Cryptocurrency Mortgage Assets: Fannie Mae & Freddie Mac Updates

Cryptocurrency mortgage assets are poised to revolutionize the housing finance landscape as U.S. federal housing authorities start to recognize digital currencies as viable forms of economic capital for mortgage evaluations. This seismic shift, driven by directives from the Federal Housing Finance Agency (FHFA), signifies a crucial step toward integrating cryptocurrency into mainstream finance. Major players like Fannie Mae and Freddie Mac are now tasked with assessing the viability of these digital assets within their mortgage risk assessment models. By embracing cryptocurrency in finance, regulators aim to enhance the accuracy of borrower reserve evaluations, potentially paving the way for broader access to homeownership. This momentous change could transform the mortgage market, inviting both opportunities and challenges associated with incorporating crypto capital for mortgages into conventional lending practices.

As the mortgage industry evolves, alternative financial instruments such as digital currencies are gaining traction in the realm of home lending. The recent policy revisions by federal housing regulators signify a willingness to adopt cryptocurrency as a legitimate asset class, enabling significant advancements in mortgage risk evaluation methods. Terms like digital mortgage assets and crypto-backed loans are becoming part of the financial lexicon, fostering discussions on how such innovations can bolster home accessibility and financial inclusivity. By acknowledging the role of cryptocurrencies, regulatory bodies like the FHFA and major housing finance institutions are not just adapting to a changing landscape but are also setting the stage for potential shifts in how digital assets influence the broader real estate market. This transformative approach could usher in a new era of financial solutions, where traditional lending powers benefit from the integration of modern digital technologies.

Understanding Cryptocurrency as Mortgage Assets

The landscape of mortgage financing is evolving rapidly as cryptocurrency emerges as a viable asset class. Recognizing cryptocurrency as mortgage assets aligns with the objectives of federal housing regulators, such as Fannie Mae and Freddie Mac, to modernize financial assessments in line with technological advancements. This transition is not merely operational; it symbolizes a shift in the perception of digital currencies in the financial ecosystem, particularly in relation to mortgage risk assessment.

This acknowledgment of cryptocurrency impacts various facets of the mortgage value chain. With the Federal Housing Finance Agency (FHFA) taking the lead, institutions are now tasked with integrating digital assets into their financial models. This will reshape how we think about borrower qualifications and reserve capital, ultimately driving more inclusive access to home ownership. As the industry adapts, the potential for cryptocurrency in finance could lead to innovative lending practices and broaden the range of acceptable collateral.

The Role of Cryptocurrency in Risk Assessments for Mortgages

Mortgage risk assessment has been traditionally focused on stable asset classes; however, the FHFA’s directive is set to transform this process. By allowing cryptocurrency to be evaluated as digital assets without requiring conversion into U.S. dollars, lenders may achieve a more realistic depiction of a borrower’s financial standing. This could potentially lower barriers for those with crypto capital seeking mortgages, redefining access to home ownership.

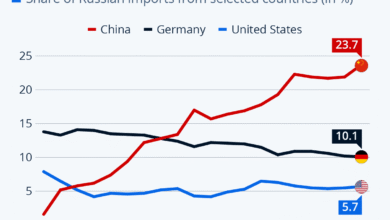

Moreover, acknowledging cryptocurrency as a reserve asset means that financial entities will have to develop new metrics for evaluating the associated risks. The FHFA’s push emphasizes the importance of verifying digital assets and adjusting for their volatility, which is paramount in today’s financial climate. This careful integration of cryptocurrency could mitigate risks and pave the way for safer lending practices that preserve the stability of the mortgage market.

Fannie Mae and Freddie Mac’s Focus on Cryptocurrency Integration

Fannie Mae and Freddie Mac, as pivotal players in the American mortgage market, have been directed to strategize the incorporation of cryptocurrency into their operations. This initiative marks a significant pivot towards modernizing how mortgages are evaluated and granted. The goal is to create a framework that accommodates digital assets as a fundamental aspect of their mortgage risk assessment protocols.

The steps being initiated not only reflect a move toward greater acceptance of cryptocurrency as a legitimate financial tool but also represent a shift in regulatory practices that could define the future of housing finance. As these agencies explore the integration of cryptocurrency into their financial models, they lay the groundwork for a more inclusive financial environment where varied forms of wealth can be considered in mortgage applications.

Implications of Cryptocurrency as Reserve Capital for Mortgages

As the U.S. housing regulators redefine the parameters by which mortgages are assessed, the implications of treating cryptocurrency as reserve capital are profound. This move signals the intent to broaden the financial base upon which home loans can be granted, aligning with the strategic vision of making the U.S. the crypto capital of the world. With such a significant change in policy, it’s important to consider how this will not only benefit borrowers but also the broader mortgage market.

