Digital Assets: A Landmark Year for Crypto Regulation

Digital assets are reshaping the financial landscape, with significant backing from key legislators like U.S. Senator Cynthia Lummis. This is a pivotal year for digital assets, as transformative federal initiatives aim to enhance crypto regulation and foster financial innovation across the country. Senator Lummis has lauded the President’s Working Group on Digital Asset Markets, declaring its latest report a vital leap forward for U.S. leadership in blockchain policy. Her advocacy for comprehensive digital asset legislation showcases her commitment to creating a regulatory environment that supports technological advancements while ensuring robust oversight. As discussions around crypto regulation intensify, the commitment from legislators like Lummis is critical to ensuring the U.S. remains at the forefront of the global financial evolution.

Digital currencies and virtual assets are rapidly gaining traction, with influential policymakers like Senator Cynthia Lummis leading the charge towards innovative financial solutions. This year has been earmarked for significant changes in the way we approach crypto regulation, focusing on developing smart legislation that nurtures financial innovation. Lummis has actively engaged in discussions surrounding blockchain policies, highlighting the importance of a balanced regulatory framework. By advocating for efficient digital asset laws, she seeks not only to protect consumers but also to promote a competitive edge for American markets in the realm of decentralized finance. As the dialogue surrounding digital currencies expands, the insights of leaders like Lummis are essential for guiding the future of this evolving industry.

The Transformative Power of Digital Assets

Digital assets have emerged as a revolutionary force within the financial sector, inspiring new policy discussions driven by innovation, regulation, and emerging technologies. As U.S. Senator Cynthia Lummis emphasizes, there is a growing recognition of the transformative impact that digital assets can have on America’s financial future. By endorsing the recent report from the President’s Working Group on Digital Asset Markets, Lummis highlights the critical need for a solid regulatory framework that is adaptable to the fast-paced advancements in blockchain technology. The potential for digital assets to reshape investment landscapes and financial markets is unprecedented, prompting lawmakers to consider how best to support these innovations.

With the intersection of crypto regulation and blockchain policy, the empowerment of digital assets can help streamline financial services and promote inclusivity. The proposed regulations aim to create an environment of certainty for markets and participants alike, where financial innovation can thrive without the cloud of excessive oversight. By harnessing distributed ledger technology, economic growth can be enhanced, allowing both individual and institutional players to leverage digital assets to their advantage, fostering a more competitive global marketplace.

Senator Lummis: Championing Comprehensive Digital Asset Legislation

Senator Cynthia Lummis stands out as a pivotal figure advocating for comprehensive digital asset legislation in the United States. Her efforts highlight the importance of establishing a clear, supportive framework for digital assets, which includes addressing taxation reforms and potential barriers to entry. Drawing from her experience and expertise, she has put forth significant proposals, such as creating a financial technology sandbox designed to test and implement innovative blockchain solutions. This sandbox approach aims to drive financial innovation while ensuring that all new technologies are compliant with existing regulations.

Furthermore, Lummis’s commitment to financial innovation is evident in her scrutiny of current regulatory practices, notably her criticism of the Federal Reserve for its perceived reluctance to engage with the digital asset market effectively. The senator has raised concerns over what she describes as a hidden agenda that may stifle competition and discourage banking institutions from embracing crypto exposure. By pushing for reforms that include de minimis exemptions and support for miners and stakers, Lummis envisions a robust and competitive framework that positions the U.S. as a leader in the global push for digital asset integration.

Addressing Regulatory Challenges for Digital Assets

Regulatory challenges remain a central concern in the journey toward mainstream adoption of digital assets. Senator Lummis has expressed her discontent with existing regulations that hinder the growth of financial innovation and blockchain-based projects. By advocating for a clearer and more favorable regulatory framework, she aims to address the concerns of the industry while ensuring that the risks associated with digital assets are managed effectively. This involves collaboration between regulatory bodies and innovators to craft guidelines that encourage rather than stifle creativity and growth.

As the landscape evolves, it becomes increasingly necessary for regulators to adopt a more nuanced understanding of digital assets and their implications for the financial system. The delicate balance between ensuring consumer protection and fostering innovation can be achieved through cooperative engagement between lawmakers and industry leaders. Senator Lummis’s push for reform reflects an understanding that embracing digital assets can lead to financial systems that are not only more efficient but also more resilient against economic shocks, thereby positioning the U.S. for long-term success.

Innovation Through Financial Technology Sandboxes

Financial technology sandboxes are gaining traction as a critical tool for promoting innovation in the realm of digital assets. Senator Lummis has illustrated how these regulatory spaces can serve as testing grounds for new ideas and technologies without the constraints of overly stringent regulations. By allowing startups and established companies alike to experiment with digital assets in a controlled environment, sandboxes can facilitate the identification of regulatory barriers and the development of more intelligent legislation.

