Consumer Confidence Surges Amid Trade Deal Optimism

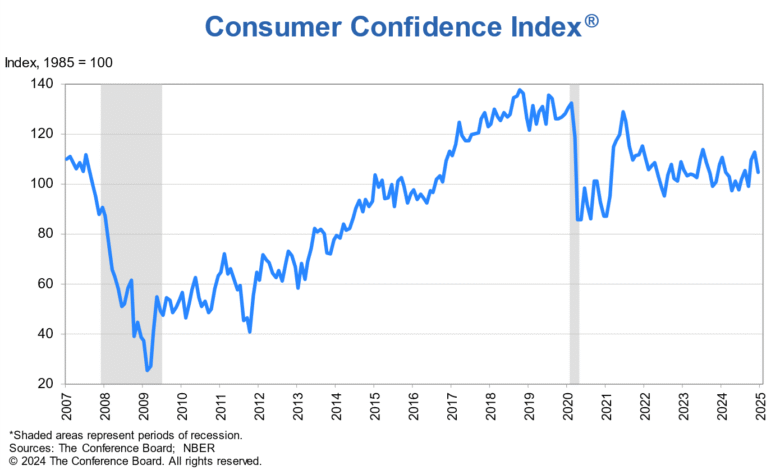

Consumer confidence has seen a remarkable surge in May 2023, as optimism regarding trade deals has captivated American sentiment. According to the latest survey from the Conference Board, the U.S. consumer confidence index skyrocketed to 98.0, evidencing a robust increase of 12.3 points from April’s figures, far surpassing analysts’ expectations of 86.0. This renewed economic optimism is largely attributed to positive developments in the protracted U.S.-China trade negotiations, particularly following President Trump’s decision to suspend severe tariffs on May 12. Notably, this significant rebound in consumer belief reflects a stabilization in market expectations and an eagerness among consumers to engage in spending once more. As we delve deeper into the implications of the May 2023 consumer survey, it becomes clear that this newfound confidence is paving the way for potential economic recovery.

The prevailing consumer sentiments have taken a decisive turn, with various indicators indicating a resurgence in public optimism about the economy. This renewed market enthusiasm, also referred to as buyer confidence, emerged from improved conditions in international trade agreements, specifically between the U.S. and China. A surge in the confidence index, as reported by the Conference Board, highlights a robust recovery phase within consumer perceptions. The latest consumer outlook signifies that individuals are becoming increasingly hopeful about their financial futures, marking a notable shift from previous months. Deconstructing this phenomenon reveals a complex interplay of factors contributing to enhanced economic sentiment, reflected through positive indicators and heightened expectations.

U.S. Consumer Confidence Hits New Highs in May 2023

The Consumer Confidence Index for May 2023, as reported by the Conference Board, revealed a surprising surge to 98.0, significantly higher than the Dow Jones estimate of 86.0. This notable increase of 12.3 points marks a stark contrast to the previous five months of declining confidence among consumers. The optimism surrounding this rise can largely be attributed to the positive developments in the ongoing U.S.-China trade negotiations, particularly President Trump’s decision to pause some of the harshest tariffs. Such actions have revitalized consumer beliefs that the economic landscape is improving, driving this substantial increase in confidence ratings.

The rebound in consumer confidence not only reflects a renewed faith in the economy but also suggests renewed optimism for future financial stability. As consumers express more favorable attitudes towards current economic conditions—as indicated by the present situation index rising to 135.9—it’s evident that expectations are shifting positively in light of recent trade discussions. This newfound optimism could potentially result in increased consumer spending, which plays a vital role in maintaining healthy economic growth.

Trade Deal Impact on Economic Optimism

The development of trade deals significantly influences economic optimism among U.S. consumers. The temporary agreement reached between the United States and China in early May acted as a catalyst for heightened confidence, reversing nearly half a year of pessimism. The sentiment reflected in the Conference Board’s Consumer Confidence Index illustrates how interconnected consumer feelings are with international trade affairs. As tariffs were suspended, not only did optimism soar among consumers, but investors also began to feel more secure, expecting signs of stock market recoveries over the coming year.

