Crypto ETF Inflows Surge with Blackrock’s IBIT & ETHA

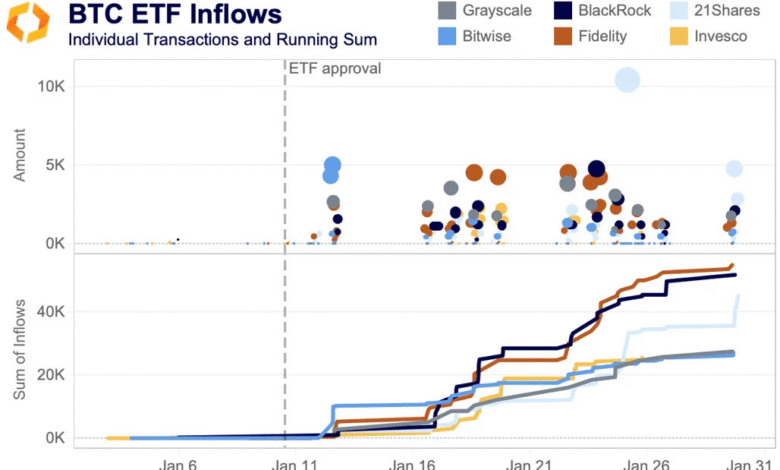

Crypto ETF inflows have become a pivotal measure of institutional interest in the burgeoning landscape of cryptocurrencies. On a significant trading day, both spot bitcoin and ethereum exchange-traded funds attracted a staggering $270.37 million, indicating a robust appetite for these investment vehicles. Leading the pack was Blackrock’s IBIT, which recorded an impressive $430.77 million in inflows, showcasing the growing trend toward institutional investment in crypto assets. Additionally, ethereum ETF inflows surged as Blackrock’s ETHA contributed a notable $52.84 million to the total, reflecting investor confidence in the potential of digital currencies. With bitcoin ETF inflows now totaling around $44.53 billion, it’s clear that institutional investors are increasingly favoring these innovative financial products.

In the realm of cryptocurrency investment, exchange-traded funds (ETFs) serve as critical indicators of market sentiment and capital flows. The substantial inflows into crypto-backed ETFs, including those focused on bitcoin and ethereum, highlight a burgeoning trend among institutional investors looking to diversify their portfolios. With major players like Blackrock leading the charge with funds such as IBIT and ETHA, the sector is witnessing an influx of capital that underscores a shift toward mainstream acceptance of digital assets. The performance of these funds, particularly in terms of inflows, is a testament to the growing integration of cryptocurrency in traditional investment strategies. As institutional capital continues to flow into these innovative financial products, the landscape of investing in digital currencies is evolving rapidly.

Understanding the Surge in Crypto ETF Inflows

In recent weeks, the surge in cryptocurrency exchange-traded funds (ETFs), particularly bitcoin and ethereum ETFs, has been remarkable. With a combined total of $270.37 million in inflows just last Friday, it is evident that institutional investors are actively exploring these new financial instruments. This rising trend is fueled by a broader acceptance of cryptocurrencies as an asset class, attracting traditional investors who are looking to diversify their portfolios with innovative financial products like crypto ETFs.

The influx of capital into these funds signals institutional confidence in the market, especially with key players like Blackrock leading the charge. Their entry through products such as the IBIT and ETHA proves pivotal in shaping market dynamics. Investors are drawn to these ETFs due to their regulated nature and the security they offer instead of direct cryptocurrency investments, reflecting a critical shift in the financial landscape.

Spot Bitcoin ETFs: Statistics and Market Impact

The recent performance of spot bitcoin ETFs can be best illustrated by the staggering $44.5 billion in cumulative inflows since their inception on January 11, 2023. According to updated statistics from Sosovalue.com, the IBIT fund from Blackrock was a standout, attracting a remarkable $430.77 million. This explosive growth showcases the increasing demand for bitcoin exposure among institutional investors, contributing to the stabilization and potential growth of the bitcoin market.

Moreover, the data illustrates stark contrasts in fund performances. While spot bitcoin ETFs thrive, others face challenges with significant outflows. For instance, Grayscale’s GBTC lost $89.17 million, indicating a selective investment environment driven by quality over quantity. The dynamics of these inflows and outflows underscore the necessity for funds to adapt and innovate to meet investor demands in a rapidly changing crypto landscape.

