Cross-Border Crypto Flows Surge to $2.6 Trillion in 2021

In recent years, the dynamics of cross-border crypto flows have reshaped the landscape of global finance, with a staggering $2.6 trillion recorded in 2021 alone. This noteworthy volume accounts for nearly 12% of international goods trade, a significant leap highlighted in the latest Bank for International Settlements (BIS) cryptocurrency report. Among these flows, stablecoins have emerged as pivotal players, dominating almost half of the transactions and facilitating seamless crypto asset transactions across borders. Especially in emerging markets, individuals are turning to Bitcoin remittance alternatives, enhancing their financial accessibility amid fluctuating currencies and high inflation rates. With such a rapid evolution in cross-border crypto activity, traditional financial systems are being forced to adapt to these groundbreaking trends in digital currency usage.

The phenomenon of international digital currency transfers has seen unprecedented growth, fundamentally altering the mechanisms through which value is exchanged globally. This surge, evident in the rise of crypto assets in global transactions, highlights the crucial role of stablecoins in facilitating trade and remittances. As markets evolve, emerging economies are increasingly adopting these digital currencies as reliable alternatives to conventional financial systems. The compelling data released in the recent BIS report illustrates the stark contrast between traditional remittance channels and Bitcoin’s ability to provide cost-effective solutions. With the shift towards the use of these decentralized financial instruments, the landscape of international currency flows is becoming more intricate and dynamic.

The Surge of Cross-Border Crypto Flows

The recent working paper from the Bank for International Settlements (BIS) highlights a phenomenal increase in cross-border crypto asset flows, reaching an eye-popping $2.6 trillion in 2021. This surge not only represents a significant portion of the global economy but also indicates a growing reliance on cryptocurrencies in international trade. Emerging markets are particularly benefiting from this trend, positioning themselves as essential players in the global crypto landscape. Countries like India and Turkey, influenced by regulatory shifts in other regions, have seen a remarkable uptick in their crypto transactions, particularly through stablecoins.

The implications of these substantial cross-border flows are profound, as traditional banking systems now face stiff competition from cryptocurrency networks. The BIS report reveals that the density of crypto networks has surpassed that of conventional banking, suggesting an evolution in how financial transactions are processed globally. Given the ongoing challenges posed by inflation and exchange rate volatility, these cross-border crypto flows are expected to continue rising, offering new opportunities and challenges for regulators and financial institutions alike.

Stablecoins: The Backbone of Global Trade

As detailed in the BIS report, stablecoins have cemented their role as pivotal instruments in global trade, accounting for nearly half of all crypto transactions. Stablecoins like Tether (USDT) and USD Coin (USDC) provide the necessary stability and reliability required for commercial exchanges, thus facilitating smoother cross-border transactions. Their ability to mitigate the volatility typical of cryptocurrencies makes them especially attractive for businesses operating in emerging markets, where currency fluctuations can heavily impact profit margins.

The integration of stablecoins into the global trade framework marks a significant shift in how transactions are executed. They not only present a cost-effective alternative to traditional currency transactions but also enhance financial inclusivity in regions with underdeveloped banking infrastructure. The ability of stablecoins to bypass the high remittance fees associated with conventional financial intermediaries positions them as a vital tool for many businesses, particularly those engaged in international trade.

Bitcoin Remittance Alternatives in Emerging Markets

Bitcoin’s appeal as a remittance alternative has surged in regions where traditional financial services often impose exorbitant fees. The BIS study indicates that corridors with historically high remittance costs are witnessing notable growth in low-value Bitcoin transactions for remittance purposes. For example, transfers under $500 have seen an increase of up to 25%, providing an economical alternative for individuals seeking to send money across borders.

This shift highlights Bitcoin’s potential as a viable substitute for conventional remittance channels, particularly in countries like Indonesia and Turkey. As inflation and economic instability persist in many regions, the demand for accessible and cost-effective remittance solutions will likely drive more users toward cryptocurrencies. Bitcoin’s decentralized nature not only reduces transaction costs but also empowers individuals by offering them more control over their financial transactions.

Impact of Regulatory Changes on Crypto Flows

The regulatory landscape surrounding cryptocurrencies is rapidly evolving, with the recent BIS report noting significant shifts influenced by government actions. For instance, China’s regulatory crackdown on crypto has inadvertently bolstered other nations, particularly in emerging markets, as they embrace this technology. Countries like Turkey and Russia are stepping up, becoming key players in the stablecoin market as they navigate the complexities of their financial futures.

