Ethereum Price Surge: New Highs Ahead for ETH

The recent Ethereum price surge has captivated the crypto world, with the value of ETH skyrocketing to new heights, recently hitting $3,772 against the U.S. dollar. As excitement builds, Ethereum’s market capitalization has also seen impressive growth, now standing at $452.66 billion, making up 11.6% of the expansive $3.9 trillion crypto economy. Traders are actively exploring various Ethereum trading strategies, with many anticipating that this is just the beginning of an upward trend. The rising interest is further fueled by the activity in the Ethereum options market and futures trading, which have both reached historic highs. As momentum builds, ETH price prediction suggests that the surge may continue, with numerous investors closely monitoring market movements.

The phenomenal rise in Ethereum’s value has sparked widespread interest among crypto enthusiasts and traders alike. This remarkable growth, characterized by increased market engagement, indicates a bullish sentiment surrounding ether’s potential. As the Ethereum futures market heats up, investors are employing diverse strategies to capitalize on this trend. Many are turning their attention to the ETH market capitalization, which reflects the growing confidence in Ethereum’s future. With alternative investment vehicles like Ethereum options drawing attention, the overall landscape for ether appears increasingly optimistic.

Ethereum Price Surge: A Bullish Outlook

The remarkable surge in Ethereum price has captured the attention of traders and investors alike. Just recently, Ethereum (ETH) reached an astonishing high of $3,772, marking a significant increase of 25.5% in just one week. This impressive growth is demonstrative of Ethereum’s strength within the overall cryptocurrency market. As ETH solidifies its position, its market capitalization also reflects this upward trend, now at a substantial $452.66 billion. This growth indicates a burgeoning confidence in Ethereum’s long-term viability and potential, particularly as the crypto landscape evolves with new trading strategies and investment opportunities.

Moreover, social media platforms are buzzing with excitement as traders anticipate even more upward potential for ETH. Many enthusiasts are engaging in discussions about ETH’s future performance, rationalizing that this is only the beginning of a much larger bullish trend. Public companies integrating Ethereum into their treasury strategies have further fueled this enthusiasm, as well as the introduction of spot ETH exchange-traded funds (ETFs). With analysts and traders carefully watching how these developments will impact the ETH market capitalization, the sentiment remains overwhelmingly positive as Ethereum continues to capture the spotlight.

The Growth of Ethereum Futures and Its Market Impact

As traders flock to Ethereum futures, the open interest has reached unprecedented levels, surpassing $55 billion. This substantial growth is a clear indicator of the spiraling interest in Ethereum among traders betting on future price movements. The close correlation between prices peaking and the increase in open contracts suggests that market participants are repositioning themselves for significant fluctuations. Particularly, the surge initiated since mid-April illustrates a strong bullish consensus, affirming that Ether is not only a popular investment choice but a favored speculation vehicle among traders seeking higher returns.

Market leaders like CME and Binance are pivotal in this trend, with Binance leading the charge with over $9.8 billion in open interest. The robust performance in Ethereum futures showcases the confidence traders have in Ethereum as a digital asset, especially as it approaches the $4,000 mark. The dynamics of the futures market also allow traders to implement various Ethereum trading strategies, ranging from hedging risks to amplifying gains. As the futures market continues to expand, the implications for the overall ETH market capitalization are significant, further carving out Ethereum’s reputation as a cornerstone of the cryptocurrency ecosystem.

Bullish Sentiment in Ethereum Options Market

The momentum in the Ethereum options market is rapidly growing, characterized by a strong bullish sentiment reflected in the volume of options being traded. Notably, traders are heavily favoring upside contracts, as evidenced by the popularity of high-stake calls such as the $4,000 call options set for September 2025. With almost 100,000 ETH in open interest for this contract, the market is exhibiting a clear inclination for upward movement, with traders betting on ETH to reach impressive heights.

Furthermore, the stark contrast between the volume of call options and put options – approximately 66.43% favoring calls – speaks volumes about how traders are speculating on Ethereum’s price trajectory. The daily volume also supports this bullish trend, with 62.49% attributed to calls, indicating a market that is bullish overall. This not only emphasizes the confidence traders have in Ethereum, but also reveals the strategies being employed to capitalize on anticipated price increases. As Ethereum trading strategies evolve in tandem with market dynamics, traders are prepared for explosive movements, indicative of the overall optimism pervading the Ethereum options markets.

