Token Unlocks in Cryptocurrency: Understanding the Impact

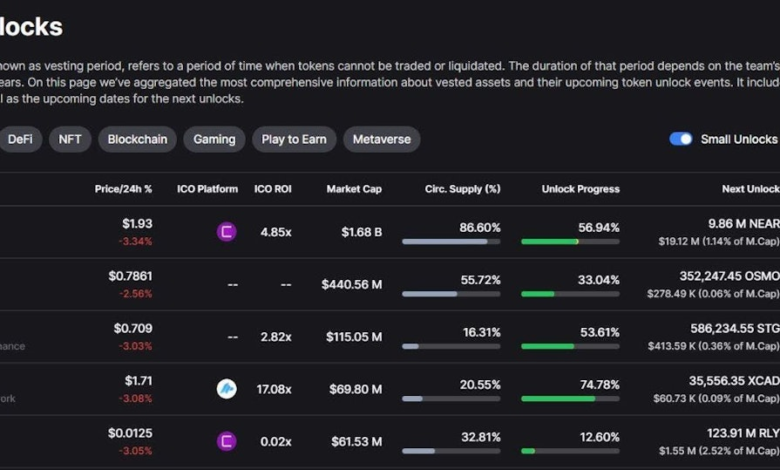

Token unlocks in cryptocurrency represent a critical moment in the lifecycle of a digital asset, influencing both market dynamics and investor sentiment. These mechanisms determine when previously restricted tokens become available for trading, significantly impacting projects’ financial strategies and tokenomics. For example, decentralized finance tokens often follow a structured vesting schedule that can span several years, meaning early investors may not see their rewards until much later. Consequently, the impact of token unlocks can either enhance market confidence or trigger volatility, as seen with the dYdX token release and other projects like Arbitrum. As such, understanding token unlocks is essential for anyone looking to navigate the complexities of cryptocurrency investments and their surrounding ecosystems.

In the cryptocurrency world, the concept of releasing locked tokens—often referred to as token distributions or vesting releases—plays a significant role in determining market behavior and asset valuation. This staggered unveiling of asset supply is pivotal for projects, especially in the decentralized finance arena, where investors closely monitor the release schedules of tokens like dYdX and Arbitrum. The planned unlocking of tokens can lead to shifts in trading volumes and overall market stability. When large proportions of a token supply are released, it frequently results in caution from prospective investors and can even precipitate price corrections. Understanding these dynamics helps investors anticipate market movements and make informed decisions in the fast-paced world of crypto.

Understanding Token Unlocks in Cryptocurrency

Token unlocks are integral to the cryptocurrency ecosystem, marking moments when previously restricted tokens are made available to the public. This release typically follows a vesting schedule, which outlines when early investors and capital providers can access their tokens. Such mechanisms are crucial as they influence market dynamics, especially the supply and pricing of crypto assets. For many projects, managing these unlocks intelligently is essential to maintaining investor confidence and overall project health.

The timing and volume of token unlocks can provoke different reactions in the market. A well-structured vesting schedule allows for gradual absorption of new tokens, stabilizing prices. However, an abrupt increase, as seen in some cases, can lead to market turbulence. Thus, understanding the mechanics of token unlocks helps investors gauge potential price movements and make informed decisions. Effective tokenomics should account for these dynamics to minimize negative market impacts.

The Impact of Token Unlocks on Crypto Prices

One of the immediate effects of token unlocks is their influence on cryptocurrency prices. In scenarios where tokens are released steadily, the impact on prices tends to be more manageable as buyers can acclimate to the increasing supply. However, in projects like Arbitrum, where nearly 90 percent of the total supply was unlocked at once, the market experienced a significant correction. This discrepancy indicates that large token supplies released suddenly can prompt anxiety among investors, potentially causing them to sell off their holdings.

The correlation between token unlocks and price fluctuations underscores the necessity for investors to monitor upcoming releases closely. Specifically, knowing when significant unlocks will occur can trigger strategic buying or selling. The fear of future price drops due to increased supply often prompts existing token holders to liquidate their positions before a potential market crash, exacerbating price declines. This cyclical dynamic illustrates why tokenomics plays a pivotal role in the cryptocurrency market.

dYdX Token Unlocks and Market Volatility

dYdX serves as an exemplary case for understanding the repercussions of token unlocks within the decentralized finance (DeFi) sector. Following its substantial token unlock in December 2021, where 70 percent of the supply was released, the price faced a sharp decline, highlighting the direct correlation between supply influx and market sentiment. Despite dYdX’s innovative trading platform, the shadow of token unlocks has lingered, influencing its market stability.

