Ether ETFs Surge with Record $7 Billion Trading Day

Ether ETFs are making headlines as they recently achieved a staggering $7 billion in trading volume on a single day, a remarkable milestone in the world of crypto trading. This remarkable surge comes alongside a significant inflow of $338 million, reinforcing investor confidence in Ether amidst ongoing challenges for Bitcoin ETFs. While Bitcoin experiences considerable outflows, including a notable $198.8 million exit from BlackRock’s IBIT, Ether continues to attract substantial funds, illustrating a clear shift in market dynamics. The strong performance of Ether ETFs, particularly led by firms like Fidelity and Grayscale, highlights the growing appetite for diversified crypto investments. As traders look to capitalize on the expanding universe of digital assets, the market is witnessing an exciting phase of growth fueled by Ether innovations and increasing transaction volumes.

The realm of exchange-traded funds (ETFs) dedicated to Ether is undergoing a transformative phase as they capture the attention of investors and analysts alike. Often compared to their counterparts for Bitcoin, Ether ETFs are gaining traction, underscoring a burgeoning interest in Ethereum-based financial products. While Bitcoin ETFs face pressures from significant capital outflows, including troubling trends from major players, Ether is experiencing an upswing in total investment and trading activity. This growth reflects broader shifts in the crypto landscape, where traders are keen to diversify their portfolios and seize emerging opportunities. With a record trading day marking a significant achievement for Ether, the narrative of crypto continues to evolve, promising exciting developments ahead.

Understanding the Surge in Ether ETFs

The recent surge in Ether ETFs is a significant development in the cryptocurrency market, particularly marked by an incredible $338 million inflow on what is now regarded as a record trading day for these funds. With investors gravitating towards Ether, the net assets have skyrocketed to $30.54 billion. This robust performance not only showcases the growing confidence in ether but also signals a shift in investor sentiment towards digital assets beyond Bitcoin. As cryptocurrency trading gains traction, the substantial inflows into Ether ETFs are reflective of a broader trend where institutional and retail investors are diversifying their portfolios, seeking opportunities in a rapidly evolving market that embraces more than just Bitcoin.

The driving factors behind this phenomenon can be attributed to various elements, including demand for decentralized finance (DeFi) and the broader adoption of blockchain technology. As Ether continues to be used extensively in smart contracts and decentralized applications, its value proposition becomes increasingly appealing. Moreover, the positive momentum observed in Ether ETFs, highlighted by a record trading day of $7 billion, indicates that investors are betting on the growth potential of Ethereum amidst a backdrop of volatility in the Bitcoin market. The influx of capital into Ether ETFs showcases the shifting tides within crypto investments, where Ethereum is establishing itself as a viable alternative and even a competitor to Bitcoin.

Comparing the Trends: Bitcoin vs. Ether

When analyzing the contrasting trends between Bitcoin and Ether, one cannot overlook the grim reality facing Bitcoin ETFs as they recorded their sixth consecutive day of outflows. Despite having foundational significance in the cryptocurrency landscape, Bitcoin has recently faced mounting pressure illustrated by heavy capital withdrawals, particularly from notable funds like BlackRock’s IBIT, which experienced a staggering $198.8 million exit. This situation stands in stark contrast to Ether, where the positive inflows reflect a burgeoning enthusiasm for Ethereum-based projects that are increasingly capturing the interest of traders and investors.

Furthermore, while Bitcoin ETFs demonstrated resilience with a trading volume of $5.74 billion, the heavy outflow signifies underlying concerns that may stem from investor sentiment regarding Bitcoin’s stagnant performance and uncertainty surrounding regulatory scrutiny. The stark divergence between the two leading cryptocurrencies highlights a broader trend in crypto trading; investors are actively seeking alternatives as Ether’s solid inflows indicate a shift not only in strategy but also in the maturation of the digital currency landscape. As Ether continues to attract capital, Bitcoin must navigate through these turbulent waters to regain its dominance in the market.

The Future Outlook for Ether ETFs

With Ether ETFs experiencing unprecedented growth, it’s essential to consider what the future holds for this segment of the market. Given the recent record trading activity and inflows, there is substantial momentum suggesting that Ether will continue to attract a diverse range of investors. As institutional adoption grows, fueled by the increasing maturity of the Ethereum ecosystem, the potential for Ether ETFs to outperform Bitcoin ETFs becomes increasingly feasible. Analysts predict that as innovations such as Ethereum 2.0 take hold, enhancing scalability and energy efficiency, Ether ETFs may see continued inflows that could reshape the crypto investment landscape.

Key factors that could further bolster the attractiveness of Ether ETFs include ongoing developments in DeFi, the rise of decentralized applications, and regulatory clarity that may boost investor confidence. Additionally, the trend of rising institutional interest in ether signifies that large-scale investors are recognizing the strategic importance of expanding their portfolios to include Ether. As these trends unfold, the potential for Ether ETFs to not only compete with Bitcoin ETFs but potentially surpass them in terms of investor inflows remains a critical narrative to watch in the evolving world of cryptocurrency.

Frequently Asked Questions

What are Ether ETFs and how do they differ from Bitcoin ETFs?

