Cryptocurrency Regulation: SEC and NYSE Explore Overhaul

Cryptocurrency regulation is at the forefront of discussions as the SEC and NYSE seek to modernize the legal framework surrounding digital assets. With the rise of tokenized markets and increasing interest in crypto trading standards, both regulatory bodies are exploring ways to create a digital asset framework that aligns with traditional financial systems. A recent meeting between the SEC’s Crypto Task Force and NYSE representatives highlighted the necessity of establishing coherent SEC cryptocurrency rules while reducing regulatory fragmentation. As the marketplace evolves, ensuring parity among market participants will be crucial in maintaining market integrity. The proposed regulations for crypto assets, including those related to exchange-traded products, underscore the urgency for a systematic approach to this dynamic industry.

The evolving landscape of digital currencies has sparked a pressing need for comprehensive oversight and governance, commonly referred to in terms such as cryptocurrency oversight or digital asset regulation. As the market for blockchain-based assets expands, the discussions around financial compliance for these innovative products are more relevant than ever. Industry leaders are advocating for clearer guidelines and standards that encompass everything from trading protocols to tokenization practices. The synergies between regulatory authorities and major trading platforms illustrate a unified approach to establishing a fair marketplace for digital investments. By ensuring consistent regulations across comparable asset classes, stakeholders aim to foster an environment that nurtures innovation while safeguarding consumers.

Understanding Cryptocurrency Regulation

Cryptocurrency regulation is becoming increasingly crucial as the market expands and evolves. The SEC and NYSE are currently in discussions to create a cohesive regulatory framework for cryptocurrencies that aligns with traditional markets. This regulatory approach aims to minimize fragmentation and ensure that digital assets can be integrated seamlessly with existing financial systems. As markets move towards tokenization, regulators are focusing on how these digital assets can be classified and traded alongside more established securities.

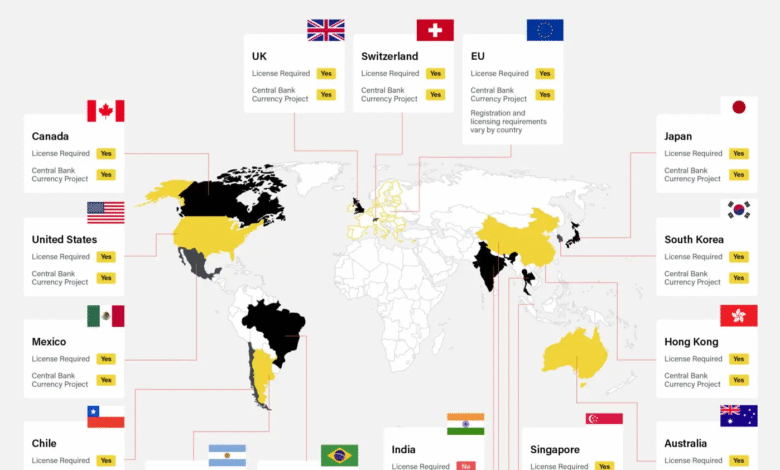

One of the key concerns surrounding cryptocurrency regulation is the inconsistency in current rules that apply to different types of assets. For instance, while the SEC has established certain rules for trading digital assets, other regulatory bodies may not have the same approach. This disparity can create confusion among investors and hinder the growth of the cryptocurrency market. Therefore, achieving parity among market participants becomes essential to support a healthy and competitive financial environment for both traditional and tokenized assets.

The Role of SEC and NYSE in Shaping Crypto Policy

The SEC’s involvement in cryptocurrency regulations is critical as it seeks to establish clear guidelines and standards for crypto assets. Through its Crypto Task Force, the SEC is actively engaging in discussions to understand the implications of tokenized markets and to develop robust trading standards for digital assets. By collaborating with major exchanges like the NYSE, the SEC aims to foster a transparent market structure that protects investors and promotes responsible trading practices.