The frequency of monthly unlocks, totaling around 10 percent at times, continues to weigh heavily on dYdX’s price performance. As a notable trading platform for cryptocurrencies, the heavy issuance of tokens to early investors can lead to significant selling pressure. This cycle emphasizes the importance of understanding not just the mechanics of token unlocks, but their implications for trader psychology and market behavior.

Arbitrum’s Significant Token Release and Market Reaction

Arbitrum’s recent token unlock, which saw nearly 90 percent of its total supply introduced to the market, stirred considerable concern among investors. This immense release, atypical for successful crypto projects, raised alarms regarding potential oversupply and its effect on price dynamics. The immediate response from the market reflected apprehension, as existing token holders rushed to sell their assets to avoid losses, thereby causing a price correction.

This situation illustrates the critical importance of structured tokenomics. Rapid releases can lead to unfavorable trading conditions, prompting negative sentiment that impacts new investments. A well-timed and phased approach to token unlocks can maintain a healthier market environment, ensuring that both developers and investors can navigate price fluctuations without excessive volatility.

Navigating Tokenomics in Cryptocurrency Investments

Investors in the cryptocurrency market must scrutinize a project’s tokenomics to assess their risk levels effectively. Tokenomics refers to the economic model that governs the distribution, supply, and investment potential of a cryptocurrency. Understanding the terms and conditions surrounding token unlocks is paramount, as these can significantly sway market behavior and pricing strategies.

Projects like dYdX and Arbitrum reveal how various token unlock strategies can affect investor confidence and market stability. A clear understanding of the anticipated vesting schedules and potential selling pressure is essential for making strategic investment decisions. Capitalizing on insights from token unlocks allows investors to better time their entries and exits, optimizing their potential returns.

When Will Selling Pressure Decrease?

Predicting when the selling pressure will ease after token unlocks is an essential part of crypto investing strategy. For instance, the final substantial token unlock for dYdX is set for June 1, 2024, transitioning to a more manageable vesting schedule thereafter. Such milestones can mark pivotal points for investor sentiment and potential price recoveries.

Following the final major unlock, the gradual release of tokens — just a few percent each month — should help stabilize prices, reducing the urgency for token holders to sell off their investments en masse. Investors keen on the long-term prospects of dYdX and similar projects should be aware that patience may yield positive results as the market ultimately adjusts to the reduced token supply influx.

The Role of Investor Sentiment in Token Unlocks

Investor sentiment plays a critical role during token unlock periods, influencing both buying and selling behaviors. As tokens transition from locked to unlocked, potential buyers often evaluate their decision based on perceived risks and market trends. The fear of an oversupply following significant unlocks can lead traders to sell their holdings quickly, further driving down prices.

Understanding this psychological aspect is vital, especially in volatile markets such as cryptocurrencies. Stakeholders should recognize how sentiments can shift rapidly, influenced by external factors or even rumors about upcoming token unlocks. Hence, fostering a positive narrative around a project’s future can align investor sentiment favorably, providing a buffer against harsh market reactions.

Comparing Token Unlocks Across Crypto Projects

Token unlocks can vary drastically across different cryptocurrency projects, impacting their respective market dynamics. By analyzing projects like dYdX and Arbitrum, investors can begin to comprehend how unlock schedules, market presence, and tokenomics relate to price fluctuations. Each project’s approach to unlocks serves as a case study for best practices and lessons learned.

Understanding the nuances of each project’s tokenomics — including total supply, investor distribution, and vesting schedules — can highlight the best investment opportunities. As token unlocks continue to shape market conditions, comparing various projects allows investors to diversify their portfolios effectively, balancing risk versus reward.

Future Trends in Token Unlocks and Cryptocurrency Economics

As the cryptocurrency market matures, future trends in token unlocks and project economics will be critical for shaping investor strategies. Projects may adopt more sophisticated unlock schedules to mitigate market volatility, thus enhancing investor confidence. Innovations in tokenomics and increased transparency around token unlocks could lead to a healthier market environment.

