Crypto Remittances Drop 45% in El Salvador—What’s Next?

Crypto remittances have emerged as a revolutionary way to send money internationally, yet in El Salvador, they have recently declined significantly. Data from the Central Bank shows that remittance trends indicate a staggering 45% drop in crypto transfers in early 2024. This stark reduction is surprising, especially considering the vast remittance fees Salvadorans typically face, estimated at over $400 million daily. Despite the government’s push for cryptocurrency adoption, particularly with initiatives like the Chivo Wallet, the actual usage remains minimal. As a result, the remittance landscape in El Salvador is still dominated by traditional methods, reflecting a complex relationship with cryptocurrency amidst evolving economic conditions.

Digital money transfers, particularly those facilitated through blockchain technology, are often touted as the future of remittances. Recent stats reveal a disheartening trend in El Salvador, where transactions made in cryptocurrencies have seen substantial decreases despite their touted advantages. With the persistent issues surrounding high transfer fees and the use of established financial systems, many Salvadorans seem to prefer conventional remittance avenues. Furthermore, the waning popularity of state-supported wallets like Chivo adds to the growing disillusionment with digital transaction methods. As discussions about financial technology evolve, the palpable disconnect between hype and reality continues to shape the narrative surrounding cryptocurrencies in this Central American nation.

Understanding the Decline of Crypto Remittances in El Salvador

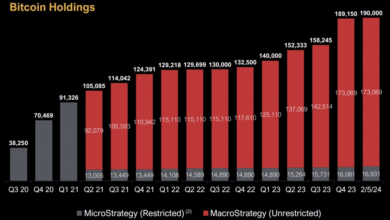

The recent findings from the Central Bank of El Salvador reveal that crypto remittances have plummeted by nearly 45% in early 2025 when compared to the previous year. This steep decline raises questions about the viability of cryptocurrencies as a mainstream option for sending money back home. Despite the initial promise that options like Bitcoin and secure blockchain transfers would provide cheaper and faster alternatives to traditional remittance methods, the actual uptake has been minimal. Recent data indicates that these crypto flows account for less than 1% of total remittance inflows, which shows a significant disparity between expectation and reality.

The factors contributing to this decline are multifaceted. For one, the traditional alternatives often offer more stability and familiarity to Salvadorans. The remittance fees in El Salvador tend to discourage citizens from switching to cryptocurrency options, especially when existing services are deeply rooted in the community. Furthermore, with announcements regarding the abandonment of Bitcoin as legal tender and a socio-political shift away from cryptocurrency, many Salvadorans might perceive crypto as an unstable or risky investment, hindering its adoption.

The Impact of Chivo Wallet’s Decline on Crypto Adoption

The downfall of the Chivo Wallet—the state-backed crypto wallet designed for facilitating remittances—has had drastic consequences for crypto adoption in El Salvador. Once promoted as a revolutionary tool for financial inclusivity, Chivo’s decline symbolizes the diminishing trust in government-endorsed crypto solutions. Without a reliable platform to facilitate transactions, many Salvadorans have reverted to traditional means of remitting money, which may incur higher fees but offer greater reassurance in terms of accessibility and support.

Additionally, the government’s push for using crypto, notably Bitcoin, as legal tender stirred initial excitement among citizens. However, the lack of tangible benefits—coupled with uncertainty around regulatory policies—has led to a growing skepticism surrounding these digital currencies. With Chivo Wallet losing traction and citizens feeling abandoned in their quest for crypto solutions, there’s been a significant drop in cryptocurrency usage. This presents a compelling case study on the importance of stable, reliable platforms in promoting crypto adoption.

Economic Implications of Rising Remittance Fees in El Salvador

As remittance fees continue to rise, the economic burden on Salvadoran families grows heavier. Reports indicate that Salvadorans pay over $400 million daily in remittance fees, a staggering amount that compounds the financial struggles faced by families relying on money sent from abroad. This situation underscores the importance of finding more affordable alternatives, like crypto remittances, that could potentially lower costs. However, in light of the weakening adoption rates of crypto, the communities remain entrenched in traditional methods.

The high cost of sending money home via standard methods encourages a search for innovative solutions. Despite the intention behind President Bukele’s push for crypto as a means to recover these exorbitant fees, the increasing disillusionment among citizens regarding cryptocurrency—partly due to the recent policy changes—renders these opportunities less appealing. If crypto remittances are to regain traction, significant changes in public perception, robust regulatory frameworks, and more reliable digital wallets will be necessary.

