary policy will undoubtedly play a critical role in shaping the future direction of the Federal Reserve. As economic data continues to fluctuate and inflation remains a pressing issue, Hammack’s insistence on maintaining a restrictive policy underscores the importance of addressing inflation head-on rather than yielding to market pressures for rate cuts. This approach will require collaboration with other Fed officials and a steadfast commitment to data-driven decision-making.

As the Cleveland Federal Reserve navigates this complex economic environment, Hammack’s insights will likely serve as a touchstone in ongoing discussions about interest rates and inflation control. By advocating for rigorous analysis and restraint, she contributes to a more stable foundation for the economy, emphasizing that any shifts in monetary policy must be carefully measured to avoid unintended consequences that could arise from overly accommodative measures.

The Relationship Between Inflation and Interest Rates

Understanding the relationship between inflation and interest rates is crucial for policymakers, as fluctuations in these areas can directly affect the economy’s health. President Beth Hammack of the Cleveland Federal Reserve highlights this connection, illustrating how lower interest rates can inadvertently provide fuel to rising inflation. The idea is rooted in the concept of demand: when borrowing costs decline, consumer spending may surge, leading to higher demand for goods and services, which can exacerbate existing inflation issues.

Conversely, raising interest rates typically helps temper inflation by reducing spending and borrowing. Hammack’s reluctance to lower rates reflects an awareness of the potential repercussions on inflation control. By advocating for a cautious approach, she emphasizes the necessity of keeping interest rates at a level that supports economic growth without reigniting inflationary pressures. This careful balancing act is essential in ensuring long-term economic stability.

Market Reactions to Fed’s Interest Rate Policies

Market reactions to the Federal Reserve’s interest rate policies are closely monitored and can reflect broader economic sentiment. Following comments from Fed Chair Jerome Powell, there has been a notable shift in traders’ expectations, with futures markets indicating a strong possibility of rate cuts in the near term. However, Cleveland Fed President Beth Hammack’s stance complicates these market predictions, as her cautious approach suggests that the Fed is not yet ready to embrace a more accommodative monetary policy.

This divergence in perspectives presents a fascinating dynamic between market participants and policymakers. While investors may celebrate the prospect of lower rates, Hammack’s emphasis on controlling inflation urges a more prudent evaluation of economic fundamentals before making such decisions. Her viewpoint serves as a reminder that the Fed’s ultimate goal is to achieve sustainable economic growth rather than immediate market gratification.

Inflation Trends and Future Predictions

Current trends in inflation pose significant challenges for economists and policymakers alike. President Beth Hammack’s observations regarding the ongoing inflationary pressures resonate deeply within the financial community as they suggest a persistent issue that must be addressed before any monetary policy shifts can take place. Her proactive comments indicate that mere speculation about rate cuts without a solid basis in economic data could be detrimental to stabilizing inflation.

Looking ahead, the Fed’s policies will likely need to evolve in response to both inflation trends and economic recovery rates. Hammack’s focus on maintaining a modestly restrictive policy stance reflects an understanding of the complexities involved. As she prepares for her voting role in upcoming committees, her insights will be pivotal in determining how the Fed navigates future challenges, aiming to achieve the delicate balance of promoting growth while keeping inflation in check.

Challenges Ahead for the Federal Reserve

The Federal Reserve faces numerous challenges ahead as it seeks to navigate a landscape fraught with economic uncertainties. The contrasting views within the Fed regarding interest rate policies, especially between figures like Fed Chair Jerome Powell and Hammack, highlight the complexity of decision-making in a volatile economic climate. Hammack’s comments about inflation underline the critical need for a unified approach, particularly in an era where inflationary pressures have not only returned but show signs of persistence.

Moreover, as she looks to take on a voting role in the Federal Open Market Committee within the next few years, Hammack’s cautious approach towards interest rates positions her as a key figure in shaping the Fed’s future. Her commitment to inflation control is crucial in ensuring that the Fed remains vigilant and responsive to changing economic conditions, ultimately aiming for a sustainable and equitable growth trajectory for the economy.

