Crypto Regulation India: Supreme Court Calls for Clarity

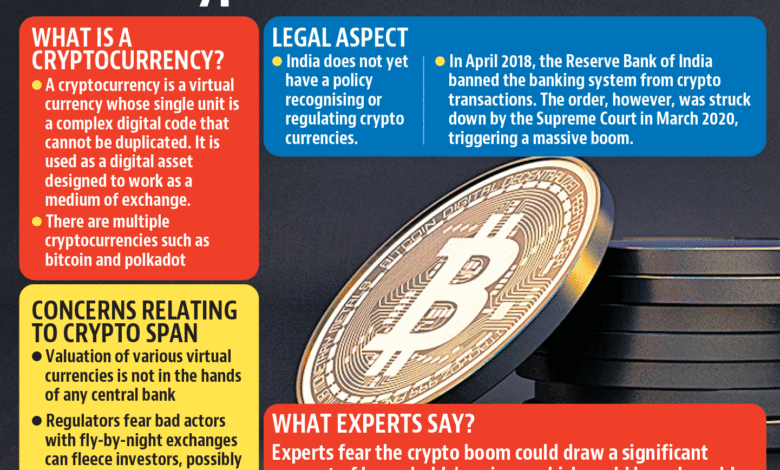

Crypto Regulation India has become a focal point of debate and concern, especially following the recent remarks from the Indian Supreme Court. The court has compared bitcoin trading to the traditional Hawala system, highlighting the dangers associated with the current lack of regulatory clarity in the crypto market. As discussions around Bitcoin regulations in India intensify, legal uncertainty remains a significant hurdle for investors and traders. The absence of a solid framework not only raises questions about the legality of bitcoin trading in India but also complicates compliance for emerging cryptocurrency businesses. In light of these developments, it is crucial for stakeholders to seek clarity on issues ranging from tax implications to broader regulatory policies.

The discourse surrounding cryptocurrency governance in India is increasingly pressing, as evidenced by the Supreme Court’s latest deliberations. Reference to bitcoin as an advanced iteration of the Hawala trade raises critical points about the need for clear and cohesive regulations in the digital asset ecosystem. Current legal ambiguities hinder the growth of the cryptocurrency sector and inhibit investors from confidently participating in Bitcoin trading in India. As the global dialogue on crypto regulation gains momentum, India finds itself at a crossroads, needing to balance innovation with necessary oversight to ensure a secure financial landscape. Thus, stakeholders in the Indian crypto space are advocating for transparent and structured regulatory frameworks to foster growth while addressing potential risks.

The Need for Crypto Regulation in India

The call for clearer cryptocurrency regulations in India has become increasingly urgent as the market experiences rapid growth. With millions of individuals engaging in Bitcoin trading and investing in various digital assets, regulators face the challenge of creating a framework that addresses the intricacies of this evolving space. The Indian Supreme Court’s recent criticism of the lack of regulatory clarity underscores the need for immediate action. The potential link between Bitcoin and traditional money laundering methods, such as Hawala, raises significant concerns about the legality and safety of crypto transactions in the absence of formal guidelines.

Moreover, the uncertainties created by a lack of regulation contribute to a precarious environment for investors. The Supreme Court highlighted how the ambiguity may lead to potential abuses, stressing that a robust regulatory framework can help protect investors and deter criminal activities. By aligning regulations with global standards, India could enhance investor confidence and encourage responsible participation in the crypto market.

Indian Supreme Court’s Stand on Bitcoin and Hawala

The Indian Supreme Court’s assertion that Bitcoin trading resembles a refined version of the Hawala system sheds light on the dark side of cryptocurrency transactions. Hawala, often associated with informal money transfer networks that evade regulatory scrutiny, shares several characteristics with Bitcoin trading, particularly in terms of anonymity and decentralization. This comparison emphasizes the need for the Indian government to develop a comprehensive regulatory framework that can distinguish legitimate crypto trading from illicit activities. By doing so, it can help mitigate the risks associated with unregulated Bitcoin transactions that may facilitate money laundering or fraud.

The Court’s commentary during a bail hearing for Shailesh Babulal Bhatt illustrates the judiciary’s growing concern about Bitcoin’s implications for financial stability. By pointing out the lack of regulation, the justices urge the government to prioritize the formulation of laws that govern digital currencies. Without a clear legal framework, individuals and businesses engaging in Bitcoin trading may inadvertently expose themselves to legal liabilities, further complicating the market landscape.