Furthermore, as decentralized finance (DeFi) continues to evolve, understanding how token unlocks impact liquidity and trading volumes will become increasingly important for investors. The emphasis on gradual and predictable unlocks can help define a more sustainable trajectory for price developments, encouraging long-term investments. Keeping an eye on these future trends will be essential for informed decision-making in an ever-changing landscape.

Frequently Asked Questions

What are token unlocks in cryptocurrency and how do they affect crypto tokenomics?

Token unlocks in cryptocurrency refer to the scheduled release of previously locked tokens into the market. This process directly impacts crypto tokenomics as it influences supply dynamics, investor sentiment, and potential price movements. Understanding the timing and quantity of token unlocks is essential for evaluating a project, especially as it can indicate how tokens will be distributed over time, affecting market liquidity.

How do token unlocks impact the price of decentralized finance tokens?

Token unlocks can significantly impact the price of decentralized finance (DeFi) tokens by increasing the circulating supply. When a large number of tokens are unlocked simultaneously, such as in the case of Arbitrum, it can lead to price corrections as investors may sell to avoid dilution. Conversely, if token unlocks occur gradually, the price impact might be less pronounced, allowing the market to adjust more comfortably.

What happened with the dYdX token release and its implications on market performance?

The dYdX token release included a major unlock of approximately 70 percent of its token supply on December 1, 2021, which led to significant price corrections. The continuous monthly token unlocks of 10 percent contribute to selling pressure, affecting its market performance. As investors anticipate these unlocks, they may choose to sell, leading to volatility in the dYdX token value.

What are the risks associated with large token unlocks for projects like Arbitrum?

Large token unlocks, such as the one experienced by Arbitrum with nearly 90 percent of its total supply released, pose risks like sharp price drops and investor caution. These unlocks can prompt token holders to sell early, fearing price dilutions and can create a negative feedback loop impacting market perception and future investment.

When can we expect a decrease in selling pressure due to token unlocks in projects like dYdX?

A decrease in selling pressure for the dYdX token is expected after the final major unlock on June 1, 2024, after which a more linear vesting schedule will begin. This phased release, with smaller token increments, is likely to stabilize market dynamics and reduce volatility compared to earlier phases of significant unlocks.

How do investors react to impending token unlocks in cryptocurrency projects?

Investors often become cautious when impending token unlocks are announced, particularly when large percentages of token supply are at stake. This anticipation leads to speculation about price movements, which may result in increased selling activity and price corrections as investors aim to preemptively mitigate losses from potential dilution.

What role does tokenomics play in the timing of token unlocks?

Tokenomics dictates the overall supply structure and distribution strategy of a cryptocurrency, including token unlocks. A well-designed tokenomic model aims to balance incentives for early investors and maintain long-term price stability. Mismanagement of token unlock schedules can adversely affect market confidence and project sustainability.

What strategies can investors use to cope with the effects of token unlocks on crypto asset prices?

Investors can adopt several strategies to cope with the effects of token unlocks, including closely monitoring schedules for future unlocks, diversifying their portfolios to spread risk, utilizing stop-loss orders to limit potential losses, and staying informed about project developments to make timely investment decisions.

| Key Concept | Description |

|---|---|

| Token Unlocks | Mechanism in cryptocurrency for releasing previously locked tokens into the market, often following a vesting schedule. |

| Vesting Schedule | A predetermined schedule dictating the gradual release of token supply, impacting investment decisions. |

| Impact on Prices | Linear token unlocks tend to have a muted price effect, while massive releases can lead to significant price corrections. |

| Case Study: Arbitrum | An example of a large token release (90% of supply) that resulted in caution among buyers and price volatility. |

| Case Study: dYdX | Following significant token unlock events, dYdX has experienced price corrections despite strong trading volumes. |

| Future Expectations | A more stable price environment is expected after the final major unlock in June 2024, transitioning to a linear schedule. |

Summary

Token unlocks in cryptocurrency are crucial events that can significantly influence market dynamics and investment strategies. As tokens are released from a locked state, understanding the implications of these unlocks, particularly in terms of price fluctuations and market behavior, is essential for potential investors. Notable projects like Arbitrum and dYdX exemplify how large token releases affect pricing and investor sentiment, highlighting the need for strategic planning around these unlock schedules. Keeping an eye on future token emission patterns can guide both investment decisions and market forecasts.