Crypto Payment Channel Launches in Dubai Government Services

The newly launched Crypto payment channel in Dubai marks a groundbreaking shift in the way government services are paid for, as it couples innovative technology with traditional financial systems. Collaborating with Crypto.com, the Dubai Finance (DOF) aims to facilitate seamless cryptocurrency transactions for service fees, making it the first government worldwide to embrace a dedicated crypto payment system. This initiative aligns perfectly with the Dubai government’s cashless strategy, which aspires to transition 90% of transactions to digital methods by 2026. Additionally, the integration of digital Dirham conversions ensures that citizens can efficiently use cryptocurrencies while maintaining stability in local currency. With this pioneering move, Dubai reinforces its position as a global leader in adopting crypto payments, setting a precedent for other nations to follow in the realm of digitized financial solutions.

The recently unveiled digital payment platform in Dubai signifies a paradigm shift in conducting financial transactions for government services through cryptocurrency. By implementing this advanced payment system, the emirate is spearheading a revolutionary approach to the cashless economy, directly linked to its overarching vision of financial innovation. Dubai aims to streamline monetary interactions by utilizing digital assets and stablecoins, all within a robust regulatory framework. This initiative not only enhances the efficiency of monetary exchanges—allowing for effortless digital Dirham conversions—but also positions Dubai as a pivotal player in the global cryptocurrency landscape. Such forward-thinking developments exemplify the city’s commitment to becoming a hub for fintech and enhancing customer experiences in public services.

Introduction to Dubai’s Government Crypto Payment Channel

Dubai Finance has embarked on a groundbreaking collaboration with Crypto.com, establishing the world’s first government cryptocurrency payment channel. This historic initiative will empower residents and businesses to pay government service fees using a diverse range of cryptocurrencies, marking a significant shift in how public sector transactions are conducted. As cryptocurrencies continue to gain traction worldwide, Dubai is leading the charge in integrating digital assets into everyday civic operations, setting a precedent for other global cities to follow.

The partnership was formally recognized during the Dubai Fintech Summit with a Memorandum of Understanding (MoU) signed on May 12, 2025. This innovative step aligns with the broader Dubai Cashless Strategy, aiming for 90% of all transactions, both public and private, to be done cashlessly by 2026. As this system rolls out, it is poised to transform the relationship between citizens and government services through seamless, efficient digital payments.

The Role of Crypto.com in Digital Dirham Conversions

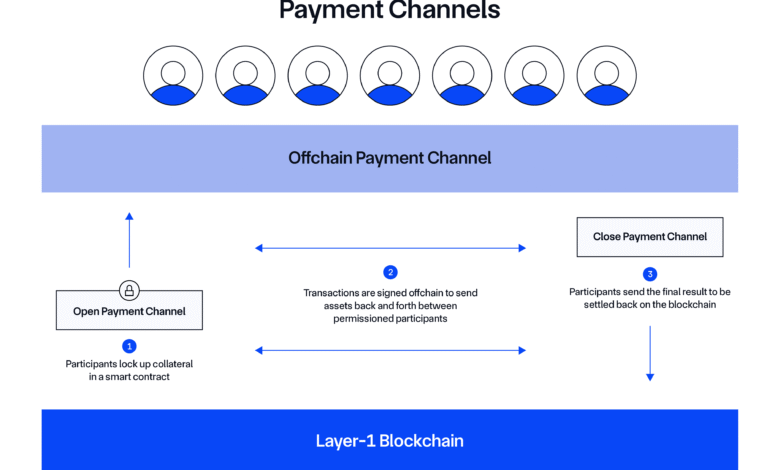

As part of the initiative, Crypto.com will facilitate digital Dirham conversions, allowing for effortless transitions between various cryptocurrencies and the Emirati dirham. This feature represents a crucial element in driving cryptocurrency adoption within government transactions, enhancing accessibility for users unfamiliar with digital currencies. Financial authorities in Dubai are confident that this gateway will not only simplify service fee payments but also bolster the broader adoption of cryptocurrency transactions in Dubai.

Furthermore, the collaboration with Crypto.com will enable customers to use their Crypto.com wallets for fee payments, converting cryptocurrencies securely to local currency. Through advanced integration with Dubai’s existing portals, these transactions will be executed smoothly and efficiently, showcasing the emirate’s commitment to fostering fintech growth and continuing its legacy as a pioneer in embracing financial technology.

