DeFi Market Analysis: Lessons from Curve Finance Collapse

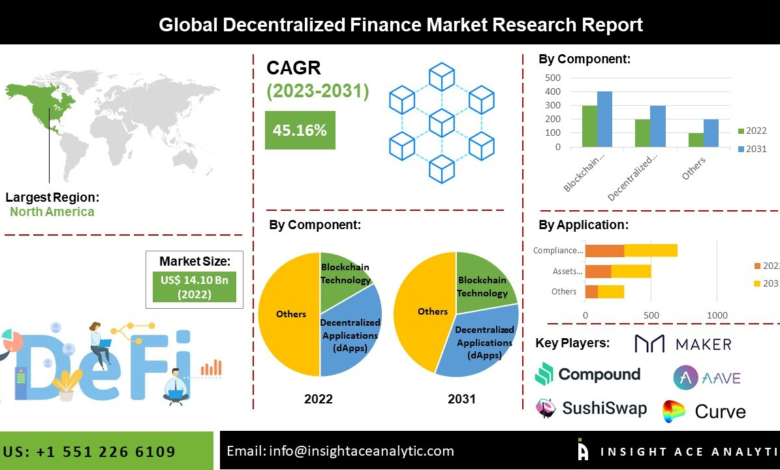

In the rapidly evolving landscape of decentralized finance (DeFi) market analysis, understanding the current trends and challenges is more crucial than ever. The DeFi sector, which encompasses innovative lending protocols and platforms like Curve Finance, has been heralded as a game changer within the crypto market. However, recent fluctuations and setbacks have sparked debates about its viability and sustainability in the face of growing regulatory scrutiny and market volatility. As investors navigate crypto market trends, keeping an eye on the dynamics of Ethereum DeFi becomes essential for assessing potential risks and rewards. The interplay between DeFi projects and their underlying technologies could ultimately determine the future trajectory of this once-promising financial revolution.

When examining the landscape of decentralized finance, one must delve into the intricacies of the DeFi ecosystem and its varying components. This realm of digital finance continues to grow, showcasing diverse offerings such as lending platforms, yield farming, and innovative staking opportunities. Alternative terminology like crypto asset management, decentralized lending, and blockchain finance encapsulates the essence of this market, providing insights into its evolution since its inception. With players emerging and redefining strategies, the sector is at a crossroads where conventional finance meets digital innovation, promising to challenge existing paradigms in the realm of monetary transactions. By understanding these alternate concepts, one can better appreciate the ongoing shifts and their implications for future investments.

Understanding Curve Finance and Its Impact on the DeFi Market

Curve Finance has been a pivotal player in the decentralized finance (DeFi) landscape since its inception, known primarily for its innovative approach to automated market making and liquidity provision. The recent tumultuous events surrounding Curve and its founder, Michael Egorov, highlight the vulnerabilities that can arise in even the most established DeFi protocols. The liquidation of $140 million worth of CRV tokens raised significant concerns about systemic risks within the DeFi ecosystem and has drawn scrutiny from both investors and regulators alike. Curve, once a shining example of the DeFi boom, is now at the center of discussions regarding the sustainability and future of decentralized financial systems, particularly in light of events suggesting that even the most robust systems can falter under extreme pressure.

Moreover, Curve’s situation underscores a troubling trend in the crypto market: the balancing act between innovation and risk. As Curve attempts to maintain its footing amidst adversity, the ripple effects extend throughout the DeFi sector. Critics question whether the fall of Curve signifies a broader loss of confidence in DeFi protocols, particularly those heavily reliant on complex lending mechanisms. This liquidity crisis is not just a test for Curve Finance; it serves as an important barometer for the entire decentralized finance market, illustrating the necessity for risk management solutions and the importance of regulatory clarity.

The events surrounding Curve Finance have ignited discussions regarding decentralized lending protocols and their resilience against market downturns. The liquidity crisis experienced by Curve serves as a case study for prospective DeFi projects aiming to establish a secure footing in the rapidly evolving crypto landscape. Investors are becoming increasingly cautious, weighing the risks associated with high-yield products against the potential returns. The situation prompts a critical reevaluation of the principles that underpin DeFi systems and emphasizes the need for effective oversight that can foster innovation while minimizing risk.

Current trends indicate that decentralized finance is still searching for stability, and Curve Finance’s challenges may catalyze new regulatory discussions. As the DeFi universe continues to mature, the industry must address areas of vulnerability that have been laid bare by incidents such as Curve’s recent liquidation. This evolution could lead to a more robust framework for DeFi platforms, ultimately enhancing their sustainability and reinforcing investor confidence.