Tracking Ethereum ETF Inflows and Their Implications

On the ethereum front, the introduction of ETFs has also led to increased inflows, with a cumulative total of $2.76 billion recorded since their launch last year. Blackrock’s ETHA was at the forefront, garnering $52.84 million, reinforcing its position as a leader in the cryptocurrency investment space. The specific attention on ETHA highlights how capital inflows are becoming strategically directed, optimizing returns based on investor confidence.

The selective nature of these inflows demonstrates a discerning institutional appetite for crypto assets. As observed, while many ethereum ETFs posted no significant changes, the standout performances indicate a market that values effective fund management and performance metrics. Institutional investors appear to prefer funds with proven track records and robust growth potential, emphasizing the necessity for managers to uphold transparency and performance in attracting future investments.

The Role of Institutional Investment in Crypto ETFs

Institutional investment continues to play a very critical role in the cryptocurrency ETF landscape. As traditional investment firms recognize the potential of digital assets, their participation through ETFs has burgeoned. This shift is particularly significant as it brings credibility and stability to the volatile crypto markets, effectively bridging the gap between conventional and modern finance.

Moreover, the trend indicates a broader acceptance of cryptocurrencies as a legitimate asset class. With institutions like Blackrock launching products tailored for professional investors, the barriers to entry are being lowered for other institutional players. Consequently, this engaged interest fosters an environment ripe for innovation and progress within the crypto industry.

Trends in Bitcoin ETF Inflows: Analysis and Insights

The trends emerging from recent bitcoin ETF inflows reveal a compelling narrative regarding market sentiment and investor behavior. The significant amount of $211.74 million that bitcoin ETFs captured during the last trading session illustrates a persistent bullish outlook among investors. Factors such as growing acceptance of bitcoin as ‘digital gold’ and favorable regulatory developments contribute to the overall positive sentiment surrounding these funds.

Furthermore, ongoing analysis of fund performances underscores a critical divergence between successful ETFs, like those operated by Blackrock, and those experiencing outflows. Investors are becoming increasingly savvy, opting for funds that promise better performance and greater transparency. This ongoing selection process represents a learning curve for fund providers as they strive to adapt to investor expectations in an increasingly competitive landscape.

ETHA Performance: A Closer Look at Investment Returns

Examining ETHA’s impressive performance brings to light its strategic advantage in the ethereum investment space. By achieving the highest inflow figures among ethereum ETFs, ETHA reflects robust investor confidence and highlights the demand for high-quality investment options. Its ability to capture $52.84 million in inflows indicates a successful pitch to institutional investors seeking exposure to ethereum.

The competitive landscape for ethereum ETFs demonstrates the significance of performance as a key driver for inflow attraction. As institutional funds continue to evaluate their options, priority is placed on those that can deliver consistent returns. As ETHA maintains its leading position, pressure mounts on competing products to enhance their offerings to capture similar attention from investors.

Comparing Institutional Crypto ETF Strategies

A detailed comparison of various institutional strategies reveals fundamental differences in how different crypto ETFs operate. Notably, while Blackrock’s IBIT and ETHA have thrived due to their stringent management and clear communication of performance metrics, others have faced challenges due to lack of investor confidence. This evolution highlights the increasing need for innovation to keep pace with investor expectations.

As institutions assess risk and return profiles, the various management styles and investment strategies reflect their approach to the evolving crypto landscape. Some funds may pursue aggressive growth strategies, while others adhere to a more conservative investment posture. As the market matures, these strategies will shape the future of institutional investment in the cryptocurrency domain.

The Future of Crypto ETFs: Predictions for Growth

Looking ahead, the future of crypto ETFs seems poised for continued growth. The combination of regulatory acceptance and heightened institutional interest suggests that these investment vehicles will become increasingly mainstream. As more institutions launch their own ETFs, competition will drive innovation, leading to more diverse and accessible investment opportunities for retail and institutional investors alike.

Significantly, as bitcoin ETF inflows remain strong and ethereum offerings expand, it is reasonable to predict that the momentum will attract even more investor engagement. This influx of capital can also stabilize price volatility within the crypto markets, thereby strengthening the overall structural integrity of the digital asset landscape.