This boost in economic optimism is not just limited to consumer confidence; it extends to expectations surrounding job markets as well. The survey revealed that a growing percentage of respondents anticipate improvements in job availability. This correlation underscores the importance of trade negotiations and agreements not just as political maneuvers, but as real-world factors driving economic perceptions and outcomes in the U.S.

Understanding the Conference Board Index Methodology

The Conference Board Consumer Confidence Index is a comprehensive measure that reflects consumers’ outlook towards current and future economic conditions. This index captures key perceptions and provides valuable insights into spending behaviors, making it an essential tool for economists and policymakers. The methodology includes surveying thousands of households across the United States, asking them to share their perspectives on employment, business conditions, and their expectations for the future.

Understanding the factors that influence the Conference Board index, such as recent trade deal outcomes and economic news, is crucial for interpreting consumer behavior accurately. Analysts pay close attention to shifts in the index because these changes can signify potential trends in consumer spending, which drives economic growth quite significantly.

Survey Insights: Consumer Expectations and the Job Market

The latest survey results from the Conference Board indicate a significant shift in consumer expectations regarding the job market. Consistent with the reported increase in the optimism index, a growing 19.2% of respondents now expect improved job opportunities in the coming months, a notable rise from 13.9% in April. This positive shift reflects a broader sentiment of recovery and growth stemming from eased trade tensions and supportive fiscal policies.

Additionally, perceptions of job availability are evolving, with those who believe jobs are plentiful rising to 31.8%. Despite a slight increase in the belief that employment is hard to get, the overall trend signals a consumer base beginning to sway positively towards the economy’s recovery. Such insights are crucial for understanding not just immediate spending habits but also longer-term trends in workforce participation and economic engagement.

Consumer Sentiment Across Demographics in May 2023

In addition to the overall increases in consumer confidence, key demographics demonstrated distinct improvements in sentiment across age, income levels, and political affiliations. Notably, Republicans showed the most pronounced growth in optimism, which could reflect the broader political narratives surrounding economic recovery and trade negotiations. Furthermore, rising consumer confidence among diverse demographic groups suggests a more unified outlook towards economic prospects, signaling stability in consumer markets.

The growth in sentiment across various demographics also indicates that economic policies being enacted are resonating broadly with the American population. This widespread increase in positive sentiment could potentially influence future policy decisions and campaign agendas, as consumer confidence has a significant bearing on electoral outcomes and governance.

The Role of Economic Indicators in Boosting Confidence

Economic indicators play a pivotal role in shaping consumer perceptions and expectations. The increase in the Conference Board’s Consumer Confidence Index and other indicators like the expectations index—growing to a substantial 72.8—demonstrate their power in boosting consumer sentiment. These indicators not only provide insight into current economic health but also serve as predictive tools for where the economy may be heading, impacting consumer decisions.

With these indicators reflecting heightened optimism in May 2023, consumers are likely to respond with increased spending, which is essential for driving economic growth. Analyzing these trends through the lens of economic indicators can help forecast consumer behavior over the coming months as they continue to react to ongoing changes in trade policies and economic reports.

Investor Confidence Surges Alongside Consumer Optimism

The increase in consumer confidence in May has not only influenced everyday consumers but has also positively affected investor confidence. With 44% of investors now anticipating stock market increases over the next year, a sentiment reflected in the 6.4 percentage point rise since April, it’s clear that optimism is permeating various sectors of the economy. Investors reacting positively to shifts in consumer sentiment indicate a correlated market response that can further support economic recovery.

This interconnectedness between consumer and investor confidence highlights the vital link between public perception and economic performance. A stable investment environment often mirrors consumer confidence; when consumers feel good about their financial situation, they spend more, leading to greater corporate development and stock performance, creating a virtuous cycle.

Navigating Changing Consumer Mindsets Post-Trade Deals

As the U.S. navigates through changing trade policies and economic landscapes, understanding shifts in consumer mindsets is crucial. The strong uptick in consumer confidence observed in May is reflective of broader economic anxieties that were alleviated by recent trade agreements and executive decisions. This changing mindset not only impacts current consumption patterns but also lays the groundwork for future economic interactions as consumers readjust their expectations.