This innovative regulatory approach paves the way for better integration of digital assets into the financial ecosystem. By granting businesses the opportunity to trial concepts and gather data, these sandboxes ultimately lead to more informed regulatory decisions. Senator Lummis’s engagement with this model underscores her commitment to positioning the U.S. as a leading nation in blockchain policy, ensuring that emerging technologies are nurtured and leveraged effectively to support overall economic growth.

Navigating Tax Reforms for Digital Assets

An essential aspect of digital asset legislation is the need for comprehensive tax reforms that address the unique circumstances surrounding cryptocurrencies and blockchain technology. Senator Lummis has been actively involved in pushing for reforms that introduce de minimis exemptions for small transactions and create relief provisions for miners and stakers. By honing in on the tax implications for digital assets, she aims to foster a more inviting environment for adoption and participation in the crypto economy.

The intricacies of digital asset taxation can be daunting for individuals and businesses alike, often leading to confusion and reluctance to engage in the market. By advocating for straightforward and equitable tax regulations, Senator Lummis seeks to promote understanding and acceptance of digital assets. Ensuring that tax frameworks are adaptable to the evolving nature of digital currencies will be crucial for supporting financial innovation and enabling the United States to remain competitive in a fast-changing global landscape.

The Role of the President’s Working Group on Digital Asset Markets

The President’s Working Group on Digital Asset Markets plays a crucial role in shaping the regulatory environment for digital assets in the U.S. Credited with producing significant reports and recommendations, this group aims to ensure that policies effectively respond to the rapid development of cryptocurrencies and blockchain technologies. Senator Lummis has lauded this group for their efforts, emphasizing the importance of thoughtful, proactive engagement with the digital asset space.

By consolidating insights from various stakeholders, the Working Group supports the crafting of legislation that aligns with current market needs while safeguarding consumers and maintaining financial stability. The collaborative approach fosters a dialogue among lawmakers, regulators, and industry representatives, which is fundamental in creating a balanced framework that encourages innovation while addressing potential risks associated with digital assets.

Combatting Misconceptions in Crypto Regulation

Despite the growing acceptance of digital assets, misconceptions regarding their regulation persist. Critics often voice concerns that a lack of oversight may lead to a lawless market fraught with risks. However, Senator Lummis counters this narrative by advocating for smart regulatory frameworks that promote investor protection and financial stability without paralyzing innovation. Her emphasis on reasoned regulation aims to dismantle prevalent myths regarding crypto and establish a clearer understanding of its potential benefits.

Engaging with the public and stakeholders is a crucial part of combatting misconceptions, as it fosters greater awareness of the realities of cryptocurrency regulation. Senator Lummis’s proactive stance in addressing these misunderstandings serves as a rallying cry for informed discussions on how best to balance the dual objectives of regulation and innovation in the digital asset space. By clarifying potential regulatory pathways, she encourages participation and investment in the burgeoning crypto market.

Future Directions for Digital Asset Legislation

The future of digital asset legislation is poised for significant developments as more lawmakers embrace the potential of cryptocurrencies and blockchain technology. Senator Lummis’s tireless advocacy for clear and favorable regulations indicates a broader trend among politicians recognizing the value of digital assets. As legislative bodies engage more deeply with the complexities of crypto regulation, we can expect a flurry of new policies aimed at facilitating growth and innovation in this sector.

These future legislative efforts will likely build upon the existing groundwork laid by initiatives like the President’s Working Group on Digital Asset Markets, as well as the comprehensive proposals championed by Senator Lummis. The evolving landscape of digital assets demands adaptive regulatory frameworks that not only embrace innovation but also ensure that the financial market can withstand disruptions. As Congress navigates through this dynamic environment, the collaborative dialogue between industry leaders and lawmakers will be instrumental in shaping the future of digital asset legislation.

Understanding the Impact of Blockchain Policy

Blockchain technology serves as the backbone of digital assets, influencing various aspects of financial innovation and regulation. Senator Lummis underscores the importance of effective blockchain policies to harness the full potential of digital currencies while ensuring proper oversight. As financial institutions explore the integration of blockchain solutions, policymakers must craft regulations that account for the unique features of this technology, including decentralization, security, and transparency.

The development of thoughtful blockchain policy will help safeguard against risks while creating an environment conducive to innovation. Senator Lummis’s commitment to advancing such policies reflects a growing recognition among lawmakers of the vital role that blockchain plays in shaping the financial landscape. By prioritizing the establishment of clear regulations that embrace blockchain’s transformative power, the U.S. can secure its place as a leader in the digital asset sphere.