The introduction of digital assets into mortgage assessments could help alleviate some of the strains seen in conventional mortgage arrangements, particularly for those with limited cash reserves. This new framework may facilitate opportunities for a more diverse array of applicants, potentially increasing the number of individuals able to secure home loans in today’s competitive environment. As the FHFA encourages this integration, the ripple effects could reach beyond mere mortgage approvals, influencing market trends and lending standards across the nation.

Challenges and Risks Associated with Cryptocurrency in Mortgages

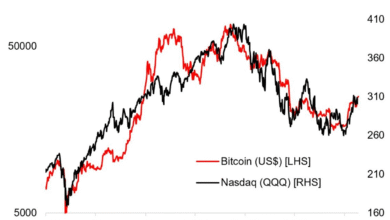

Incorporating cryptocurrency into mortgage lending raises a myriad of challenges and risks that regulatory bodies must address. The inherent volatility of cryptocurrencies can pose significant risks to both lenders and borrowers. This variability must be carefully factored into risk assessments to prevent financial instability within mortgage lending practices.

Moreover, the regulatory landscape for digital assets is still developing, leaving space for legal ambiguities that could complicate their integration into the mortgage sector. Stakeholders will need to navigate these waters carefully, balancing innovation with prudent risk management to protect both the mortgage market and its consumers. As Fannie Mae and Freddie Mac move forward, close attention to these challenges will be essential for the successful adoption of cryptocurrency as mortgage assets.

The Future of Housing Finance in a Crypto-Enabled Market

The incorporation of cryptocurrency into the housing finance system marks a pivotal moment that could reshape how we view and approach mortgages in the digital age. With Fannie Mae and Freddie Mac poised to adapt to this new reality, the future of housing finance may become more flexible, transparent, and accessible. This shift aligns with a broader trend towards intertwining traditional finance with emerging technologies, reflecting changing consumer behavior and preferences in asset management.

As the mortgage industry evolves, it is crucial for all stakeholders to remain responsive to the implications of such transformations. By exploring innovative solutions and staying informed about regulatory changes, lenders and borrowers alike can navigate this crypto-enabled landscape successfully. Ultimately, the potential for cryptocurrency in finance transcends mere mortgage applications—its integration could signify a complete revolution in how transactions are conducted, leveraging technology to enhance efficiency and accessibility.

The Impact of Cryptocurrency on Home Ownership Accessibility

One of the most promising outcomes of integrating cryptocurrency into mortgage assessments is the increased accessibility to home ownership it may facilitate. Traditional financial barriers often prevent individuals from obtaining mortgages; however, recognizing digital assets as valid collateral could empower a broader demographic to achieve their homeownership dreams. This evolution emphasizes the need for inclusive financial practices in today’s economy.

Furthermore, access to cryptocurrency capital could provide unique advantages, especially for younger generations who might hold substantial digital assets but lack traditional savings. By allowing these assets to count towards mortgage qualifications, regulatory bodies can address longstanding inequalities in the housing market, fostering a more equitable approach to home financing. This initiative could ultimately spur higher rates of home ownership and enhance community stability.

Regulatory Perspectives on Cryptocurrency and Mortgages

The evolving regulatory landscape surrounding cryptocurrency signifies an important acknowledgment of digital assets in mainstream finance. Agencies like the FHFA are at the forefront of this transformation, advocating for a structured approach to integrating cryptocurrency as legitimate collateral in mortgage lending. This demonstrates an openness to innovation while ensuring that adequate protections and evaluations are in place.

As authorities encourage the adoption of cryptocurrency in mortgage frameworks, the emphasis on risk-based assessments also becomes crucial. How they choose to regulate these assets will likely set precedents that could influence other financial sectors. The commitment to responsible implementation will play a significant role in shaping public trust and confidence in the use of digital currencies within mortgage markets.

Consumer Perspectives on Cryptocurrency in Mortgage Applications

For consumers, the possibility of utilizing cryptocurrency in mortgage applications can seem innovative and enticing. It brings forth an opportunity for individuals who have invested in digital currencies to leverage these assets in ways that were previously unavailable. Understanding this shift can empower consumers, providing them with more options to explore and strategies to overcome the hurdles that often accompany traditional mortgage processes.

As education and awareness rise around using cryptocurrency in financial transactions, potential homebuyers may find themselves better equipped to navigate this new terrain. Transparent communication from lenders about integrating digital assets can foster confidence, making consumers more comfortable with the idea. Ultimately, this could lead to an informed community ready to embrace the future of housing finance in a cryptocurrency-inclusive world.