The Role of Education in Crypto Remittances Utilization

Educational initiatives could play a pivotal role in addressing the decline of crypto remittances in El Salvador. Many potential users lack the understanding of how cryptocurrency works or its advantages over traditional remittance channels. It is crucial to prioritize digital literacy that demystifies cryptocurrency, technologies underlying blockchain, and the specific utilities like lower fees associated with crypto remittance systems. Engaging communities through workshops, seminars, and online resources could bolster confidence in these digital tools.

Moreover, a well-informed populace may be more likely to advocate for crypto adoption, urging local businesses and legislation to support such initiatives. Enhanced education regarding cryptocurrency usage and its implications could help alleviate fears stemming from the recent failures and support the creation of a healthier, more versatile financial ecosystem. Ultimately, equipping Salvadorans with knowledge about crypto could reshape the remittance landscape and revive interest in leveraging these digital alternatives.

Government Policies and Their Impact on Cryptocurrency in El Salvador

Government policies play a decisive role in shaping the landscape of cryptocurrency in El Salvador. The once-promising implementation of Bitcoin as legal tender by President Bukele aimed at fostering economic growth through widespread crypto adoption. However, subsequent governmental decisions, including its retraction and the shuttering of platforms like Chivo Wallet, have created confusion and led citizens to reassess their commitment to digital currencies. The fluctuating political environment poses significant risks for potential adopters and investors alike.

The interaction between ancient financial systems and evolving technologies necessitates cautious yet decisive policy frameworks that can offer long-term stability for all stakeholders involved. If the government seeks to revive interest in crypto remittances, clear guidelines and a proactive approach to crypto education will be essential. Encouraging collaboration with fintech companies could facilitate innovation in crypto solutions, promoting not only growth but resilience within the remittance sector.

Public Perception of Cryptocurrency and Remittances

Public perception is often the linchpin for the success or failure of emerging financial technologies, and that stands true for cryptocurrency in El Salvador. Initially embraced during its legalization, public sentiment has shifted dramatically amid a series of policy transformations and setbacks. As recent data illustrates a drop in crypto remittances, many Salvadorans are left questioning the viability and reliability of digital currencies to meet their remittance needs. The lack of faith in crypto, especially in the face of failing platforms like Chivo Wallet, highlights an urgent need for increased transparency and trust-building from government and financial institutions alike.

To change the narrative, local leaders, influencers, and educators can play a crucial role in reshaping public opinions toward crypto. Empowering the community with success stories and practical demonstrations of how crypto remittances can facilitate their financial stability could help revitalize interest. Creating more approachable narratives around cryptocurrency and its potential to save on remittance fees will engage wider audiences and encourage the adoption necessary for a vibrant digital economy.

Analyzing the Future of Crypto Remittances in El Salvador

The future of crypto remittances in El Salvador hinges on a variety of factors. As it stands, the current decline signals significant challenges ahead. The shift back to traditional remittance methods highlights entrenched habits and systemic issues that digital currencies must overcome to gain traction. As alternative payment methods become more routine, the crypto industry faces the uphill battle of changing public sentiment and demonstrating the unique advantages that cryptocurrency can offer.

Looking forward, it is reasonable to anticipate that, for crypto remittances to recover in El Salvador, both innovation and education must complement each other. Policy reforms that provide a more supportive framework for cryptocurrencies, combined with targeted educational campaigns addressing misconceptions and complexities, could set a conducive path for the future. Ultimately, brands and entities investing in crypto solutions must ensure user accessibility and affordability to reignite interest and foster a long-lasting commitment from Salvadorans.

The Influence of Regulatory Frameworks on Crypto Usage

Regulatory frameworks act as crucial determinants of the adoption landscape for cryptocurrencies, particularly in emerging markets like El Salvador. A clear, supportive regulatory environment can nurture crypto ventures, driving institutional investment as well as individual participation. Conversely, overregulation or indecision can stifle innovation and create barriers that dissuade users from engaging with crypto technologies. Given the recent shifts in El Salvador’s stance toward crypto, the fading confidence in blockchain solutions is echoed by declining remittance volumes.

If the government were to adopt a more favorable regulatory stance that protects users while promoting innovation, the potential for crypto remittances could significantly increase. Simplifying the integration of crypto technologies into existing financial systems, augmenting consumer protection, and actively engaging with the community could foster a more optimistic climate for cryptocurrencies. A robust, pro-crypto regulatory framework is essential for empowering Salvadorans to utilize these digital assets.