Impact of Regulatory Developments on Crypto ETF Inflows

Regulatory developments play a pivotal role in shaping the trajectory of crypto ETF inflows. As regulations evolve to accommodate and clarify the status of cryptocurrencies, institutional confidence in these investment products continues to grow. Clear guidelines allow firms to better assess risks and deploy capital, further stimulating the influx of institutional investments into crypto ETFs.

Moreover, favorable regulatory news often correlates directly with spikes in inflow volumes. As seen with the recent approval of new crypto ETFs, submissions and inquiries from investment firms have increased, suggesting a burgeoning confidence in these markets. This trend indicates that as regulations solidify and mature, they will bolster participation from a broader array of institutional investors.

Frequently Asked Questions

What are the latest trends in bitcoin ETF inflows?

Recent data shows that bitcoin ETFs have attracted significant institutional investment, with cumulative inflows reaching $44.53 billion since their launch. On May 23, 2025, spot bitcoin ETFs alone saw inflows of $211.74 million, indicating a strong demand for crypto-backed funds.

How much did Blackrock’s IBIT attract in bitcoin ETF inflows recently?

Blackrock’s IBIT has been a standout performer among bitcoin ETFs, pulling in $430.77 million in inflows during the last reported session. This highlights its popularity among institutional investors seeking crypto exposure.

What impact do ethereum ETF inflows have on institutional investment in crypto?

Ethereum ETF inflows are growing, with a total of $2.76 billion since the inception of these funds. On a recent day, they attracted $58.63 million, reflecting sustained interest in crypto investments by institutions, particularly in Blackrock’s ETHA, which led with $52.84 million.

How do bitcoin ETF inflows compare to ethereum ETF inflows?

Currently, bitcoin ETF inflows significantly outpace those of ethereum. For example, bitcoin ETFs have amassed $44.53 billion, while ethereum ETFs have reached $2.76 billion in total inflows. This indicates a stronger institutional focus on bitcoin compared to ethereum.

What should investors know about the performance of Blackrock’s ETHA and IBIT funds?

Blackrock’s ETHA and IBIT have shown robust performance, leading their respective markets with significant inflows. ETHA reported $52.84 million in recent inflows, while IBIT attracted $430.77 million, demonstrating their dominant positions in the crypto ETF landscape.

What factors are influencing institutional investment in crypto ETFs?

Institutional investment in crypto ETFs is driven by factors such as regulatory clarity, growing acceptance of cryptocurrencies, and the performance metrics of specific ETFs. The recent inflows into bitcoin and ethereum ETFs suggest that investors are selectively favoring funds with strong track records like Blackrock’s offerings.

What are the implications of recent bitcoin ETF and ethereum ETF inflows for the crypto market?

The influx of funds into bitcoin and ethereum ETFs signifies a bullish sentiment among institutional investors towards the crypto market. With bitcoin leading the inflows, it suggests a growing preference for BTC as a preferred digital asset among institutions, potentially impacting market dynamics.

What risks should institutions consider regarding crypto ETF inflows?

While the trend in crypto ETF inflows is positive, institutions should consider risks such as market volatility, regulatory changes, and potential outflows from underperforming funds. The disparity in inflows also highlights the need for careful selection of crypto ETFs.

| ETF Name | Inflows (USD) | Total Inflows (USD) | Launch Date |

|---|---|---|---|

| Blackrock IBIT | 430.77 million | 44.53 billion | Jan 11, 2025 (approx.) |

| Vaneck HODL | 17.72 million | N/A | |

| Grayscale GBTC | -89.17 million | N/A | |

| Blackrock ETHA | 52.84 million | 2.76 billion | July 23, 2024 |

| Grayscale ETHE | 0 | N/A | |

| Fidelity FBTC | -73.69 million | N/A |

Summary

Crypto ETF inflows have remained robust, with Blackrock’s IBIT and ETHA leading significant investments over recent trading sessions. The continuous engagement from institutional investors reflects a growing confidence in cryptocurrency as an asset class, particularly demonstrating a strong preference for bitcoin ETFs. The positive inflows signal a healthy trend in the market, underscoring the potential for sustained growth in this sector.