CPI Impact on Federal Reserve Rate Cuts: Insights by Rick Rieder

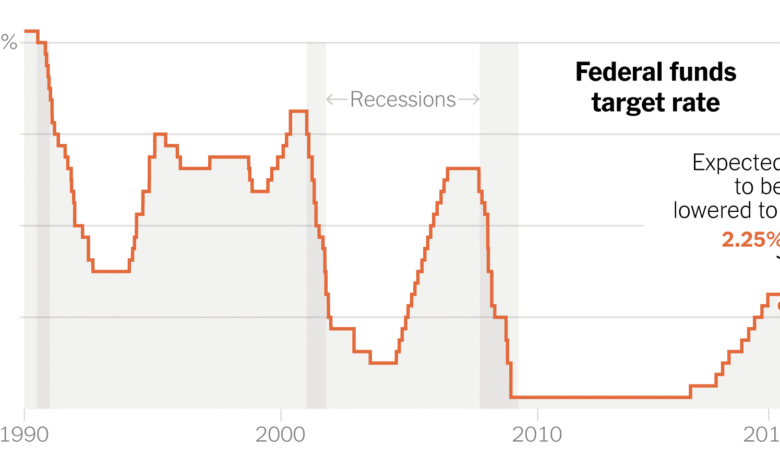

The impact of the Consumer Price Index (CPI) on Federal Reserve rate cuts is becoming increasingly significant in today’s economic landscape. As inflation continues to fluctuate, recent CPI reports suggest that the Fed may be justified in implementing a reduction of interest rates, potentially by as much as 50 basis points this September. This speculation, fueled by insights from BlackRock’s Rick Rieder, highlights how lower-than-anticipated inflation rates can pave the way for such adjustments. With the current CPI showing a year-over-year increase of just 2.7%, which fell below market expectations, the Fed is encouraged to act swiftly. Consequently, a strategic Federal Reserve cut could not only stabilize the economy but also align interest rates with longer-term inflationary expectations.

Examining the influence of the inflation index on monetary policy reveals a crucial relationship between CPI dynamics and interest rate adjustments. As market observers anticipate a potential shift in the Federal Reserve’s approach, the dialogue surrounding economic indicators like inflation rates becomes vital. BlackRock’s expertise, especially through figures like Rick Rieder, sheds light on the effects of CPI data on upcoming rate cuts. With mounting evidence suggesting that recent CPI fluctuations could lead to a systemic easing, the implications for borrowers and investors alike necessitate careful consideration. Ultimately, understanding this interplay between inflation metrics and Federal Reserve policies is essential for navigating the financial landscape.

The Recent CPI Report and Its Significance

The recent Consumer Price Index (CPI) report, released in August 2025, has reignited discussions about the Federal Reserve’s monetary policy. With inflation rates coming in lower than expectations at 2.7% year-over-year, market analysts are closely examining how this data could influence interest rate decisions moving forward. The CPI’s subdued rise of 0.2% for the month suggests a cooling in price pressures, which could justify a shift in the Federal Reserve’s approach to managing interest rates. Investors are particularly interested in how these figures align with the Fed’s long-term inflation targets.

Furthermore, the core CPI, which excludes food and energy, rose 0.3% monthly and 3.1% year-over-year, indicating some resilience in price pressures even as overall inflation becomes more manageable. This nuanced view of inflation could lead to strategic changes in the Federal Reserve’s policies. Analysts note that while this data provides some reassurance, any cuts in interest rates must be methodical to sustain economic stability.

CPI Impact on Federal Reserve Rate Cuts

The latest CPI report plays a crucial role in shaping the Federal Reserve’s upcoming interest rate decisions, particularly regarding the anticipated half-point cut in September. Rick Rieder of BlackRock highlights how this inflation data supports the case for significant rate cuts, which are intended to realign the Federal Funds rate to accommodate the evolving economic landscape. A well-justified cut could stimulate further economic growth by lowering borrowing costs for consumers and businesses alike.

Moreover, as the Fed contemplates these rate adjustments, it’s essential to consider the broader impact of inflation on the U.S. economy. By analyzing the CPI trends and the potential benefits of inflation rate cuts, investors can gain insights into future Federal Reserve actions. Such strategic financial guidance could create favorable conditions for economic expansion, especially for sectors sensitive to interest rate changes.