Moreover, the NYSE is taking proactive steps to propose regulatory standards for exchange-traded products (ETPs) linked to cryptocurrencies, highlighting its commitment to integrating credible digital asset offerings into traditional markets. The discussions between the SEC and NYSE are a testament to the importance of collaborative governance in establishing a framework that not only allows for innovation but also safeguards market integrity and investor confidence.

Tokenized Markets and Regulatory Challenges

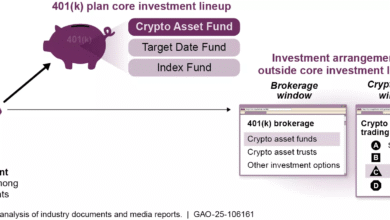

As the cryptocurrency landscape continues to evolve, tokenized markets are gaining traction, attracting both investors and regulators. Tokenization enables the representation of traditional assets as digital tokens on a blockchain, providing enhanced liquidity and accessibility. However, the regulatory challenges surrounding tokenized markets are complex, necessitating clear guidelines to ensure compliance and safeguarding of investors’ interests.

The integration of tokenized assets requires a comprehensive regulatory approach—one that addresses custody solutions, trading mechanisms, and decentralized finance scenarios. As the SEC collaborates with the NYSE to explore regulations for tokenized equities, there is a strong need to clarify how these digital financial products will be treated under existing laws. This ongoing dialogue is crucial for creating a stable and secure environment for digital asset trading.

The Future of Crypto Trading Standards

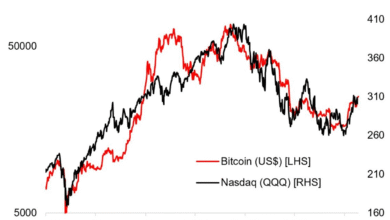

With the rise of cryptocurrencies, establishing trading standards has become imperative for both innovation and investor protection. The SEC seeks to promote a standardized approach to trading digital assets, mitigating risks associated with price volatility and market manipulation. By outlining specific regulations, the SEC aims to protect investors while allowing legitimate cryptocurrency trading to flourish.

As part of these standards, regulatory bodies may implement measures that enhance transparency and accountability among trading platforms. This includes requirements for reporting, disclosure, and even collaboration between various exchanges to establish industry-wide compliance. Such efforts are vital to ensure a robust and trustworthy trading environment for all market participants engaged in cryptocurrency transactions.

Building a Digital Asset Framework

The emergence of digital assets demands a comprehensive framework that encapsulates various components, from regulatory compliance to market infrastructure. As cryptocurrencies become more mainstream, developing a robust digital asset framework is essential for ensuring that regulations keep pace with technological advancements. This framework should provide clarity for both investors and businesses operating in this space.

This endeavor requires collaboration between regulatory bodies like the SEC and industry players, including exchanges and financial institutions. By actively engaging in research, roundtables, and constructive dialogues, regulators can create guidelines that take into account the unique characteristics of digital assets and the diverse needs of the market. Such proactive measures will better position the financial industry to adapt to the rapidly evolving landscape of digital currencies.

Addressing Investor Concerns in Cryptocurrency

Investor confidence is vital for the growth of the cryptocurrency market; therefore, addressing their concerns is paramount. As discussions between the SEC and NYSE progress, it is essential to ensure that any regulatory framework incorporates mechanisms for protecting investors from potential risks. These risks include fraud, misrepresentation, and market volatility—issues that have historically plagued cryptocurrency trading.

By establishing clear guidelines and frameworks for digital assets, regulatory bodies can help mitigate these risks. This includes creating standards for disclosures, offering education on the complexities of cryptocurrencies, and implementing safeguards that enhance market integrity. Through these measures, regulators can uphold investor interests and foster a more secure trading environment.

The Need for Parity Among Market Participants

One of the main themes discussed between the SEC and NYSE is the importance of achieving parity among market participants, particularly when it comes to regulating cryptocurrencies. Differing regulations for traditional assets compared to digital assets can create an unbalanced market that favors one type over the other. By promoting equal treatment of market participants, regulators can help ensure a level playing field.

