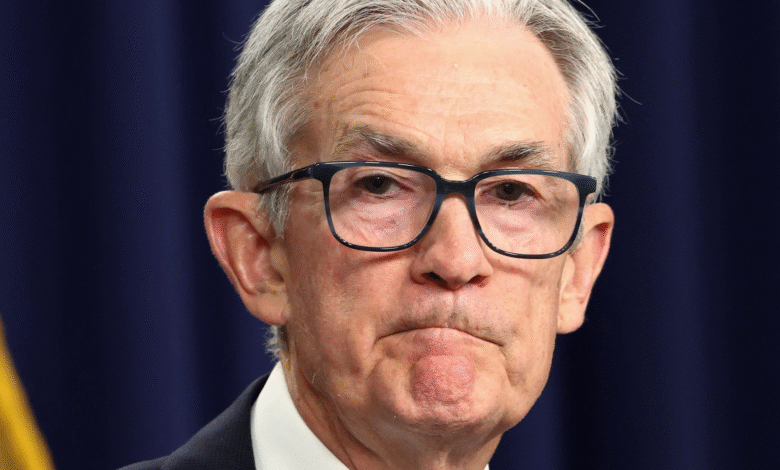

Donald Trump Criticizes Jerome Powell’s Fed Rate Decisions

In a bold confrontation, Donald Trump criticizes Jerome Powell, calling the Federal Reserve Chair “stupid” and openly questioning his decision-making ahead of a crucial meeting regarding interest rates. The ongoing Trump-Powell feud has intensified as Trump emphasizes the need for Federal Reserve rate cuts, arguing that the current rates are excessively high and detrimental to the U.S. economy. His comments, made just hours before the Federal Open Market Committee’s critical announcement, highlight his dissatisfaction with Powell’s performance and suggest a political undertone to the Fed’s reluctance to lower rates. With Trump asserting that European counterparts have made ten cuts while the U.S. stands still, he claims the high interest rates are costing the nation “hundreds of billions.” As Federal Reserve news continues to unfold, analysts and investors alike are closely monitoring the implications of this clash on market dynamics and future monetary policy.

The ongoing tensions between President Trump and the Federal Reserve Chair have sparked significant debate in financial circles, as many analysts explore the broader implications of this controversial leadership. Discussion around potential changes in the key interest rates has intensified, particularly as Trump criticizes Powell’s approach to monetary policy. This friction is not just a personal rivalry; it reflects deeper concerns about the Federal Reserve’s independence amid political pressures and economic uncertainties. Many are left wondering if Powell’s steadfastness in maintaining current rates aligns with the overall economic strategy, or if it could hinder growth in the long-term. As the landscape of U.S. monetary policy evolves, the conversation surrounding Trump’s critiques and the Federal Reserve’s decisions remains a hot topic of interest.

Donald Trump Criticizes Jerome Powell’s Leadership

In a vocal attack, President Donald Trump expressed his discontent with Federal Reserve Chair Jerome Powell, labeling him as “stupid” during a public statement outside the White House. This aggressive remark came just hours before the Federal Open Market Committee’s scheduled announcement regarding interest rates. Trump argued that the central bank’s current rates were significantly too high, insisting they should be reduced by at least 2 percentage points to bolster the nation’s economic growth. His criticism highlights the ongoing friction between the Trump administration and the Federal Reserve, particularly regarding interest rate policies.

Trump’s dissatisfaction emerges amidst a contrasting landscape in Europe, where multiple interest rate cuts have been executed. He pointed out that while European nations have been proactive in reducing rates to enhance economic activity, the U.S. has lagged behind, approaching the issue with hesitation. This discontent reflects a deeper concern Trump has over the economic ramifications of high interest rates, which he claims are leading to substantial losses for American businesses and consumers.

Impact of Trump-Powell Tension on Federal Reserve Policies

The ongoing feud between Trump and Powell raises critical questions about the independence of the Federal Reserve. Trump’s public remarks suggest a desire for more aggressive monetary policy changes, notably lower interest rates, which he believes would facilitate economic recovery. This sentiment aligns with Trump’s broader agenda of stimulating economic growth through reduced financing costs. Critics of Trump’s approach argue that such demands may undermine the Federal Reserve’s autonomy, which is crucial for maintaining effective monetary policy.

The tension between the Trump administration and Jerome Powell brings to light the complexities of balancing economic interests with the Federal Reserve’s mandate. Powell and his colleagues have expressed their commitment to making decisions based on economic data rather than political pressures. However, as Trump continues to voice his frustrations with the Fed’s approach, particularly its reluctance to cut rates, the implications for future monetary policy decisions remain significant. Such dynamics could influence market confidence and investor sentiment, especially as economic uncertainties persist.

Understanding Trump’s Views on Interest Rates and Economy

Trump’s critical stance on the Federal Reserve’s interest rate policies primarily stems from his belief that lower rates would invigorate economic growth in the United States. This assertion comes amidst debates surrounding inflation and the economic landscape post-tariffs implemented earlier in the year. Despite stable inflation indicators, Trump remains convinced that the costs associated with high interest rates are detrimental and could lead to financial strains on American businesses.