Rick Rieder’s Perspective on Rate Cuts

Rick Rieder, BlackRock’s chief investment officer, is advocating for a proactive monetary policy in response to the recent CPI data. His insights reveal a thoughtful approach towards managing fixed-income investments in light of potential Federal Reserve rate cuts. As one of Wall Street’s prominent figures, Rieder emphasizes that a half-point decrease in September could be pivotal in addressing long-term inflation expectations while harnessing productivity growth across various sectors.

Rieder’s predictions are anchored in empirical observations of the economy’s response to past rate adjustments. By drawing parallels to the Fed’s actions in September 2024, he posits that similar cuts now could enhance market stability and foster a more conducive environment for investment. His commentary serves as a vital reference point for investors keen on navigating the complexities of fixed-income landscapes amid changing monetary policies.

Understanding Federal Reserve’s Easing Cycle

The Federal Reserve’s easing cycle is a critical factor influencing market dynamics and investor strategies. After a rigorous period of rate hikes designed to combat inflation, recent CPI data indicates a shift back towards easing. This pivot towards lower interest rates is rooted in the Fed’s current assessment of economic conditions, including labor market trends and inflation indices. The Fed’s decision to initiate rate cuts, particularly a half-point cut, could signal a broader trend towards accommodating economic growth.

It is vital for stakeholders to understand how these monetary policy shifts affect various asset classes, particularly fixed income. As the Federal Reserve formulates its responses to inflation indicators, investor sentiment plays a significant role in shaping market expectations. Thus, grasping the intricacies of the Fed’s easing cycle is crucial for making informed investment decisions in a landscape heavily influenced by interest rate fluctuations.

The Role of Interest Rates in Economic Growth

Interest rates serve as a foundational aspect of economic policy, influencing everything from consumer spending to business investment. As the Federal Reserve considers potential rate cuts in light of recent CPI reports, the implications for economic growth cannot be understated. Lower interest rates generally facilitate increased borrowing and spending, providing a crucial boost to economic activity, especially in sectors that are sensitive to credit conditions.

Moreover, sustained lower interest rates can lead to higher asset prices, encouraging investments in equities and bonds. With Rick Rieder positing a forecast for a 50 basis point cut, it highlights the balance the Federal Reserve must strike between fostering growth and managing inflation. As the CPI remains relatively low, the Fed appears to be leaning towards stimulating the economy, suggesting a favorable environment for both consumers and investors alike.

Market Reactions to CPI Changes

The market response to CPI changes is often immediate and significant, as investors react to the implications for Federal Reserve policy. Following the latest inflation report, markets surged, with the S&P 500 hitting record highs as investors took the news as a green light for rate cuts. With lower-than-expected inflation figures, there is a growing sentiment that the Fed can act without fearing runaway prices, hence bolstering market confidence.

Additionally, the reaction of various asset classes can indicate investor expectations regarding future monetary policy. For instance, bond yields typically decrease when rates are anticipated to fall, while equities can rally in hopes of stronger growth prospects. Thus, understanding market dynamics in relation to CPI changes offers investors crucial insights into potential shifts in the economic landscape.

Predicting Future Federal Reserve Actions

Predicting the Federal Reserve’s future actions requires a careful analysis of incoming economic data, particularly inflation metrics such as the CPI report. The current climate indicates a willingness from the Fed to adjust monetary policy, especially with the latest inflation numbers supporting the case for rate cuts. Analysts and investors alike are now looking to upcoming economic indicators for further signs of the Fed’s potential moves.

Moreover, as the Fed balances its dual mandate of maximizing employment and stabilizing prices, understanding the implications of CPI trends will be integral. With experts like Rick Rieder signaling confidence in a rate cut, the market awaits further clarifications from Federal Reserve officials, which could provide guidance for anticipated economic conditions over the coming months.

Investing Strategies Amid Changing Interest Rates

As the Federal Reserve hints at potential rate cuts, particularly a significant reduction in September, investors must reassess their strategies to navigate an evolving market landscape. Lower interest rates could create favorable conditions for growth-oriented investments, prompting a shift in portfolio allocations toward equities and risk assets. Essential to this strategy is an understanding of how fixed-income assets may respond to the changing rate environment.

Investors should also consider the implications of CPI reports on their long-term investment goals. As inflation expectations adjust, those heavily invested in income-generating securities might need to explore higher-yield opportunities that can withstand fluctuations in interest rates. Staying informed about Federal Reserve signals and macroeconomic updates will be crucial in refining investment strategies to align with ongoing changes in the economic climate.