Impact on Dubai’s Economy and Cashless Strategy

Experts predict that enabling cryptocurrency payments for government fees will significantly contribute to the UAE’s economy, potentially adding up to AED 8 billion ($2.2 billion) annually. This initiative is not just about innovation; it is viewed as a strategic move to stimulate fintech growth within the region while encouraging a culture that embraces digital payments. The integration of cryptocurrency transactions facilitates a more dynamic economic environment where businesses and consumers can engage more freely.

Dubai’s cashless strategy aims to streamline government and business operations while enhancing customer experiences. In aligning with such forward-thinking strategies, the partnership with Crypto.com is expected to reinforce the efficiency and transparency of governmental services, address public needs for convenience, and maintain Dubai’s status as a global leader in financial technology.

Technological Innovations in Government Services

The introduction of cryptocurrency payments powered by Crypto.com reflects a significant technological innovation in government services. The Dubai Festival Authority, through this partnership, aims to underpin transparency and reduce transaction costs, making public sector interactions smoother for all stakeholders involved. Transitioning to a digital-first payment infrastructure aligns with global trends, recognizing that technology is integral to improving service delivery.

Beyond mere currency conversion, the implementation of a secure regulatory framework for these digital transactions is imperative. With Dubai’s Virtual Assets Regulatory Authority (VARA) licensing Crypto.com just two years prior, the groundwork for secure and regulated cryptocurrency transactions is already being laid. This approach ensures that as Dubai ventures into new avenues of payments, it maintains a robust oversight mechanism that fosters confidence among users.

Leadership Initiatives Supporting Financial Innovation

His Excellency Abdulla Mohammed Al Basti remarked on the initiative reflecting Dubai’s ‘proactive approach’ to financial innovation. By embracing emerging technologies like blockchain and cryptocurrency, Dubai aims to position itself at the forefront of global fintech advancements while enhancing the financial literacy of its citizens. These initiatives align with Sheikh Mohammed bin Rashid Al Maktoum’s vision of a digitally savvy and economically resilient society.

The support from Dubai’s executive council illustrates the city’s commitment to integrating advanced digital solutions in enhancing its economic stature. Such endorsements not only build public trust in government innovations but also motivate stakeholders in the fintech ecosystem to actively contribute to creating a healthier economic framework.

Achieving Seamless Crypto Transactions in Dubai

The partnership with Crypto.com is poised to allow government payments to be processed quickly and efficiently. By utilizing stablecoins for these transactions, users can assertively engage in financial dealings with minimal worries of currency volatility, which is a common concern among cryptocurrency users. This innovative model will not only ease payment processes but also further educate the populace about digital currencies.

As technology shapes the future of financial interactions, the seamless transactions envisioned by this initiative may set a new standard for how governments and citizens engage financially. Through innovations like these, Dubai is not just keeping pace with global financial movements; it’s establishing the benchmarks for others to aspire to.

Future Prospects for Cryptocurrency in Dubai’s Regulatory Framework

The launching of a government crypto payment channel reflects a broader trend in the regulatory landscape that aims to embrace digital assets. The establishment of a clear regulatory framework by VARA is critical for building a secure and trustworthy environment for cryptocurrency transactions in Dubai. As regulations evolve, they will likely influence the adoption rates of cryptocurrency among businesses and residents alike.

By exploring the promising intersection between government services and digital currencies, Dubai positions itself as a potential hub for global fintech innovation, drawing international businesses and investors into its growing ecosystem. This proactive regulatory stance will propel Dubai into the forefront of the global cryptocurrency discourse, setting a range of best practices for other regions to follow.

Community Engagement and Awareness on Crypto Payments

Engaging the community and raising awareness about the new cryptocurrency payment channels will be essential to ensuring the success of this initiative. Programs aimed at educating the public on how to utilize their Crypto.com wallets effectively for government transactions will empower residents to embrace this new payment method confidently. Public workshops and information sessions can demystify the processes involved and foster greater acceptance.

Organizations like the Dubai Finance Department must invest in outreach efforts to demonstrate the benefits of cryptocurrency payments, addressing any hesitations about security and viability. By creating a culture of informed participation, the emirate can ensure the effectiveness of its cashless strategy and fully realize its economic potential.

