Crypto Market Analysis: Bitcoin and Altcoins Face Losses

Crypto Market Analysis delves into the volatile world of digital currencies, offering insights into the drastic shifts that characterized this week’s trading. As the macroeconomic landscape continues to unfold, cryptocurrency losses have rattled investors, prompting a significant reassessment of market strategies. Following a series of adverse events, including a notable Bitcoin price drop that impacted overall market sentiment, traders are left grappling with the implications of these changes. The decline in market capitalization reflects a broader trend, where altcoin performance took a hit alongside Bitcoin, further complicating the narrative for investors. Understanding these dynamics is crucial for navigating the uncertain waters of cryptocurrency investments effectively.

In examining the pulse of digital currencies, one cannot overlook the relevance of market evaluations and trends, especially within the cryptocurrency sector. Recent fluctuations have led to pronounced downturns among major tokens, affecting not only Bitcoin but various altcoins as well. As we dissect the ramifications of financial events and their macroeconomic impact, the distinct challenges facing the crypto ecosystem become clearer. Awareness of patterns like customer sentiment shifts and investment behaviors is essential for stakeholders aiming to mitigate risks associated with cryptocurrency volatility. By staying informed about these aspects, investors can better strategize to enhance their portfolios amid ongoing uncertainties.

Crypto Market Analysis: A Week of Losses

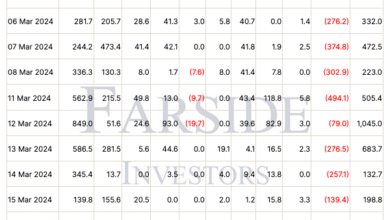

The past week showcased a stark contrast in the performance of cryptocurrencies, highlighting the ongoing volatility in the market. Following an optimistic start, the crypto landscape quickly turned grim, with Bitcoin leading the downward trend. As the price dropped significantly, concerns surrounding economic factors began to take center stage. Market analysts pointed to unprecedented macroeconomic impact stemming from the FOMC’s decision to maintain interest rates, alongside historical tariffs imposed by the Trump administration, setting off a chain reaction that led to notable cryptocurrency losses.

As Bitcoin’s price fell below critical thresholds, the ripple effect was felt across altcoin performance. Ethereum and XRP, once resilient amidst market uncertainties, posted steep losses, comprising of 6.3% and 8.2% respectively. Notably, other major cryptocurrencies such as Solana and Cardano experienced downturns exceeding 10%, indicating a broad market capitalization decline. This served as a reminder of the interconnectedness of cryptocurrency valuations and broader economic trends.

The Impact of Macroeconomic Events on Crypto Prices

In-depth analysis of the recent market downturn reveals how macroeconomic events have a pronounced effect on cryptocurrency prices. After the Federal Open Market Committee’s decision to keep interest rates unchanged, there was a swift response from the market, indicating a lack of confidence among investors. The abrupt introduction of new tariffs by the Trump administration only exacerbated these sentiments, leading to a swift decrease in market capitalization across cryptocurrencies.

This phenomenon illustrates a critical lesson for investors: macroeconomic factors cannot be ignored when assessing digital asset performance. As traditional markets respond to such changes, so too do cryptocurrencies, often mirroring the sentiment of risk aversion or heightened speculation seen in equity markets. This week’s steep losses amongst altcoins underlined how sensitive these assets are to external economic influences, prompting investors to reconsider their strategies amidst such turbulent times.

Market Trends: Bitcoin vs. Altcoins

While Bitcoin remains the cornerstone of the cryptocurrency market, recent trends suggest an increasing disparity between its performance and that of altcoins. This week was particularly revealing, as Bitcoin’s price decline was accompanied by even sharper drops in several major altcoins, illustrating a clear division. Some investors are beginning to question the sustainable nature of altcoins as they ruminate over Bitcoin’s established market leadership.

