Credit Default Swaps Surge Amid U.S. Debt Concerns

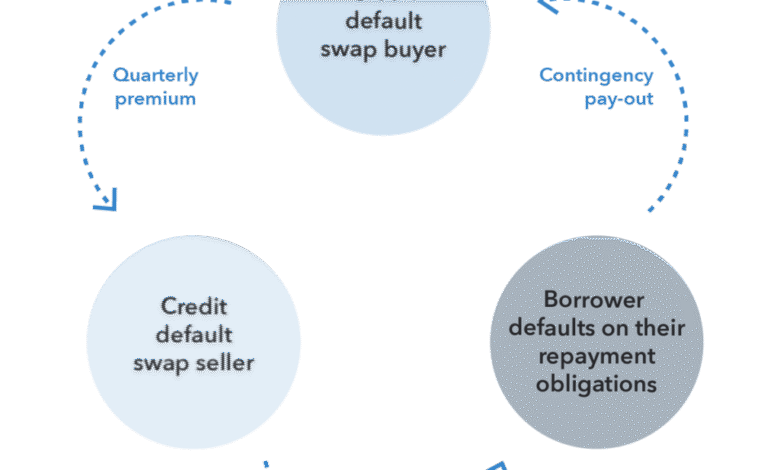

Credit default swaps (CDS) are gaining significant attention once again amidst mounting concerns over U.S. debt obligations. As investors become increasingly anxious about the government’s capacity to uphold its financial commitments, many are seeking this form of investors insurance to hedge against potential defaults. The rising cost of credit default swap spreads, now peaking at their highest since two years, reflects growing trepidation in the market. This uptick illustrates an essential mechanism in financial risk management, where CDS serve as a safeguard for those exposed to U.S. fiscal uncertainty. With political risk hedging becoming a focal point, the dynamics surrounding credit default swaps are pivotal to understanding current investment strategies.

Within the realm of financial derivatives, credit default swaps (CDS) represent a crucial tool for risk mitigation, often termed as default insurance by investors. As market participants navigate the complexities of sovereign debt and its implications, the rising demand for these instruments signals a shift towards protective measures against potential payment failures. With recent increases in CDS premiums indicating elevated market anxieties, such products play a vital role in hedging against not just outright defaults but broader risks associated with government fiscal policies. This trend highlights the interplay of financial security and investor psychology, redefining how risks associated with U.S. fiscal health are managed. The growing interest in these financial instruments underscores a strategic pivot towards maintaining stability amid uncertainty.

Understanding Credit Default Swaps in Today’s Market

Credit default swaps (CDS) have emerged as a hot topic in the finance world as investors grapple with the realities of U.S. fiscal policy and its implications on debt obligations. These financial instruments serve as a safety net, allowing investors to purchase protection against the risk of default by the U.S. government. The rising demand for CDS reflects heightened anxiety regarding the government’s ability to meet its debt obligations, evidenced by the recent increase in swap spreads. As spreads increased from 16 to 52 basis points, it became clear that investors are hedging against potential political and financial uncertainties, suggesting a proactive approach to financial risk management.

Moreover, the recent spikes in CDS premiums indicate not only concern about default risk but also serve to spotlight broader political risks impacting fiscal health. Investors are increasingly seeking insurance against the unpredictable landscape of U.S. politics, which can affect economic stability and confidence in debt securities. The emphasis on CDS as a tool for political risk hedging highlights the complexities within the current market environment, where financial instruments are being utilized to manage not just credit risk, but broader systemic uncertainties.

The Rising Cost of Insuring U.S. Government Debt

As credit default swap spreads for U.S. government debt soar, the cost of insuring against a potential default becomes a pressing concern for investors. With spreads on 5-year CDS rising to close to 50 basis points, there is a growing perception of risk among market participants that may not have been present previously. This increase indicates a market sentiment shift where investors are actively seeking ways to protect themselves from the financial implications of potential government dysfunction. The current economic landscape, highlighted by unresolved debt ceilings and looming fiscal challenges, has contributed to the uptick in insurance costs.

The narrative surrounding the U.S. government’s fiscal policies has shifted markedly over the past year. As concerns mount regarding the government’s capacity to manage its $36.1 trillion debt, investors are revisiting the value of CDS as an effective measure of financial protection. This heightened demand isn’t merely a reflection of investor panic but reveals a strategic approach to safeguarding investments against broader economic implications, which could include elevated credit default swap spreads resulting from political stalemates and fiscal challenges.

Political Risk Hedging and Investor Sentiment

In today’s tumultuous political environment, the strategy of political risk hedging has taken center stage, particularly in light of ongoing fiscal policy uncertainties. Investors, who typically rely on credit default swaps for unilateral hedging against default risk, are now increasingly employing them as a means to mitigate the risk associated with political dynamics. The situation underscores a critical shift in how investors assess risk, with political factors becoming integral to financial risk management approaches.