Aligning with Global Trends in Digital Transactions

The initiative is part of a larger global trend towards the digitization of financial systems and the adoption of cryptocurrencies as legitimate payment mechanisms. Cities around the world are exploring similar options, recognizing that in a rapidly advancing digital economy, reliance on traditional payment methods is becoming increasingly obsolete. Dubai’s embrace of these changes positions it as a leader among cost-effective and flexible transaction solutions.

As the momentum for cryptocurrency payments grows, Dubai stands at the forefront of a transformative era in financial services, ready to redefine how governmental transactions are executed. By adopting such measures, Dubai not only enhances its local economy but also reinforces its role as a global financial technology powerhouse.

Frequently Asked Questions

What is the role of Crypto.com in Dubai’s government crypto payment channel?

Crypto.com plays a pivotal role in enabling Dubai’s government crypto payment channel by facilitating cryptocurrency payments for government service fees. This groundbreaking collaboration aligns with Dubai’s Cashless Strategy, allowing users to pay fees using Crypto.com wallets, with cryptocurrencies smoothly converted to Emirati dirhams.

How do digital Dirham conversions work in Dubai’s crypto payment channel?

In Dubai’s innovative crypto payment channel, digital Dirham conversions occur seamlessly via the Crypto.com platform. When users initiate payments using cryptocurrencies, these assets are instantly converted to dirhams and securely transferred to the Dubai Finance (DOF) accounts, enhancing efficiency in government transactions.

What impact will cryptocurrency transactions have on Dubai’s economy?

The introduction of cryptocurrency transactions through the government payment channel is expected to significantly boost Dubai’s economy, potentially adding AED 8 billion ($2.2 billion) annually. This initiative is designed to accelerate fintech growth, reflecting Dubai’s commitment to becoming a leader in digital innovation.

How does the Dubai cashless strategy support cryptocurrency payments?

Dubai’s cashless strategy aims to transition 90% of public and private sector transactions to cashless methods by 2026. The partnership with Crypto.com to introduce a government crypto payment channel is a vital part of this strategy, enabling residents to engage in cryptocurrency transactions efficiently while promoting a cashless economy.

What are the advantages of using Crypto.com for government service fees in Dubai?

Using Crypto.com for government service fees in Dubai offers numerous advantages, including faster transactions, lower fees, and the ability to pay directly with cryptocurrencies. This method enhances user convenience and aligns with Dubai’s vision of becoming a global hub for financial technology and digital innovation.

What notable agreements have been made regarding cryptocurrency payments in Dubai?

A notable agreement regarding cryptocurrency payments in Dubai is the Memorandum of Understanding (MoU) between Dubai Finance (DOF) and Crypto.com. This agreement marks a significant step in providing a government-wide crypto payment channel, emphasizing Dubai’s role as a pioneer in adopting cryptocurrency for government transactions.

When will the government crypto payment channel in Dubai go live?

The government crypto payment channel in Dubai is anticipated to go live within the next year, following the completion of technical preparations. This initiative is set to enhance trust and efficiency in government services, reflecting Dubai’s innovative approach to financial technology.

What is the vision behind Dubai’s initiative for cryptocurrency payments?

The vision behind Dubai’s initiative for cryptocurrency payments is to foster financial innovation and establish the emirate as a leader in digital payments. By integrating Crypto.com into government transactions, Dubai aims to revolutionize its payment systems, aligning with global fintech trends and economic growth ambitions.

| Key Points |

|---|

| Dubai Finance (DOF) has partnered with Crypto.com for the first government-supported Crypto Payment Channel globally. |

| The partnership was formalized on May 12, 2025, at the Dubai Fintech Summit. |

| The initiative supports Dubai’s Cashless Strategy, aiming for 90% cashless transactions by 2026. |

| Customers will use Crypto.com wallets to pay fees, with cryptocurrency converted to Emirati dirhams. |

| The initiative is expected to contribute AED 8 billion ($2.2 billion) annually to Dubai’s economy. |

| The system will enhance trust and efficiency in government services and support fintech growth. |

| Officials expect the system to be operational within the next year. |

Summary

The new Crypto payment channel initiated by Dubai Finance and powered by Crypto.com marks a significant step towards financial innovation for governmental services. This pioneering partnership represents a commitment to modernizing payment systems and enhancing economic growth in Dubai. By integrating cryptocurrency payments for government service fees, Dubai not only sets a precedent as the first government to adopt such a method but also aligns itself with broader cashless transaction goals. The anticipated economic contributions and streamlined processes highlight the potential of crypto in transforming public sector interactions and fostering a more advanced financial ecosystem.