Dogecoin Technical Analysis: Navigating Key Price Levels

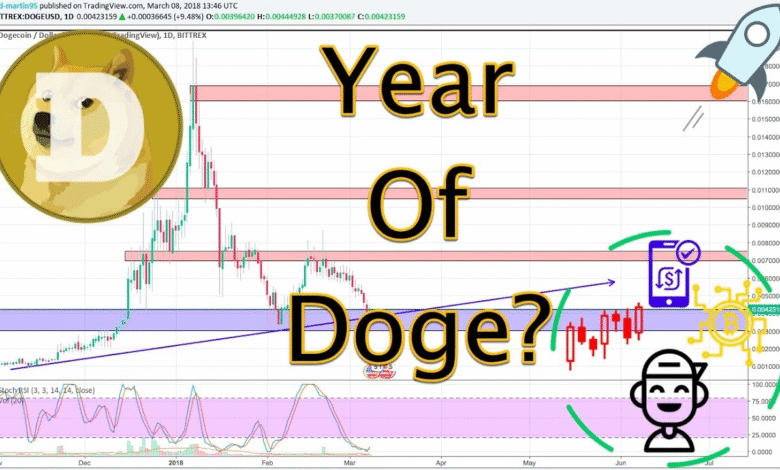

When diving into Dogecoin technical analysis, traders uncover intricate patterns that shape the altcoin’s future behavior. Currently, the DOGE price analysis reveals a significant support zone around $0.20, created from the dynamic confluence of the 50 and 200 EMA. This pivotal area plays a crucial role in cryptocurrency trading, especially in light of recent market trends Dogecoin experienced following a sell-off led by Bitcoin. Analysts closely monitor DOGE resistance levels as the price attempts to break free from its recent sideways movement. With accurate Dogecoin price predictions, investors remain hopeful for a potential bullish reversal that could see the cryptocurrency reclaim lost ground.

In exploring the nuanced world of Dogecoin’s market dynamics, one can appreciate the importance of advanced charting techniques and indicators. This kind of analysis encompasses the examination of price movements and trading patterns, enabling enthusiasts to gauge the viability of DOGE as a promising digital asset. The resistance points and support zones are critical in forming a comprehensive view of Dogecoin’s price trajectory, which directly impacts strategy formation for savvy traders. As the momentum of Dogecoin fluctuates, predictions based on technical scrutiny become increasingly vital for making informed trading decisions in the broader cryptocurrency landscape. Understanding these elements is key to navigating the volatile yet exciting world of crypto investing.

Understanding the Current Technical Situation of Dogecoin

In the technological landscape of Dogecoin (DOGE), the current scenario is shaped by pivotal indicators such as the 50 and 200 EMA. These moving averages, regarded as critical support levels, are now playing a major role in determining future price trends. With DOGE recently pulling back to the $0.20 support zone, traders are keenly monitoring whether this zone can hold. This is not just about the metrics; it represents a crucial psychological threshold that could influence investor sentiment and market dynamics.

As the Moving Average Convergence Divergence (MACD) reflects a declining negative trend, there is emerging potential for stabilization in DOGE’s price action. The Relative Strength Index (RSI), hovering just above the neutral 50 line, could signal that although momentum has dipped, a bullish recovery could still be on the table. However, caution prevails; if the price breaches the $0.20 level, it may open the floodgates to deeper corrections, re-establishing lower resistance levels.

DOGE Price Analysis: Correlation with Bitcoin Trends

The performance of Dogecoin (DOGE) is closely tied to Bitcoin’s movements, with implications that extend across the entire cryptocurrency market. Recently, as Bitcoin has faced selling pressure, primarily due to its retreat to the 50 EMA, the ripples have undeniably impacted DOGE. Understanding how Bitcoin’s fluctuations affect altcoins like Dogecoin can provide insights into potential price movements. If Bitcoin can stabilize and initiate a recovery, it is likely to uplift Dogecoin along with it.

Market trends in Dogecoin indicate a potential path toward recovery, specifically targeting the $0.24 resistance zone. Should Bitcoin regain traction, traders could see DOGE capitalize on this momentum, making the analysis of Bitcoin’s price pivotal for any Dogecoin forecast. An insightful DOGE price analysis would entail tracing how these broader market sentiments then directly affect buy and sell decisions within the DOGE community.

