Crypto Regulations: SEC Chair Advocates for Clear Rules

Crypto regulations are rapidly evolving as the cryptocurrency landscape matures and gains mainstream adoption. The U.S. Securities and Exchange Commission (SEC) is shifting its focus from regulatory enforcement to establishing comprehensive rules that foster safe crypto asset trading and custody practices. This anticipated regulatory framework aims to enhance investor protections and support on-chain innovation by clearly defining the boundaries for various crypto activities. By addressing concerns like blockchain regulation and ensuring clear SEC crypto rules, the SEC seeks to diminish fraudulent schemes and promote a robust market environment. As the industry navigates these changes, stakeholders will gain greater clarity on compliance, ultimately shaping a secure future for digital assets.

In recent years, the landscape of digital currencies has demanded effective governance, leading to discussions about the regulations surrounding cryptocurrencies. With terms like blockchain oversight and cryptocurrency governance becoming more prevalent, the emphasis on compliance and investor security is critical. The shift towards transparent frameworks for crypto asset management, including regulations on custodial practices and trading activities, marks a significant transformation in how these assets are viewed by regulatory bodies. As industry players work alongside regulators, the development of coherent policies will not only bolster confidence but also encourage innovation in the blockchain space. This collaborative approach seeks to establish a competitive environment that nurtures technological advancements while safeguarding market participants.

The Necessity for Crypto Regulations in the Digital Age

As the landscape of finance evolves, the necessity for comprehensive crypto regulations becomes increasingly apparent. The rapid growth of digital assets has outpaced existing legal frameworks, leaving a gap that could be exploited by unscrupulous actors. This emphasizes the SEC’s commitment to establishing regulations that not only nurture innovation but also protect investors amidst the volatile nature of crypto asset trading.

Crypto regulations serve as a foundation for new financial systems built on the principles of transparency and security. By regulating areas like crypto custody and issuance, agencies like the SEC can cultivate trust in blockchain technologies. By introducing clear, enforceable rules, the regulatory body can ensure that compliant market participants can flourish without fear of arbitrary enforcement actions.

SEC’s Vision for Clear Rules in Crypto Asset Trading

The SEC’s approach to creating structured regulations reflects an understanding that clarity in crypto asset trading is vital for market stability. Chairman Paul S. Atkins articulated a need for a regulatory framework that distinguishes between different types of securities—not just those that exist in traditional forms. With the rise of blockchain as a viable alternative, the SEC aims to ensure that market dynamics are informed by clear guidelines that benefit both traders and consumers.

By advocating for a rational approach, the SEC is placing emphasis on creating an environment where crypto asset trading can develop safely. This includes ensuring that all stakeholders, from institutional investors to individual traders, understand the rules of engagement within the marketplace. A well-defined regulatory framework can lead to increased participation, thereby enhancing liquidity and stability in the crypto economy.

Implementing Secure Crypto Custody Practices

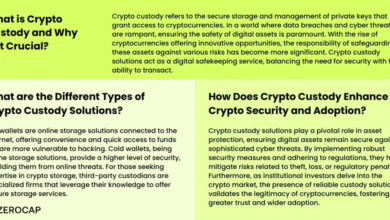

Secure crypto custody is a critical component for fostering trust in digital currencies. As crypto becomes more mainstream, the SEC recognizes the importance of developing robust frameworks for the safekeeping of these assets. Custodians play a key role in ensuring that investors can confidently store their digital holdings while minimizing the risk of theft or fraud.

The SEC’s emphasis on crypto custody regulations seeks to facilitate the integration of traditional financial systems with blockchain technologies. By establishing protocols that safeguard digital assets, the agency enhances the overall integrity of the market. This initiative not only reassures investors but also supports the ongoing growth and acceptance of cryptocurrencies in everyday transactions.

Encouraging On-Chain Innovation through Regulation

On-chain innovation is at the forefront of the blockchain revolution, but without a supportive regulatory environment, its potential may go untapped. SEC Chairman Atkins highlighted the need for creative policy solutions that foster innovation while guarding against malicious practices. By creating regulations that embrace on-chain assets, the SEC is laying the groundwork for a thriving crypto ecosystem.