With his characteristic bluntness, Trump underscored the potential financial burdens inflicted by the Fed’s current rate policies, alleging that they are costing the nation “hundreds of billions” in unnecessary financing expenses. His arguments highlight a fundamental disagreement regarding economic strategy; while he advocates for proactive measures like rate cuts, Powell has taken a more cautious approach, aiming to maintain economic stability in the face of uncertainties. This dichotomy illustrates the contrasting views on how best to navigate the future of the economy.

Federal Reserve News: Rate Cuts and Economic Expectations

In the landscape of Federal Reserve news, the anticipation surrounding potential interest rate cuts significantly impacts market sentiment. Analysts and investors keenly observe remarks from figures like Trump, as they can foreshadow monetary policy shifts or reinforce existing trends. Currently, expectations suggest that substantial rate cuts may remain on hold until later in the year, potentially delaying the economic uplift that advocates of lower rates are hoping for.

Market indicators prior to Trump’s remarks reflected skepticism about immediate rate cuts, acknowledging that the Fed might prioritize caution amid domestic and global economic pressures. The response to Federal Reserve actions is closely linked to inflation rates, employment figures, and geopolitical tensions, creating a complex backdrop against which Trump’s criticisms must be viewed. As financial markets react to evolving Fed policies, stakeholders remain vigilant about both Trump’s commentary and Powell’s decisions in a rapidly changing economic environment.

Increased Scrutiny on Jerome Powell’s Decisions

Jerome Powell’s decisions as the Federal Reserve Chair are under increasing scrutiny, primarily due to the recent tensions with Donald Trump. Powell’s reluctance to lower interest rates despite pressure from the administration places him in a challenging position, as market participants and policymakers alike seek clarity on future monetary policy. The Fed’s approach to interest rates will significantly influence economic growth and inflation management, making Powell’s credibility crucial in these uncertain times.

As Trump continues to publicly challenge Powell’s effectiveness, the potential consequences for the Federal Reserve’s operational independence could become a topic of broader national discussion. Stakeholders are keen to assess whether politically charged criticisms will affect the Fed’s decision-making process, particularly as the Trump administration advocates for a more accommodative monetary policy. The unfolding narrative offers insights into the intricate relationship between politics and economic policy, particularly within the realm of interest rates.

The Broader Economic Context of the Trump-Powell Debate

The contentious dialogue between Trump and Powell must be understood against the broader economic backdrop which includes factors such as inflation rates, employment figures, and international trade. Trump’s insistence on rate cuts is emblematic of his overarching goal to stimulate the economy, especially in sectors impacted by his administration’s policies, including tariffs. The implications of high interest rates on consumer spending and business investments create a complex interplay that involves multiple stakeholders.

Furthermore, as the Federal Reserve navigates through these challenging economic waters, it faces the dual challenge of addressing Trump’s calls for more accommodative policies while maintaining its credibility as an independent entity. Economists and market analysts are keenly observing how this dynamic will unfold, particularly as the Fed weighs the timing and magnitude of potential rate cuts. This situation emphasizes the delicate balance the Fed must achieve in fostering economic stability while managing political pressures.

Jerome Powell’s Response to Political Pressures

In light of Trump’s recent criticisms, Jerome Powell’s response entails a firm commitment to the Federal Reserve’s independence and decision-making process. As Powell has reiterated, the Fed’s policies are driven by economic data rather than political motivations, highlighting the institution’s role as a stabilizing force within the economy. His insistence on focusing on long-term economic indicators rather than short-term pressures is essential for maintaining the Fed’s credibility.

Powell’s stewardship also involves careful communication with market participants and the broader public, ensuring transparency regarding the Fed’s rationale for its decisions. By navigating the political landscape without yielding to external pressures, Powell aims to reinforce trust in the Federal Reserve’s commitment to fostering economic growth while managing inflation. The balance he strikes will significantly shape the future direction of U.S. monetary policy.

Market Reactions to Trump’s Criticism of the Fed

Trump’s outspoken criticism of Jerome Powell has drawn significant attention from market analysts and investors, prompting discussions about its impact on market stability. The immediate reaction to Trump’s remarks often includes fluctuations in stock markets as investors reassess their expectations regarding future interest rates and the Fed’s position. This volatility highlights the sensitivity of markets to political discourse surrounding the central bank’s policies.

As Trump’s feud with the Fed plays out, traders and analysts remain attuned to potential implications for monetary policy, especially regarding interest rate cuts. The prospect of lower rates can energize market activity, yet uncertainty surrounding the Fed’s decisions may also create hesitancy. This intricate interaction between Trump’s statements and market confidence underscores the vital role of effective communication in shaping economic outcomes.

Looking Ahead: The Future of Rate Cuts and Economic Policy

As we look toward the future, the question of whether the Federal Reserve will implement rate cuts remains a pivotal concern for policymakers and economists alike. With Trump’s vocal advocacy for a more aggressive monetary policy, the Fed faces increasing pressure to respond to the economic challenges espoused by the administration. The debate surrounding interest rates encapsulates broader discussions on economic recovery and growth trajectory amid ongoing global uncertainties.