In a rapidly changing economic climate, where trade deals can shift perceptions overnight, businesses must remain agile and responsive to these consumer sentiments. The ongoing dialogue between policymakers and consumers is foundational to fostering a stable economic environment, ensuring that confidence in the market remains robust.

Future Outlook: Sustaining Consumer Confidence Beyond Trade Deals

While the surge in consumer confidence during May 2023 indicates a positive turn, sustaining this momentum will require continued focus on economic policies that nurture consumer trust. Future trade dealings, both domestic and international, will play a crucial role in maintaining the optimism established in the current Consumer Confidence Index. Regular engagement from economic leaders and outlets that keep consumers informed can facilitate ongoing confidence.

Moreover, the interplay between consumer and economic policies will dictate trends moving forward. Strategic planning and responsive actions from both the private and public sectors will be necessary to nurture this recovering sentiment, ensuring that consumer confidence does not wane as new challenges arise.

Frequently Asked Questions

What factors contributed to the rise in U.S. consumer confidence in May 2023?

The May 2023 consumer confidence surged due to renewed optimism regarding U.S.-China trade negotiations. The Conference Board’s Consumer Confidence Index increased significantly by 12.3 points to reach 98.0, driven by President Trump’s decision to delay severe tariffs, fostering a better outlook among consumers.

How does the Conference Board index measure consumer confidence?

The Conference Board index measures consumer confidence by surveying households about their current economic situation and future expectations. In May 2023, the index reflected stronger than expected consumer sentiment, climbing due to positive news from trade deal developments with China.

What is the impact of trade deals on consumer confidence?

Trade deals have a significant impact on consumer confidence, as seen in May 2023. Optimism around renewed negotiations between the U.S. and China led to an increase in consumer sentiment, showing that trade relations can directly influence economic optimism.

What were the key findings of the May 2023 consumer survey regarding economic optimism?

The May 2023 consumer survey indicated a notable recovery in economic optimism, with the present situation index rising to 135.9 and the expectations index increasing to 72.8, highlighting improved perceptions about job availability and consumer sentiment following trade deal announcements.

Why was the May 2023 consumer confidence index particularly noteworthy compared to previous months?

The May 2023 consumer confidence index was particularly noteworthy due to its recovery from five months of decline, aided by favorable trade deal impacts and a surge in consumer optimism, marking a significant turnaround in respondents’ outlook on the economy.

How do labor market perceptions affect consumer confidence?

Labor market perceptions directly affect consumer confidence; in May 2023, there was an increase in the percentage of respondents expecting more jobs in the next six months, which contributed positively to the overall consumer confidence index and reflected economic optimism.

| Key Point | Details |

|---|---|

| Consumer Confidence Index | Surged to 98.0 in May, a 12.3-point increase from April. |

| Dow Jones Estimate | Exceeded the estimate of 86.0 significantly. |

| Trade Deal Impact | Optimism driven by suspension of severe tariffs on May 12. |

| Previous Trends | Followed five months of decline in consumer confidence. |

| Present Situation Index | Risen to 135.9, an increase of 4.8 points. |

| Expectations Index | Jumped to 72.8, up by 17.4 points. |

| Investor Sentiment | 44% anticipate stock market increases, up 6.4 percentage points. |

| Job Availability Predictions | 19.2% expect more jobs in 6 months, compared to 13.9% in April. |

| Job Market Perception | 31.8% believe jobs are ‘plentiful’, while 18.6% say ‘hard to get’. |

| Demographic Improvements | Sentiment improved across age, income, and political demographics. |

Summary

Consumer confidence has markedly rebounded, revealing significant optimism among consumers regarding the economy. The key driver of this renewed confidence is the positive impact of recent trade developments, particularly the temporary resolution of the U.S.-China trade dispute. This optimism is reflected in the dramatic rise of the Consumer Confidence Index in May, which surged past expectations, signaling a potential upward trend in economic sentiments. Additionally, improvements in sentiment across various demographics indicate a broader, more inclusive rebound in confidence. The data suggests consumers are beginning to feel more secure about their economic future, which is a promising sign for the economy moving forward.