Digital Assets: Treasury Secretary Reinforces Dollar Dominance

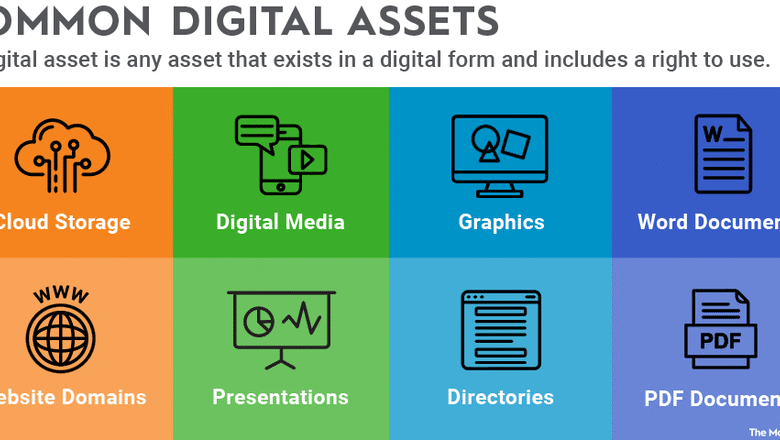

In a swiftly evolving financial landscape, digital assets are emerging as pivotal players in reshaping global economies. The U.S. Treasury is strategically positioning the dollar to not only maintain but strengthen its dominance, as it embraces the transformative power of these technologies. With a focus on stablecoins, Treasury Secretary Scott Bessent emphasizes that rather than threatening dollar supremacy, digital assets can significantly bolster it. As the GENIUS Act gains momentum in Congress, the implications of crypto regulation and its benefits for U.S. Treasuries are becoming clearer. This legislative push signifies a crucial step in establishing a robust framework that fosters digital innovation while preserving the dollar’s leading role in the global economy.

As the realm of digital currency expands, alternative terminologies such as virtual currencies and blockchain-based assets come to the forefront, emphasizing their role in the modern financial ecosystem. The U.S. government’s commitment to these innovative financial instruments reflects a broader move towards regulatory clarity, particularly in light of the anticipated impact of stablecoins. Treasury Secretary Bessent’s vision aligns with a proactive policy that seeks to navigate the complexities of crypto regulation, ensuring that national strategies effectively support financial evolution. The push for the GENIUS Act not only addresses the challenges posed by traditional frameworks but also aims to elevate the U.S. dollar’s status amidst international competition. By securing a place at the forefront of this digital transformation, the U.S. can enhance its economic resilience and leadership in the evolving market.

The Impact of Stablecoins on Dollar Supremacy

Stablecoins are emerging as a significant component in the landscape of digital assets, heralding potential benefits for the U.S. dollar’s global dominance. By linking their value to stable currencies like the U.S. dollar, stablecoins can provide a reliable alternative for transactions in the digital economy. Secretary Bessent has emphasized that these assets will not only enhance but also reinforce the dollar’s supremacy, countering arguments that cryptocurrency poses a threat to it. In this light, the growth of stablecoins could attract new investment into dollar-denominated assets, fostering a more robust financial ecosystem.

Furthermore, as more individuals and businesses begin to adopt stablecoins, there’s potential for increased demand for U.S. Treasuries, which are foundational in backing these digital assets. This heightened demand could lead to lower borrowing costs for the government, effectively aiding in national debt reduction. The interplay between digital assets and traditional financial structures highlights how innovation can bolster existing models, positioning the U.S. for sustained economic strength in an age increasingly influenced by technology.

The GENIUS Act: A Step Towards Regulatory Clarity

The recently passed GENIUS Act in the U.S. Senate represents a pivotal step in establishing regulatory frameworks for stablecoins and digital assets. With a 68-30 vote in favor of the legislation, the Act aims to provide the much-needed clarity that industry players have long sought. Treasury Secretary Bessent has expressed how crucial this legislation is for the U.S. to remain competitive in digital asset innovation, stating that regulatory uncertainty has been a significant hurdle for many businesses within this space.

By advocating for the GENIUS Act, the Trump administration is positioning itself as a proponent for fostering innovation, contrasting sharply with prior regulations that had stifled growth and creativity in the crypto industry. The act aims to lay the groundwork for the U.S. to not only catch up with international counterparts but to lead in the burgeoning digital economy, where regulatory clarity is critical for attracting global investment and talent.