The Fed’s decisions in upcoming meetings will be closely monitored not just for their immediate impact on markets, but also for their longer-term implications for economic policy. While the Fed seeks to navigate between inflation concerns and the need for growth, the pervasive tension exemplified by Trump’s criticisms of Powell casts a shadow over its operations. Therefore, understanding the trajectory of rate cuts will depend heavily on both economic data and the evolving political landscape.

Frequently Asked Questions

What did Donald Trump criticize about Jerome Powell recently?

Donald Trump recently criticized Jerome Powell, the Chair of the Federal Reserve, branding him ‘stupid’ for not implementing rate cuts expected by the market. Trump argued that the Fed’s key borrowing rate should be at least 2 percentage points lower, pointing out that unlike Europe, the U.S. has not seen any rate cuts.

How has the Trump-Powell feud impacted Federal Reserve decisions?

The Trump-Powell feud has created significant scrutiny on the Federal Reserve’s decisions regarding interest rates. Trump’s public criticism of Powell suggests that he believes the Fed’s reluctance to cut rates is detrimental to the U.S. economy, potentially influencing future decisions as the administration pushes for lower rates.

What are Donald Trump’s views on Federal Reserve rate cuts?

Trump’s views on Federal Reserve rate cuts are that the rates should be significantly lowered to benefit the economy. He has pointed out that other countries, like those in Europe, are experiencing multiple rate cuts, and he believes the U.S. should follow suit to avoid high financing costs.

What reasons did Trump give for criticizing Jerome Powell’s decisions?

Trump criticized Jerome Powell’s decisions by stating that high interest rates are costing the U.S. economy ‘hundreds of billions’ and suggested that Powell is not making smart decisions regarding rate cuts. Trump’s frustration stems from the belief that Powell is failing to recognize the lack of inflation and economic stability.

What is the current target for the Federal Reserve’s overnight borrowing rate?

As of the latest updates, the current target for the Federal Reserve’s overnight borrowing rate is between 4.25% and 4.5%. This rate has been a focal point of Trump’s criticism, as he argues it should be lower to enhance economic performance.

How does Jerome Powell respond to Trump’s criticisms?

Jerome Powell and Federal Reserve officials have maintained that they will not succumb to political pressure, emphasizing their commitment to making decisions based on economic indicators rather than external criticism, including those from Donald Trump.

What was the market’s expectation regarding rate cuts before Trump’s criticisms?

Before Trump’s criticisms of Jerome Powell, market indicators suggested that a rate cut was improbable at the Fed’s meeting. Analysts projected that any potential cuts would not occur until later discussions, indicating a cautious approach by the Federal Reserve amid economic uncertainties.

What underlying concerns does Trump have regarding interest rates?

Trump’s underlying concerns about interest rates revolve around their impact on financing costs for the U.S. economy. He believes that high rates hinder economic growth and places the country at a disadvantage, especially in comparison to international counterparts who are more willing to enact cuts.

What recent interactions have Trump and Powell had?

While there has been a recent meeting between Trump and Powell, details of their discussions have not been publicly disclosed. The relationship has been strained due to Trump’s ongoing criticism of Powell’s decisions regarding federal interest rates.

What did Trump imply about Powell’s political motivations?

Trump implied that Powell might have political motivations affecting his decisions, suggesting that he may not take necessary actions regarding interest rates due to a personal bias against him, stating, ‘I think he hates me, but that’s OK.’

Why is there tension between the Trump administration and the Federal Reserve?

Tension between the Trump administration and the Federal Reserve largely stems from disagreements over interest rate policies. Trump’s insistence on rate cuts and his public criticisms of Jerome Powell have highlighted a broader conflict regarding economic management during his presidency.

| Key Point | Details |

|---|---|

| Trump’s Criticism of Powell | Trump called Powell ‘stupid’ and criticized his reluctance to cut interest rates. |

| Expected Rate Cuts | Despite Trump’s expectations, market indicators suggested that there would likely be no rate cut at the upcoming Fed meeting. |

| Current Interest Rate | The Fed’s target overnight borrowing rate is between 4.25% and 4.5%. |

| Impact of High Rates | Trump claimed that high interest rates are costing the U.S. economy hundreds of billions. |

| Political Undertones | Trump suggested that Powell may be acting politically, even claiming Powell might ‘hate’ him. |

| Fed’s Stance on Independence | Powell has stated that the Fed will not bow to political pressure, a stance supported by other officials. |

Summary

Donald Trump criticizes Jerome Powell for his handling of interest rates, labeling him as ‘stupid’ and questioning the Federal Reserve’s reluctance to cut rates. As the market awaits the Fed’s decision, Trump emphasizes the financial burden high rates impose on the economy. His public remarks showcase a contentious relationship with Powell and highlight concerns about the balance of political influence on economic policies.