Ethereum Price Analysis: Bullish Signals and Key Targets

Ethereum price analysis shows that the second-largest cryptocurrency is currently experiencing significant momentum, hinting at potential bullish trends. Over the past week, Ethereum (ETH) has seen a remarkable increase of 12%, driven by a broader recovery in the cryptocurrency market, particularly following Bitcoin’s performance. As Ethereum attempts to reclaim vital support levels around $1,761, traders are keenly watching for possible price targets that could signal a breakout above the key resistance at $1,861. With the right ETH trading strategy in place, investors may position themselves to capitalize on these upward movements. This analysis not only charts Ethereum’s path but also highlights the critical levels that must be achieved for sustained growth in the future.

In the realm of digital currencies, dissecting Ethereum’s market trends is indispensable for potential investors and traders. Recent fluctuations indicate that Ethereum might be on the verge of a significant breakout, mirroring shifts observed in other major cryptocurrencies. Traders are now focusing on the critical resistance points and chart levels that could determine the future trajectory of ETH prices. By analyzing Ethereum’s performance through various lenses, including bullish target levels, market trends, and strategic trading approaches, one can gain a comprehensive understanding of its potential direction. As the digital asset landscape evolves, keeping an eye on Ethereum’s price movements will be vital for anyone looking to engage in this dynamic market.

Ethereum Price Analysis: Current Trends and Future Outlook

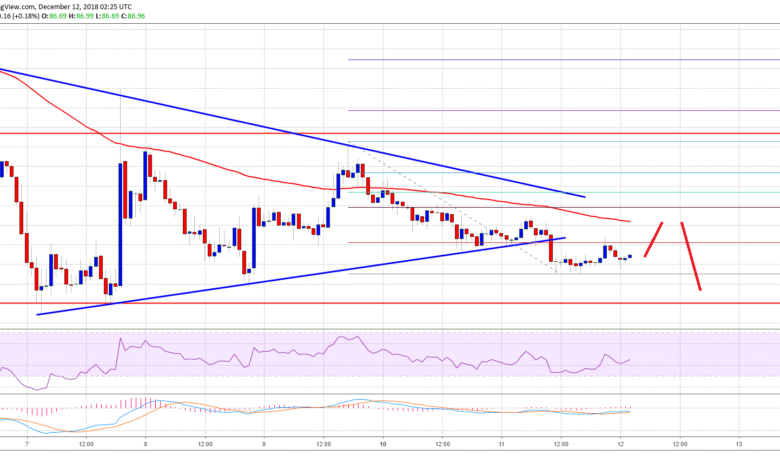

Currently, Ethereum (ETH) is showing signs of a potential price recovery after a difficult period characterized by a prolonged downtrend. With a notable 12 percent increase over the past week, the motivation for this bullish momentum can largely be attributed to the overall recovery of the cryptocurrency market, which is benefitting from positive movements in Bitcoin (BTC) and affirming economic data from tech giants like Netflix and Alphabet. For Ethereum, the crucial level to watch lies at $1,861, as breaking through this resistance could signify a clearer path towards achieving higher price targets.

Investors are keeping a keen eye on Ethereum’s movements, particularly as the price hovers above significant support levels such as the $1,761 mark. Should the bulls manage to push ETH through the EMA50 resistance, further targets emerge towards the green resistance zone encompassing $2,086. As the cryptocurrency market stabilizes amid a generally favorable economic backdrop, Ethereum could very well capitalize on the prevailing bullish trends, leading to an impressive price rally in the subsequent trading weeks.

Understanding Ethereum’s Potential Bullish Trend

The recent surge in Ethereum’s price reflects a broader bullish sentiment within the cryptocurrency sphere. The altcoin appears ready to challenge strong resistance levels, driven by increasing investor confidence and recent inflows into Ethereum spot ETFs. A bullish trend for Ethereum would not only depend on overcoming immediate resistance levels but also on maintaining upward momentum against the backdrop of market volatility. Successfully breaking above $1,861 would open the doors for ETH to target its long-term price objectives, potentially reaching up to $2,530 in the months ahead.

For traders employing an ETH trading strategy, monitoring market indicators will be crucial, especially when evaluating the viability of this bullish trend. The crossing of ETH’s moving averages, volatility indicators, and trading volumes may provide signals of the altcoin’s capacity to sustain upward momentum. The focus on bullish price targets, including $2,345 and even as high as $3,106, signals that there are considerable levels of resistance to watch for, which could significantly impact trading decisions and strategies for ETH.