DeFi Market Analysis: Future Outlook and Challenges

Analyzing the DeFi market reveals a landscape marked by both potential and challenges. With projects like Curve Finance facing setbacks, it becomes essential to assess the overall health and future prospects of decentralized finance. As of late 2024, although some traditional DeFi players like Aave and Maker have managed to sustain their significance, the overall TVL across the sector remains volatile. Regulatory scrutiny continues to cloud the market’s outlook. The SEC’s increasing clampdown on protocols presents significant barriers for developers and investors alike, urging many to reconsider their entry into the space. The future of DeFi hinges on how well these challenges can be navigated, particularly as new narratives emerge and attract fresh capital into the sector.

Despite the hurdles, there is a visible shift towards innovation within the DeFi ecosystem, with new players like Pendle Finance and Ethena showcasing the potential for growth. These projects are capitalizing on market gaps and responding to changing user demands, thus indicating a vital progression within the sector. Such innovations suggest that while the DeFi market faces turbulence, there remains a strong undercurrent of opportunity that can thrive amid adversity, provided the offerings are aligned with user needs and evolving market conditions.

Furthermore, the increasing interdependencies between DeFi and traditional finance create an interesting tapestry of opportunities and challenges. As Ethereum continues to maintain its dominance in the DeFi space, market participants are vying for unique propositions that can cater to user demands while addressing the inherent risks. The ongoing developments within the Ethereum ecosystem, especially with the potential for institutional investments following the approval of ETH-based ETFs, could inject new life into the DeFi sector. This would not only enhance the valuation of established protocols but also stimulate fresh interest in decentralized applications across the board.

In essence, the DeFi market analysis reveals a complex web of interconnected variables, where innovation, regulation, and user demand play integral roles. The success of future projects will largely depend on their ability to demonstrate resilience amidst market fluctuations while tapping into the evolving sentiment of investors and users alike. The growth trajectory of DeFi will ultimately reflect its capacity to adapt and thrive in the face of ongoing challenges.

The Role of Lending Protocols in the Evolving DeFi Landscape

Lending protocols have become foundational pillars of the decentralized finance landscape, serving as key mechanisms for liquidity and capital efficiency. Protocols like Aave and Compound have pioneered the lending sector, enabling users to earn interest on their cryptocurrency holdings while simultaneously providing borrowing opportunities. However, the recent turmoil surrounding lending mechanisms, particularly the crisis affecting Curve Finance, has shed light on the risks associated with these platforms. The sudden liquidation events demonstrate that while these protocols offer enticing yield opportunities, they also carry significant dangers that can undermine user confidence.

Additionally, as the lending sector evolves, it is becoming increasingly clear that a more risk-aware environment is necessary for sustainable growth. Many lending protocols face challenges in attracting users due to the prevalent risks associated with smart contracts and collateral requirements. The importance of developing innovative solutions that address these risks cannot be overstated. Enhancing transparency and security measures will be crucial as the market seeks to recover from recent setbacks, ultimately contributing to a safer lending environment in the DeFi space.

On the flip side, the advancement of lending protocols has catalyzed a new wave of opportunities for innovation in the DeFi sector. New entrants are emerging with fresh concepts that aim to improve user experience and mitigate risks. As protocols experiment with novel approaches, there is potential for significant disruptions that could reshape the lending landscape. Projects that can effectively address existing pain points—such as introducing better collateralization models or adaptive interest rate systems—are likely to gain traction among users and investors alike.

Ultimately, the evolution of lending protocols within decentralized finance underscores the need for a balanced approach that values innovation while ensuring protections against systemic risks. As the market strives to regain stability and attract new participants, the success of lending platforms will hinge on their ability to instill confidence and deliver reliable financial services that resonate with users’ needs.

Navigating the Relationship Between DeFi and Regulatory Challenges

The relationship between decentralized finance (DeFi) and regulatory authorities is increasingly fraught with tension. On one hand, regulatory scrutiny, such as that seen from the U.S. Securities and Exchange Commission (SEC), presents challenges that DeFi protocols must navigate. For example, the SEC’s focus on decentralized exchanges and yield-generating procedures could alter how these platforms operate, necessitating compliance that can stifle innovation. As the DeFi market attempts to find its footing, understanding how regulations impact project development and user participation is crucial. Developers must engage with regulators proactively to foster an environment that supports innovation while ensuring consumer protection and market integrity.

On the other hand, regulatory oversight presents an opportunity for legitimacy within the DeFi space. By establishing clear guidelines, regulators could create a framework that encourages the responsible growth of decentralized finance, leading to increased institutional investment and participation. Nevertheless, the path to effective regulation will require collaboration between industry stakeholders and policymakers to develop standards that reflect the unique nature of DeFi while protecting investors from potential pitfalls.

