Consumer Confidence Index Drops Amid Economic Concerns

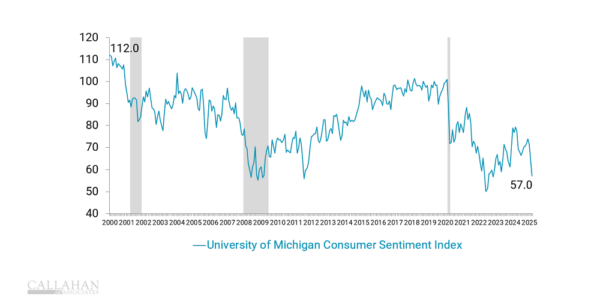

The Consumer Confidence Index, a crucial barometer of economic sentiment, has seen a significant downturn in April, plunging to a worrisome 86 as tariffs continue to undermine consumer attitudes. This decline, stepping back 7.9 points from earlier readings, marks the lowest consumer confidence in almost five years and falls short of expectations set by the Dow Jones. Concerns about employment are amplifying, with confidence levels seen as low as during the global financial crisis. Additionally, inflation expectations have soared to 7%, sparking anxiety about future economic conditions and reigniting fears of a potential recession. As consumers grapple with these challenges, it’s clear that the current economic landscape is raising alarms about declining employment confidence and uncertain inflation pressures.

The Consumer Sentiment Indicator, an essential measure of public outlook on economic stability, has experienced notable shifts in April driven by external factors like tariffs impacting market perception. As consumer optimism wanes, feelings regarding job security and future employment prospects are at a low not witnessed since the onset of the pandemic. Furthermore, apprehensions over rising inflation and a potential economic downturn are reshaping expectations for the coming months. This dip in consumer morale indicates a broader concern about the economy’s resilience amid growing inflation expectations and less favorable employment conditions. Understanding these trends is critical as they could influence both short and long-term economic policies.

The Decline of the Consumer Confidence Index in April

In April, the Consumer Confidence Index experienced a significant drop to 86, marking a severe setback for consumer attitudes following recent trends. This decline can be attributed to the unsettling impact of tariffs, which have eroded public sentiment and heightened concerns about economic stability. With a reduction of 7.9 points, the index has fallen below analysts’ expectations, signifying a growing unease among consumers that may be reflective of deeper economic issues.

This concerning trend is the lowest the Consumer Confidence Index has been in nearly five years, indicating a potential shift in consumer behavior. As individuals become increasingly wary of the outlook for employment and potential economic recession, their spending habits could change, impacting overall economic growth. This drop underscores the pertinent relationship between consumer confidence and broader economic indicators, highlighting the importance of restoring optimism to maintain consumer spending.

Impact of Tariffs on Consumer Sentiment

Tariffs have become a focal point in discussions of economic sentiment, as their effects ripple through various sectors. The imposition of tariffs has not only raised prices on imported goods but also contributed to a broader sense of insecurity regarding employment prospects. As businesses adjust to these increased costs, hiring may slow, resulting in a worsening perception among consumers about job availability—a trend clearly reflected in April’s data.

The sentiment surrounding tariffs and their impact on inflation expectations significantly exacerbates consumer anxiety. With inflation expectations reaching 7%, concerns weigh heavily on consumers as they brace for higher prices in the coming year. Understanding the direct correlation between tariffs and consumer sentiment is crucial for policymakers aiming to stabilize the economy and boost overall confidence among citizens.

Frequently Asked Questions

What factors contributed to the recent drop in the Consumer Confidence Index in April?

The Consumer Confidence Index decreased in April due to growing concerns over tariffs negatively impacting economic sentiment. Additionally, employment confidence has reached levels not seen since the global financial crisis, raising fears about job availability and economic stability.

How do tariffs impact the Consumer Confidence Index?

Tariffs have a significant negative impact on the Consumer Confidence Index as they lead to higher prices and uncertainty in the economy. This month, tariffs contributed to a pessimistic outlook regarding employment and economic conditions, reflecting broader concerns about inflation expectations and potential recession.

What does the April Consumer Confidence Index indicate about economic recession outlook?

The April Consumer Confidence Index suggests a deteriorating economic recession outlook, as the expectations index fell sharply. This decline signals widespread pessimism regarding future business conditions, employment prospects, and income, leading many analysts to predict a potential recession.

How is employment confidence reflected in the Consumer Confidence Index?

Employment confidence is a crucial component of the Consumer Confidence Index, which showed significant decline this April. The report indicated that a growing number of respondents anticipate fewer job opportunities in the future, echoing levels of sentiment last witnessed during economic downturns.

What are the inflation expectations according to the latest Consumer Confidence Index report?

According to the latest report, inflation expectations surged to 7% for the upcoming year, marking the highest level since November 2022. This rise in inflation expectations adversely affects the Consumer Confidence Index, as consumers grow increasingly concerned about rising costs and economic stability.

| Key Points | Details |

|---|---|

| Consumer Confidence Index | Dropped to 86, a decrease of 7.9 points and the lowest level in almost five years. |

| Expectations Index | Plummeted to 54.4, a decline of 12.5 points and the lowest since October 2011. |

| Employment Outlook | 32.1% expect a decline in employment over the next six months, almost as high as during the Great Recession. |

| Job Perception | 16.6% find jobs hard to get, and 31.7% view jobs as plentiful, both showing negative trends. |

| Future Income Expectations | Turned negative for the first time in five years, contributing to low consumer sentiment. |

| Stock Market Sentiment | 48.5% forecast lower prices, the worst sentiment since October 2011. |

| Inflation Expectations | Risen to 7%, the highest since November 2022, driven by tariff concerns. |

| Job Openings | Fell to 7.19 million, the lowest since September 2024, below Wall Street expectations. |

Summary

The Consumer Confidence Index has significantly dropped, reflecting a negative sentiment among consumers regarding the current economic situation and future expectations. With the index falling to 86, it showcases a level of pessimism not seen in years. This decline is largely attributed to concerns over tariffs, employment prospects, and expectations of future income turning negative for the first time in five years. As consumers brace for potential recession conditions, the outlook for the economy appears bleak, emphasizing the need for strategic responses to restore consumer confidence.