The Influence of Inflation on Consumer Behavior

Inflation directly impacts consumer behavior, influencing purchasing decisions and overall economic activity. When the CPI reflects lower inflation rates, as seen in the recent report, consumers may feel more confident about spending, which in turn can stimulate demand across various sectors. This boost in consumer confidence is pivotal for driving growth, especially in economies that are gradually recovering from previous downturns.

Conversely, persistent inflation can lead to hesitancy in consumer spending as individuals become more discerning about their financial choices. As the Federal Reserve navigates its monetary policy to manage inflation effectively, understanding these consumer dynamics will be essential for businesses and policymakers alike to adapt their strategies and meet shifting demands.

Frequently Asked Questions

How does the CPI report affect Federal Reserve rate cuts?

The CPI report provides crucial data about inflation trends that influence the Federal Reserve’s decisions on interest rates. A lower CPI indicates reduced inflationary pressures, potentially leading to rate cuts. For instance, the recent CPI report showing a year-over-year increase of just 2.7% gives the Fed justification to consider more significant cuts, like a half-point reduction.

What impact does CPI have on the timing of Federal Reserve cut decisions?

CPI significantly impacts the timing of Federal Reserve cut decisions. A lower-than-expected CPI, as seen recently, suggests that inflation is under control, prompting the Fed to adjust rates sooner rather than later. This could lead to immediate rate cuts, aligning with macroeconomic predictions, as supported by insights from experts like Rick Rieder from BlackRock.

Can a lower inflation rate lead to more aggressive Federal Reserve interest rate cuts?

Yes, a lower inflation rate can encourage more aggressive interest rate cuts from the Federal Reserve. If inflation rates show a downward trend, such as in the latest CPI report where price increases were below expectations, the Fed may opt for bolder moves, such as a 50 basis point rate cut to stimulate the economy.

What role does Rick Rieder from BlackRock play in forecasting Federal Reserve rate cuts?

Rick Rieder, Chief Investment Officer for BlackRock’s global fixed income, plays a significant role in forecasting Federal Reserve rate cuts. His analyses of CPI data and inflation trends guide investor expectations. His prediction that the Fed might implement a half-point cut is based on recent CPI readings and overall economic performance, shaping market responses.

How does the core CPI figure influence Federal Reserve policy decisions?

The core CPI figure is crucial for Federal Reserve policy decisions as it excludes volatile food and energy prices, providing a clearer view of underlying inflation trends. A strong core CPI, such as the recent rise of 3.1%, can still lead to rate cuts if overall inflation is manageable, as indicated by the broader CPI report.

What is the relationship between inflation rate cuts and Federal Reserve interest rate policy?

Inflation rate cuts and Federal Reserve interest rate policy are closely linked. When inflation rates drop, as shown in CPI reports, the Fed may lower interest rates to stimulate economic growth and prevent deflation. Rate cuts can help lower borrowing costs and increase spending, which is vital in maintaining economic stability.

How might future CPI reports influence Federal Reserve cuts later this year?

Future CPI reports will be essential in determining whether the Federal Reserve will make further cuts this year. If upcoming CPI data continues to show minimal inflation, it could reinforce the Fed’s trend towards easing monetary policy, potentially leading to additional rate cuts to support economic conditions.

Why are Federal Reserve rate cuts expected after a CPI report?

Federal Reserve rate cuts are expected after a CPI report if inflation rates suggest a need for stimulus. A CPI report that reveals lower inflation may prompt the Fed to lower rates to encourage borrowing and investment, creating a more favorable economic climate. Insights from market experts can also accelerate these expectations.

| Key Points |

|---|

| Rick Rieder from BlackRock suggests a potential 50 basis point cut from the Fed due to recent CPI data. |

| The CPI showed a 0.2% increase in July and a 2.7% rise year-over-year, which is below the expected 2.8%. |

| Rieder believes this will align the Funds rate with long-term inflation expectations and productivity. |

| The last significant cut occurred in September 2024, resembling the forecast for this September’s potential cut. |

| Excluding food and energy, core CPI climbed 0.3% for the month, reaching a 3.1% annual increase, showing signs of higher inflation. |

Summary

The CPI impact on Federal Reserve rate cuts indicates a significant shift in monetary policy may be on the horizon. With Rick Rieder of BlackRock predicting a half-point cut in September, recent inflation data suggests the Fed is in a position to adjust rates to foster economic stability. The lower-than-expected CPI results signal that the inflation pressures that typically prompt rate hikes are less pronounced, allowing the Fed to take a more accommodative stance without risking overheating the economy. Investors and economists alike are closely watching these developments as they will shape future financial strategies.