Digital Asset Custody: Driving Stablecoin Adoption & Growth

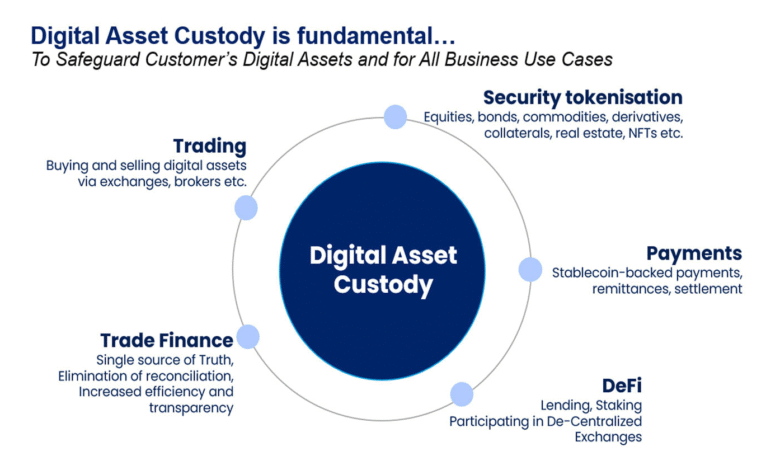

Digital asset custody is emerging as a crucial pillar of the financial landscape, particularly as institutions navigate the burgeoning market of stablecoin adoption and tokenized assets. As digital currencies gain momentum, the need for secure custody solutions becomes paramount, enabling compliance with regulatory standards while fostering innovation in financial infrastructure. This evolution supports cross-border payments and enhances overall market confidence, allowing businesses and consumers to participate in a digitized ecosystem. With projections indicating that the value of tokenized assets could reach nearly $18.9 trillion by 2033, the focus on robust custody systems is more relevant than ever. As such, understanding digital asset custody is essential for any institution aiming to succeed in this rapidly changing financial environment.

In today’s digital economy, the safeguarding of crypto holdings—often referred to as crypto custody or virtual asset storage—plays a fundamental role in the transition towards decentralized finance. This essential service not only ensures the security of digital currencies but also enhances crypto-compliance by adhering to established regulations. As financial systems evolve with the rise of automated systems for cross-border transactions and the growing prominence of tokenized assets, the significance of secure asset management continues to rise. Institutions are increasingly recognizing that effective management of digital assets can drive stablecoin implementations and open new pathways for financial innovation. Thus, integrating advanced custody solutions is vital for enhancing confidence and trust within the emerging digital finance landscape.

The Critical Role of Digital Asset Custody in Financial Infrastructure

Digital asset custody has emerged as a pivotal element in the evolving landscape of financial infrastructure, especially as institutions embrace the shift towards tokenized finance. With the explosion of digital assets, including cryptocurrencies and stablecoins, ensuring the secure management of these assets is daunting yet essential. This transition is not just about safeguarding assets but also about building trust and promoting regulatory compliance. As businesses adapt to this new landscape, effective custody solutions are necessary to anchor the financial ecosystem, thereby enhancing the confidence of stakeholders involved in transactions.

Furthermore, the necessity of competent custody services cannot be overstated as they provide the backbone for implementing advanced financial operations. Institutions looking to explore stablecoin adoption and capitalize on the benefits of tokenized assets must prioritize robust custody frameworks. By doing so, they not only protect their investments but also streamline their operations across borders, facilitating secure and efficient cross-border payments. This assurance of safety and compliance positions digital asset custody as the foundation upon which future financial systems will be built.

Impacts of Stablecoin Adoption on Digital Asset Custody

The rise of stablecoin adoption presents both opportunities and challenges for digital asset custody. Stablecoins, designed to maintain a stable value against fiat currencies, are increasingly being recognized as viable alternatives in the financial market. For financial institutions, the necessity to manage these assets securely and efficiently has made custody systems more critical than ever. By integrating advanced custody solutions, institutions can mitigate risks associated with volatility and regulatory scrutiny, while paving the way for greater participation in the burgeoning market of tokenized finance.

Additionally, the adoption of stablecoins can lead to a more structured and compliant framework for cryptocurrency engagement, as it provides a stable medium for transactions. This transition enhances the importance of custody services that can facilitate seamless integration with existing financial systems. As institutions harness stablecoins for daily operations, a sustainable and trustworthy digital asset custody strategy becomes indispensable, ensuring both operational reliability and legal compliance in a rapidly changing regulatory environment.

Tokenized Assets: Redefining Custody Solutions

Tokenized assets are reshaping the landscape of how digital custody services are conceived and implemented. Unlike traditional assets, tokenized assets leverage blockchain technology to represent ownership digitally, introducing unique custody considerations. Institutions are increasingly recognizing the potential of these assets and the significant role custody plays in maintaining their integrity and market liquidity. As the projected value of tokenized real-world assets balloons, financial institutions must rethink their custody strategies to accommodate this transformation, incorporating innovations that align with regulatory developments and market dynamics.

