Corporate Bitcoin Acquisition: Strategy Expands Holdings

In recent years, corporate bitcoin acquisition has transformed the landscape of institutional investment, with companies like Strategy leading the charge. Under the visionary guidance of Executive Chairman Michael Saylor, Strategy has significantly bolstered its bitcoin treasury by acquiring an additional 13,390 bitcoins for approximately $1.34 billion. This next-level bitcoin strategy has elevated the firm’s holdings to a staggering total of 568,840 bitcoins, valued at nearly $39.41 billion. With a year-to-date bitcoin yield of 15.5%, this acquisition reinforces the growing trend of institutional bitcoin demand, as businesses recognize the potential long-term benefits of digital assets. Amidst geopolitical instability, the latest purchase underscores a resilient market for bitcoin, reflecting a pivotal shift in how corporations approach asset diversification and financial strategy.

The evolution of corporate investments in digital currencies, specifically the acquisition of bitcoin, is setting a new precedent in the financial sector. Many firms are now recognizing the value of maintaining a bitcoin treasury, carefully evaluating their bitcoin strategies to optimize returns. Companies like Strategy exemplify this trend, strategically leveraging their resources to accumulate significant digital assets and enhance their portfolios. As institutional adoption of cryptocurrencies continues to rise, the economic implications of these investments highlight a seismic shift towards recognizing cryptocurrencies as viable treasury assets. This burgeoning interest is prompting organizations to consider innovative approaches to not just acquisition but also management of their cryptocurrency holdings, tapping into potential yields and market opportunities.

Understanding Corporate Bitcoin Acquisition Strategies

Corporate bitcoin acquisition has emerged as a pivotal strategy for companies looking to capitalize on the growing digital asset market. Firms like Strategy, spearheaded by Executive Chairman Michael Saylor, are implementing comprehensive bitcoin strategies that allow them to build substantial holdings. By accumulating large quantities of bitcoin, these companies not only aim for speculative gains but also seek to bolster their overall financial stability and future growth potential. This strategic approach reflects a keen awareness of institutional bitcoin demand, showcasing how corporations can leverage a volatile market to secure potentially lucrative assets.

The recent addition of 13,390 bitcoins to Strategy’s treasury, purchased at an average price of $99,856, underscores the carefully calculated nature of corporate acquisitions. By adopting a long-term view, companies are not merely investing in a currency but positioning themselves within an evolving financial landscape. This type of corporate bitcoin strategy is set against a backdrop of increasing inflation and fiscal uncertainty, driving firms to seek alternative stores of value that can outperform traditional investments.

The Role of Bitcoin Treasury Management

Effective bitcoin treasury management is essential for corporations that are heavily invested in this digital asset. For instance, Strategy’s holdings of 568,840 bitcoins reflect a robust investment strategy worth approximately $39.41 billion. This impressive treasury management not only entails acquiring bitcoin at strategic price points but also managing the inherent volatility of the asset. By harnessing tools like derivatives and yield generation strategies, companies like Strategy can optimize returns on their bitcoin investments, reflecting a sophisticated understanding of market dynamics.

Moreover, as corporations continue to embrace bitcoin, treasury management will evolve to encompass yield generation alongside asset appreciation strategies. For instance, Strategy’s reported bitcoin yield of 15.5% year-to-date highlights the importance of developing mechanisms to generate returns while holding substantial amounts of the digital asset. This dual approach allows firms to remain agile and responsive to the competing demands of market fluctuations and long-term financial goals.

The Impact of Michael Saylor’s Vision on Bitcoin Adoption

Michael Saylor has played a crucial role in shaping the narrative around corporate bitcoin investments. His commitment to bitcoin as a primary asset class has led to significant shifts in how other corporations perceive and approach digital currency. By articulating a clear bitcoin strategy, Saylor has not only proven the viability of such investments but has also inspired a wave of institutional bitcoin demand that could transform traditional finance.

Under Saylor’s leadership, companies are now viewing bitcoin not just as a speculative asset but as an essential component of their corporate treasury. His influence extends beyond simple acquisition; it encompasses advocating for the digital asset as a strategic reserve. This mindset is pivotal, especially as traditional fiat currencies face inflationary pressures, thus pushing more corporations to explore innovative financial strategies in line with Saylor’s vision.