Leveraging Technology to Enhance Crypto Remittances

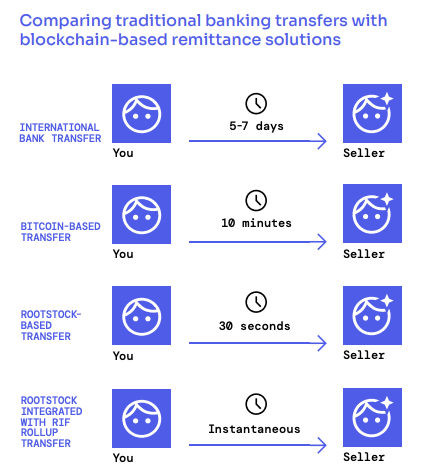

The integration of advanced technology stands as a paramount factor in optimizing the landscape for crypto remittances in El Salvador. Blockchain technology offers unprecedented scalability and security; however, many individuals still find navigating these systems challenging. By adopting user-friendly interfaces and ensuring high interoperability with other payment methods, tech developers can remove barriers that have prevented broader crypto adoption. Creating intuitive platforms could engage users at all socioeconomic levels and bridge the gap between traditional remittances and emerging crypto options.

Moreover, innovation in the realm of remittance processing can drastically reduce transaction times and fees. By disrupting traditional banking processes through integrated systems powered by blockchain, Salvadorans could benefit from a new era of remittances that aligns with their needs and expectations. In turn, emphasizing these technological advancements in educational campaigns will cultivate a generation of users who feel confident utilizing crypto in their day-to-day transactions.

Frequently Asked Questions

What is the recent trend in crypto remittances to El Salvador?

Crypto remittances to El Salvador have seen a significant decline, with a 45% drop compared to the first four months of 2024, totaling only $16 million sent during this period. This decline highlights the challenges of crypto adoption in El Salvador’s remittance market.

How do remittance fees in El Salvador affect crypto remittance usage?

Despite the potential for lower costs, crypto remittances are still overshadowed by traditional channels, which dominate the market due to established trust and familiarity, despite often higher remittance fees in El Salvador. Salvadorans continue to prefer these traditional methods over crypto.

What are the implications of the Chivo Wallet decline on crypto remittances?

The decline of the Chivo Wallet, a state-backed cryptocurrency wallet, has significantly impacted crypto remittances in El Salvador. As government-sanctioned options diminish, fewer individuals are incentivized to use crypto for remittances, contributing to the overall decrease in usage.

Why did cryptocurrency usage for remittances drop in El Salvador during 2025?

Cryptocurrency usage for remittances in El Salvador dropped due to a combination of factors, including the abandonment of bitcoin as legal tender and a lack of effective promotional campaigns to encourage its use for remittances. This led to crypto accounting for only 0.52% of total remittance inflows.

Is crypto getting more popular for remittances in El Salvador?

Currently, crypto remains unpopular for remittances in El Salvador, with adoption stagnating and failing to gain momentum despite earlier claims of its benefits. The percentage of remittances sent via crypto was just 0.52% in early 2025, highlighting widespread skepticism.

How does crypto adoption in El Salvador compare to other countries?

Crypto adoption for remittances in El Salvador has not reached the expected levels, particularly when compared to other countries where cryptocurrency is used more extensively. The reliance on traditional methods remains strong in El Salvador, and recent trends indicate minimal interest in crypto alternatives.

What role did President Bukele’s policies play in the use of crypto for remittances?

President Bukele initially promoted the use of cryptocurrency for remittances in El Salvador, aiming to reduce the $400 million in fees Salvadorans paid. However, recent trends indicate that his policies have not led to widespread utilization of crypto remittances as intended.

| Key Point | Details |

|---|---|

| Significant Decline | Crypto remittances fell by 45% in El Salvador during the first four months of 2024. |

| Limited Adoption | Crypto accounts for less than 1% of total remittances sent to El Salvador, specifically 0.52%. |

| Volume Comparison | Salvadorans received $16 million in crypto during Q1 2025, down from $28.83 million in Q1 2024. |

| Impact of Regulations | The abandonment of bitcoin as legal tender and restrictions on its public use have contributed to the decline. |

| Preference for Traditional Methods | Despite high remittance fees, Salvadorans continue to prefer established financial institutions. |

| Chivo Wallet’s Dissolution | The planned shutdown of Chivo Wallet reduced governmental options for crypto transactions. |

| Initial Expectations | President Bukele emphasized that crypto could save Salvadorans over $400 million in remittance fees. |

| Trend Analysis | Crypto remittance utilization has been decreasing since October 2021 when it comprised 5% of total inflows. |

Summary

Crypto remittances in El Salvador have faced significant challenges, with a nearly 45% decline observed in early 2024. The drop reflects the struggle for acceptance and utilization of cryptocurrencies in remittance services, particularly as they account for less than 1% of total funds received. Regulatory changes, traditional banking preferences, and the phased withdrawal of state-supported services like Chivo Wallet have likely exacerbated this trend. As the landscape evolves, understanding the implications of these shifts on both the local economy and the broader adoption of crypto remains essential.