Moreover, the evolution of tokenized assets necessitates custodial models that accommodate various asset types, liquidity requirements, and compliance frameworks. By diversifying custody solutions – whether through self-custody, outsourced services, or hybrid approaches – institutions can better address the complexities of managing a portfolio that includes a range of tokenized assets. This capability not only enhances the safety of assets but also stimulates the broader adoption of tokenized finance, allowing organizations to engage in an expanding global market efficiently.

Enhancing Compliance through Robust Digital Custody Solutions

Compliance has become a critical focal point for financial institutions operating in the digital asset space, especially given the rapid growth of cryptocurrencies and related technologies. As jurisdictions evolve their regulatory frameworks, the need for reliable custody solutions that ensure adherence to compliance standards is paramount. Digital asset custody solutions are uniquely positioned to facilitate compliance by integrating regulatory requirements into their operational infrastructures, thus assuring institutions of their capacity to protect themselves against possible legal repercussions.

Implementing cutting-edge technologies within custody operations not only strengthens regulatory compliance but also helps institutions confidently engage in emerging markets like stablecoins and tokenized finance. Enhanced oversight and transparency provided through sophisticated custody mechanisms can empower institutions to meet evolving regulations while increasing trust with clients and regulators alike. With a compliance-conscious approach, digital custody solutions can ultimately serve as enablers for expanded participation in cross-border payments and the global financial system.

The Intersection of Cybersecurity and Digital Asset Custody

As the financial world embraces digital assets, the convergence of cybersecurity and digital asset custody has never been more vital. Institutions must combat the rising tide of cyber threats that can jeopardize the safety of digital assets. Effective custody solutions not only prioritize asset protection but also incorporate advanced cybersecurity measures to thwart unauthorized access and potential breaches. This dual focus on custody and cybersecurity is essential for generating trust among clients and stakeholders throughout the financial ecosystem.

Moreover, as custodial frameworks expand to encompass complex systems that include tokenized assets and stablecoin operations, maintaining high cybersecurity standards becomes integral. Custodians must implement end-to-end security measures, ensuring that both hardware and software solutions provide robust protection. By investing in cybersecurity and aligning it with custody solutions, institutions can create a secure transaction environment that supports cross-border payments, reduces risks associated with cryptocurrency compliance, and ultimately fosters a more stable and efficient financial landscape.

Future Challenges for Digital Asset Custody Infrastructure

Looking ahead, digital asset custody faces several challenges that will require innovative solutions. As regulatory frameworks mature globally, custodians must continuously adapt their operations to comply with evolving requirements while meeting the expectations of an increasingly sophisticated client base. The integration of smart contracts and programmable infrastructure into custody systems will also demand agility and foresight, prompting custodians to build systems that are robust yet flexible enough to embrace new technologies and methodologies.

Additionally, as the market for tokenized assets expands, custodians will be compelled to accommodate a wider array of asset types and complexities. This includes not only traditional assets but also dynamic frameworks that incorporate off-chain elements and automated compliance processes. The challenge lies in developing custody infrastructures that can handle this complexity while ensuring security, compliance, and operational efficiency. As digital finance continues to evolve, custodians must stay ahead of the curve, continually refining their strategies to meet both current and future custodial demands.

Integrating Smart Contracts with Custody Solutions

The integration of smart contracts within digital asset custody solutions represents a breakthrough in programmable financial infrastructure. This innovation allows for the automation of various compliance and transaction processes, leading to greater efficiency and reduced operational risks. By embedding smart contracts into custody frameworks, institutions can rapidly execute trades, manage conditional settlements, and enhance the overall transparency of asset management.

Furthermore, the ability to execute agreements automatically through smart contracts minimizes manual intervention and its associated errors, fostering trust among market participants. As the demand for tokenized assets and stablecoin adoption grows, the synergy between custody and smart contracts will be essential to facilitate complex financial transactions, particularly in cross-border payments. This progressive approach to integrating technology into custody solutions emphasizes the transition toward a more secure, streamlined, and compliant digital finance ecosystem.

Custody as a Catalyst for Cross-Border Payments

Digital asset custody plays a critical role in enhancing cross-border payment systems. As the global economy becomes increasingly interconnected, the ability to move assets securely and efficiently across borders is paramount. By implementing reliable custody solutions, financial institutions can facilitate seamless transactions that transcend geographical barriers, ensuring liquidity and timely settlements in an ever-competitive environment.

Moreover, the security provided by advanced custody solutions further enhances the trust necessary for cross-border transactions. Institutions equipped with state-of-the-art custody platforms can assure clients that their assets are secure throughout the entire transaction process. This confidence fosters greater engagement in stablecoin adoption and tokenized finance initiatives, ultimately driving growth in global payment networks. As demand for rapid and secure cross-border payments continues to rise, the strategic importance of digital asset custody will only increase.