Key Resistance Levels for Dogecoin Trading

The resistance levels for Dogecoin are paramount for any cryptocurrency trading strategy. Currently, DOGE is contending with a significant wall at $0.21, where several technical indicators converge, presenting a formidable barrier against upward movement. Historically, this zone has proven to provoke selling pressure, causing traders to remain cautious of potential long positions. Analyzing DOGE resistance levels not only helps in strategic planning but plays a critical role in managing risk.

The accumulation of liquidity around the $0.19 mark also presents a tactical focus for traders. If further price deterioration occurs, this area could become a target for buying opportunities, creating a buying zone for participants willing to capitalize on the volatility. Therefore, understanding both current resistance and potential support levels surrounding $0.19 provides critical insights for short-term trading decisions.

Technical Analysis of Dogecoin: Short-Term Perspectives

A thorough technical analysis of Dogecoin reveals a challenging short-term landscape. The 4-hour chart showcases DOGE trapped in a sideways phase, with price oscillating under structural resistance. This phase presents a tough decision point for traders looking to engage with the cryptocurrency. Given the persistent barriers above the price level, the likelihood of a momentum shift remains uncertain unless a breakout occurs.

Traders need to observe the interplay of dynamic moving averages that are constraining upward movement. For DOGE to initiate a new price wave, a breakthrough above the $0.21 level, ideally with accompanying high trading volume, is critical. Without solid breakout indicators, the prevailing uncertainty may perpetuate sideways trading, accentuating risk within the DOGE market.

The Impact of Market Sentiment on Dogecoin

Market sentiment plays an essential role in Dogecoin’s price dynamics, often swaying prices in favor of traders’ emotional reactions rather than purely fundamental factors. In recent weeks, the volatility induced by Bitcoin’s withdrawal dragged DOGE prices down, illustrating how broader market sentiments can significantly impact individual cryptocurrencies. Traders must remain vigilant, balancing external influences such as news and social media chatter related to Dogecoin.

Moreover, understanding market sentiment also requires an analysis of trader behavior in bullish versus bearish environments. Positive sentiment can sustain DOGE within its critical support levels, while negativity can propel it towards further declines. Thus, assessing market sentiment through various channels enhances trading strategies and arguably contributes to the overall momentum in price recovery efforts.

Long-Term Dogecoin Price Predictions

When considering long-term Dogecoin price predictions, multiple factors come into play, including broader market conditions, technological developments, and regulatory environments. With the current stability observed in some indicators, like the RSI, there is a cautiously optimistic outlook for DOGE among certain analysts. If the crypto community continues to engage actively and build on foundational technological aspects, Dogecoin’s price could see significant growth in the long run.

However, prospective investors must account for potential risks, including unpredictable market corrections. Setting a price prediction for DOGE hinges primarily upon observing how consistently it can hold critical support levels while navigating broader market challenges. All eyes will need to remain on both DOGE’s inherent metrics as well as external elements that could influence its upward trajectory.

Learning About Cryptocurrency Trading Strategies

For those interested in cryptocurrency trading, understanding effective strategies is crucial. Platforms like the BTC-ECHO Academy offer invaluable resources for learning nuances in crypto trading. Engaging with expert traders such as Bastian (Bitbull) can illuminate various approaches that can enhance trading outcomes. The ability to discern market signals and apply suitable strategies often distinguishes successful traders from their counterparts.

Learning about cryptocurrency trading not only involves theoretical knowledge but practical application too. Through courses and resources, users can familiarize themselves with market structures, making them adept at navigating volatility in markets such as that of Dogecoin. As cryptocurrency continues to evolve, remaining informed and adaptable will serve traders well on their pathways to profitability.

The Role of Indicators in Dogecoin Trading

Indicators play a pivotal role in cryptocurrency trading strategies. Tools such as the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and various moving averages provide critical data points for analysts and traders alike. For Dogecoin, these indicators generate insight into market momentum, trend direction, and potential reversal points.

Implementing these indicators in trading decisions allows for calculated risk management and better entry and exit points. As DOGE fluctuates within its given charts, savvy traders will seek to understand how these indicators interact to inform their trading positions. Adapting to these signals can greatly enhance the success rates for individuals looking to profit from their exchanges in the volatile cryptocurrency landscape.

Navigating the Crypto Market: Predictions and Challenges

Navigating the cryptocurrency market involves understanding prevailing trends and challenges. For traders, developing a strategy requires not just knowledge about Dogecoin, but an awareness of the overall market environment that influences crypto-related assets. Current market trends suggest a cautiously optimistic but volatile landscape where traders must remain agile and informed.

