Corporate Bitcoin Holdings: A Blessing or a Future Challenge?

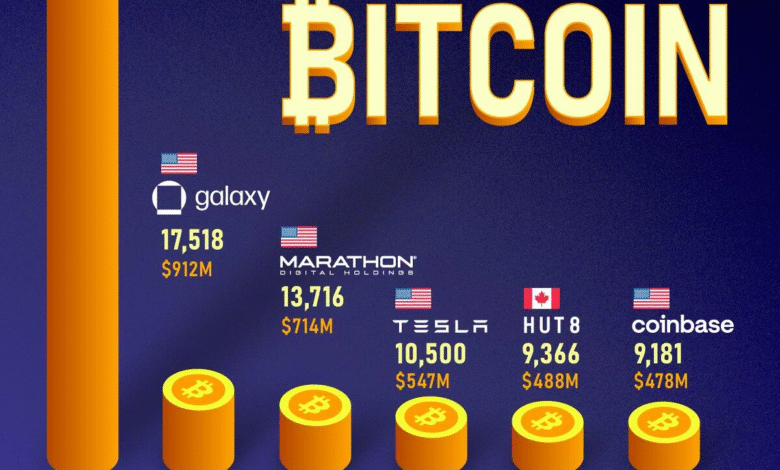

Corporate Bitcoin Holdings have emerged as a pivotal topic in the world of cryptocurrency investment, especially in light of the recent bullish movements in the Bitcoin market. As companies around the globe, including those led by influential figures like Roxom Global CEO Borja Martel Seward, adopt innovative Bitcoin treasury strategies, they create a unique landscape for financial resilience and growth. With Bitcoin’s powerful performance, many firms are exploring the benefits of integrating this digital asset into their portfolios, navigating both the opportunities presented by a bull market and the challenges that a bear market cryptocurrency phase may induce. However, as Seward cautions, the excitement surrounding such corporate Bitcoin investments may wane as market dynamics shift, calling for cautious Bitcoin investment strategies moving forward. Understanding the implications of corporate participation in Bitcoin holdings is essential for investors looking to capitalize on the potential of this digital currency.

The integration of Bitcoin into corporate financial strategies has sparked both interest and debate among investors and financial analysts alike. As more businesses recognize the advantages of holding cryptocurrencies, this trend introduces an alternative method of capital management. The approach, often referred to as Bitcoin treasury management, aims to secure long-term value amidst the inherent volatility of digital assets. Influential industry leaders, such as the CEO of Roxom Global, have paved the way, offering insights into how companies can effectively navigate the complexities of a fluctuating Bitcoin landscape. As the market stands at a crossroads, investors must adapt their perspectives on cryptocurrency and explore how to leverage these corporate holdings to maximize potential returns.

Understanding Corporate Bitcoin Holdings in Today’s Market

Corporate Bitcoin Holdings have emerged as a strategic focal point for many businesses as they navigate the complexities of today’s financial landscape. As highlighted by Roxom Global CEO Borja Martel Seward, this trend signifies a broader acceptance of Bitcoin as a legitimate asset within corporate treasury strategies. Companies that hold Bitcoin not only diversify their portfolios but also leverage its potential for appreciation amidst traditional market volatility.

However, this practice is met with mixed sentiments, especially as markets shift from bullish to bearish cycles. The current enthusiasm surrounding Bitcoin may lead to overexposure for corporations if they fail to manage their holdings wisely. When the bear market inevitably surfaces, the reaction of these treasury firms could significantly impact overall market conditions, highlighting the necessity for prudent investment strategies in the cryptocurrency space.

The Implications of a Bull Market for Bitcoin Investments

In a bullish market, Bitcoin’s value surges, attracting institutional investors and encouraging corporations to adopt a Bitcoin treasury strategy. Roxom Global’s CEO emphasizes that many companies, following the lead of early adopters, are accumulating Bitcoin during this price surge. This creates a vibrant ecosystem where Bitcoin serves as a hedge against inflation and economic downturns, while potentially delivering substantial returns to corporate investors.

Yet, as the bull market appears poised to continue for several more months, it is critical to remain vigilant. As Seward warns, the subsequent phase will testing these corporations’ strategies. Investors must consider how to approach their Bitcoin holdings strategically, avoiding the pitfalls of complacency and premature profit-taking.