The Future of Digital Custody Collaboration

Collaboration among industry stakeholders is crucial for the evolution of digital asset custody systems. As financial markets increasingly embrace digital currencies and tokenized assets, shared knowledge and resources can accelerate the development of robust custody solutions. Collaborative efforts help standardize practices across the industry, which is particularly important as regulations are established and best practices emerge. This shared vision among custodians, regulators, and financial institutions can enhance the overall integrity of the digital finance sector.

The collaborative approach also positions industry players to respond collectively to emerging challenges, such as cybersecurity threats and regulatory compliance issues. By pooling resources and expertise, organizations can create innovative solutions that are more resilient and responsive. As we look toward the future of digital finance, fostering partnerships and alliances within the custody space will be essential in building a secure, compliant, and efficient financial ecosystem that embraces the full potential of stablecoin adoption and tokenized assets.

Frequently Asked Questions

What is digital asset custody and why is it important for stablecoin adoption?

Digital asset custody refers to the secure storage and management of digital assets, such as cryptocurrencies and tokenized assets. Its importance in stablecoin adoption lies in providing secure practices that enhance investor confidence, ensure regulatory compliance, and facilitate seamless transactions across financial infrastructure.

How does digital asset custody support the growth of tokenized assets?

Digital asset custody supports the growth of tokenized assets by ensuring their security and compliance, thus fostering trust among investors and institutions. With reliable custody solutions, businesses can safely tokenize real-world assets, unlocking new opportunities in the evolving digital economy.

What role does digital asset custody play in improving financial infrastructure?

Digital asset custody plays a pivotal role in enhancing financial infrastructure by introducing secure methods of asset management that simplify compliance and operational processes for financial institutions, paving the way for innovative financial services and seamless cross-border payments.

Why is cybersecurity a critical aspect of digital asset custody?

Cybersecurity is critical in digital asset custody as it protects against theft, hacking, and fraud. Robust security measures ensure that sensitive financial information and assets are safeguarded, thereby influencing stablecoin adoption and market confidence.

How is digital asset custody evolving to meet regulatory requirements for cryptocurrency compliance?

Digital asset custody is evolving by integrating compliance features that adhere to regulatory guidelines, including KYC (Know Your Customer) and AML (Anti-Money Laundering) practices. This evolution ensures that custody solutions contribute positively to cryptocurrency compliance and the legitimacy of the digital asset market.

What are the key custody configurations in the context of digital asset management?

Key custody configurations include self-managed models, outsourced solutions, and hybrid approaches. These configurations allow institutions to choose the right balance of risk, control, and security to meet their specific compliance and operational needs in asset management.

How can digital asset custody facilitate cross-border payments?

Digital asset custody can facilitate cross-border payments by providing secure and efficient transaction processes that eliminate traditional banking obstacles. With robust custody solutions, transactions can be completed faster and with lower fees, enhancing global trade and financial connectivity.

What does Ripple’s report say about the future of digital asset custody and investor confidence?

Ripple’s report indicates that 71% of financial institutions in the Asia-Pacific region are becoming more confident in digital assets, primarily due to advancements in digital asset custody. However, the report also highlights that only 30% actively use custody platforms, suggesting significant growth potential in the coming years.

What innovations are needed in digital asset custody for the next generation of financial systems?

Next-generation digital asset custody systems must include deeper integration with smart contracts and tokenized documents. This innovation is essential for enabling programmable payments, automated compliance processes, and seamless on-chain execution of trade flows, thus driving the future of financial systems.

Why is understanding digital asset custody crucial for financial institutions today?

Understanding digital asset custody is crucial for financial institutions as it helps them navigate the complexities of digital finance, ensure compliance, manage risks effectively, and meet the growing demands for stablecoins and tokenized assets in an increasingly digital marketplace.

| Key Points | |

|---|---|

| Importance of Custody | Custody has become the cornerstone of digital finance, facilitating the adoption of stablecoins, tokenized assets, and enhancing regulatory confidence. |

| Current Market Trends | The demand for digital asset custody is growing alongside the expected value of tokenized real-world assets reaching $18.9 trillion by 2033. |

| Institutional Confidence | 71% of financial institutions in the Asia-Pacific have gained confidence in digital assets recently, yet only 30% currently use custody platforms. |

| Future Custody Models | Custody systems will evolve to include self-custody, third-party, and hybrid models to meet regulatory and operational demands. |

| Integration with Technology | Future custody systems must integrate with smart contracts and tokenized documents to enable programmable payments and conditional settlements. |

Summary

Digital asset custody is increasingly recognized as a fundamental element of modern financial infrastructure. As highlighted by Ripple, effective custody solutions are essential for advancing stablecoin applications, supporting regulatory compliance, and facilitating cross-border transactions. With growing institutional confidence in digital assets and the expected surge in the tokenized asset market, the demand for sophisticated custody platforms will only amplify. As the landscape evolves, future systems will need to leverage technological advancements to provide secure, compliant, and innovative solutions that enhance operational efficiency. Thus, the role of digital asset custody will be pivotal in shaping the future of financial ecosystems.