For instance, the uncertainty surrounding the U.S. debt ceiling negotiations has fostered a climate of caution among investors. The lessons learned from past fiscal crises indicate that political debates and stalemates can have dire consequences for economic stability. Therefore, the desire to engage in political risk hedging through instruments like CDS has become essential for those seeking to navigate the intricacies of managing exposure to government debt under uncertain conditions.

Investor Strategies in Response to U.S. Fiscal Policy

Investors are continuously adapting their strategies in response to evolving U.S. fiscal policies, particularly as fears surrounding the debt ceiling grow. The current trend shows a marked increase in the use of credit default swaps as a hedge against perceived risks associated with government debt. This adaptability reflects a growing recognition of the interconnectedness between government actions and market stability, pushing investors to reassess how they allocate their resources.

Additionally, the moves made by the Congressional Budget Office and Treasury officials in relation to the debt ceiling negotiations are closely monitored by investors. A significant aspect of their strategy includes adjusting their exposure to U.S. Treasury securities based on anticipated fiscal developments. This reflects an understanding that uncertainty regarding government fiscal policy can lead to broader market implications, highlighting the necessity for investor vigilance in the face of changing economic landscapes.

The Role of Credit Default Swaps in Financial Crisis Management

Historically, credit default swaps have played a pivotal role in financial crisis management, allowing investors to navigate turbulent markets by providing necessary protection against default risks. This historical context has now resurfaced as the U.S. government faces rising pressure regarding its debt management amidst political gridlock. As institutional and retail investors alike turn to CDS, it’s essential to understand how these instruments were utilized during previous crises and what lessons can be applied to today’s fiscal environment.

In recent years, the increased trading activity in CDS markets has drawn parallels to the behavior observed during the 2008 financial crisis. While the prior market conditions were marked by high-risk corporate debt linked to subprime mortgages, the current scenario emphasizes government debt. Investors are not merely preparing for possible default scenarios but also anticipating systemic risks that could affect overall market liquidity and investor confidence. Engaging with CDS as a tool reflects a broader risk management philosophy in today’s uncertain fiscal climate.

Implications of Rising CDS Premiums on Market Stability

The implications of rising credit default swap premiums on market stability are multifaceted, suggesting both opportunities and risks for investors as they navigate potential default outcomes. Increasing premiums often reflect broader market sentiments that may destabilize investor confidence and consequently affect liquidity in the bond markets. This marks a critical juncture for those invested in government securities, as rising CDS prices can influence secondary market valuations and overall investment strategies.

Furthermore, these rising CDS premiums signal to investors that they may need to reconsider traditional approaches to risk assessment and management. With market analysts closely monitoring fluctuations in CDS spreads, the data serves as a barometer for underlying concerns relating to government fiscal health, prompting investors to recalibrate their portfolios accordingly. Understanding the direct relationship between CDS premiums and overall market health is vital in making informed investment decisions in this dynamic environment.

Navigating the Uncertain U.S. Fiscal Landscape

Navigating the uncertain U.S. fiscal landscape requires a keen understanding of how various economic factors interplay, especially concerning government debt and investor behaviors. With U.S. Treasury hitting its debt limit and ongoing negotiations sparking investor unease, the market is poised at a delicate balance. As investors pursue credit default swaps for protection, an overarching narrative emerges about the importance of proactive financial risk strategies to mitigate potential losses amid fiscal uncertainties.

Moreover, as officials seek solutions to raise the debt ceiling through legislative action, market dynamics may shift dramatically based on the outcomes of these discussions. Investors must remain informed and adaptable, utilizing tools such as CDS to hedge against unforeseen consequences stemming from government policy changes. This strategic foresight is essential in capitalizing on investment opportunities while safeguarding against inherent risks posed by an unpredictable political environment.

Analyzing the Movement of Credit Default Swap Spreads

The movement of credit default swap spreads offers a critical insight into the market’s expectations regarding the U.S. government’s creditworthiness. As observed, the sharp increase in swap spreads indicates that investors are recalibrating their assessments of risk in light of unresolved fiscal challenges. Each percentage point increase can be interpreted as a corresponding shift in investor sentiment towards the perceived stability and solvency of U.S. government debt, highlighting the sensitivity of CDS spreads to broader economic indicators.

Detailed analysis of the fluctuation patterns in credit default swap spreads not only provides analysts with a window into investor psychology but also showcases the contagious nature of perceived risk within the financial sector. For instance, changes in CDS premiums can influence interest rates on government securities, creating a ripple effect throughout the financial markets. This interconnectivity emphasizes the importance of understanding these spreads as integral components within the larger ecosystem of financial risk management.

The Future of Credit Default Swaps in U.S. Finance

The future of credit default swaps in U.S. finance is poised for evolution as the market adapts to new regulatory frameworks and investor needs. As the demand for risk mitigation tools grows amid ongoing fiscal challenges, CDS will likely become an essential part of many investment strategies. Investors, recognizing the protective capacity of these instruments, may seek to innovate upon their traditional uses, incorporating them into a broader risk management framework that addresses both financial and political risks.