Beth Hammack’s Influence on the Fed’s Future

Beth Hammack’s influence on the Federal Reserve cannot be understated, especially as she prepares for a voting role in 2026. Her commitment to maintaining a cautious approach to monetary policy and her focus on inflation control position her as a significant voice in the ongoing discussions surrounding interest rates. Her insights provide a foundation for future policy decisions that prioritize long-term economic stability over short-term gains.

As the Cleveland Federal Reserve continues to engage with complex economic dynamics, Hammack’s emphasis on a restrictive policy stance reinforces the importance of data-driven decision-making. Her perspectives should take center stage as the Fed navigates forthcoming challenges, ensuring that inflation is kept at bay while fostering an environment conducive to sustainable growth.

Frequently Asked Questions

What is the stance of Cleveland Federal Reserve President Beth Hammack on lowering interest rates?

Cleveland Federal Reserve President Beth Hammack has expressed hesitation about lowering interest rates as long as inflation remains a threat. In her recent remarks, she emphasized the need for a cautious approach to monetary policy to avoid reinvigorating inflationary pressures.

How does Beth Hammack’s view on interest rates compare to Fed Chair Jerome Powell’s comments?

While Fed Chair Jerome Powell indicated that current conditions may warrant easing policy, Beth Hammack disagrees with the market’s enthusiasm for a rate cut. She is concerned about high inflation and advocates for maintaining a modestly restrictive monetary policy.

Why is Beth Hammack concerned about inflation control at the Cleveland Federal Reserve?

Beth Hammack is focused on controlling inflation because it has remained above target levels for an extended period. She believes that it is crucial to maintain a restrictive policy stance to ensure that inflation is brought back to target levels.

What is the current interest rate range set by the Cleveland Federal Reserve?

As of now, the Cleveland Federal Reserve has maintained its benchmark funds rate in a range between 4.25% and 4.5% since December 2024, reflecting a cautious approach to managing inflation through monetary policy.

When will Beth Hammack be a voting member of the Federal Open Market Committee?

Beth Hammack will become a voting member of the Federal Open Market Committee in 2026. Until then, she continues to influence discussions around interest rates and inflation control at the Cleveland Federal Reserve.

How does Beth Hammack’s perception of the neutral interest rate differ from her Fed colleagues?

Beth Hammack believes that her view of the ‘neutral’ interest rate is higher than that of most of her Federal Reserve colleagues. This perspective influences her cautious stance on monetary policy and interest rate adjustments.

What impact do current inflation trends have on the Cleveland Federal Reserve’s monetary policy?

Current inflation trends play a significant role in shaping the Cleveland Federal Reserve’s monetary policy. With inflation trending upward, President Beth Hammack is committed to maintaining a restrictive policy stance to bring inflation back under control.

What is the significance of the relationship between interest rates and inflation control at the Cleveland Federal Reserve?

The relationship between interest rates and inflation control is critical at the Cleveland Federal Reserve, as higher interest rates are used as a tool to curb inflation. Beth Hammack’s cautious approach emphasizes the importance of not becoming overly accommodative, which could exacerbate inflationary pressures.

| Key Point | Details |

|---|---|

| Cleveland Fed President’s Stance | Beth Hammack is hesitant to lower interest rates due to ongoing inflation threats. |

| Inflation Concern | Hammack highlighted that inflation remains too high and is trending upward, necessitating a cautious approach. |

| Monetary Policy Position | She advocates for maintaining a modestly restrictive policy to control inflation. |

| Interest Rate Context | The current Fed funds rate is between 4.25%-4.5% and has not changed since December 2024. |

| Future Predictions | Despite Powell’s hints towards easing policy, Hammack does not support immediate rate cuts, differing from market expectations. |

| Other Federal Reserve Perspectives | Kansas City Fed President Jeffrey Schmid shares skepticism about rate cuts, reinforcing the cautious stance within the Fed. |

Summary

The Cleveland Federal Reserve, represented by President Beth Hammack, underscores the complexities and risks associated with the current inflation environment. Despite speculation about potential interest rate cuts following recent comments from Fed Chair Jerome Powell, Hammack advocates for a careful and restrained approach to monetary policy. Her commitment to keeping rates steady until inflation is fully under control reflects a broader cautious sentiment within the Federal Reserve, as echoed by other leaders like Kansas City Fed President Jeffrey Schmid. As the Fed navigates these challenging economic waters, the focus remains on achieving and maintaining inflation targets.