Key Ethereum Price Targets for Investors

With the current market dynamics shaping up positively, investors in Ethereum must identify key price targets to enhance their trading strategies. The first significant target to anticipate beyond the current price is $1,861; a breakout here would signify a strong bullish trend and set the stage for higher targets. Other imminent targets include the price ranges of $1,932 to $1,972, and potentially $2,086, which previous price actions have indicated as critical resistance points. The importance of these targets cannot be understated, as they set the buying framework for many traders.

Furthermore, as Ethereum approaches resistance zones, investors should be ready to take profits while remaining vigilant of pullbacks. The ideal trading strategy incorporates both aggressive buying when approaching support levels and prudent profit taking at higher price targets, ensuring balanced risk management. The sustainable breaking of these key levels could very well define the altcoin’s price trajectory for months to come, cementing Ethereum’s place in a bullish market narrative.

Making Sense of Bearish Price Targets for Ethereum

While the bullish narrative for Ethereum dominates at present, it’s vital for investors to remain cognizant of potential bearish trends that could arise. In the event that Ethereum fails to break above the EMA50 resistance, there exists a risk of price pullbacks to the support area around $1,761 or even lower to $1,668. If selling pressure intensifies from here, the market may be forced into a retest around last week’s lows, leading to additional bearish price targets that could disrupt the recent recovery pattern.

Understanding these bearish price targets, including levels between $1,516 and $1,100, allows investors to strategize effectively. Having a clear understanding of support levels where buyers should step in to mitigate losses is equally important. As Ethereum navigates these potential downturns, recognizing market indicators and employing a strategic ETH trading strategy can help investors maintain their positions and make informed decisions about entering and exiting the market.

Ethereum Breakout: What It Means for Traders

The possibility of an Ethereum breakout above the established resistance levels presents a critical opportunity for traders. Should ETH sustainably breach the $1,861 mark, this would confirm a bullish trend with potential upward momentum to follow. Traders must prepare to capitalize on this breakout by adjusting their trading strategies accordingly, utilizing technical analysis to identify key entry and exit points for maximizing profits.

A successful breakout could also influence market sentiment significantly, as an influx of bullish traders may further drive the price upward, solidifying Ethereum’s position in a recovering cryptocurrency market. For those active in the crypto space, understanding the broader implications of such breakouts, combined with effective risk management strategies, can lead to substantial rewards. The quick shifts corresponding to market dynamics necessitate a proactive approach to ETH trading and volatility.

The Role of Technical Indicators in Ethereum Trading Strategies

Technical indicators play a crucial role in developing effective Ethereum trading strategies. The moving averages, particularly the EMA20 and EMA50, serve as significant indicators for traders to discern trends and set entry points. A bullish crossover could suggest a strong buy signal, indicating potential upward movement, while conversely a bearish divergence could signal caution. Adopting a methodology that includes analyzing these indicators can greatly enhance the precision of trading decisions.

Furthermore, the Relative Strength Index (RSI) offers insights into market sentiment. Reading RSI levels can help traders identify overbought or oversold situations, allowing them to time their entries and exits more effectively. As Ethereum navigation continues in this volatile market, leveraging these technical factors is essential for developing a competitive edge in executing trades successfully and achieving favorable outcomes.

Ethereum’s Impact on the Broader Cryptocurrency Market

As the second-largest cryptocurrency by market capitalization, Ethereum’s price movements have a profound effect on the overall cryptocurrency market. Its performance often correlates with Bitcoin’s trends, acting as a market leader influencing investor sentiment across various altcoins. When Ethereum prices rise, it typically boosts confidence among traders, drawing in more capital into the cryptocurrency sector and potentially triggering a broader market rally.

Additionally, Ethereum’s technological advancements and its potential enhancements in decentralized applications (dApps) could serve as a catalyst for renewed interests among investors. As new developments like ETH 2.0 or Layer 2 solutions become more established, this factor is likely to contribute to increasing Ethereum values, subsequently affecting the market as a whole. Thus, understanding Ethereum’s influence is crucial for investors focused on maximizing their positions in the cryptocurrency market.

Strategies for Buying Ethereum in 2025

Looking ahead to 2025, potential Ethereum buyers must formulate well-informed strategies to navigate this rapidly evolving market. Ensuring safety in investments should be the primary focus, emphasizing thorough research into current trends and long-term projections for Ethereum’s adoption. Utilizing reputable exchanges and employing advanced trading tools will be essential to mitigate risks alongside enhancing the buying process.

Investors should consider diversifying their portfolios by incorporating Ethereum with other promising assets. By doing so, they can balance potential risks associated with the inherent volatility of cryptocurrencies. Being up to date on Ethereum developments, community activities, and market analyses will aid in making educated decisions and ensuring that any investments made align with broader market trends and Ethereum’s growth trajectory.