These regulatory changes have resulted in enhanced activity within cross-border crypto flows, granting individuals and businesses an opportunity to circumvent typical barriers imposed by traditional finance. As countries implement different regulatory approaches, the crypto landscape becomes increasingly fragmented, demanding that both users and policymakers adapt to these shifts. Understanding these nuances is critical for predicting future trends in cryptocurrency usage across the globe.

Challenges of Integrating Crypto into Mainstream Finance

As the adoption of cryptocurrencies accelerates, the BIS report emphasizes the challenges that accompany their integration into the mainstream financial system. Policymakers face a dual task: they must foster innovation while also safeguarding against potential systemic vulnerabilities that could arise from unregulated crypto usage. The operational risks involved in cryptocurrencies, from security concerns to volatility, can pose significant threats to financial stability, particularly in emerging markets that are more susceptible to economic disruptions.

These challenges necessitate a proactive approach from regulators who must establish robust frameworks that can accommodate the unique characteristics of digital assets. The line between encouraging innovation and ensuring consumer protection becomes increasingly blurred as cryptocurrencies gain traction. Moving forward, it is crucial for global financial authorities to collaborate and develop regulations that address these challenges without stifling the growth of this transformative technology.

The Role of Crypto in Financial Inclusion

Cryptocurrencies, especially stablecoins, have the potential to significantly enhance financial inclusion in underserved regions. The BIS report reveals that crypto networks offer an alternative to traditional banking systems, especially in emerging markets where access to conventional banking is limited. Many individuals in these regions lack reliable access to financial services, and cryptocurrencies can fill that gap by providing opportunities for savings, transactions, and investments.

As the use of stablecoins and other cryptocurrencies increases, there is potential for transformative change in how economies function. By enabling easier access to cross-border transactions, these digital assets can empower individuals and small businesses, fostering entrepreneurship and economic growth. The ability to conduct transactions without relying on traditional banking infrastructure opens doors to financial participation for many who have been historically excluded.

Technological Innovation Driving Crypto Adoption

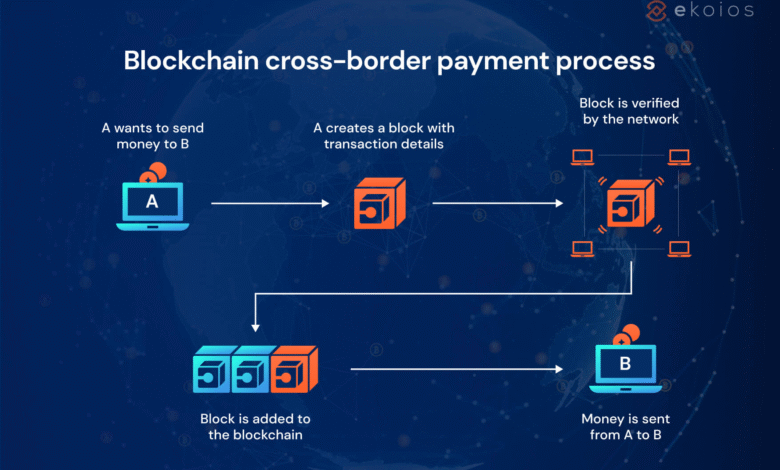

Technology plays a crucial role in the accelerated adoption of cryptocurrencies across the globe. The BIS study highlights how advancements in blockchain technology have facilitated the growth of crypto asset transactions, enabling faster and more efficient cross-border transfers. As the infrastructure supporting cryptocurrencies continues to evolve and improve, more individuals and businesses are recognizing the advantages of incorporating these digital assets into their transactional frameworks.

Moreover, as technology becomes more accessible, the barriers to entry for using cryptocurrencies diminish. Increased smartphone penetration, internet accessibility, and the development of user-friendly wallets are significant drivers of crypto adoption in emerging markets. The ability to harness these technological advancements allows users to engage in crypto asset transactions easily, thereby enhancing their ability to participate in global trade and finance.

The Future of Cross-Border Transactions and Crypto

Looking ahead, the potential for cross-border transactions using cryptocurrencies remains vast. The BIS report suggests that as more countries adapt to the digital economy, the landscape for crypto asset transactions will likely expand significantly. With stablecoins leading the way as flexible transactional tools, businesses and individuals can expect more seamless international trade experiences.

This future also entails navigating the regulatory minefield that accompanies the growth of digital currencies. Stakeholders must work collaboratively to devise regulations that protect users while fostering innovation. The trajectory of cross-border crypto flows and their role in global trade will ultimately depend on how effectively these challenges are addressed, paving the way for a more integrated financial system.