Navigating the Landscape of Institutional Bitcoin Demand

The landscape of institutional bitcoin demand is rapidly evolving, as more companies recognize the potential of incorporating bitcoin into their asset portfolios. High-profile acquisitions, such as those by Strategy, serve as bellwethers for this trend, illustrating the growing appetite among corporations to hold bitcoin as a safeguard against economic instability and inflation. As institutional investors continue to enter the market, their collective demand could have significant implications for bitcoin’s valuation and accessibility in the years to come.

Furthermore, the increasing institutional demand for bitcoin is driving discussions regarding regulatory frameworks and market maturity. Corporations are now more engaged in advocating for clearer guidelines that can provide a safer environment for digital asset investments. This burgeoning interest has led to a more cohesive ecosystem where institutions collaborate to analyze risks, thus enhancing confidence in corporate bitcoin strategies.

Bitcoin Yield: Balancing Investment Risk and Return

The concept of bitcoin yield is becoming an integral part of corporate investment strategies as companies look to maximize their returns in a volatile market. Strategy’s reported yield of 15.5% underscores the potential for earning additional income through various financial instruments connected to bitcoin. This yield generation is an essential aspect of risk management, allowing firms to mitigate some of the inherent volatility associated with holding large amounts of bitcoin.

However, maximizing bitcoin yield also requires a deep understanding of market trends and investment vehicles available to corporations. This includes utilizing lending platforms or participating in yield farming to generate returns on idle bitcoin assets. As corporations refine their bitcoin treasury and leverage emerging yield opportunities, they must also remain aware of the risks involved, ensuring a balanced approach to their overall digital asset strategies.

The Future of Bitcoin in Corporate Asset Management

The future of bitcoin in corporate asset management appears bright, as more firms recognize the asset’s potential to enhance financial resilience and growth. As companies look to diversify their portfolios, bitcoin is likely to play an increasingly prominent role. This shift towards digital currencies reflects broader trends toward innovation and modernization in asset management practices.

Additionally, as technology continues to advance, the mechanisms for integrating bitcoin into corporate financial strategies will become more sophisticated. Companies will need to invest in understanding blockchain technology, crypto market trends, and regulatory changes to fully leverage the potential of bitcoin. This proactive approach will not only optimize their asset management strategies but also secure their positions as leaders in the ever-evolving landscape of digital finance.

Assessing the Risk Factors in Bitcoin Investment

While the potential rewards of investing in bitcoin are substantial, understanding the associated risk factors is equally important for corporations. The volatile nature of bitcoin prices can lead to significant fluctuations in asset value, challenging companies to navigate the uncertainties inherent in such allocations. A thoughtful approach to risk management is essential, as firms must weigh the benefits of bitcoin against potential losses in a down market.

Moreover, the regulatory environment surrounding bitcoin is still developing. Companies must stay abreast of changes in legislation and compliance, as these can significantly impact their investment strategies. By fostering a comprehensive understanding of these risks, corporations can make informed decisions that align with their long-term financial objectives while still engaging with the dynamic world of bitcoin.

Creating a Sustainable Corporate Bitcoin Strategy

Developing a sustainable corporate bitcoin strategy involves more than just acquiring the digital asset; it requires a holistic view of how the asset fits into an organization’s overall business objectives. Successful corporations are taking the initiative to establish clear guidelines and policies that outline how bitcoin can be utilized within their financial frameworks, ensuring long-term benefits. This approach involves continual assessment of market conditions and risk exposure related to bitcoin.

Additionally, companies need to invest in education and training for their teams to foster a strong understanding of bitcoin and its implications for business growth. By cultivating in-house expertise, firms can enhance their decision-making capabilities regarding bitcoin acquisitions, asset management, and market positioning. A sustainable strategy will ultimately enable corporations to leverage bitcoin not just as a safe haven asset, but as a vibrant part of their operational strategies.

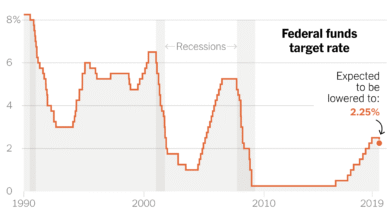

Bitcoin as a Hedge Against Inflation

In recent years, bitcoin has emerged as a potential hedge against inflation, gaining traction among corporations and investors alike. As central banks around the world respond to economic pressures by increasing money supply, the value of traditional currencies may diminish, leading many to seek out alternative assets. Bitcoin’s fixed supply and deflationary nature make it an attractive option for companies looking to preserve their capital’s value.