An environment that encourages on-chain innovation can lead to significant advancements in various sectors such as finance, healthcare, and supply chain management. By establishing a clear regulatory framework, the SEC aims to enhance the attractiveness of blockchain technologies for developers and innovators, ensuring that the U.S. retains its competitive edge in the global digital economy.

Collaboration for Better Crypto Regulation

The SEC’s recent initiatives underline the importance of internal collaboration among regulatory bodies to establish clear guidelines for the rapidly evolving crypto landscape. The formation of the Crypto Task Force, led by commissioners with expertise in blockchain and digital assets, signifies a strategic move towards cohesive policymaking. This collaborative approach aims to break down the silos that have historically hindered effective regulation.

By working together, the SEC’s various divisions can create a unified perspective that addresses the unique challenges posed by crypto assets. This collaborative spirit not only streamlines the regulatory process but also enhances the quality of rules implemented, ensuring they accommodate the nuances of blockchain technology while still protecting the interests of investors.

The SEC’s Role in Upholding Investor Protection

Investor protection remains a primary concern for the SEC as it navigates the complexities of crypto regulations. By establishing comprehensive rules governing the issuance, custody, and trading of crypto assets, the SEC aims to safeguard individuals from potential fraud and malfeasance in the rapidly diversifying market. Clear guidelines will help investors discern legitimate offerings from scams, fostering a healthier marketplace.

The commitment to investor protection is not just about enforcing compliance but also about educating the public on the risks associated with digital assets. As the SEC proposes more transparent regulations, it provides the tools necessary for investors to make informed decisions. Encouraging transparency and accountability in the crypto sphere will ultimately contribute to a more equitable trading environment.

Promoting Compliance Among Crypto Market Participants

The SEC is prioritizing the promotion of compliance amongst all crypto market participants. Clear regulatory frameworks aimed at crypto asset issuance, trading, and custody will guide entities toward best practices, reducing the risk of regulatory breaches. As businesses begin to understand their obligations under these guidelines, they can operate with greater assurance, leading to a more stable and compliant market.

By fostering compliance, the SEC also seeks to establish a level playing field where honest businesses can thrive without the fear of competition from non-compliant actors. This commitment creates an environment where innovative entrepreneurs are encouraged to contribute to the crypto economy, knowing they are operating within legally defined parameters.

Navigating the Future of Blockchain Regulation

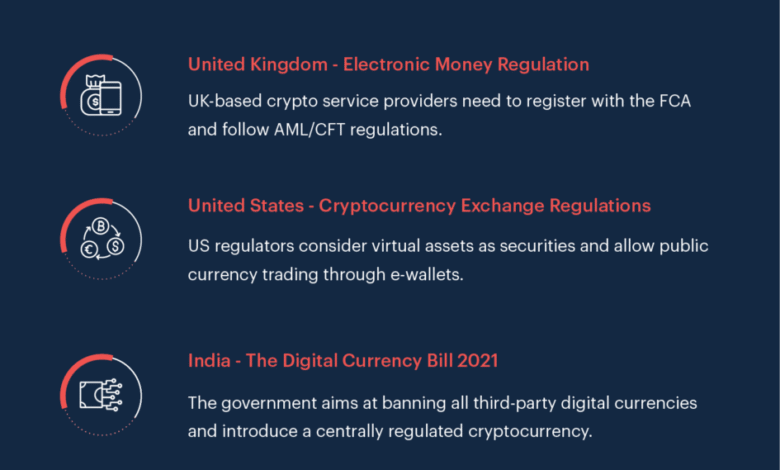

The future of blockchain regulation hinges significantly on how effectively the SEC can adapt its existing frameworks to accommodate the unique characteristics of digital assets. As blockchain technology continues to evolve, regulators are tasked with striking a balance between enabling innovation and maintaining market integrity. This evolving regulatory landscape represents both challenges and opportunities for stakeholders in the crypto ecosystem.

Effective navigation of this landscape will require ongoing dialogue among regulators, market participants, and technology developers. The SEC’s holistic approach aims to encourage cooperative efforts to create governance structures that support the evolution of blockchain technology while ensuring compliance with existing laws. By keeping an open line of communication, the SEC can foster a collaborative relationship that ultimately benefits the entire financial ecosystem.