Strategies for Navigating a Bear Market

As predicted by industry leaders, the eventual bear market will challenge existing Bitcoin investment strategies, particularly for corporate holders. In this new phase, the focus will shift from accumulation to risk management. The Roxom Global CEO suggests that companies need to be prepared for potential sell-offs, where a wave of investors rushes to liquidate their assets to mitigate losses. This scenario could lead to significant declines in Bitcoin’s price and disrupt established market dynamics.

Investors must adapt their strategies to account for these challenges, emphasizing the importance of patience and due diligence. Rather than trying to time the market, experts recommend maintaining a long-term outlook and prioritizing the accumulation of Bitcoin during more favorable conditions. By honing in on these rational investment approaches, companies can better weather market fluctuations and capitalize on future opportunities in the cryptocurrency ecosystem.

The Future Projections of Bitcoin’s Value

Looking ahead, the projections for Bitcoin’s peak value in the near future remain optimistic. Roxom Global’s CEO, Borja Martel Seward, has speculated that Bitcoin could reach between $120,000 and $200,000 by year-end. Such bullish predictions are driving increased confidence among corporate investors, particularly as the prospects of Bitcoin Exchange Traded Funds (ETFs) become more favorable, enhancing liquidity and adoption.

However, the expectation of a sell-off following such peaks raises critical questions about how corporate BTC holders will respond. A wave of profit-taking could create volatility and challenges for market stability. Investors will need to navigate these transitional phases with informed strategies, particularly those that encourage long-term holds, recognizing key points in the market cycle to maximize their Bitcoin investments.

Benefits of Bitcoin as a Corporate Treasury Asset

Incorporating Bitcoin into corporate treasuries offers several strategic advantages. Firstly, Bitcoin’s decentralized nature and finite supply make it an attractive hedge against inflation, particularly in an unpredictable macroeconomic environment. Companies such as Roxom Global are capitalizing on these benefits by positioning Bitcoin as a cornerstone of their treasury strategy, further legitimizing cryptocurrency in the corporate financial framework.

Moreover, Bitcoin presents opportunities for diversification that traditional assets may lack. As corporations increasingly recognize Bitcoin as a viable asset class, this inevitably leads to larger allocations within treasury reserves. Companies can bolster their balance sheets by integrating cryptocurrency, effectively adapting to modern investment landscapes and ensuring long-term viability amidst evolving market conditions.

Key Considerations for Corporate Bitcoin Holders

Corporations embracing Bitcoin must navigate a landscape filled with unique challenges and considerations. One primary factor to consider is regulatory compliance, as differing attitudes towards cryptocurrency across jurisdictions can impact company policies. It’s crucial for corporate entities to consult legal and financial advisors familiar with cryptocurrency regulations to avoid potential legal pitfalls.

Additionally, risk management strategies should be at the forefront of corporate Bitcoin policies. Recognizing that the cryptocurrency market is rife with volatility, businesses need to implement contingency plans for managing their holdings. As Borja Martel Seward notes, careful monitoring and strategic selling will be imperative during bearish phases, ensuring companies do not overextend their positions.

How Roxom Global is Redefining Bitcoin Usage

Roxom Global is pioneering a novel approach to Bitcoin utility, integrating it as a unit of account within a broader financial ecosystem. This initiative allows various asset classes, including stocks and commodities, to be traded against Bitcoin, providing an innovative method for investors to drive returns in a cryptocurrency-focused market. Such frameworks challenge traditional financial norms, fostering a new era of liquidity and efficiency.

Seward’s ambition for Roxom insists on creating a user-friendly experience that simplifies complex trading processes, facilitating wider accessibility to Bitcoin-denominated markets. By doing so, the company not only positions itself at the forefront of the cryptocurrency revolution but also empowers investors to explore new opportunities in yield generation, thus redefining the current landscape of asset trading.

Preparing for the Inevitable Bitcoin Market Correction

Every market cycle includes inevitable corrections, and Bitcoin is no exception. As we experience the current bullish momentum, it is critical for corporate Bitcoin holders to prepare for the forthcoming corrections that can disrupt market equilibrium. Roxom Global’s CEO emphasizes that the focus should shift towards safeguarding investments rather than merely riding the volatility wave.

By implementing effective risk management and maintaining flexible investment strategies, businesses can better weather downturns. Understanding market signals, being ready to de-risk positions, and staying informed of macroeconomic developments will be essential for firms looking to preserve their Bitcoin investments through potential market corrections.

The Role of Institutional Investors in the Bitcoin Market

Institutional investors are becoming increasingly influential in shaping the Bitcoin market, bringing unprecedented levels of legitimacy and capital to the cryptocurrency space. Figures like Roxom Global’s Borja Martel Seward express optimism regarding the impact of institutional involvement, as it fosters stability and promotes sustainable growth within the market.