In contrast, certain altcoins like Tron (TRX) expanded their market share amidst the chaos, recording a modest gain even as others plummeted. This phenomenon raises intriguing questions about market dynamics, where select altcoins may offer refuge or alternative investment opportunities during widespread downturns. The variability in performance signifies that while Bitcoin leads the market, strategic investors may find potential in select altcoins during periods of instability.

Understanding Bitcoin’s Price Trends Amidst Economic Shifts

Analyzing Bitcoin’s price trends provides insight into how economic shifts can reshape market landscapes. With a pullback to nearly $112,680, Bitcoin’s substantial losses are indicative of investor sentiment skewed by ongoing macroeconomic uncertainty. Understanding these fluctuations is essential for both seasoned and novice investors seeking to navigate the crypto market safely.

Moreover, with Bitcoin’s historical price movements often setting the tone for the broader market, its recent struggles may foreshadow further volatility. As economic indicators fluctuate, the correlation between Bitcoin’s price and macroeconomic conditions remains a critical factor for investors to monitor. This week’s performance makes it evident that Bitcoin’s fate is inextricably tied to the currents of global finance.

The Role of Tariffs and Economic Data on Cryptocurrency Valuation

The introduction of new tariffs by the Trump administration has significantly impacted cryptocurrency valuation this week, driving prices downward. Market participants were left reeling as these economic pressures became evident, leading to increased volatility across the board. Tariffs create uncertainty, causing investors to adopt a risk-off approach that can dampen interest in speculative assets like cryptocurrencies.

Additionally, the disappointing results from the jobs data released by the Bureau of Labor Statistics further compounded these issues. The economic indicators sent shockwaves through the market, further correlating negative sentiment with declining cryptocurrency prices. Understanding the relationship between such economic factors and cryptocurrency performance is vital for investors looking to anticipate market trends.

Next Steps for Investors: Navigating a Volatile Crypto Market

As the cryptocurrency market faces a turbulent week marked by substantial losses, investors are left pondering their next steps. The importance of strategic risk management has never been more pertinent, especially in light of the Bitcoin price drop and its cascading effects on altcoins. Investors must reassess their portfolios, weighing the potential benefits of diversifying their assets to mitigate losses during downturns.

Additionally, staying informed on macroeconomic developments will prove crucial moving forward. Observing how new policies, tariffs, and financial data influence market sentiment can arm investors with the necessary insights to navigate these precarious waters. In this unpredictable environment, a combination of informed decision-making and strategic flexibility will be key to thriving amidst the ongoing volatility.

Long-Term Crypto Investment Strategies During Market Turbulence

Developing long-term investment strategies becomes imperative during periods of market turbulence. The recent macroeconomic events have highlighted the necessity for a shift in perspective, as investors must look beyond immediate fluctuations to identify opportunities for growth. In this context, cryptocurrency losses can also present unique buying opportunities for long-term investors who believe in the underlying value of these digital assets.

Market capitalization declines, such as those witnessed this week, often lead to attractive entry points for notable cryptocurrencies. Investors should consider a balanced approach, incorporating dollar-cost averaging strategies and establishing specific price points for buy-ins. By doing so, they can position themselves favorably for when the market rebounds, capitalizing on potential long-term growth trends within the cryptocurrency sector.

Evaluating Performance: Altcoins Amid Crypto Market Decline

Amidst the broader crypto market decline, evaluating the individual performance of altcoins provides valuable insights into potential resilience and recovery. This week, while many noted digital assets fell significantly, a few altcoins like TRX and toncoin showed gains, prompting discussions about their relative strength. Investors are increasingly focused on the altcoin performance as a means to differentiate between short-term volatility and long-term viability.

Furthermore, the stark contrast between altcoin performance and Bitcoin’s struggles signals the emergence of alternative investment opportunities in the cryptocurrency market. By analyzing the characteristics of those altcoins that have weathered recent storms, investors can identify potential breakout stars and build a more resilient portfolio to withstand future market uncertainties.

