Coinbase FOIA Documents Expose Hidden US Crypto Regulations

Coinbase FOIA documents have recently become a focal point in the ongoing debate surrounding government crypto regulation, unveiling over 10,000 pages that illuminate hidden tactics and strategies used by regulators. As a prominent crypto exchange, Coinbase is challenging the status quo by making these previously unpublished records accessible to the public, catalyzing discussions about regulatory transparency. The documents, which include critical communications such as SEC emails, highlight inconsistencies within governmental agencies that call for immediate reforms. Coinbase’s commitment to transparency resonates with millions of crypto holders across the United States who seek clarity in the continuously evolving crypto landscape. This landmark FOIA release could potentially reshape the future of digital currency regulation, emphasizing the pressing need for clear and coherent guidelines.

The recent publication of Coinbase’s extensive repository of FOIA documents marks a significant moment in the quest for regulatory clarity in the cryptocurrency space. These newly released records not only shed light on the strategies employed by government agencies but also unveil internal communications that may contradict public statements made by regulators. By pushing for the release of this information, Coinbase is taking a bold stance in favor of open government practices, which could influence how digital assets are governed in the future. This initiative underscores the importance of holding regulatory bodies accountable, as stakeholders demand insights into the mechanisms of crypto oversight. In an age where the boundaries of digital finance are constantly tested, the revelations from this comprehensive documentation are set to galvanize discussions on regulatory fairness and effectiveness.

Coinbase’s FOIA Releases: A Milestone for Regulatory Transparency

Coinbase’s recent release of over 10,000 pages of previously unpublished government documents signifies a pivotal moment in the ongoing debate surrounding government crypto regulation. These documents, obtained through extensive Freedom of Information Act (FOIA) requests, provide a rare glimpse into the internal workings of governmental regulatory bodies like the U.S. Securities and Exchange Commission (SEC). By making this trove of information public, Coinbase not only underscores the need for regulatory transparency but also sets a precedent for other crypto organizations to pursue similar efforts in advocating for clear and consistent regulations.

The information brought to light through the FOIA releases showcases many discrepancies and hidden tactics used by various regulatory agencies, which fuel concerns among crypto investors and advocates for the industry. By exposing internal communications, including SEC emails that admit to regulatory gaps in the crypto space, Coinbase has effectively challenged the notion held by some regulators that information should remain restricted. This release empowers individuals and organizations advocating for reform by providing them with the evidence needed to demand clearer guidelines from government bodies involved in crypto regulation.

The Impact of SEC Emails on Crypto Regulation

Among the treasure trove of documents released by Coinbase, the internal SEC emails reveal serious contradictions regarding the Commission’s stance on cryptocurrency regulations. For instance, a 2019 email from the SEC acknowledges a ‘crypto regulatory gap’, which directly contradicts later public assertions that the regulatory framework was sufficient. This inconsistency not only raises questions about the effectiveness of current regulations but also highlights a potential lack of communication within regulatory agencies, adding urgency to calls for reform in how these agencies approach the burgeoning crypto market.

Furthermore, the exposure of these internal discussions surrounding regulatory gaps in SEC emails may ignite calls for a reevaluation of enforcement strategies. Regulatory transparency is crucial in bridging the confidence gap between industry stakeholders and regulatory bodies. By addressing these inconsistencies, regulators may begin to harmonize their approaches, ultimately fostering an environment where innovation in the crypto space can thrive unimpeded by unclear or opposing regulations.

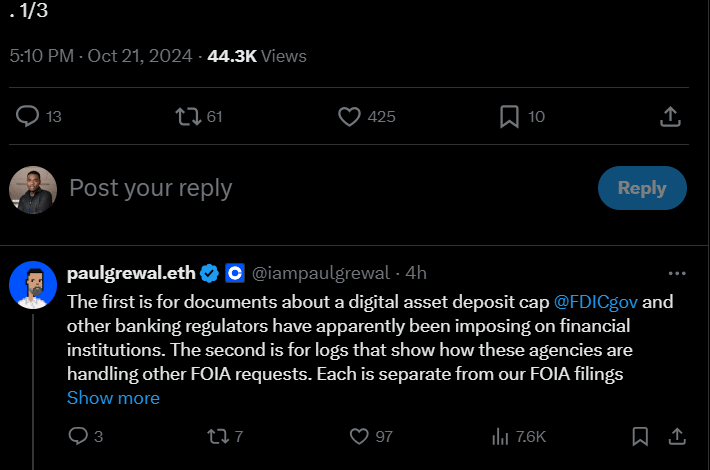

Challenges to FOIA Requests: Coinbase’s Litigation Strategy

Despite Coinbase’s commitment to transparency through their FOIA requests, the company encountered significant challenges in acquiring information from regulatory agencies, such as excessive redactions and broad denials. This obstruction illustrates a potential roadblock for many organizations attempting to secure clarity on crypto regulations. By choosing to sue the agencies for noncompliance, Coinbase has not only demonstrated its resolve but also highlighted the need for regulatory bodies to provide greater transparency and accessibility to information pertaining to the rapidly evolving cryptocurrency landscape.