Equally, as the regulatory landscape evolves, it’s imperative for DeFi projects to adapt and develop strategies that align with compliance requirements without sacrificing their core principles of decentralization and transparency. Implementing best practices—such as KYC (Know Your Customer) and AML (Anti-Money Laundering)—may be necessary to ensure broader acceptance and support from traditional financial institutions. At this crossroads, DeFi has the potential to redefine financial interactions and empower users, provided that it can demonstrate its commitment to responsible growth in a regulated environment.

In conclusion, navigating the complexities of DeFi amid regulatory challenges will be pivotal for the future trajectory of the sector. As both innovators and regulators work together, the outcome of these interactions could determine the extent to which decentralized finance can thrive, adapt, and ultimately reshape the global financial landscape.

Emerging Trends in Ethereum and Their Influence on DeFi

Ethereum has long been the cornerstone of the DeFi revolution, and as the network continues to evolve, new trends are beginning to emerge that significantly impact the DeFi landscape. Projects like Lido and EigenLayer illustrate the potential for staking and restaking to dominate narratives within the ecosystem. As these innovative mechanisms gain traction, they not only provide users with opportunities to earn yields but also contribute to the overall health and scalability of the Ethereum network. This trend indicates a shift away from traditional lending and borrowing towards staking solutions that are increasingly appealing to investors seeking lower-risk options in a turbulent market.

Additionally, the transition to Ethereum’s layer-2 solutions is becoming more pronounced, with platforms like Arbitrum helping to alleviate congestion and reduce transaction fees. As these advancements materialize, they foster a more user-friendly DeFi experience, enticing a broader audience to engage with decentralized applications. The continued development of Ethereum’s infrastructure will play a crucial role in supporting the next wave of DeFi innovation and growth.

Furthermore, the anticipated approval of Ethereum-based ETFs could catalyze a seismic shift in the market, paving the way for institutional investments to flood into the DeFi ecosystem. With a significant portion of DeFi transactions pegged to ETH, any increase in demand for Ethereum can lead to a cascading effect across all DeFi protocols. This could potentially drive up total value locked (TVL) across the sector, enhancing liquidity and propelling the growth of various decentralized applications. With increasing institutional interest, DeFi may witness a renaissance that redefines user engagement while establishing Ethereum as an enduring force in the financial landscape.

In summary, the emerging trends within Ethereum serve as a microcosm of the broader dynamics shaping the DeFi landscape. By harnessing opportunities presented by staking, layer-2 solutions, and institutional adoption, the Ethereum ecosystem remains well-positioned to respond to market changes and continue evolving toward sustainable growth within decentralized finance.

Investor Sentiment and Market Dynamics in DeFi

Investor sentiment plays a crucial role in shaping market dynamics within the decentralized finance (DeFi) sector. As experiences with projects like Curve Finance color perceptions, both new and experienced investors remain wary of the risks associated with DeFi protocols. The prevailing sentiment can significantly influence liquidity flows, market participation, and overall growth prospects for various platforms. In the wake of crises such as the CRV liquidation, assessing how sentiment shifts can provide insight into potential recovery paths or additional downturns for the market.

Moreover, understanding the forces that drive investor sentiment can lead to more informed decision-making within DeFi investment strategies. The rise of community-driven governance models has also introduced a layer of complexity, as stakeholders engage more directly with the evolution of protocols. The influence of community sentiment can guide the direction of protocols, affecting everything from protocol upgrades to liquidity incentives, thereby creating a dynamic interplay between investor views and market movements.

As the DeFi space continues to mature, it is essential to monitor shifts in investor sentiment and their implications for decentralized finance’s trajectory. Projects that can foster transparent communication and engage with their community effectively are likely to build stronger investor relationships, contributing to market resilience. Ultimately, those protocols that align their development with user sentiment and capitalize on trends of increasing user engagement will be better positioned to withstand market fluctuations and attract sustained interest over time.

The Future of DeFi: Innovations and Ecosystem Resilience

The future of decentralized finance (DeFi) hinges upon the ability of projects to innovate and adapt in an ever-changing landscape. As the sector emerges from the shadow of recent crises, it faces a crucial period of transformation characterized by new technologies, evolving user demands, and shifting market conditions. Innovation will play an indispensable role, not only in addressing the current challenges but also in unlocking new potential within the DeFi ecosystem. For example, platforms leveraging advanced data analytics and machine learning can enhance user experience and streamline processes, making DeFi more accessible to a broader audience.