Future Outlook for Bitcoin and the Crypto Market

As we look ahead, the future outlook for Bitcoin and the broader cryptocurrency market remains uncertain yet tantalizing. Given its recent price dynamics and the overarching impact of macroeconomic factors, market analysts predict continued volatility as investors grapple with external pressures. The Bitcoin price drop may serve as both a cautionary tale and a rallying point for seasoned traders who thrive amid uncertainty.

Looking forward, the potential for market recovery hinges on several factors, including economic policy shifts and global market trends. As cryptocurrencies establish themselves within the financial ecosystem, navigating these changes will be paramount for sustained growth. In light of possible market correction cycles, both Bitcoin holders and new investors should stay informed and possibly reconsider their long-term engagement with the cryptocurrency space.

Frequently Asked Questions

What recent events caused significant cryptocurrency losses in the market?

Recent macroeconomic events, including unchanged interest rates by the Federal Open Market Committee (FOMC) and new tariffs imposed by the Trump administration, sparked a significant downturn in cryptocurrency prices. This resulted in notable cryptocurrency losses, with many top digital assets experiencing double-digit declines.

How did the Bitcoin price drop correlate with market capitalization decline?

The Bitcoin price drop was a key contributor to the overall market capitalization decline in the crypto market. After reaching a high of $4.024 trillion, the market capitalization fell to $3.753 trillion, primarily due to Bitcoin’s decline to around $112,680, along with widespread losses in other major altcoins.

What impact did disappointing jobs data have on the cryptocurrency market?

Disappointing jobs data released by the Bureau of Labor Statistics (BLS) added to the existing bearish sentiment in the cryptocurrency market. This data spooked investors, leading to heightened volatility and contributing to the overall capital loss as major cryptocurrencies, including Bitcoin and Ethereum, faced severe price corrections.

Which altcoins showed the worst performances during the recent market downturn?

During the recent market downturn, notable altcoin performances included substantial losses for Solana (SOL) at 12.6%, Dogecoin (DOGE) at 16.1%, and Cardano (ADA) at 13.7%. These substantial declines reflect the broader trend of the cryptocurrency market facing steep losses amid adverse macroeconomic conditions.

How does macroeconomic impact influence the crypto market analysis?

Macroeconomic factors such as interest rate decisions, tariffs, and employment data significantly influence crypto market analysis. These elements affect investor sentiment and trading patterns, leading to fluctuations in price and market capitalization, as seen in the recent downturn where Bitcoin and other major cryptocurrencies suffered notable losses.

Which cryptocurrency gained despite the market’s negative trends?

Tron (TRX) was a standout performer, gaining 2.7% despite the overall negative trends in the cryptocurrency market. Additionally, Toncoin saw an impressive increase of 8.9%, demonstrating resilience in a time when many other digital assets faced significant losses.

| Cryptocurrency | Price Change | Market Impact |

|---|---|---|

| Bitcoin (BTC) | -4% | Dropped to near $113,300, market capitalization decline. |

| Ethereum (ETH) | -6.3% | Part of the overall market downturn. |

| XRP | -8.2% | Continued struggles amidst market dip. |

| Solana (SOL) | -12.6% | Significant loss contributing to overall downturn. |

| Dogecoin (DOGE) | -16.1% | Part of the noteworthy declines. |

| Cardano (ADA) | -13.7% | Notable drop impacting market health. |

| Tron (TRX) | +2.7% | Only top asset with gains. |

| Toncoin | +8.9% | Notable gain compared to losses. |

Summary

Crypto Market Analysis shows that the recent week brought significant challenges to the cryptocurrency market, highlighted by steep losses across major digital assets. Macroeconomic factors, including tariffs and disappointing jobs data, triggered a market rout that drastically impacted market capitalization. This illustrates the volatility inherent in the crypto space and emphasizes the need for investors to stay informed about economic events that can influence market trends.