Towards a Digital Asset Economy: Prospects and Challenges

As the U.S. forges ahead towards becoming a digital asset economy, various prospects and challenges lie on the horizon. The recent assertions by Secretary Bessent highlight a growing belief that crypto regulation will pave the way for stablecoins to thrive and ultimately contribute to the robustness of the U.S. dollar. However, the journey is fraught with challenges, particularly concerning regulatory frameworks that need to adapt to rapidly evolving technologies and market dynamics.

A cooperative approach among regulatory bodies, innovators, and the public will be vital for addressing these challenges. Utilizing the framework set out by the GENIUS Act, the administration can transition towards a balanced regulatory approach that encourages innovation while safeguarding consumer interests. This holistic strategy might very well determine the trajectory of the U.S. in the global digital assets landscape, particularly in relation to maintaining dollar supremacy amid increasing competition.

Emphasizing Digital Innovation in Financial Reforms

The U.S. Treasury has adopted a proactive stance in embracing digital innovation as part of its broader financial reform agenda. Treasury Secretary Bessent’s statements reflect an understanding that inaction regarding digital assets could hinder economic growth and innovation. He communicates that the current administration recognizes the critical importance of digital assets in the modern financial landscape and the need to adapt regulations to accommodate these shifting dynamics.

Moreover, by prioritizing the GENIUS Act and similar initiatives, the administration seeks to facilitate an environment ripe for innovation. These reforms are not only about capturing new markets, but also about ensuring that the U.S. remains a leader in navigating the complexities of a digital economy, where dollar supremacy increasingly becomes intertwined with advancements in technology.

Navigating the Future of Digital Assets with Regulatory Reform

As digital assets continue to evolve and integrate into mainstream finance, the call for comprehensive crypto regulation grows louder. The Treasury’s acknowledgment that crypto does not threaten the dollar is a critical step towards creating a balanced environment where digital assets can operate securely and efficiently. Implementing the GENIUS Act represents a commitment to not just regulation, but thoughtful engagement with the technologies that are shaping our economic future, ensuring that U.S. leadership in the digital arena is maintained.

With a clear commitment to regulatory reform, the U.S. will be able to navigate the intricacies of digital asset management while harnessing the transformative potential they herald. This proactive approach could potentially set a precedent for international digital asset regulation and impact the way nations view and interact with digital currencies, ensuring that the U.S. remains at the forefront of these discussions.

Global Implications of U.S. Digital Asset Policies

The implications of U.S. policies on digital assets extend far beyond its borders, influencing global financial systems and practices. The Treasury’s aggressive push into digital assets reflects a strategic maneuver to maintain dollar supremacy in a world that increasingly seeks alternatives in digital currencies. By embracing stablecoins and facilitating their growth through legislative measures like the GENIUS Act, the U.S. sets a tone for other countries grappling with the complexities of digital finance.

Internationally, the alignment of regulatory clarity with innovation may draw countries to the U.S. model, creating a ripple effect that could reshape how nations approach their own digital asset frameworks. As countries consider their stance on crypto regulation, they will likely look to the U.S. for guidance, thus magnifying the impact of the U.S. Treasury’s initiatives on a global scale.

Stablecoins: New Instruments for National Debt Management

Stablecoins have emerged as potential solutions for managing national debt while introducing flexibility into financial systems. By leveraging the compatibility of stablecoins with traditional assets, the U.S. could effectively lower borrowing costs, as Bessent pointed out. As stablecoins gain acceptance, their backing by U.S. Treasuries could enhance investor confidence, leading to a more favorable economic climate.

Moreover, stablecoins can serve as instruments for innovative debt management strategies, aligning perfectly with the objectives outlined in the GENIUS Act. By integrating digital assets into the national financial framework, the U.S. government could not only attract investment but also promote a broader adoption of the dollar in a digital format, ensuring that national debt management remains efficient in an evolving economic landscape.

The Importance of Timely Regulations for Digital Assets

Timely and effective regulations for digital assets are crucial to fostering an environment of innovation within the financial sector. The delay in formal frameworks can deter investment and slow the integration of new technologies that promise to enhance economic stability and growth. Bessent’s advocacy for the GENIUS Act underscores the importance of creating a solid regulatory foundation that addresses the unique challenges posed by digital currencies.

As more companies enter the digital asset space, the demand for clear and concise regulations will continue to surge. Ensuring these frameworks are established promptly can provide certainty for innovators and help the U.S. secure a competitive edge in the global digital economy. In this light, effective regulation can be seen not as a barrier but rather as a catalyst for growth.