Looking ahead, the evolution of credit default swaps will be heavily influenced by changes in market dynamics and investor behavior toward government securities. As uncertainty surrounding U.S. fiscal policy persists, the significance of CDS as a hedge against potential default and political turmoil will become increasingly pronounced. Financial institutions may need to enhance their offerings in CDS and related products to meet the needs of a changing investor base, solidifying their place in the new investment landscape.

Frequently Asked Questions

What are credit default swaps and how do they relate to U.S. debt obligations?

Credit default swaps (CDS) are financial instruments that serve as insurance for investors against the default of a borrower, such as the U.S. government. In the context of U.S. debt obligations, CDS allow investors to manage the financial risk associated with potential non-payment of government debt. With rising concerns over the U.S. fiscal health, the demand for CDS has increased, reflecting worries among investors that the government may struggle to meet its obligations.

How do credit default swap spreads indicate rising concerns among investors?

Credit default swap spreads represent the cost of insurance that investors must pay to protect against default risk. An increase in these spreads indicates that investors are becoming more concerned about the likelihood of default. Recently, spreads on U.S. 1-year credit default swaps rose significantly, highlighting a growing unease among investors regarding U.S. debt obligations and fiscal stability.

What role do credit default swaps play in financial risk management?

Credit default swaps are crucial tools in financial risk management, allowing investors to hedge against the risk of borrower default. By purchasing CDS, investors can mitigate potential losses from U.S. debt obligations in case of a default. These instruments provide a way to manage exposure and enhance portfolio stability, especially during periods of economic uncertainty or political risk.

Why are credit default swaps considered a hedge against political risk?

Credit default swaps are viewed as a hedge against political risk because they provide protection against potential disruptions in government financial stability. Investors are currently using CDS to safeguard against uncertainties related to U.S. fiscal policy and the unresolved debt ceiling, suggesting that the demand for these swaps is driven more by political concerns than by fundamental risks of insolvency.

What recent trends have been observed in credit default swap prices related to U.S. government debt?

Recent trends show that credit default swap prices on U.S. government debt have increased significantly amid fiscal concerns. For instance, the spreads for U.S. 1-year CDS have shot up from 16 to 52 basis points since the beginning of the year. This hike indicates an increased perception of risk among investors as they navigate potential default scenarios related to U.S. debt obligations.

How does the unresolved U.S. debt ceiling affect credit default swap markets?

The unresolved U.S. debt ceiling has a direct impact on credit default swap markets, as it raises the perceived risk of default among investors. The ongoing uncertainty surrounding the U.S. government’s borrowing capacity has resulted in increased demand for CDS as a precautionary measure. Observers note that spikes in CDS spreads tend to coincide with debates and deadlocks over the debt ceiling, reflecting investor anxieties.

What implications does a downgrade in the U.S. sovereign credit rating have on credit default swaps?

A downgrade in the U.S. sovereign credit rating, like Moody’s recent adjustment from Aaa to Aa1, typically leads to increased credit default swap prices as it signals deteriorating fiscal health. This downgrading heightens investor concerns and could result in greater demand for CDS as investors seek to safeguard their investments tied to U.S. debt obligations.

Are credit default swaps a sign of impending financial crisis?

While rising credit default swap prices may suggest increasing risk perceptions, they are not necessarily indicative of an impending financial crisis. The current demand for CDS related to U.S. government debt reflects more on political risk than systemic financial distress, as observed in past crises where CDS were linked to corporate defaults. Investors are utilizing CDS primarily as a protection mechanism during uncertain political and fiscal conditions.

| Key Points | Details |

|---|---|

| Increased Demand for CDS | Investors are buying credit default swaps as insurance against potential U.S. government debt defaults. |

| Rising CDS Premiums | Cost of insuring U.S. debt has risen, with 1-year CDS premiums increasing from 16 to 52 basis points this year. |

| Reasons for Demand Increase | Concerns over U.S. fiscal policy and political dysfunction, particularly regarding unresolved debt ceiling issues. |

| Historical Context | CDS spreads spike during heightened concern over debt limit, seen in years like 2011, 2013, and 2023. |

| Impending Debt Ceiling Challenges | U.S. Treasury hit its debt ceiling in January 2025, with warnings about the potential for economic disaster without action. |

Summary

Credit default swaps are experiencing renewed interest as investors grow increasingly concerned about the U.S. government’s ability to fulfill its debt obligations due to political and fiscal issues. The notable rise in CDS premiums indicates a protective measure against perceived risks associated with government securities. As debates around the debt ceiling heat up, investors are leveraging credit default swaps to hedge against potential defaults, reaffirming their importance as a tool in the current economic climate.