De-Dollarization in Asia: Challenging Dollar Dominance

De-Dollarization in Asia is becoming an increasingly prominent trend as countries across the region seek to diminish their reliance on the U.S. dollar, thus challenging the long-standing dollar dominance in global trade. Influential economic groups like BRICS and ASEAN are spearheading this movement by advocating for local currency trading, which supports currency hedging in Asia at unprecedented levels. This shift is born from concerns over the weakening stability of the dollar and the geopolitical manipulation of monetary systems, prompting many Asian nations to explore viable Asia currency alternatives. According to recent reports, the share of the dollar in global foreign exchange reserves has notably declined, laying the groundwork for a more diversified currency landscape. As the momentum of de-dollarization continues to build, it signals a transformative period for trade and economic interactions in Asia and beyond.

The movement towards reducing dependency on the American dollar is reshaping the financial landscape throughout Asia. This shift, often referred to in discussions about the decline of dollar hegemony, involves regional alliances like BRICS and ASEAN advocating for transactions in local currencies. These developments not only promote efficient trade mechanisms but also introduce innovative strategies for currency risk management, notably through enhanced currency hedging practices across various markets. As countries seek to mitigate the vulnerabilities associated with dollar fluctuations, the focus on regional currency alternatives is gaining ground, suggesting a pivotal evolution in international trade protocols.

The Emergence of Currency Alternatives in Asia

As Asian economies grow and integrate further, a shift towards alternative currencies is becoming evident. Countries like Japan, South Korea, and Taiwan are leading the charge, actively promoting their domestic currencies as viable substitutes for the U.S. dollar. This trend is partly driven by the desire to mitigate foreign exchange risks, particularly in the face of increasing geopolitical tensions and unpredictable monetary policies emanating from the West. By fostering bilateral trade agreements that utilize local currencies, these nations aim to create a more balanced and stable trading environment that is less susceptible to external shocks.

In conjunction with these efforts, the adoption of regional payment systems is gaining momentum. Initiatives led by the Association of Southeast Asian Nations (ASEAN) and BRICS aim to facilitate trade and investment without reliance on the dollar. Such frameworks not only encourage local currency transactions but also bolster regional economic ties. As businesses and governments continue to embrace these alternatives, it signifies a broader movement towards financial autonomy and resilience in the region.

De-Dollarization in Asia: Key Reasons and Impacts

The de-dollarization movement in Asia stems from various factors that have prompted regional players to reconsider their dependence on the dollar. Economic volatility and uncertainty surrounding U.S. monetary policy have led to a lack of confidence among Asian investors in holding dollars as a reserve asset. Moreover, the weaponization of the dollar, particularly through sanctions, has further fueled the urgency for countries to seek currency hedging strategies and protect their economies. The International Monetary Fund’s data showing a decline in the dollar’s share of global reserves underscores this urgent need for diversification.

The ramifications of this shift are profound, as it may redefine global trade dynamics. As Asian countries transact in their local currencies, the demand for the dollar could diminish, altering its role as the world’s dominant reserve currency. While the transition is not without risks—many analysts highlight that no currency currently provides the same liquidity and stability as the dollar—the emerging trends suggest a transformative phase in the global economic landscape. As Asia embraces this de-dollarization strategy, it may pave the way for a multipolar currency system in the future.

ASEAN’s Strategic Vision for Local Currency Trade

The ASEAN Economic Community Strategic Plan for 2026 to 2030 marks a pivotal moment in the shift towards increased local currency trade within the region. By advocating for greater use of domestic currencies, ASEAN countries are signaling a commitment to reducing their reliance on the dollar. This strategic move is essential for fostering regional integration and building a more resilient economic framework. Policymakers believe that local currency trade not only enhances trade efficiency but also protects member states from fluctuations in global currency markets.

To facilitate this transition, ASEAN is actively working on enhancing regional payment systems that accommodate local currencies. By doing so, they aim to address the transactional challenges currently posed by dollar-centric trade practices. Leaders from member countries stress that a more cooperative approach to trade, utilizing local currencies, can help cushion economies against external shocks, thereby promoting long-term stability and growth in the region.

Rising Demand for Currency Hedging Strategies in Asia

As the trend of de-dollarization gains momentum, Asian investors are increasingly looking toward currency hedging as a strategy to mitigate risks associated with foreign exchange fluctuations. According to various financial analysts, there’s been a noticeable uptick in demand for hedging instruments, with countries like Japan and Taiwan demonstrating significant increases in their hedge ratios. For instance, Japanese life insurers raised their hedge ratio from 44% to 48% in just a month, indicating a growing awareness and responsiveness to impending economic risks.