Ethereum Indicators: Assessing Market Strength

The current Ethereum price analysis is heavily influenced by various market indicators, which help traders gauge market strength and potential direction. The daily and weekly RSI indicators are essential, revealing the overall market sentiment regarding Ethereum’s price action. A rising RSI can suggest increasing buying pressure, while a declining one may indicate bearish sentiment taking hold, allowing traders to adapt their strategies accordingly.

Moreover, volume trends associated with Ethereum’s price fluctuations also provide valuable insights. Significant increases in trading volume accompanying price rises may highlight strong buyer interest and conviction. Conversely, diminishing volume during upward movements could suggest a lack of enthusiasm and a potential price retracement. This comprehensive approach, combining multiple indicators, enables a deeper understanding of Ethereum’s market momentum, supporting more informed trading decisions.

Frequently Asked Questions

What are the key Ethereum price targets to watch in July 2023?

The key Ethereum price targets in July 2023 include significant levels such as $1,861, $1,932/$1,972, and $2,086. If Ethereum successfully breaks above $1,861, it may pave the way towards $1,953 and the critical resistance zone around $2,345-$2,423, indicating a potential bullish trend.

How can Ethereum’s bullish trend impact the overall cryptocurrency market?

Ethereum’s bullish trend can significantly influence the overall cryptocurrency market by attracting more investments and boosting confidence among traders. A successful breakout above essential resistance levels, such as $1,861 and $1,953, could lead to a broader rally, encouraging positive price movements in other cryptocurrencies as well.

What factors could lead to an Ethereum breakout above $1,861?

For an Ethereum breakout above $1,861, key factors include overcoming the cross resistance of the 50-day moving average and sustaining upward momentum. Additionally, external influences such as favorable market conditions, bullish sentiments from Bitcoin’s performance, and solid technical indicators could contribute to this bullish movement.

What trading strategies can be employed for Ethereum price analysis during bullish sentiments?

Investors can implement various trading strategies for Ethereum price analysis, including setting buy orders at key levels such as $1,761 for support and targeting resistances like $1,953 for profits. Additionally, employing techniques such as dollar-cost averaging and trailing stop-loss orders can help manage risk and capitalize on potential bullish trends.

How does the current ETH price analysis indicate a potential trend reversal?

The current ETH price analysis suggests a potential trend reversal with a reclaim of the crucial support level at $1,761 and an increase of 12% in the last week. The positive momentum is further supported by bullish indicators such as the daily RSI moving upward, pointing to increased buying pressure and a possible shift to a bullish trend.

What are the bearish price targets for Ethereum in the event of a pullback?

In the event of a pullback, bearish price targets for Ethereum include levels such as $1,766, $1,551, and crucially $1,416. If Ethereum fails to break above its resistance and tests these support zones without recovering, further declines could lead to price targets in the range of $1,100 to $1,032.

What indicators can help analyze Ethereum’s price action effectively?

To analyze Ethereum’s price action effectively, traders should focus on indicators such as the Relative Strength Index (RSI), moving averages (like the EMA50 and EMA20), and price patterns. These tools can help identify bullish or bearish trends, gauge market momentum, and make informed trading decisions based on market dynamics.

Why is the $1,953 resistance zone important for Ethereum’s future performance?

The $1,953 resistance zone is crucial for Ethereum’s future performance as it represents a significant barrier that must be overcome for a sustained bullish trend. Successfully breaking through this level could signal strong buying momentum and open the pathway towards higher price targets, marking a potential shift in investor sentiment.

| Key Points |

|---|

| Ethereum shows initial signs of forming a bottom with a 12% price increase in the last week. |

| The price reclaimed the support zone around $1,761, with the next technical hurdle at $1,861. |

| Ethereum must overcome EMA50 and downtrend line for a bullish trend reversal. |

| Bullish targets include: $1,861, $2,086, up to $3,106. |

| Bearish targets include: $1,766, down to $1,032. |

| Market recovery aided by positive tech earnings and dollar weakness. |

| RSI indicators show potential for a bullish recovery, although current values indicate bearish territory. |

Summary

Ethereum price analysis indicates that the cryptocurrency is showing initial recovery signs after a period of downtrend, characterized by a recent 12% price increase. Key price targets and resistance levels have emerged, making this a pivotal time for Ethereum investors. If Ethereum can successfully break resistance at $1,861, we might expect bullish momentum towards higher targets. Conversely, if it fails to maintain its progress above critical support, it could lead to bearish outcomes. This analysis emphasizes the importance of watching these levels closely.