Corporate giants like Strategy are capitalizing on this trend, using their bitcoin acquisitions as a strategic safeguard against inflationary risks. By positioning bitcoin as part of a diversified asset portfolio, firms enhance their resilience against economic fluctuations and currency devaluation. This perspective suggests that corporate interest in bitcoin will continue to gain momentum, particularly among organizations wary of inflation’s impact on their financial stability.

Frequently Asked Questions

What are the key benefits of corporate bitcoin acquisition for companies like Strategy?

Corporate bitcoin acquisition provides a hedge against inflation and currency fluctuations, enhances balance sheet strength, and diversifies investment portfolios. Companies like Strategy, which added 13,390 bitcoins to their treasury, leverage this strategy to secure financial stability and capitalize on the growing institutional bitcoin demand.

How does Strategy’s bitcoin yield influence its corporate bitcoin strategy?

Strategy’s bitcoin yield of 15.5% year-to-date demonstrates the potential for substantial passive income through its bitcoin holdings. This yield positively impacts the corporate bitcoin strategy by reinforcing the company’s financial performance and attracting further institutional investment, as seen in the increased interest surrounding corporate bitcoin acquisition.

Who is Michael Saylor and what role does he play in corporate bitcoin acquisition?

Michael Saylor is the Executive Chairman of Strategy, a prominent figure in corporate bitcoin acquisition. He champions the firm’s bitcoin strategy, advocating for the accumulation of bitcoin as a core asset to enhance corporate treasuries, thereby influencing market trends and inspiring other companies to consider similar bitcoin strategies.

What factors are contributing to the rise in institutional bitcoin demand?

Several factors are driving institutional bitcoin demand, including the asset’s perceived store of value, increasing mainstream acceptance, and the macroeconomic environment characterized by geopolitical instability. Corporations like Strategy that actively engage in corporate bitcoin acquisition highlight the growing trend as they capitalize on these market conditions.

How does Strategy plan to position itself in the bitcoin market through its acquisition strategy?

Strategy aims to become a leading player in the bitcoin market by adopting an aggressive corporate bitcoin acquisition strategy. By accumulating significant amounts of bitcoin, currently totaling 568,840 coins, and utilizing innovative funding methods, it positions itself as a bellwether for the industry, showing confidence in the long-term value of bitcoin.

What is the significance of Strategy holding 568,840 bitcoins in relation to corporate bitcoin acquisition trends?

Holding 568,840 bitcoins solidifies Strategy’s status as the largest corporate holder of the digital asset, setting a precedent in the corporate bitcoin acquisition landscape. This accumulation reflects a strategic commitment towards bitcoin and influences trends in bullish sentiment among institutional investors and other corporations.

What challenges do companies face when implementing a bitcoin strategy like that of Strategy?

Companies pursuing a bitcoin strategy face challenges such as regulatory scrutiny, market volatility, and public perception. However, the aggressive corporate bitcoin acquisition by firms like Strategy demonstrates how these challenges can be navigated for long-term financial benefits and institutional credibility.

| Key Point | Details |

|---|---|

| Recent Acquisition | Acquired 13,390 bitcoins for approximately $1.34 billion at an average price of $99,856 per coin. |

| Total Holdings | Now holds a total of 568,840 bitcoins, purchased for roughly $39.41 billion at an average price of $69,287 per bitcoin. |

| Year-to-Date Yield | Bitcoin yield of 15.5%, indicating ongoing returns from their investment strategy. |

| Market Position | Firm is currently the largest corporate holder of bitcoin, highlighting their aggressive acquisition strategy amidst market stability. |

| Strategic Approach | Utilizes both equity and debt for bitcoin purchases, demonstrating an insightful approach towards growth in the crypto market. |

Summary

Corporate bitcoin acquisition has gained significant traction in recent years, as seen with Strategy’s latest move of adding 13,390 bitcoins to its treasury. The firm’s substantial investments and strategic approach towards bitcoin not only place it at the forefront of corporate cryptocurrency adoption but also underscore the growing institutional demand within the market. By demonstrating consistent yields and a robust acquisition strategy, companies like Strategy are setting the pace for the future of corporate investment in digital assets.