This rise in currency hedging strategies is not only a byproduct of the de-dollarization movement but also a reflection of the strategic shifts within the global markets. Investors are becoming more astute about their positions in light of unpredictable geopolitical scenarios and monetary policies. With the intent to safeguard their investments, many are opting for hedging solutions that involve local currencies, which presents a clear path toward both greater financial security and the potential for redefined regional currency alliances.

Challenges Ahead: The Search for a Dollar Replacement

While the momentum for de-dollarization in Asia is noteworthy, analysts caution that the road ahead is fraught with challenges. One of the primary hurdles is the lack of a clear and universally accepted replacement for the U.S. dollar. Despite the enthusiasm surrounding emerging currencies, no other currency currently offers the same level of liquidity, depth in bond markets, and international trust that the dollar enjoys. This inherent challenge raises questions about the feasibility of fully replacing the dollar, which might be an unattainable goal in the immediate future.

Additionally, political dynamics within Asia can complicate the transition toward alternative currencies. The effectiveness of currency alternatives relies heavily on mutual trust and cooperation among Asian nations. Any political turmoil or strained diplomatic relations could hinder collective progress towards de-dollarization, leaving economies vulnerable during times of market volatility. Thus, while the movement toward alternative currencies is gaining traction, caution is warranted as stakeholders navigate these significant challenges.

The Role of BRICS in Promoting Currency Alternatives

The BRICS nations, comprising Brazil, Russia, India, China, and South Africa, are pivotal players in the ongoing de-dollarization efforts across Asia. By advocating for trade that utilizes their respective local currencies, BRICS is not only challenging dollar dominance but also positioning themselves as viable alternatives to Western economic influence. The push for bilateral agreements among BRICS nations serves as a foundation for economic cooperation and mutual support, which is essential in the quest for sustainable growth and foreign exchange stability.

Moreover, BRICS countries are venturing into the creation of their own payment systems to circumvent the established systems like SWIFT, which they view as tools for financial hegemony by Western powers. This initiative is expected to enhance transaction efficiency among member states and fortify their economic resilience. As the BRICS bloc continues to innovate and promote local currency trades, it may inspire other nations to follow suit, further accelerating the process of de-dollarization and fostering a multipolar financial landscape.

Geopolitical Influences on De-Dollarization Trends

Geopolitical tensions significantly influence the pace and success of de-dollarization trends in Asia. Factors such as trade wars, sanctions, and diplomatic crises compel nations to reconsider their monetary strategies and reliance on the dollar. The perception that the dollar can be weaponized against countries through sanctions has intensified the urgency for alternatives. As nations face the increasing likelihood of economic sanctions or restrictions, the strategic value of diversifying away from the dollar becomes clearer. This trend shapes regional policies and drives the adoption of alternative currencies.

Furthermore, the unpredictability of U.S. foreign policy, especially under varying administrations, adds to the uncertainty surrounding the dollar’s future. Asian countries are beginning to recognize that they must be proactive in managing the risks associated with the dollar. Thus, the importance of forming alliances and enhancing regional cooperation in currency matters has never been more critical. By prioritizing local currencies, Asian nations aim to cultivate economic independence and resilience in the face of an unpredictable global landscape.

Future Prospects of Currency Markets in Asia

Looking forward, the future of currency markets in Asia appears to be on the brink of transformation. As more countries embrace local currency trade and hedge against dollar fluctuations, we may witness a significant reshaping of the region’s financial landscape. This shift has the potential to foster new investment opportunities and drive regional economic growth. The enthusiastic endorsement of local currencies by governments across Asia could spark a ripple effect, encouraging businesses and investors to adapt their strategies accordingly. In this evolving scenario, the importance of currency stability and trust becomes paramount.

Nonetheless, it is critical for policymakers to implement effective frameworks that support the growth of alternative currencies and ensure their acceptance in regional and global markets. Education and awareness among businesses regarding the benefits of local currency engagement will also play a vital role in this transition. As Asian nations advance their de-dollarization efforts, the prospects of a more diversified currency landscape using homegrown solutions could serve as a model for other regions around the globe.

Frequently Asked Questions

What is driving de-dollarization in Asia and how does it relate to the BRICS currency strategy?

De-dollarization in Asia is primarily driven by concerns over monetary volatility, geopolitical risks, and the strategic use of the U.S. dollar in sanctions. The BRICS currency strategy plays a crucial role as it promotes bilateral trade in local currencies, reducing reliance on the dollar and enhancing alternative currency systems.

How does ASEAN’s local currency trade initiative impact de-dollarization in Asia?

ASEAN’s local currency trade initiative significantly supports de-dollarization in Asia by promoting greater use of members’ currencies in trade and investment. This strategic shift, outlined in their Economic Community Strategic Plan for 2026-2030, aims to deepen regional payment integration and reduce dependence on the dollar.