In facing challenges, understanding how Dogecoin intersects with broader market movements can provide potential predictive insights. For instance, if there are indications of recovery within Bitcoin, DOGE may follow suit, but being prepared for market reversals and corrections is crucial. Therefore, adept navigation of the crypto market requires a blend of strategic foresight, analysis, and the ability to respond to rapidly changing conditions.

Frequently Asked Questions

What is the current trend based on Dogecoin technical analysis?

Based on recent Dogecoin technical analysis, DOGE has shown a potential W-pattern activation but faced a pullback due to a broad market sell-off influenced by Bitcoin’s movements. The price is currently supported by the 50 and 200 EMA, which creates a bullish scenario if maintained. A recovery towards the $0.24 resistance level is possible if market conditions stabilize.

How do DOGE resistance levels impact Dogecoin price prediction?

DOGE resistance levels significantly influence Dogecoin price predictions. Currently, the price struggles against the $0.21 resistance, which has historically triggered selling pressure. A sustainable breakout above this level may lead to an upward trend towards the next resistance at $0.24, whereas failing to breach it could result in continued bearish sentiments.

What are the key indicators to consider in DOGE price analysis?

In DOGE price analysis, key indicators include the MACD and RSI. The MACD is currently showing a declining trend, which indicates hesitancy among buyers, while the RSI remains just above the neutral 50, suggesting that the upward trend is not broken yet. These indicators help traders assess potential price movements in Dogecoin.

What are the implications of market trends Dogecoin is experiencing?

Market trends for Dogecoin are heavily influenced by the overall cryptocurrency market, particularly Bitcoin. Recent analysis shows DOGE is in a sideways phase under heavy resistance, indicating a neutral to slightly bearish outlook unless a breakout occurs above significant resistance levels. This environment suggests that DOGE could face risks if further market sell-offs happen.

How does a break below $0.20 affect Dogecoin technical analysis?

A break below $0.20 in Dogecoin technical analysis would significantly weaken the bullish structure, favoring an extension of the correction. This level is crucial as it represents the lower boundary of a support zone. If prices drop below this mark, it may lead to new lows, negatively impacting the short-term outlook for DOGE.

What trading strategies are effective when analyzing DOGE resistance levels?

Effective trading strategies for DOGE resistance levels involve waiting for a clear breakout signal above the $0.21 resistance, ideally supported by increased volume. Traders should also watch for indications of bullish momentum, such as a rising MACD or a strengthening RSI, to confirm potential upward movements after a breakout.

How important is technical confluence in Dogecoin price analysis?

Technical confluence is very important in Dogecoin price analysis. The current confluence between the 50 and 200 EMA around the $0.20 level serves as a strong support area. If DOGE maintains this zone, it could trigger a bullish reversal, highlighting the significance of these technical indicators for potential price predictions.

What are dynamic EMA confluence and its significance in Dogecoin trading?

Dynamic EMA confluence refers to multiple Exponential Moving Averages aligning around specific price levels, which can signal critical support or resistance. In Dogecoin trading, the convergence of the 50, 200, and 800 EMA indicates significant technical barriers that DOGE must address for any upward momentum, underscoring the importance of employing moving averages in technical analysis.

| Key Points | Details |

|---|---|

| Current Status | Dogecoin (DOGE) is experiencing a pullback after failing to activate a W-pattern due to a broader market sell-off led by Bitcoin. |

| Support Level | The price retraced to a key support zone around $0.20, coinciding with the 50 EMA and 200 EMA. |

| MACD and RSI Analysis | The MACD indicates a declining trend while the RSI is slightly above 50, suggesting the upward trend is not yet broken. |

| Resistance Levels | Significant resistance at $0.21, which has historically caused selling pressure. |

| Short-Term Outlook | If Bitcoin stabilizes, DOGE could recover towards $0.24, but dropping below $0.20 risks further declines. |

| 4-Hour Chart Analysis | Currently, DOGE shows a sideways phase below resistance with challenges in gaining upward momentum. |

| Conclusion | The technical condition of Dogecoin remains fragile with potential for recovery if market conditions improve. |

Summary

Dogecoin technical analysis reveals a complex situation as the altcoin navigates through critical support and resistance levels. Following a pullback to $0.20 caused by a market sell-off, Dogecoin’s future movements depend heavily on Bitcoin’s stability. The oversold conditions indicated by MACD and the RSI suggest that while there’s potential for recovery towards key resistance levels, any drop below $0.20 may lead to new lows. This precarious balance between upward potential and downside risks highlights the need for cautious trading strategies in the current crypto market.