Ethereum’s Market Capitalization and Future Potential

As Ethereum continues its price rally, its market capitalization has surged to an impressive $452.66 billion, reflecting its growing prominence in the $3.9 trillion cryptocurrency market. This significant rise in market cap illustrates how Ethereum’s share has increased, now accounting for 11.6% of the total crypto assets. Such metrics not only highlight Ethereum’s current standing but also signify its potential as a digital asset amid a rapidly evolving financial landscape. With market sentiment shifting towards Ethereum and the integration of innovative trading strategies, there’s optimism about its future valuation.

Investors and analysts are eager to formulate Ethereum price predictions based on historical data, market trends, and current trading phenomena. Many believe that Ethereum’s fundamental strength, driven by factors such as its adoption among institutions and the increasing demand for ETH as a means for smart contracts and decentralized finance (DeFi), will fortify its market capitalization. Thus, those looking at Ethereum’s future trajectory should consider the implications of the prevailing market trends, which strongly suggest that Ethereum could reach new milestones in the coming months and years.

Strategies for Navigating the Ethereum Trading Landscape

Navigating the Ethereum trading landscape requires a robust understanding of various strategies tailored to capitalize on price movements effectively. With Ethereum witnessing a monumental rise, traders are increasingly looking to implement diverse strategies such as swing trading, day trading, and long-term holding. Each strategy plays a crucial role in maximizing potential gains while managing risks associated with the inherent volatility of cryptocurrency markets. Traders are also advised to keep abreast of developments in the Ethereum futures and options markets to align their strategies with upcoming trends.

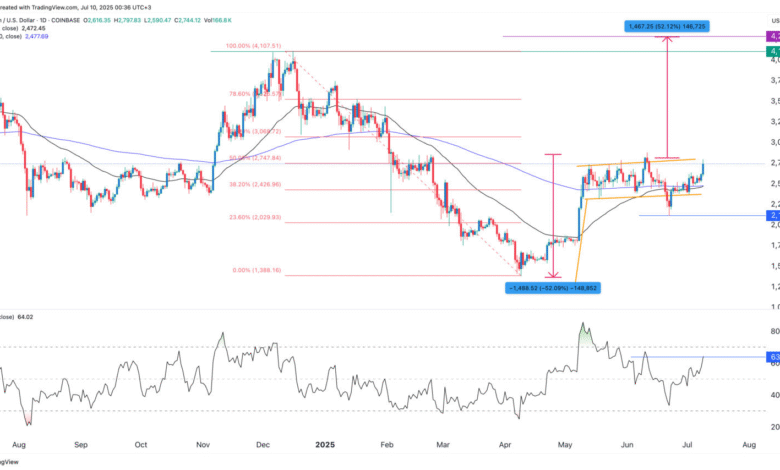

Moreover, the integration of technical analysis tools can enhance trading strategies, allowing traders to identify key support and resistance levels based on historical price behavior. Utilizing indicators such as moving averages and Fibonacci retracement can aid in pinpointing optimal entry and exit points, especially in a bullish market environment. As open interest in Ethereum futures continues to rise, staying informed about market sentiment and global economic indicators will be essential in forging effective Ethereum trading strategies, ensuring traders remain agile in the rapidly changing digital asset space.

The Role of Institutional Investment in Ethereum’s Rise

Institutional investment is playing an increasingly pivotal role in driving Ethereum’s recent price surge. The influx of corporate treasury allocations into ETH is indicative of a broader acceptance of cryptocurrencies as legitimate assets. This paradigm shift is fueling renewed interest and establishing Ethereum as a credible player in the world of digital finance. With companies recognizing Ethereum’s versatility, particularly in relation to DeFi projects and blockchain applications, the market capitalization of ETH is likely to experience further growth as institutional players deepen their stake in the ecosystem.

Moreover, the launch of Ethereum-based exchange-traded funds (ETFs) has catalyzed further institutional involvement, attracting significant capital inflows. Such developments have allowed traditional investors to gain exposure to Ethereum without having to manage the complexities of holding individual tokens. By making ETH more accessible to institutional portfolios, the dynamics of the Ethereum market are poised for significant transformation, creating a robust infrastructure that supports sustained growth and innovation. The synergy between institutional adoption and market performance suggests an optimistic outlook for Ethereum in the long-term.