The legal action taken by Coinbase serves as a catalyst for an important conversation about transparency in government operations. As the fight for clarity continues, other crypto exchanges may be inspired to follow Coinbase’s lead in pursuing legal avenues to unveil the hidden mechanisms that govern their industries. This scenario presents an opportunity for widespread advocacy that can ultimately reshape the regulatory landscape to better protect industry participants and their investments.

The Nature of Cryptocurrency Exchanges in a New Regulatory Era

As cryptocurrency exchanges like Coinbase push for regulatory transparency, they pave the way for a new era in how cryptocurrencies are understood within the framework of government crypto regulation. The growing demand for clear regulations has become especially pressing as more investors engage with digital assets, thus increasing the need for protective measures against potential market abuses and misinformation. Adopting a proactive regulatory posture may help facilitate a balanced relationship between innovation and safety in the crypto sector.

Furthermore, the establishment of transparent guidelines can foster trust between consumers and exchanges, ultimately driving more institutional adoption and creating a more stable market. In this sense, the efforts by exchanges to obtain and release documents related to regulatory actions underline a collaborative approach that can benefit all stakeholders involved. The recent developments demonstrate that regulatory clarity can coexist with innovation, leading to a more sustainable and thriving cryptocurrency ecosystem.

The Role of Government in Shaping Crypto Futures

Government involvement plays a crucial role in shaping the future of cryptocurrencies and their regulation. As demonstrated through Coinbase’s FOIA documents, increasing transparency can lead to a more informed and cooperative dialogue between regulatory agencies and those in the crypto space. Clearer regulations foster an environment where innovation can flourish, but they also ensure that there is accountability from the regulatory side, allowing for adjustments to laws that better reflect technological advancements within the industry.

Additionally, the revelations contained in the FOIA releases can serve as a basis for policymakers to consider the implications of their current regulations and refine them to meet the evolving needs of the crypto market. Engaging with crypto exchanges and stakeholders can help governments adapt their strategies and approaches, potentially leading to the establishment of a regulatory framework that supports innovation while protecting consumers. This alignment can help integrate cryptocurrencies into the broader financial system, ultimately enabling a more robust and secure market.

Understanding the Crypto Regulatory Gap

The crypto regulatory gap identified in SEC emails underscores a critical issue that industry participants face as they navigate the complex landscape of government regulations. As Coinbase’s FOIA documents reveal, the lack of cohesive guidance has resulted in confusion and uncertainty among both regulators and stakeholders. Understanding this gap is essential in advocating for reforms that can align regulatory practices with technological advancements in the crypto space, such as decentralized finance (DeFi) and NFTs.

Addressing the crypto regulatory gap means ensuring that there are clear guidelines for crypto exchanges and businesses. This can help mitigate the risks associated with regulatory uncertainty while simultaneously supporting innovation. Policymakers and regulators can leverage insights from these FOIA documents as a roadmap to closing this gap, allowing for the development of policies that reflect the reality of a rapidly changing digital financial landscape.

Demands for Transparency Reforms in Crypto

The release of Coinbase’s FOIA documents has sparked mounting demands for transparency reforms in how government bodies handle crypto regulation. Advocates argue that without transparency, regulatory bodies are at risk of making arbitrary decisions that may not reflect the realities of the industry or the needs of consumers. By shedding light on internal communications and regulatory tactics, Coinbase emphasizes the importance of accountability and the need for lawmakers to prioritize clarity in their regulatory frameworks.

Creating a system that embraces transparency can empower crypto stakeholders, including the 52 million Americans who own cryptocurrencies, to engage more effectively with regulators. This potential engagement can lead to a constructive dialogue that ultimately shapes more nuanced regulations that foster industry growth while protecting investors. As public scrutiny and consumer demand for transparency increase, legislators and regulators will likely need to respond more proactively to the evolving landscape.

The Future of Crypto Regulations Post-Disclosure

Following the extensive disclosures by Coinbase, the future of crypto regulations is poised for transformation. The overwhelming amount of content now available for analysis allows stakeholders to hold regulators accountable, promoting an environment where future policies can be shaped by real, actionable insights rather than conjecture. An informed discussion on crypto regulations will allow regulators to devise frameworks that not only address current challenges but also remain flexible enough to adapt to industry advancements.

