Dormant Bitcoin Moves: 801 BTC Transfers After 8 Years

Dormant Bitcoin has captured the attention of investors as long-overlooked wallets have started to move significant assets after years of inactivity. Recent Bitcoin wallet activity has indicated a surge, as wallets that have been silent since 2017 suddenly released 801 BTC within just 72 hours. With Bitcoin movement in 2023 gaining momentum, the release of these dormant assets has sparked intrigue among traders and analysts alike, especially after the peak prices recorded in Bitcoin news June 2023. The transactions originating from long-dormant wallets suggest a possible strategic reevaluation among early adopters in light of current market conditions. This unexpected shift in vintage Bitcoin transactions is a testament to the dynamic nature of digital currencies and their holders, demonstrating how even inactive wallets can influence the broader market landscape.

The recent activity involving dormant cryptocurrencies presents an interesting scenario in the ever-evolving world of digital asset management. With once-silent Bitcoin addresses igniting interest, the dynamics surrounding these static funds have shifted dramatically. Many of these so-called long-idle wallets, which had lain inactive for several years, are now seeing unprecedented levels of interest as they reactivate during a volatile market period. These movements highlight a resurgence in transactions from 2017, indicating that even the most dormant of Bitcoin investments are susceptible to the changing currents of market sentiment. As 2023 unfolds, the interaction between old and new Bitcoin wallets may shape the future of cryptocurrency trading strategies and investor behaviors.

The Recent Surge in Dormant Bitcoin Activity

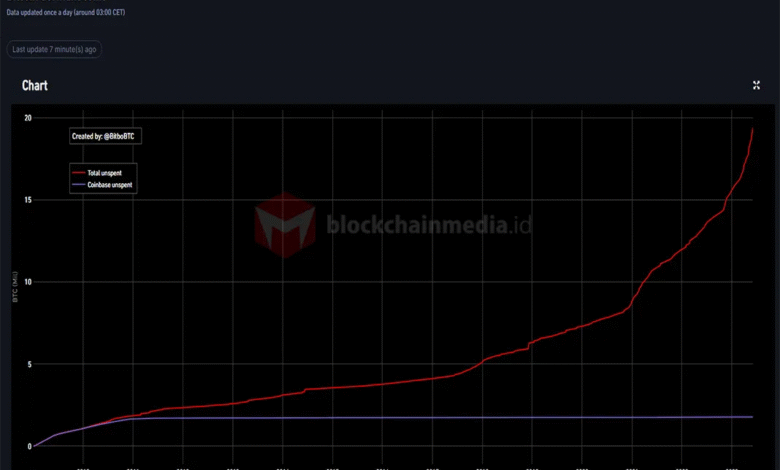

In June 2023, a notable resurgence in dormant Bitcoin activity has captured the attention of the cryptocurrency community as long-dormant wallets, many from 2017, began transferring significant amounts of Bitcoin. Over a period of just 72 hours, a total of 801.58 BTC worth approximately $82.98 million changed hands, signaling to investors and analysts that there may be strategic market maneuvers afoot. This unusual activity flushes new life into older wallets, often associated with early adopters who have maintained their holdings through volatile market conditions for years.

The 801 BTC moving from wallets that had been inactive since 2017 prompts questions about market timing and price sensitivity among Bitcoin holders. The current price around $103,000, while down from its recent peak, may have encouraged dormant investors to realize gains or to reposition their assets in more modern wallets, such as Bech32 addresses. The movement of these dormant funds not only reflects a shift in confidence but also illustrates the intricate decision-making processes that underpin Bitcoin wallet activity.

Understanding Long-Dormant Wallet Dynamics

The phenomenon of long-dormant Bitcoin wallets stirring to life is not uncommon, yet the scale of the recent activity prompts further examination. With many of these transactions initiated from P2PKH wallets created back in 2017, we see a pattern wherein holders who purchased Bitcoin during previous market rallies are now engaging with the evolving landscape of cryptocurrency. This movement tracks not only individual investor sentiment but also highlights how market fluctuations can drive long-term holders to take action after years of inactivity.