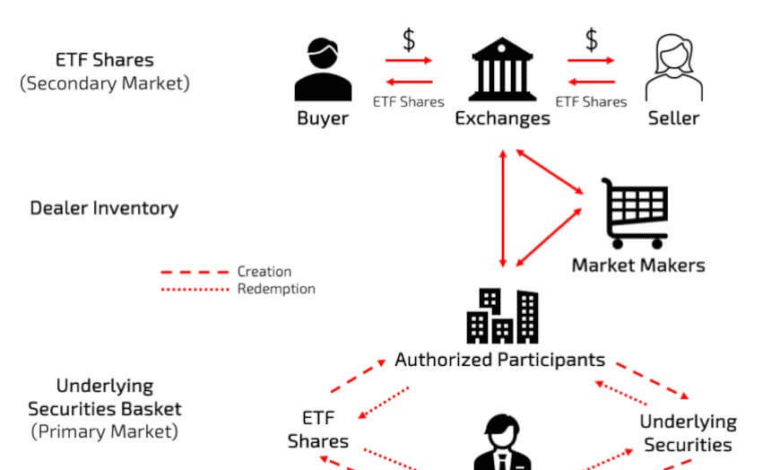

Ether ETFs are exchange-traded funds that track the performance of Ethereum, the second-largest cryptocurrency by market capitalization. Unlike Bitcoin ETFs, which follow Bitcoin’s price movements, Ether ETFs specifically focus on Ether’s performance. This distinction is important as it allows investors to gain exposure to the Ethereum ecosystem, which has unique applications like smart contracts and decentralized finance (DeFi) projects.

How have recent Ether ETF inflows impacted the market compared to Bitcoin ETFs?

Recent data shows that Ether ETFs experienced a significant inflow of $338 million, leading to a record trading day with $7 billion in activity. This marks a stark contrast to Bitcoin ETFs, which faced $198.8 million in outflows despite overall healthy inflows across other funds. This divergence indicates a strong investor sentiment towards Ether amidst Bitcoin’s struggles.

What factors are driving the record inflows into Ether ETFs?

The remarkable inflows into Ether ETFs can be attributed to several factors, including increased adoption of Ethereum’s decentralized applications, the rise of DeFi projects, and market sentiment favoring Ether over Bitcoin during certain trading periods. Additionally, institutional investors are increasingly viewing Ether ETFs as a viable investment to capitalize on the growth of the Ethereum network.

Why are Bitcoin ETFs experiencing outflows while Ether ETFs are seeing inflows?

The persistent outflows from Bitcoin ETFs, particularly from major funds like BlackRock’s IBIT, suggest a cautionary stance among investors influenced by market conditions. In contrast, Ether ETFs have benefited from positive developments and strong demand in the Ethereum ecosystem, attracting investor capital as they seek opportunities in the crypto market, resulting in significant inflows.

What is the significance of the $7 billion trading day for Ether ETFs?

The $7 billion trading day for Ether ETFs signifies unprecedented investor interest and activity, reflecting a growing bullish sentiment towards Ethereum. This level of trading volume not only boosts the profile of Ether ETFs in the investment community but also highlights the increasing acceptance of cryptocurrencies in institutional portfolios, setting a positive precedent for future trading days.

How do Ether ETF investments reflect the overall crypto trading landscape?

Investments in Ether ETFs are indicative of a broader bullish trend in the crypto trading landscape, where Ethereum is gaining traction as a leading digital asset. The stark contrast between Ether ETF inflows and Bitcoin ETF outflows suggests shifting investor preferences, highlighting the evolving dynamics of the cryptocurrency market and the growing importance of diversifying into various cryptocurrencies.

Can Ether ETFs provide a safer investment option compared to Bitcoin ETFs?

While neither investment is without risk, some investors might consider Ether ETFs to be relatively safer during periods of volatility in Bitcoin, especially given the recent strong inflows and market interest in Ethereum’s technology and applications. However, potential investors should thoroughly assess both options and consider their risk tolerance and market outlook before deciding.

How do Ether ETF performances influence other cryptocurrency investments?

The performance of Ether ETFs often sets a benchmark for other cryptocurrency investments, particularly in how they attract institutional interest and trading volume. A strong performance in Ether ETFs can positively influence other cryptocurrencies, as investor confidence in the broader crypto market tends to surge with successful Ether ETF results, potentially driving up prices across the board.

| Metrics | Ether ETFs | Bitcoin ETFs |

|---|---|---|

| Daily Inflow | $338 million | $23.15 million outflow |

| Trading Activity | $7.01 billion | $5.74 billion |

| Notable Funds (Inflow) | Fidelity’s FETH: $117.90M BlackRock’s ETHA: $109.37M |

ARKB: +$65.74M FBTC: +$50.88M |

| Net Assets | $30.54 billion | $150.23 billion |

Summary

Ether ETFs have achieved significant milestones recently, evidenced by record trading volume and consistent inflows. As more investors shift their focus towards Ether, the divergence between Ether and Bitcoin funding is becoming increasingly clear. Ether ETFs not only welcomed a staggering $7 billion in trading activity but also recorded large inflows, signaling strong investor confidence in the asset. Contrarily, Bitcoin ETFs are facing outflows, particularly from major funds like BlackRock’s IBIT. This ongoing trend underscores the growing popularity of Ether ETFs amidst shifting market dynamics, making them a compelling investment for those looking to capitalize on cryptocurrency opportunities.