What are the implications of dollar dominance declining in Asia for currency hedging?

The decline of dollar dominance in Asia has led to increased demand for currency hedging, as investors seek to mitigate foreign exchange risks associated with dollar exposure. This trend reflects a broader strategy to diversify into regional currencies, resonating with the ongoing de-dollarization efforts.

What are the alternative currencies emerging in Asia as part of the de-dollarization trend?

As part of the de-dollarization trend in Asia, alternative currencies like the Japanese yen, Korean won, and Taiwan dollar are gaining prominence. Analysts indicate that these currencies are being strategically favored for trade and investment to minimize reliance on the U.S. dollar.

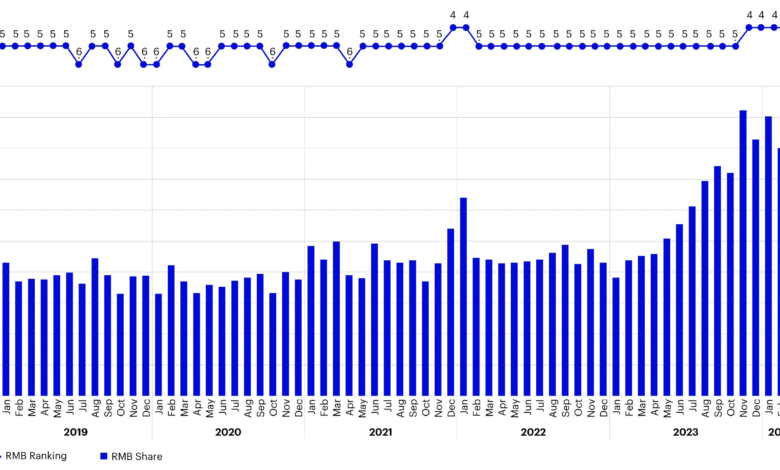

How has the share of the U.S. dollar in global foreign exchange reserves changed?

Recent data shows that the dollar’s share of global foreign exchange reserves has decreased to 57.8% in 2024, down from over 70% in 2000. This reduction highlights the ongoing de-dollarization movement and the search for reliable currency alternatives among Asian economies.

What role do geopolitical factors play in Asia’s push for de-dollarization?

Geopolitical factors play a significant role in Asia’s push for de-dollarization, as many countries consider the dollar’s use in sanctions a potential threat. The desire to maintain economic sovereignty and security is driving nations to adopt local currencies and explore other currency alternatives in trade.

Can a clear alternative to the U.S. dollar emerge from Asia’s de-dollarization efforts?

Despite the efforts towards de-dollarization in Asia, analysts caution that no single currency yet matches the liquidity and depth of the U.S. dollar’s bond and credit markets. Therefore, while alternatives are being explored, a clear replacement for dollar dominance remains uncertain.

What strategies are Asian economies employing to reduce reliance on the U.S. dollar?

Asian economies are employing several strategies to reduce reliance on the U.S. dollar, including promoting local currency trade, enhancing currency hedging practices, and establishing bilateral agreements that favor the use of domestic currencies in transactions, all contributing to the de-dollarization trend.

| Key Point | Details |

|---|---|

| Growth of De-Dollarization in Asia | Policymakers and institutional investors are seeking alternatives to the U.S. dollar due to monetary volatility and geopolitical risks. |

| Decline in Dollar’s Share of Reserves | IMF reports show the dollar’s share of global foreign exchange reserves dropped to 57.8% in 2024. |

| ASEAN’s Economic Community Strategic Plan 2026-2030 | Focus on increasing local currency usage in trade and investment to enhance regional payment integration. |

| BRICS Nations Promoting Local Currencies | BRICS countries are boosting bilateral trade in local currencies, moving away from Western financial systems. |

| Increase in Currency Hedging | Japanese insurers raised their hedge ratio from 44% to 48%, and Taiwan’s hedge ratio is at 70%. |

| Strategic Shift Against U.S. Dollar | Countries are treating the dollar as a potential weapon for trade sanctions, prompting a shift towards local currencies. |

| Market Responses | Political changes and market volatility are accelerating the move toward diverse currencies. |

Summary

De-Dollarization in Asia is becoming a significant movement as countries in the region actively seek alternatives to the U.S. dollar. This strategy not only aims to mitigate risks associated with reliance on a single currency but fosters trade partnerships through local currencies and enhances regional economic integration. The concerted efforts by organizations like ASEAN and the BRICS nations highlight a critical shift in the economic landscape of Asia, as it evolves from traditional dollar dependency toward a more diversified currency approach.