In the context of Bitcoin transactions from 2017, the recent activity presents an interesting case study into market psychology. Bitcoin’s increasing price over recent months could be a primary factor, as those who once purchased Bitcoin at relatively low prices may feel incentivized to capitalize on their investments. The activity we’ve observed in June serves as a reminder that even the most inactive wallets can significantly influence market dynamics, further sparking conversations among traders and analysts regarding Bitcoin movement and overall market health.

Frequently Asked Questions

What does dormant Bitcoin refer to in the context of Bitcoin wallet activity?

Dormant Bitcoin refers to Bitcoin held in wallets that have not been active for an extended period, typically several years. This inactivity signifies that the wallet owner has not conducted any Bitcoin transactions. Recent activity from long-dormant wallets, especially those from 2017, has raised interest as they can indicate shifts in market sentiment or investor strategy.

What was the recent movement of dormant Bitcoin from 2017 in June 2023?

In June 2023, a notable movement of dormant Bitcoin occurred when wallets created in 2017 transferred a total of 801.58 BTC over a three-day period. This surge in Bitcoin movement from long-inactive wallets is significant as it reflects a potential change in the wallets’ owners’ investment strategies.

How does Bitcoin wallet activity impact Bitcoin transactions from 2017?

Bitcoin wallet activity, particularly the recent movement of dormant Bitcoin from 2017, can significantly impact market dynamics. When long-dormant wallets become active, it can influence Bitcoin pricing and investor behavior, signaling either an exit strategy or a new investment cycle. Such activities tend to attract attention in Bitcoin news, demonstrating the lasting impact of earlier investments.

What does the increase in Bitcoin movement in June 2023 reveal about dormant Bitcoin wallets?

The increase in Bitcoin movement in June 2023, particularly from dormant Bitcoin wallets created in 2017, suggests that holders may be responding to current market conditions. This phenomenon raises questions about long-term investor confidence and the factors prompting these earlier adopters to reactivate their wallets after years of inactivity.

Why are long-dormant wallets significant to Bitcoin news in June 2023?

Long-dormant wallets are significant to Bitcoin news in June 2023 because their recent activity—transferring over 800 BTC—highlights shifting trends in investment behavior. These movements may signal a strategic response to market conditions, enhancing analysis on liquidity and trade strategies among Bitcoin holders.

What trends can be seen from the Bitcoin transactions involving dormant wallets?

Trends from Bitcoin transactions involving dormant wallets indicate a deliberate coordination among certain long-time holders. The recent activity from these wallets, particularly from addresses created in 2017, showcases how even long-term holders are adapting to new market conditions, reinforcing Bitcoin’s evolving role in financial markets.

What impact does the movement of dormant Bitcoin have on investors and market psychology?

The movement of dormant Bitcoin can have profound effects on investor sentiment and market psychology. When substantial amounts of Bitcoin are suddenly transferred from long-dormant wallets, it can create speculation surrounding the intentions of these investors, lead to increased trading volume, and affect the overall supply dynamics of Bitcoin in the market.

| Date | Amount Transferred (BTC) | Origin Address Type | Destination Address Type | Notes |

|---|---|---|---|---|

| June 19, 2023 | 35 BTC | P2PKH | Bech32 | First transaction after 8 years of inactivity. |

Summary

Dormant Bitcoin has stirred after eight years of silence, as wallets from 2017 have recently come alive, moving a total of 801 BTC. This unexpected activity not only marks a significant transaction in the Bitcoin space but also highlights the ongoing influence of early Bitcoin holders, who may be reacting to the current market valuations. The continuous shift in dormant Bitcoin signals a fascinating evolution within the cryptocurrency landscape, revealing how even the quietest participants can impact liquidity and market dynamics.