As more companies adopt Bitcoin as part of their treasury strategies, institutional investors could play a crucial role in establishing long-term price floors and encouraging wider adoption. The active participation of these investors not only legitimizes Bitcoin but also entices more corporations to reconsider their investment strategies in light of the advantages offered by cryptocurrency.

Frequently Asked Questions

What is the impact of Corporate Bitcoin Holdings on treasury companies amidst market changes?

Corporate Bitcoin Holdings, while currently beneficial due to the ongoing bull market, may pose challenges for treasury companies in the future. Roxom Global CEO, Borja Martel Seward, highlights that when the bull market ends, a bearish phase could lead to sell-offs by these companies, impacting market sentiment and price action surrounding Bitcoin.

How does Roxom Global’s CEO view Bitcoin investment strategies amid market fluctuations?

Borja Martel Seward, CEO of Roxom Global, believes that Bitcoin investment strategies should focus on long-term accumulation rather than trying to time the market. His approach involves strategic selling when prices peak and repurchasing during dips, ensuring that corporate Bitcoin holdings continue to grow over time, regardless of market conditions.

What are the potential risks associated with Corporate Bitcoin Holdings during a bear market?

As noted by Roxom CEO Borja Martel Seward, Treasury companies holding Bitcoin may face significant risks during a bear market. The potential for substantial sell-offs from corporate Bitcoin holdings could exacerbate market downturns, leading to increased volatility and uncertainty in the crypto landscape.

How does a bull market affect the strategy of companies holding BTC in their treasuries?

In a bull market, corporate entities like Roxom Global tend to benefit from higher Bitcoin prices, allowing them to implement aggressive accumulation strategies. CEO Borja Martel Seward suggests that companies can maximize their Bitcoin treasury by selling at a high price and repurchasing during corrections, taking full advantage of the bullish momentum.

What is Roxom Global’s long-term vision for Corporate Bitcoin Holdings?

Roxom Global envisions a long-term strategy focused on accumulating Bitcoin rather than engaging in market timing. CEO Borja Martel Seward emphasizes the importance of learning from market cycles and remaining prepared for future entry points, indicating that the focus should be on overall Bitcoin holdings rather than transient fiat value.

Why is Bitcoin considered an independent asset according to Roxom’s CEO?

According to Roxom Global CEO Borja Martel Seward, Bitcoin is seen as an independent asset due to its unique market cycles and resilience against external economic pressures. This independence allows it to operate contrary to traditional financial markets, making it a pivotal component of corporate Bitcoin holdings.

What projections does Roxom Global CEO have for Bitcoin’s value by year-end?

Borja Martel Seward from Roxom Global projects that Bitcoin could reach between $120,000 and $200,000 by year-end. However, he warns that a subsequent sell-off may occur as investors capitalize on their gains, emphasizing the need for strategic management of corporate Bitcoin holdings during such transitions.

| Key Point | Details |

|---|---|

| Bull Market Outlook | CEO Borja Martel Seward predicts the current bull run will continue for several months, driven by macroeconomic factors. |

| Bitcoin as a Unique Asset | BTC operates independently of traditional markets, with its own cycles and fundamental resilience. |

| Challenges Ahead | Seward warns of potential struggles for bitcoin treasury companies during a bearish phase after the bull market ends. |

| Corporate Bitcoin Holdings | Increased adoption by companies poses risks and opportunities, especially during market shifts. |

| Long-term Strategy | Seward emphasizes a rational long-term accumulation approach, rather than attempting to time the market. |

| Price Projections | BTC is expected to peak between $120,000 to $200,000 by year-end, with potential sell-offs anticipated thereafter. |

| Roxom’s Focus | Roxom aims to create a financial ecosystem where BTC is the unit of account for trading diverse assets. |

Summary

Corporate Bitcoin Holdings are increasingly seen as a double-edged sword, offering significant benefits during bullish trends but posing substantial risks when the market turns bearish. As industry leaders like Roxom’s CEO Borja Martel Seward point out, while the short-term outlook remains optimistic, it is essential for corporations to prepare for potential downturns. Strategic long-term accumulation and careful management of assets, particularly in volatile market conditions, are pivotal for sustaining the value of corporate bitcoin investments. Understanding these dynamics will help stakeholders navigate the complexities of incorporating Bitcoin into corporate treasuries.