Legal Uncertainty in the Crypto Market

One of the most pressing issues in India’s cryptocurrency landscape is legal uncertainty. The Supreme Court’s observation regarding the government’s failure to provide clarity on Bitcoin regulations has left many investors in a state of confusion. As the market evolves, the absence of a formal regulatory structure not only questions the legality of trading but also stymies innovation and growth. Investors remain apprehensive about participating in a market that could be deemed illegal at any moment due to shifting political tides.

Industry experts believe that clear regulations are essential for fostering a healthy and transparent crypto ecosystem. By establishing distinct guidelines for digital assets, the Indian government can provide the necessary protection for investors, thus encouraging participation and investment in this burgeoning market. Additionally, proper regulatory oversight can aid in integrating cryptocurrencies into the traditional financial system, ensuring that they complement rather than challenge existing frameworks.

The Path Forward for Cryptocurrency Regulations in India

As India grapples with the complexities surrounding cryptocurrency regulations, the Supreme Court’s call for action may serve as a catalyst for necessary reforms. The Indian government is urged to engage in proactive discussions with industry stakeholders to create a balanced regulatory framework that promotes innovation while maintaining consumer protection. The establishment of a clear legal framework can enhance India’s position as a leader in the emerging digital asset economy.

Moreover, drawing from the international conversations around crypto regulations during India’s G20 presidency in 2023, there is a significant opportunity to align domestic policies with global standards. Coordinated efforts, in collaboration with bodies like the International Monetary Fund (IMF) and the Financial Stability Board (FSB), can pave the way for harmonized regulations that not only cater to national interests but also bolster global financial stability.

Tax Implications of Crypto Trading in India

Despite the recognized challenges in the crypto space, India has imposed a 30% tax on profits generated from trading virtual digital assets (VDAs), reflecting a clear stance on the taxation of cryptocurrencies. This tax structure, however, poses its own set of complications as it does not allow for the deduction of losses or expenses incurred during trading. Investors may find themselves at a disadvantage if they experience losses in a volatile market, ultimately discouraging long-term engagement.

Additionally, the introduction of a 1% Tax Deducted at Source (TDS) on annual crypto transactions exceeding a certain threshold complicates the compliance landscape for traders. This tax policy may result in further legal implications and a lack of clarity among investors regarding their tax responsibilities. As discussions on crypto regulation evolve, it becomes crucial for the government to evaluate its tax strategy, ensuring it fosters an environment conducive to responsible trading and investment.

Bitcoin as a Commodity: Navigating Legal Status

The classification of Bitcoin as a commodity remains a point of contention within legal discussions surrounding cryptocurrency in India. The recent comments from the Supreme Court raise significant questions regarding the treatment of Bitcoin and other cryptocurrencies under existing law. Advocates for clear regulation support the notion that defining Bitcoin’s legal status is critical for compliance and market growth, highlighting the complexities of the evolving digital landscape.

A definitive classification can simplify tax implications and enhance legal clarity, enabling investors to understand their rights and responsibilities. As legislative efforts continue to evolve, the government must be proactive in issuing clear guidelines and definitions for Bitcoin, ensuring that the market can operate with transparency and accountability. This clarity can attract institutional investment and encourage more widespread adoption of digital currencies in India.

The Role of the Enforcement Directorate in Crypto Regulation

The Enforcement Directorate (ED) has a pivotal role in enforcing compliance and addressing illicit activities within the cryptocurrency space in India. As highlighted by the Supreme Court’s directive for the ED to respond regarding the ongoing case against Shailesh Babulal Bhatt, the agency is crucial in managing concerns associated with money laundering and fraud within the crypto market. Its involvement underscores the necessity for a regulatory framework that not only promotes innovation but also ensures safety and accountability in transactions.

The ED’s active engagement signals the government’s recognition of the importance of monitoring the cryptocurrency landscape. As regulatory frameworks develop, collaboration between law enforcement and industry stakeholders can create a more secure environment for users. This proactive approach, alongside clear guidelines, can provide the essential balance needed to cultivate a sustainable cryptocurrency market in India.

Advocacy for Transparent Crypto Regulations

In light of the Supreme Court’s observations, industry advocates are pushing for the establishment of transparent regulations that promote growth while ensuring oversight. The call for regulation stems from a desire not just to protect consumers, but to build a framework that encourages innovation within the crypto sector. Industry voices argue that clear guidelines can lead to increased participation, improved investor confidence, and ultimately stimulate economic growth.