Innovative solutions such as insurance protocols, enhanced security measures, and new product offerings tailored to an evolving user base can help rebuild confidence among investors. As resilience is tested through market fluctuations, protocols that successfully demonstrate strong fundamentals and transparency are likely to thrive in the long term. A focus on innovation, combined with an emphasis on community engagement and active feedback loops, will be fundamental to fostering a robust DeFi ecosystem.

Moreover, the integration of DeFi with other emerging technologies, such as blockchain interoperability and layer-2 solutions, could redefine how decentralized applications function and interact. By building seamless bridges between blockchain ecosystems, the DeFi market can enhance liquidity across platforms and create a more cohesive experience for users. As these innovations develop, they can help strengthen DeFi’s position in the larger financial landscape while potentially attracting institutional interest that could serve as a catalyst for long-term growth.

In conclusion, the potential for DeFi to evolve and thrive in the future is tremendous, driven by resilience, innovation, and a commitment to addressing user needs. Although the path ahead may be fraught with challenges, the lessons learned from past experiences will forge a stronger and more competitive ecosystem poised for success in the coming years.

Frequently Asked Questions

What role does Curve Finance play in DeFi market analysis?

Curve Finance is a central hub in decentralized finance (DeFi) market analysis, known for its liquidity pools and efficient trading of stablecoins. Its performance often reflects broader crypto market trends, making it a key indicator for DeFi’s health.

How do lending protocols impact DeFi market trends?

Lending protocols are crucial in DeFi market analysis as they determine borrowing rates and liquidity in the ecosystem. Their efficiency and adoption rates directly influence crypto market trends and user activity within DeFi.

What challenges are currently facing the DeFi market, particularly with platforms like Curve Finance?

The DeFi market is facing challenges such as regulatory scrutiny, systemic risks exemplified by situations with Curve Finance, and decreasing total value locked (TVL) in older protocols. These factors complicate market analysis and investor confidence.

How is Ethereum DeFi influencing the overall market?

Ethereum DeFi dominates over 69% of total DeFi activity, influencing market dynamics through project innovations and liquidity. Its performance is pivotal in market analysis, especially as institutional interest grows in the ecosystem.

What are some new narratives emerging in the DeFi space?

Emerging narratives in DeFi include innovations in staking and yield generation, exemplified by projects like Pendle Finance. These shifts are crucial for DeFi market analysis as they attract new users and capital, potentially reviving interest in the sector.

Why is total value locked (TVL) an important metric in DeFi market analysis?

Total value locked (TVL) is a pivotal metric in DeFi market analysis, reflecting the amount of capital secured in protocols. It helps gauge the health and popularity of lending protocols and overall market trends, informing investment strategies.

How might the SEC’s actions impact DeFi market analysis?

The SEC’s actions, particularly against decentralized exchanges and lending protocols, introduce regulatory risks that affect market sentiment and confidence. These developments are critical in DeFi market analysis, influencing investment decisions and protocol viability.

What effects could an ETH ETF approval have on the DeFi market?

If an ETH ETF is approved, it could lead to substantial institutional investments flowing into Ethereum and its DeFi ecosystem. This would likely increase market activity and total value locked, making it a significant subject in DeFi market analysis.

| Key Point | Details |

|---|---|

| DeFi’s Crisis | Decentralized finance faces significant challenges with growing pains and regulatory scrutiny after incidents like the Curve Finance liquidation. |

| Current State of Curve Finance | The Curve founder, Michael Egorov, faced a $140 million liquidation which adversely affected the CRV token’s price. |

| Market Performance of DeFi Projects | Most DeFi projects, including Curve, Uniswap, and Compound, have seen a decline in total value locked (TVL), while Lido remains strong. |

| Emerging DeFi Innovations | Projects like Pendle Finance and Ethena have gained traction by offering innovative solutions in the yield farming space. |

| Impact of Ethereum ETFs | If spot ETFs are approved, influxes of institutional money could boost Ethereum’s market and, consequently, the entire DeFi ecosystem. |

| Regulatory Barriers | Increased scrutiny from the SEC presents challenges for DeFi protocols, causing hesitance among high-end investors. |

| Conclusion on DeFi’s Future | Despite setbacks, many DeFi protocols are showcasing resilience and could regain momentum with favorable regulations. |

Summary

In the ever-evolving landscape of DeFi market analysis, the sector is currently navigating through significant growing pains, highlighted by regulatory scrutiny and the fallout from major incidents like the liquidation at Curve Finance. However, the emergence of innovative projects and the potential for institutional investment via Ethereum spot ETFs suggest that the sector has the capability to rebound. As new narratives and increasing user demand reshape the DeFi landscape, the resilience of established protocols might spark a renewed wave of investment and interest in the space. Therefore, while the DeFi market faces challenges, it remains a fundamental element of crypto’s future.