CRCL Stock Surges 674% — A New Era for Cryptocurrency

CRCL stock has taken Wall Street by storm, surging 674% in just ten trading sessions, capturing the attention of investors and crypto enthusiasts alike. As Circle Internet Group made its remarkable debut through a special purpose acquisition company (SPAC), the stock’s meteoric rise reflects the growing interest in cryptocurrency stocks and the innovative nature of this transition. Spearheaded by venture capitalist Chamath Palihapitiya, the Circle IPO signifies not just a financial event but a turning point in how digital assets are perceived on public markets. Amidst volatility, CRCL stands out as a beacon of potential, promising to reshape the landscape as cryptocurrency continues to evolve. This surge also highlights the interplay between SPACs and traditional IPOs, raising crucial discussions about value transfer in financial markets.

The recent explosion of Circle Internet Group’s shares, typically represented as CRCL, has captured significant interest on the financial markets. This exciting rise is part of a broader trend where businesses in the cryptocurrency sector are now being recognized through unique financial frameworks like SPACs. Under the leadership of innovative figures like Chamath Palihapitiya, the company’s initial public offering has sparked a movement that prioritizes transparency and investor engagement. This evolution within the capital markets not only emphasizes the potential for profit but also draws attention to the importance of smart investment strategies in the digital currency arena. With CRCL leading the charge, the stock exemplifies the dynamism of the evolving intersection of traditional finance and digital currencies.

CRCL Stock: A Record-Breaking Surge in Cryptocurrency Stocks

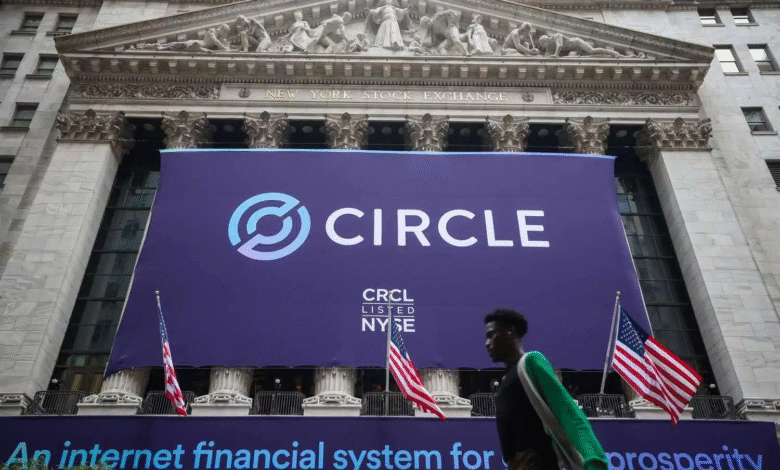

Circle Internet Group’s stock, CRCL, has made headlines recently by soaring 674% in a mere ten trading sessions on the New York Stock Exchange (NYSE). This meteoric rise exemplifies the rising trend of cryptocurrency stocks in the market, showcasing the growing interest from both retail and institutional investors. The stock’s performance reflects not only a successful initial public offering (IPO) but also emphasizes the potential of companies operating within the crypto sphere to attract significant capital rapidly.

Investors are particularly excited about CRCL’s role in the burgeoning stablecoin market, especially with the company’s involvement in the USDC project. As a significant player in cryptocurrency and decentralized finance (DeFi), Circle’s market activities bring newfound exposure and legitimacy to the sector. With venture capitalists like Chamath Palihapitiya championing the stock, it lends an air of confidence to potential investors, pointing towards a strong future for cryptocurrencies on Wall Street.

Frequently Asked Questions

What factors contributed to the recent surge in CRCL stock?

CRCL stock, linked to Circle Internet Group, surged 674% in just ten trading days due to increased investor interest and a growing demand for cryptocurrency-related stocks. Notably, the public excitement surrounding the Circle IPO and inherent market activities propelled its value amidst global economic uncertainties.

How does the Circle IPO compare to traditional IPOs in terms of investor benefit?

Chamath Palihapitiya highlights that the Circle IPO differs significantly from traditional IPOs because, in the latter, value often flows to investment banks rather than benefiting investors directly. He argues that SPACs, like those associated with Circle, could provide a more transparent and equitable structure for raising capital.

What is a SPAC, and how is it related to CRCL stock?

A SPAC, or Special Purpose Acquisition Company, is a company formed to raise capital through an IPO to acquire existing companies. CRCL stock emerged from a SPAC process, allowing Circle Internet Group to capitalize on public investment while navigating the complexities typical of a standard IPO.

What role does Chamath Palihapitiya play in the context of CRCL stock?

Chamath Palihapitiya, a noted venture capitalist, has been vocal about CRCL stock’s IPO process, asserting that the traditional IPO model failed to serve its investors. He sees the Circle IPO as an example of how SPACs can be an alternative that provides clarity and potential benefits for both the company and its investors.

How does CRCL stock’s performance compare to other cryptocurrency stocks?

CRCL stock has outperformed other cryptocurrency stocks significantly, gaining 674% in a short timeframe, making it the top performer in the sector. This contrasts with companies like Coinbase, which experienced declines in their stock value.

What are the implications of CRCL stock’s rise for cryptocurrency stocks as a whole?

The meteoric rise of CRCL stock could signal increased interest and investment in cryptocurrency stocks. As the market stabilizes and mainstream investors look for valid opportunities, Circle Internet Group’s success could pave the way for greater acceptance and investment in the broader cryptocurrency sector.

Is the recent rise in CRCL stock sustainable in the long term?

While the current surge in CRCL stock is impressive, its sustainability will depend on market conditions, ongoing adoption of cryptocurrencies, and the performance of Circle Internet Group. Investors should weigh these factors before making decisions regarding their investments in CRCL or related cryptocurrency stocks.

| Key Points | Details |

|---|---|

| CRCL Stock Performance | CRCL surged 22% on June 20, 2023, with a total gain of 674% over ten trading sessions. |

| Initial Share Price | The stock started at $31 per share on June 5, 2023. |

| Market Context | Despite geopolitical issues and macroeconomic noise, CRCL maintained its momentum. |

| Chamath Palihapitiya’s Analysis | Palihapitiya criticized traditional IPOs and highlighted the significant gains that investment banks reaped from CRCL’s IPO. |

| SPAC vs. IPO | SPACs, like CRCL’s method of going public, allow for more transparency compared to traditional IPO processes. |

| Comparison with Coinbase | CRCL’s debut contrasted with Coinbase’s direct listing, where COIN fell 13.37% post-listing. |

| Collaboration with Coinbase | Circle works closely with Coinbase through the USDC stablecoin; their successes are often interconnected. |

Summary

CRCL stock has made headlines on Wall Street with its astonishing 674% rise in just ten trading sessions. As the leading crypto-related stock, Circle Internet Group’s IPO has captured significant attention, not only for its explosive performance but also for the discussions it sparked regarding the IPO process. The insights shared by Chamath Palihapitiya highlight critical views on how traditional IPOs operate. Overall, the success of CRCL stock indicates a strong interest in the crypto market, suggesting that investors are increasingly looking towards the stablecoin sector.