The Importance of Global Collaboration on Crypto Regulation

To ensure the responsible growth of cryptocurrencies, global collaboration on regulatory standards is essential. The BIS report underscores the need for countries to come together to establish guidelines that can effectively manage the risks present in the crypto market while promoting its benefits. Such collaboration can facilitate a more stable environment for cross-border crypto flows, encouraging participation from diverse economies.

By working together on regulatory frameworks, nations can align their approaches to tackle common challenges, such as fraud, money laundering, and systemic risks. This concerted effort not only instills confidence in digital asset transactions but also supports the ongoing evolution of cryptocurrencies as legitimate financial instruments in global trade.

Frequently Asked Questions

What are cross-border crypto flows and how do they relate to global goods trade?

Cross-border crypto flows refer to the transfer of cryptocurrencies and crypto assets over borders, typically for transactions or investment purposes. According to the Bank for International Settlements (BIS) report, these flows surged to $2.6 trillion in 2021, constituting nearly 12% of global goods trade. This growth indicates that crypto asset transactions are increasingly integrated into international commerce and finance.

How do stablecoins impact cross-border crypto flows in global trade?

Stablecoins play a crucial role in cross-border crypto flows, accounting for nearly half of the $2.6 trillion reported in 2021. They offer a stable medium of exchange which facilitates international trade and transactions, especially in emerging markets. The use of stablecoins, such as Tether (USDT) and USD Coin (USDC), provides a reliable alternative to traditional fiat currencies, reducing the volatility often associated with crypto asset transactions.

Can Bitcoin remittance alternatives effectively replace traditional remittance services in cross-border transactions?

Yes, Bitcoin remittance alternatives are becoming increasingly popular, especially in regions with high remittance fees. The BIS study highlights that corridors with traditionally high remittance costs saw a 25% increase in low-value Bitcoin and stablecoin transactions. This indicates that individuals are turning to crypto assets as cost-effective alternatives to conventional remittance services, particularly for transactions under $500.

What trends are emerging in cross-border crypto flows from advanced economies to emerging markets?

The BIS report reveals a significant shift in cross-border crypto flows from advanced economies to emerging markets like India, Indonesia, and Turkey. This trend has been accelerated by tighter regulations in countries like China, prompting users to seek alternatives in less regulated environments. The influx of crypto asset transactions in these markets is linked to high inflation rates and exchange rate volatility, further driving demand for stablecoins and Bitcoin as viable transaction mediums.

What challenges do policymakers face regarding cross-border crypto flows and emerging markets?

Policymakers are confronted with the challenge of fostering innovation in the crypto space while managing systemic risks, particularly in emerging markets. The BIS study points out that crypto networks can bypass traditional financial capital flow restrictions, creating potential regulatory headaches. Policymakers must balance the benefits of increased financial inclusion through cross-border crypto flows against the need to mitigate risks associated with the integration of these assets into mainstream finance.

| Key Points | Details |

|---|---|

| Surge in Crypto Flows | Cross-border crypto asset flows reached $2.6 trillion in 2021, constituting nearly 12% of global goods trade. |

| Role of Stablecoins | Stablecoins account for almost half of the crypto transactions. |

| Geographic Trends | Major hubs include the USA and UK, with emerging markets like India and Turkey gaining prominence. |

| Impact of Regulations | China’s regulatory crackdown has shifted crypto flows towards nations like Turkey and Russia. |

| Network Density | Crypto networks are denser than traditional banking systems. |

| Market Correlation | Crypto flows are increasingly linked to global financial conditions, impacting trading volumes. |

| Usage of Crypto for Remittances | High remittance fees correlate with increased stablecoin usage and low-value Bitcoin transactions. |

| Stability and Speculation | Stablecoins like USDT and USDC are crucial, while Bitcoin’s use is largely speculative. |

| Regulatory Challenges | Crypto’s integration poses risks, prompting policymakers to manage innovation while mitigating vulnerabilities. |

Summary

Cross-border crypto flows have drastically changed the landscape of international transactions, reaching $2.6 trillion in 2021. This unprecedented growth reflects the increasing acceptance and usage of cryptocurrency, particularly stablecoins, as viable alternatives for remittance and trade. As countries adopt diverse regulatory frameworks, understanding the dynamics of these flows becomes crucial for policymakers aiming to balance innovation with systemic stability.