Frequently Asked Questions

What are digital assets and why are they important in crypto regulation?

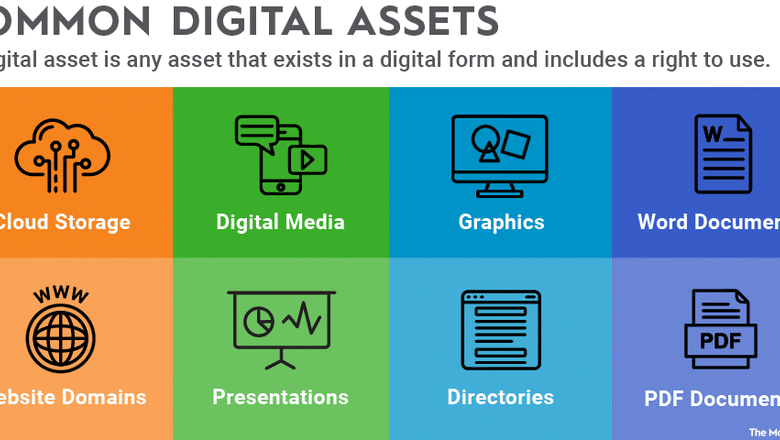

Digital assets refer to assets in a digital form, including cryptocurrencies, tokens, and other forms of digital value. They play a critical role in crypto regulation as they require new frameworks to ensure compliance, consumer protection, and security within emerging financial markets.

How is Senator Lummis influencing financial innovation through digital asset legislation?

Senator Cynthia Lummis has been a prominent advocate for financial innovation concerning digital assets. She has introduced comprehensive digital asset legislation aimed at creating a regulatory framework that fosters innovation while ensuring accountability within the financial system.

What impact does blockchain policy have on the future of digital assets?

Blockchain policy is essential for the future of digital assets, as it determines how these technologies are regulated. Effective policy can enhance trust, clarify legal frameworks, and promote the widespread adoption of digital assets across various sectors.

What recently advocated measures by Senator Lummis could reshape crypto regulation?

Senator Lummis has advocated for measures including a financial technology sandbox that allows for innovation in digital asset applications, reforms in digital asset taxation, and improved compliance measures for banks that deal with cryptocurrencies.

How is the President’s Working Group on Digital Asset Markets relevant to financial innovation?

The President’s Working Group on Digital Asset Markets has proposed recommendations that could significantly promote financial innovation by creating a more secure and robust regulatory environment for digital assets and their adoption in mainstream finance.

What are the risks associated with the Federal Reserve’s approach to digital assets?

Critics, including Senator Lummis, argue that the Federal Reserve’s approach, particularly its focus on ‘reputation risk,’ could stifle innovation and limit access to banking services for entities dealing with digital assets, which may hinder the sector’s growth.

What are the key proposals in Senator Lummis’s digital asset legislation?

Senator Lummis’s digital asset legislation includes a financial technology sandbox framework, tax reforms for digital asset transactions, de minimis exemptions for small transactions, and regulatory clarity for miners and stakers in the crypto ecosystem.

Why is 2023 considered a pivotal year for digital assets by Senator Lummis?

Senator Lummis regards 2023 as pivotal for digital assets due to the anticipated transformative regulatory policies being discussed, which aim to solidify the United States’ leadership in the global digital asset market and enhance the country’s competitive edge in financial innovation.

| Key Point | Details |

|---|---|

| Senator’s Endorsement | Senator Cynthia Lummis declared 2023 as the year for digital assets, emphasizing the transformative potential of digital assets and blockchain technology. |

| Presidential Report | Lummis praised the President’s Working Group on Digital Asset Markets’ latest report, viewing it as a significant advancement for U.S. leadership in financial innovation. |

| Regulatory Challenges | Lummis criticized the Federal Reserve for its lack of compliance with federal laws regarding master account access for digital asset institutions, which contributed to the withdrawal of a key nomination. |

| Legislative Initiatives | She’s introduced a financial technology sandbox framework and proposed reforms to digital asset taxation, aiming to ensure the U.S. remains competitive in blockchain innovation. |

| Public Sentiment | While some critics express concern over reduced oversight, supporters agree that these reforms could bolster America’s position in the global blockchain landscape. |

Summary

Digital assets are poised to revolutionize the financial landscape, as highlighted by U.S. Senator Cynthia Lummis’s recent endorsement of comprehensive federal efforts to regulate and promote the sector. This year marks a critical turning point, with initiatives aiming to enhance innovation, address regulatory challenges, and solidify the United States’ role in the global digital asset marketplace. With the backing of influential legislators and a focus on reform, 2023 could indeed be the year where digital assets gain the recognition and support they need for significant growth.