The call for parity emphasizes that all assets, whether traditional stocks or tokenized equities, should be subject to consistent regulatory standards. This approach not only protects investors but also encourages a fair competitive environment, ultimately leading to enhanced market efficiency. By aligning the regulatory framework across asset classes, the industry can thrive with greater collaboration and innovation.

The Impact of Crypto Regulations on Innovation

While some argue that stringent regulations could stifle innovation within the cryptocurrency space, a well-structured regulatory framework can actually serve as a catalyst for innovation. By providing clear guidelines and standards, businesses can operate with greater certainty, which fosters an environment conducive to new product development and technological advancements.

The SEC and NYSE’s efforts to establish a sound regulatory environment for cryptocurrencies can enhance investor protection while also promoting responsible innovation. As companies feel more secure in their operations, we can expect to see an influx of innovative solutions that leverage blockchain technology and cryptocurrencies, ultimately benefiting the broader financial ecosystem.

Public Engagement in Crypto Regulatory Development

Public engagement is a critical aspect of developing effective cryptocurrency regulations. The SEC has recognized the importance of soliciting input from various stakeholders, including industry experts, investors, and the general public. Through public roundtables and targeted discussions, regulators can gain valuable insights into the challenges and opportunities presented by digital assets.

This collaborative approach ensures that regulations are not only comprehensive but also reflective of the real-world dynamics of the cryptocurrency market. By incorporating diverse perspectives, the SEC and other regulatory bodies can create a regulatory framework that is both effective and adaptable, capable of evolving alongside the rapidly changing digital landscape.

Frequently Asked Questions

What are the key points of the SEC cryptocurrency rules discussed during recent meetings?

The SEC cryptocurrency rules focus on addressing regulatory fragmentation between traditional markets and digital assets. Recent meetings involved discussions on how to integrate crypto regulations within existing frameworks, ensuring that cryptocurrencies and tokenized markets operate under similar standards as traditional financial products.

How do NYSE crypto assets influence regulation in the cryptocurrency market?

NYSE crypto assets are pivotal in shaping cryptocurrency regulation as they highlight the need for uniform rules governing both digital assets and traditional securities. The NYSE’s proposals for initial standards around exchange-traded products (ETPs) emphasize the importance of regulatory consistency for market integrity and investor protection.

What is the significance of tokenized markets regulation in cryptocurrency?

Tokenized markets regulation is significant because it governs the trading of tokenized equities and other blockchain-based securities, ensuring robust compliance and investor safety. By establishing clear guidelines for these markets, regulators can facilitate innovation while mitigating risks associated with digital asset trading.

What are the expected crypto trading standards to emerge from SEC discussions?

Expected crypto trading standards emerging from discussions include fostering parity among market participants, reducing regulatory inconsistencies, and outlining specific compliance measures for trading digital assets. These standards aim to enhance market integrity and investor trust as the cryptocurrency landscape evolves.

What role does the digital asset framework play in cryptocurrency regulation?

The digital asset framework is designed to provide a comprehensive regulatory structure for cryptocurrencies, allowing for clearer guidelines on tokenization, custody, and trading practices. This framework aims to harmonize regulations across traditional and digital assets, enhancing market confidence and functionality.

| Key Focus Areas | Participants | Objectives | Proposals |

|---|---|---|---|

| Overhaul of cryptocurrency regulations | SEC’s Crypto Task Force | Reduce regulatory fragmentation | Initial standards for tokenized equities and ETPs |

| Integration of tokenized markets | NYSE participants including Jaime Klima and Tony Frouge | Ensure parity among market participants | Regulatory clarity for crypto products |

| Digital asset market discussions | Blackrock and JPMorgan engagement | Maintain market integrity | Engagement in comprehensive input formats |

Summary

Cryptocurrency regulation is a critical focus for the SEC and NYSE as they explore ways to adapt existing financial frameworks to encompass digital assets. The recent meetings highlighted the importance of reducing regulatory fragmentation and ensuring equal treatment for all market participants. As discussions evolve, it is clear that establishing clear regulatory standards for cryptocurrencies and tokenized products is essential for maintaining market integrity and fostering innovation.