The Importance of Adapting to Technological Advances

As technology rapidly advances, the SEC recognizes the imperative to adapt existing regulations to keep pace with innovations in the crypto world. The distinction between off-chain and on-chain assets requires a nuanced understanding of how these technologies function. By embracing the unique qualities of blockchain systems, the SEC aims to establish regulations that meet the needs of evolving markets without stifling creativity.

Adapting to technological advances is essential not just for regulatory relevance but also to protect investors and promote long-term market viability. As digital assets gain broader acceptance, the SEC’s proactive stance on updating its regulatory approach or even creating new rules reflects its commitment to ensuring a fair and effective marketplace.

Frequently Asked Questions

What are the SEC crypto rules regarding trading and custody of digital assets?

The SEC crypto rules are designed to establish clear guidelines for the trading and custody of digital assets. SEC Chairman Paul S. Atkins highlights the need for a structured regulatory framework that defines the operational standards for crypto asset trading and custody, ensuring investor protection against fraud while fostering innovation.

How will blockchain regulation impact the development of on-chain innovations?

Blockchain regulation is pivotal in shaping the landscape for on-chain innovations. By moving away from enforcement-driven policies, the SEC aims to implement clear guidelines that encourage the growth of blockchain technologies, ensuring regulations are compatible with the unique characteristics of on-chain assets.

What is the SEC’s stance on crypto asset trading compliance?

The SEC emphasizes the importance of compliance in crypto asset trading. The new regulatory framework aims to clearly define the rules surrounding crypto trading, thus providing a compliant environment that protects investors and deters fraudulent activities while promoting market expansion.

Why is crypto custody becoming a regulatory focus for the SEC?

Crypto custody has become a regulatory focus due to the critical role it plays in safeguarding digital assets. Clear rules surrounding crypto custody are necessary to protect investors, define responsibilities for custodians, and ensure the secure handling of digital assets, thus bolstering trust in the crypto ecosystem.

How does the SEC plan to deter bad actors in the crypto market?

The SEC plans to deter bad actors by implementing a rational regulatory framework that clearly outlines acceptable practices for crypto asset issuance, custody, and trading. This proactive approach aims to mitigate non-compliance and fraudulent activities through clear rules rather than reactive enforcement.

What challenges might arise from applying traditional securities regulations to on-chain crypto assets?

Applying traditional securities regulations to on-chain crypto assets may lead to incompatibilities that stifle innovation. The SEC recognizes that old regulatory frameworks might not adequately address the unique nature of blockchain technologies, which necessitates a reevaluation of existing rules to support the growth of crypto-related ventures.

How is the SEC facilitating collaboration for crypto regulations?

The SEC is facilitating collaboration through its newly formed Crypto Task Force, which brings together various divisions to address crypto regulations. This internal teamwork aims to expedite policy modernization, providing clarity and certainty in regulatory approaches for stakeholders in the crypto market.

What impact do the SEC’s crypto rules have on investor protection?

The SEC’s crypto rules significantly enhance investor protection by establishing clear standards for crypto asset trading and custody. These regulations aim to prevent fraud and misconduct, empowering investors to identify compliant offerings and minimizing risk in the evolving digital asset landscape.

| Key Point | Details |

|---|---|

| SEC’s Shift in Approach | Moving from enforcement to clear rulemaking for crypto regulations to foster innovation and market growth. |

| Ambitious Agenda | Chairman Paul S. Atkins wants a structured plan focused on the issuance, custody, and trading of crypto assets. |

| Importance of Clear Rules | Clear regulations are necessary to protect investors from fraud and scams. |

| Team Collaboration | Emphasizes the need for teamwork within the SEC to modernize policies effectively. |

| Innovation and Competitiveness | Regulation is crucial to enable the U.S. to become a leader in the global crypto market. |

| Incompatibility of Old Rules | Old regulations may hinder the growth of blockchain technology if improperly applied. |

Summary

Crypto regulations are evolving, with a strong shift from enforcement-based policies to a structured rule-making approach led by the SEC. Chairman Paul S. Atkins summarized the need for clear and comprehensive regulations to support innovation and market integrity during his keynote address at the Crypto Task Force Roundtable. By establishing defined rules for the issuance, custody, and trading of cryptocurrencies, the SEC aims to protect investors, enhance collaboration within the commission, and ensure that the United States remains competitive in the global crypto landscape.