Ethereum’s Future in the Global Financial Ecosystem

As Ethereum carves its niche in the global financial ecosystem, it’s clear that the digital asset is set to redefine traditional finance as we know it. With its wide array of applications, particularly in programmable contracts and finance decentralization, Ethereum is uniquely positioned to challenge established banking and financial services. The growing blockchain ecosystem surrounding Ethereum enhances its utility, paving the way for various sectors to integrate decentralized technologies into their operations. With Ethereum’s current trajectory, discussions around ETH becoming a mainstream financial option are gaining traction.

The prospects for Ethereum’s future are also being fueled by ongoing technological upgrades, such as the transition to Ethereum 2.0. This upgrade aims to enhance scalability, security, and sustainability, potentially making Ethereum transactions faster and more cost-effective. As Ethereum continues to evolve, its ability to remain competitive in an ever-changing landscape will be crucial. The combination of an expanding user base, increasing institutional investments, and continual technological improvement signals a future where Ethereum could solidify its status as a cornerstone of the global financial ecosystem.

Understanding Ethereum Market Sentiment Through Social Media Analysis

Social media analysis serves as a vital tool for understanding market sentiment surrounding Ethereum (ETH). Platforms like X (formerly Twitter) have become hotspots for crypto discussions where traders and enthusiasts share insights, predictions, and sentiment about price movements. The observations noted, including phrases like ‘the run Ethereum is about to go on is going to be glorious,’ reflect the collective optimism that can influence and even drive market confidence. This crowd-sourced information can provide valuable insights into trader psychology and potential future price movements.

Additionally, sentiment analysis can help traders gauge the level of enthusiasm or caution prevalent within the market. Monitoring the frequency of bullish versus bearish sentiments can assist traders in making informed decisions about their positions. As Ethereum navigates through its rapid price changes, the feedback loop created by social media platforms can amplify movements, serving as both an indicator and influencer of trader sentiment. Therefore, integrating social media analysis into trading strategies offers an innovative approach to understanding and reacting to market dynamics efficiently.

Frequently Asked Questions

What factors are contributing to the Ethereum price surge?

The Ethereum price surge can be attributed to several factors, including increased adoption by public companies for treasury strategies, a rise in spot ETH exchange-traded funds (ETFs) attracting capital, and a significant increase in open interest in Ethereum futures, which surpassed $55 billion, indicating strong trader interest and confidence.

How do Ethereum futures influence the ETH price surge?

Ethereum futures play a crucial role in the ETH price surge as they reflect trader sentiment and market expectations. The recent surge in open interest, reaching over $55 billion, demonstrates that many traders are betting on future price increases, which can lead to further upward momentum in Ethereum’s price.

What does the rise in ETH market capitalization indicate about the Ethereum price surge?

With Ethereum’s market capitalization rising to $452.66 billion and its market share growing from 10.9% to 11.6%, it indicates a strong bullish sentiment in the market. This increase means that more capital is being invested in Ethereum, firmly supporting its price surge amid a broader crypto market valuation of $3.9 trillion.

How are Ethereum trading strategies adapting during this price surge?

As Ethereum’s price surges, traders are adapting their strategies by focusing on bullish positions in both the futures and options markets. The preference for upside contracts, especially in the options market, suggests that traders are more inclined to capitalize on potential further increases in ETH price rather than just hedging against downturns.

What are the implications of ETH price prediction on future Ethereum price movements?

The recent bullish trends and ETH price predictions are leading many traders to anticipate further price increases. With contracts like the $4,000 September 2025 call gaining traction, trader optimism is high, suggesting that Ethereum could continue its upward trajectory, especially as more institutional investment enters the market.

| Key Metrics | Current Value | % Change | Market Share | Open Interest (Futures) | Bullish Sentiment in Options |

|---|---|---|---|---|---|

| Ethereum Price | $3,772 | +25.5% weekly | 11.6% | $55 billion | 66.43% calls vs 33.57% puts |

| Market Capitalization | $452.66 billion | 2.29 million ETH bullish bets | |||

| BTC dominance | 60.2% | ||||

| Traders’ Sentiment | Optimistic | Key options contracts active |

Summary

The Ethereum price surge is indicative of growing confidence and investment within the cryptocurrency market. As Ethereum continues to reach new heights, with its market capitalization rising and a significant increase in trading activity, it demonstrates a robust bullish trend. The open interest in Ethereum futures and the strong preference for call options signal that traders are anticipating continued price growth, reinforcing Ethereum’s position in the cryptocurrency landscape.