Frequently Asked Questions

What are cryptocurrency mortgage assets and how do they function in financial transactions?

Cryptocurrency mortgage assets refer to digital currencies recognized as valid collateral for mortgage loans. These assets can be assessed as reserve capital by mortgage lenders, such as Fannie Mae and Freddie Mac, allowing borrowers to include their cryptocurrency holdings in mortgage applications, thereby improving access to homeownership.

How does Fannie Mae plan to incorporate cryptocurrency in mortgage risk assessments?

Fannie Mae has been directed by the FHFA to explore the integration of cryptocurrency into mortgage risk assessments. This involves evaluating digital assets without requiring their conversion to U.S. dollars, thus enhancing the accuracy of assessments regarding borrower reserves and potentially expanding affordable housing access.

What is the significance of Freddie Mac recognizing cryptocurrency as a mortgage asset?

The recognition of cryptocurrency by Freddie Mac as a potential mortgage asset signifies a major shift in the housing finance system, allowing for a broader acceptance of digital assets in mortgage processes. This helps validate cryptocurrency’s role in conventional finance and may lead to more inclusive lending practices for potential homeowners.

What impact does cryptocurrency in finance have on mortgage capital requirements?

The inclusion of cryptocurrency in finance changes how mortgage capital requirements are evaluated. It offers an alternative way for borrowers to demonstrate financial stability through digital asset reserves, which can enhance their creditworthiness and access to loans in the housing market.

What are the risks associated with using crypto capital for mortgages?

Using crypto capital for mortgages involves risks such as price volatility of digital currencies and the necessity of rigorous risk assessments. Regulatory bodies like the FHFA stress the importance of implementing risk-based discounts to manage these uncertainties and ensure responsible lending practices.

How does the recent shift in federal housing policy affect cryptocurrency investments?

The recent shift in federal housing policy towards accepting cryptocurrency as a legitimate asset may encourage more investment in digital currencies. As regulators legitimize these assets within mortgage frameworks, it could bolster confidence among investors and foster greater participation in the cryptocurrency market.

Can cryptocurrency reserves improve the mortgage approval process?

Yes, incorporating cryptocurrency reserves into the mortgage approval process can improve efficiency. By recognizing verified digital assets as legitimate borrowing capital, lenders can offer more tailored financial solutions, facilitating smoother approvals for individuals with significant crypto holdings.

What precautions will Fannie Mae and Freddie Mac take regarding cryptocurrency volatility?

Fannie Mae and Freddie Mac will apply rigorous risk-based discounts to account for cryptocurrency volatility when assessing mortgage applications that include digital assets. This ensures that the potential fluctuations in value are factored into the overall risk analysis for loan approvals.

What steps must be taken before cryptocurrency can be used as a reserve capital for mortgages?

Before cryptocurrency can be utilized as reserve capital for mortgages, it must be verified and held on U.S.-regulated centralized exchanges. Additionally, both Fannie Mae and Freddie Mac must develop proposals that comply with new guidelines from the FHFA before implementation.

How might this initiative change the landscape for home buyers utilizing cryptocurrency?

This initiative could significantly transform the landscape for home buyers utilizing cryptocurrency by providing new avenues for wealth-building and ownership. It alters traditional lending paradigms, making it easier for crypto investors to obtain home financing under more favorable conditions.

| Key Points |

|---|

| Fannie Mae and Freddie Mac are being directed to prepare for cryptocurrency as a mortgage asset. |

| The FHFA has recognized cryptocurrency as a legitimate reserve capital for mortgages. |

| Digital assets may enhance the accuracy of borrower risk assessments without needing conversion to U.S. dollars. |

| Proposals must ensure assets are verified and held on U.S.-regulated exchanges, considering volatility and risk. |

| The initiative aims to promote greater inclusivity in the housing finance system and enhance affordability. |

| Critics are concerned about market instability, but advocates see this as a significant institutional endorsement. |

Summary

Cryptocurrency mortgage assets have gained momentum as U.S. housing regulators move towards legitimizing them as reserve capital for mortgages. The Federal Housing Finance Agency has instructed Fannie Mae and Freddie Mac to recognize cryptocurrency in their risk assessments, which could reshape how borrowers are evaluated. This shift could potentially open doors for more individuals to access affordable homeownership while addressing volatility through stringent risk management. As the integration of digital assets into mainstream finance continues to unfold, the landscape for mortgage financing may experience notable transformations.