Moreover, the push for regulatory transparency, as indicated by Coinbase’s FOIA releases, may encourage other jurisdictions globally to adopt similar measures, leading to a more harmonized approach to cryptocurrency regulation. This could ultimately create a sense of security and consistency for both market participants and regulatory bodies. As disclosure efforts expand, the foundation for a collaborative regulatory ecosystem begins to take shape, ensuring that technological innovation and consumer protection coexist.

The Importance of Public Advocacy for Crypto Transparency

The revelations from Coinbase’s FOIA documents highlight the critical role of public advocacy in demanding transparency from regulatory bodies. When entities like Coinbase step forward to challenge the status quo, they pave the way for a broader movement focused on creating an environment where regulatory actions are openly communicated and accessible. Public advocacy for transparency not only strengthens the relationship between regulators and the crypto community but also emphasizes the importance of informed policymaking.

Engaging the public in the conversation about government crypto regulation encourages a more inclusive approach to policy formulation. Stakeholders from diverse backgrounds can contribute to the dialogue, ensuring that varying perspectives are represented in the regulatory process. The pressure for transparency not only enriches discussions but also helps to foster a regulatory environment that is responsive, accountable, and open to necessary changes.

Frequently Asked Questions

What are Coinbase FOIA documents and why are they significant?

Coinbase FOIA documents refer to the extensive collection of over 10,000 pages of previously unpublished government records obtained by Coinbase via Freedom of Information Act (FOIA) requests. They are significant because they reveal undisclosed tactics and internal conflicts regarding government crypto regulation, thus fueling demands for increased regulatory transparency in the cryptocurrency sector.

How can I access the Coinbase FOIA documents?

The Coinbase FOIA documents can be accessed through the Coinbase FOIA Reading Room, which provides the public with a digital archive of these documents collected from various government agencies like the SEC and FDIC. This transparency initiative aims to shed light on crypto exchange regulations.

What types of information are included in the Coinbase FOIA release?

The Coinbase FOIA release includes a variety of information such as internal emails, legal correspondence, and exchanges with agencies like the SEC. Notably, it reveals discussions about a ‘crypto regulatory gap’ and other vital communications concerning government crypto regulation.

What impact do the Coinbase FOIA documents have on regulatory transparency?

The impact of the Coinbase FOIA documents on regulatory transparency is significant. They expose challenges and contradictions in the current regulatory approach, highlighting the need for clearer and more consistent guidelines for crypto exchanges. This disclosure is a call for reform in how government agencies manage crypto regulations.

How did Coinbase respond to initial FOIA request denials?

In response to initial FOIA request denials and excessive redactions, Coinbase directed a third-party expert, History Associates Inc., to file lawsuits against the agencies in federal court. This action underscores Coinbase’s commitment to securing the transparency of government actions related to crypto regulation.

Why is the Coinbase FOIA document release important for crypto stakeholders?

The Coinbase FOIA document release is crucial for crypto stakeholders as it provides insights into the regulatory environment affecting cryptocurrencies. By unveiling hidden documents, it empowers individual investors and companies to demand accountability and advocate for regulatory reforms that would support a more favorable environment for digital assets.

What role do SEC emails play in the Coinbase FOIA documents?

SEC emails included in the Coinbase FOIA documents provide critical insights into the agency’s stance on crypto regulations. For example, an email from 2019 highlights a recognized ‘crypto regulatory gap’ which counters earlier public statements made by the SEC, showcasing the need for clearer regulatory frameworks.

Can the public influence government crypto regulation through the Coinbase FOIA initiative?

Yes, the public can influence government crypto regulation through initiatives like Coinbase’s FOIA release. By highlighting inconsistencies and advocating for transparency, stakeholders can engage more effectively with regulatory bodies and push for reforms that promote a clearer legal framework for the cryptocurrency industry.

| Key Point | Description |

|---|---|

| FOIA Document Release | Coinbase has released over 10,000 pages of previously unpublished government crypto documents. |

| Regulatory Transparency | The documents reveal undisclosed regulatory tactics and internal contradictions in U.S. crypto regulation. |

| Legal Posture | Coinbase directed a third-party expert to file FOIA requests and lawsuits to combat obstructions. |

| Key Findings | The documents include internal SEC emails noting regulatory gaps and call for clarity in crypto regulation. |

| Public Statement | Coinbase’s Chief Legal Officer highlighted the importance of transparency and government accountability. |

Summary

Coinbase FOIA documents stand at the forefront of the movement towards regulatory transparency in the cryptocurrency sector. The release of over 10,000 pages of government documents has shed light on the hidden tactics employed in U.S. crypto regulation, revealing significant contradictions within agencies like the SEC. This initiative signifies a critical demand for clarity and accountability in government dealings concerning cryptocurrency, showcasing how Coinbase is not only advocating for itself but also for the over 52 million Americans invested in crypto.