Charting a Strategic Path for U.S. Digital Leadership

The path towards establishing U.S. leadership in digital assets requires a strategic focus that aligns regulatory measures with technological advancements. The Treasury’s commitment to supporting stablecoins and embracing overarching reforms through legislative initiatives like the GENIUS Act reflects a clear vision for the future of finance. This strategic path positions the U.S. to leverage its existing financial infrastructure while adapting to the rapid changes brought about by digital technologies.

By prioritizing proactive regulation over stifling oversight, the U.S. can effectively manage the challenges associated with the integration of digital assets into mainstream finance. Charting this strategic course not only benefits the U.S. economy but sets a benchmark for international counterparts, potentially influencing global standards for the regulation of digital currencies and enhancing U.S. standing in a digital future.

Frequently Asked Questions

How does the U.S. Treasury’s digital strategy affect the future of digital assets?

The U.S. Treasury’s digital strategy aims to position the U.S. dollar as a leader in the digital asset landscape. By embracing digital assets, especially stablecoins, the Treasury believes it can harness their potential for innovation and financial expansion while reinforcing the dollar’s global dominance.

What is the impact of stablecoins on the dollar’s supremacy in the digital economy?

Stablecoins are seen as a key component in enhancing the dollar’s supremacy. Treasury Secretary Scott Bessent has indicated that rather than threatening the dollar, stablecoins can actually support its position in the global market, making it easier for users to engage with a dollar-backed digital economy.

What are the key objectives of the GENIUS Act regarding digital assets and stablecoins?

The GENIUS Act aims to provide clear regulatory frameworks for stablecoins and ensure U.S. competitiveness in digital asset innovation. By passing this legislation, the government seeks to stimulate economic growth, increase demand for U.S. Treasuries, and onboard millions into the dollar-based digital ecosystem.

Why does the U.S. Treasury Secretary claim crypto does not threaten the dollar’s global dominance?

Treasury Secretary Scott Bessent believes that instead of undermining the dollar, crypto, particularly stablecoins, can enhance its standing in the international market. He asserts that crypto can create additional pathways for the dollar’s integration into the digital economy, ensuring its continued supremacy.

What implications does the U.S. Treasury’s push for digital assets have for global crypto regulation?

The U.S. Treasury’s commitment to establishing a regulatory framework for digital assets indicates a proactive approach to global crypto regulation. This could set a precedent for other nations to follow, potentially leading to more standardized regulations that will benefit the international digital asset landscape.

How might the advancement of digital assets reduce national debt and borrowing costs?

According to the U.S. Treasury, as digital assets and stablecoins gain traction, they could increase the demand for U.S. Treasuries, which are often utilized to back stablecoins. This elevated demand might lower borrowing costs for the government and assist in reducing the national debt, creating a more robust economy.

What role do digital assets play in the U.S. economic recovery according to the Treasury’s strategy?

Digital assets are viewed as a critical instrument for economic recovery by fostering innovation and attracting investment. By supporting the development of stablecoins and other digital assets through initiatives like the GENIUS Act, the Treasury believes it can stimulate job growth, enhance financial inclusion, and invigorate economic activity.

| Key Point | Details |

|---|---|

| Crypto Not a Threat to Dollar | Treasury Secretary Bessent asserts that cryptocurrencies, particularly stablecoins, can actually reinforce the U.S. dollar’s global dominance rather than undermine it. |

| U.S. Push for Digital Asset Dominance | The U.S. administration aims to establish a hub for digital asset innovation through legislation like the GENIUS Act. |

| GENIUS Act Implications | Passed by the Senate, this act seeks regulatory clarity for stablecoin growth, which may enhance the demand for U.S. Treasuries and lower borrowing costs. |

| Critique of Previous Administration | Bessent contrasts the current administration’s approach with that of the previous, highlighting a shift from anti-innovation to proactive support of digital assets. |

Summary

Digital assets are a crucial component of the evolving financial landscape, as outlined by Treasury Secretary Scott Bessent. His recent statements highlight the United States’ intent to not only preserve the dominance of the U.S. dollar but also leverage digital assets like stablecoins to create a more robust economy. The introduction of legislative measures such as the GENIUS Act marks a significant step toward fostering an environment conducive to innovation and growth in the digital asset space. This proactive approach is a stark contrast to previous policies and is positioned to transform the U.S. into a leading hub for digital asset technology.