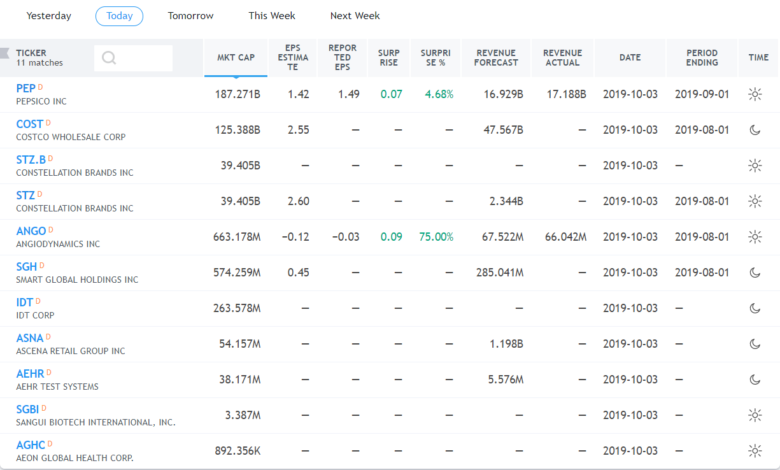

Earnings Reports: Key Financial Results Before the Bell

Earnings reports are pivotal documents that reveal a company’s financial performance over a specified period, often leading to significant market reactions. For instance, the recent **JPMorgan Chase earnings** announcement showcased a revenue of **$46.01 billion**, surpassing expectations and driving shares up by more than 2%. Similarly, **Morgan Stanley results** wowed investors with an earnings per share of **$2.60**, reflecting strong market confidence. Meanwhile, **BlackRock financials** highlighted a divergence between strong earnings per share yet slightly disappointing revenue, which kept investors on edge. As the market digests these quarterly insights, the focus also shifts to upcoming disclosures from entities like **Wells Fargo** and the **Bank of New York Mellon report**, each promising to shape investor sentiment in the days to come.

Quarterly financial disclosures serve as a window into corporate health, providing essential insights into profitability, revenue, and operational efficiency. The latest announcements, such as **JPMorgan affairs** revealing robust earnings that exceeded forecasts, illustrate the dynamic landscape of financial reporting. Likewise, the **Morgan Stanley financial results** unveil a performance that defied analyst predictions, sparking positive investor reactions. Furthermore, insights from **BlackRock’s quarterly statements** showcase both triumphs and challenges within their revenue streams. As investors await further updates from notable players like **Wells Fargo** and the **Bank of New York Mellon**, these reports remain critical for assessing the overall economic climate.

JPMorgan Chase Earnings Overview

JPMorgan Chase has recently reported strong first-quarter earnings, showcasing a revenue of $46.01 billion which surpasses analysts’ expectations of $44.11 billion. This impressive result has resulted in a significant surge in shares, climbing over 2%. CEO Jamie Dimon has acknowledged the current economic climate as one of considerable turbulence, which adds a layer of caution to the positive financial outcomes. Investors are eager to see how JPMorgan maintains its performance amid potential economic challenges.

The financial health of JPMorgan Chase is crucial not only to its shareholders but also to the banking sector at large. The strong earnings performance may indicate broader resilience in large financial institutions. Analysts will be closely monitoring upcoming earnings reports from competitors to gauge whether this trend is isolated or part of a larger shift in the banking sector.

Frequently Asked Questions

What were the earnings results for JPMorgan Chase in the latest earnings report?

In its latest earnings report, JPMorgan Chase reported a revenue of $46.01 billion for the first quarter, surpassing Wall Street expectations of $44.11 billion. This positive result contributed to a rise in shares by over 2%.

How did Morgan Stanley’s results compare to analyst expectations?

Morgan Stanley’s first-quarter results exceeded analysts’ expectations, reporting earnings of $2.60 per share and revenue of $17.74 billion. Analysts had anticipated earnings of $2.20 per share and $16.58 billion in revenue, leading to a share increase of more than 3%.

What were the key financials reported by BlackRock?

In its earnings report for the first quarter, BlackRock posted earnings of $11.30 per share, which exceeded expectations of $10.14 per share. However, the company’s revenue of $5.28 billion fell short of the estimated $5.34 billion, leading the stock to rise by nearly 2%.

What were Wells Fargo’s earnings compared to analyst estimates?

Wells Fargo reported a 16% increase in earnings for the first quarter compared to the previous year, with revenues reaching $20.15 billion. However, this figure was below the consensus estimate of $20.75 billion, resulting in a more than 1% increase in shares.

How did the Bank of New York Mellon perform in its first-quarter financial results?

The Bank of New York Mellon reported earnings of $1.58 per share in its first-quarter results, exceeding the expected $1.50 per share. Additionally, the bank’s revenue of $4.79 billion was slightly above the consensus estimate of $4.76 billion, leading to a 2% increase in shares.

| Company | Earnings Per Share (EPS) | Revenue | Key Highlights |

|---|---|---|---|

| JPMorgan Chase | N/A | $46.01 billion | Revenue beat estimates; CEO warns of economic turbulence. |

| Morgan Stanley | $2.60 | $17.74 billion | Earnings and revenue both surpassed expectations. |

| BlackRock | $11.30 | $5.28 billion | EPS exceeded forecasts but revenue fell short. |

| Wells Fargo | N/A | $20.15 billion | 16% increase in earnings year-over-year, but revenue missed estimates. |

| Bank of New York Mellon | $1.58 | $4.79 billion | Earnings and revenue outperformed expectations. |

| Newmont Corporation | N/A | N/A | Stock jumped after UBS upgrade, strong cash returns expected. |

| Nvidia | N/A | N/A | Stock rebounded after prior day fall; strong week overall. |

Summary

Earnings Reports capture crucial financial performance metrics from companies, reflecting both successes and shortcomings in the marketplace. Amidst recent fluctuations in stock performance, major institutions like JPMorgan Chase and Morgan Stanley have reported better-than-expected interactions, while others like BlackRock have faced challenges in revenue expectations. As the landscape continues to evolve, investors and analysts alike should remain vigilant about the implications these earnings have on future market conditions.