By fostering transparency in cryptocurrency transactions and adopting regulations aligned with international best practices, India can capitalize on its burgeoning digital asset market. Such progress will not only address current legal uncertainties but also position India as a forward-thinking player in the global cryptocurrency ecosystem.

Impacts of Global Trends on Indian Crypto Regulation

With the rapidly evolving landscape of cryptocurrency regulation worldwide, India’s approach to digital assets will inevitably be influenced by global trends. The efforts made during India’s G20 presidency to encourage coordinated international policies reflect a growing recognition that digital assets transcend national boundaries, which necessitates harmonized regulations. The collaboration with the International Monetary Fund (IMF) and the Financial Stability Board (FSB) highlights the importance of engaging in global discourse, ensuring that Indian regulations are competitive and responsive to worldwide standards.

Understanding and embracing these global trends is crucial for India as it crafts its own regulatory framework. The integration of insights from international peers can aid in mitigating risks associated with digital currencies while promoting a safe and innovative environment for domestic investors. Ultimately, a globally informed regulatory approach will enhance India’s position in the rapidly growing cryptocurrency market.

Frequently Asked Questions

What are the current Bitcoin regulations in India?

As of now, India does not have a specific regulatory framework for Bitcoin regulations. While cryptocurrency trading, including Bitcoin, is not illegal under existing laws, there is a significant lack of regulatory clarity, which has raised concerns in the crypto market. The Indian Supreme Court has critiqued the government for this delay and likened Bitcoin trading to an evolved form of Hawala.

How does the Indian Supreme Court view Bitcoin in terms of legality?

The Indian Supreme Court has indicated that Bitcoin trading is not illegal, referencing a 2020 ruling that overturned an RBI ban on banks servicing cryptocurrency transactions. However, the court has expressed concern over the absence of a regulatory framework, stating that this contributes to legal uncertainties within the market.

What are the implications of legal uncertainty in the crypto market in India?

Legal uncertainty in the Indian crypto market can lead to significant risks for investors and traders. The Supreme Court has emphasized that without clear regulations, there may be potential for abuse, likening Bitcoin trading to a sophisticated form of Hawala, which could pose serious concerns regarding legal compliance and financial oversight.

Is there a proposed regulatory framework for cryptocurrencies in India?

Yes, there have been proposals for a cryptocurrency regulatory framework in India, especially during its G20 presidency in 2023. Finance Minister Nirmala Sitharaman has advocated for a comprehensive regulatory roadmap, collaborating with international bodies like the IMF and FSB to establish better oversight and coordinated policies.

How does taxation on Bitcoin trading work in India?

In India, profits from Bitcoin trading and other cryptocurrencies are subject to a 30% tax, with no deductions for losses or expenses allowed. Additionally, a Tax Deducted at Source (TDS) of 1% applies to crypto transactions that exceed a specified annual threshold.

Are there ongoing efforts to regulate cryptocurrencies in India?

Yes, there are ongoing efforts to regulate cryptocurrencies in India. The Supreme Court has previously directed the government to clarify the legal status of cryptocurrencies and address the regulatory gaps. Stakeholders in the crypto industry continue to push for transparent regulations to foster innovation while ensuring proper financial oversight.

| Key Point | Details |

|---|---|

| Supreme Court Critique | India’s Supreme Court has criticized the absence of a regulatory framework for cryptocurrencies, comparing bitcoin trading to Hawala. |

| Government Delays | The court expressed frustration over the government’s delays in establishing crypto regulations, highlighting the risks involved in trading with no legal clarity. |

| Legal Case | The case involves a bail hearing for Shailesh Babulal Bhatt, accused of illegal bitcoin transactions, arguing that cryptocurrency trading is not illegal under current laws. |

| Regulatory Framework | Despite discussions, no comprehensive regulations have been implemented since the Supreme Court’s 2022 directive for clarity on cryptocurrency trading. |

| Taxation | India charges a 30% tax on profits from trading virtual digital assets and a 1% TDS on substantial crypto transactions. |

| G20 Presidency Role | During its G20 presidency in 2023, India emphasized the need for a regulatory roadmap for cryptocurrencies alongside international bodies like the IMF and FSB. |

Summary

Crypto Regulation India is under significant scrutiny as the Supreme Court raises concerns regarding the absence of a regulatory framework. The Indian government is urged to address these issues, especially after drawing parallels between bitcoin trading and illicit Hawala. Moving forward, the establishment of clear regulations is imperative to ensure legal clarity, tackle misuse, and foster innovation in the rapidly evolving digital asset landscape.