Fed Interest Rates: Waller Advocates Proactive Rate Cuts

Fed interest rates have become a focal point in recent economic discussions, especially in light of remarks from Fed Governor Christopher Waller. On a recent episode of CNBC’s “Squawk Box,” Waller indicated that the economic landscape might warrant a reconsideration of rate cuts, particularly if the labor market shows signs of distress. With the Federal Open Market Committee (FOMC) maintaining the current rates in a range of 4.25%-4.5%, the future of these rates remains uncertain amidst rising public discourse around interest rates news. Waller’s caution against unnecessary delays suggests that policymakers should stay alert to changing economic indicators, including the effects of inflation and tariffs. As the market reacts to these developments, the implications of Fed rate cuts and their timing are hot topics among investors and economists alike.

In the realm of monetary policy, the discourse around central bank rate levels is gaining momentum, particularly in response to the evolving economic climate. Central to this conversation is the outlook from key officials, such as Governor Christopher Waller, who has articulated potential shifts in interest rate strategies. The discussion surrounding recent monetary policy decisions includes debates on maintaining stability versus implementing reductions to stimulate growth. With inflation concerns intertwined with external factors like tariffs, the implications for borrowing costs are pivotal. As market participants assess these dynamics, the upcoming FOMC meeting promises to be a critical juncture for understanding future adjustments in monetary policy.

The Potential Impact of Fed Interest Rates on the Economy

Fed interest rates play a crucial role in shaping the economic landscape, influencing everything from consumer borrowing to business investments. As Fed Governor Christopher Waller highlighted, the decision-making process surrounding interest rates is becoming increasingly important, particularly with concerns about the labor market in the wake of potential economic downturns. Keeping interest rates steady may ease borrowing costs now, but Waller’s suggestion to look into rate cuts indicates a proactive stance in responding to economic signals.

In the recent Federal Open Market Committee (FOMC) meeting, the decision to maintain the interest rates at the 4.25%-4.5% range reflects a cautious approach amidst conflicting views within the committee. With some members advocating for more aggressive rate cuts, the balance of maintaining economic stability while addressing inflation concerns is delicate. Waller’s remarks suggest that adapting the Fed’s strategy, based on the evolving economic data and labor market trends, will be key to fostering a stable economic environment.

How Inflation and Tariffs Influence Federal Rate Decisions

Inflation rates often dictate the direction of Fed interest rates, and the relationship between inflation and tariffs can create additional complexity in this equation. Waller has indicated that current tariffs are not expected to significantly increase inflation, which opens the door for possible rate reductions. The issue at hand is whether these tariffs will impact consumer prices and demand in the long term, which could affect the Fed’s ability to cut rates without triggering inflationary effects.

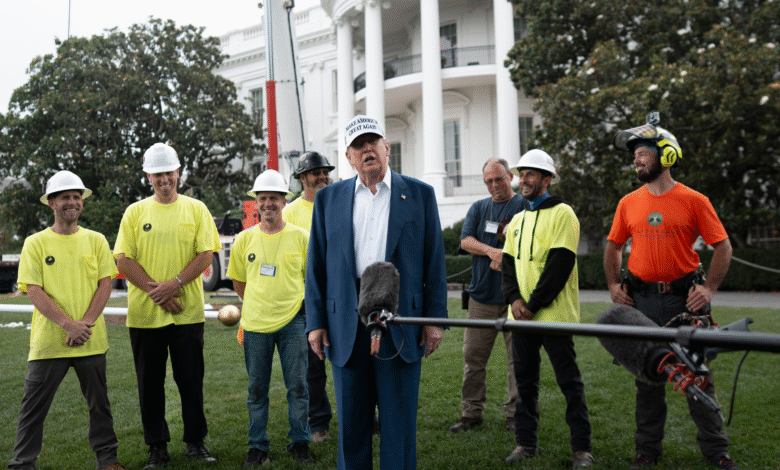

Moreover, as President Trump has been vocal about his call for lower interest rates, the discussions surrounding tariffs become increasingly relevant. If tariffs do not lead to the inflationary pressures that were anticipated, it could bolster Waller’s viewpoint on rate cuts. This evolution in inflation dynamics highlights the importance of real-time economic assessments in guiding Fed policy. Adjustments to interest rates must be considered in light of both current inflationary trends and the potential future ramifications of trade policies.

FOMC Meeting Updates and Future Rate Cut Projections

The Federal Open Market Committee (FOMC) meetings are pivotal in shaping expectations for Fed interest rates. Recent updates indicate a split among members regarding the future trajectory of interest rates. While Waller and others advocate for a cautious review of economic indicators, there is a growing faction within the committee that pushes for more immediate rate cuts as a means to stimulate economic growth amid labor market concerns. Observing these dynamics can help investors and policymakers understand what to expect moving forward.

With the next FOMC meeting approaching, market participants are closely monitoring the comments made by members like Waller and the implications of economic data. The ongoing debate around interest rates not only impacts stock markets—as seen with the recent positive market response—but also shapes consumer confidence and spending. As discussions continue about the necessity of rate cuts, the balance between responsive action and strategic caution remains under scrutiny.

Christopher Waller’s Perspective on Rate Adjustments

Christopher Waller’s recent remarks underscore a shift towards a more proactive monetary policy in response to economic fluctuations. His belief that the Fed should not wait to implement rate cuts reflects a growing concern regarding the outlook for the labor market. Waller’s call to ‘move now’ rather than adopting a wait-and-see approach resonates with the urgency that many economists feel in the current environment of uncertainty and economic volatility.

Furthermore, Waller’s evaluation of the economic landscape indicates a necessity for the Fed to act decisively in light of evolving data. By advocating for gradual rate adjustments, he aims to mitigate risks associated with labor market declines while avoiding excessive inflation. The combination of his insights with broader economic indicators will likely influence future Fed actions, marking a critical juncture in U.S. monetary policy.

Market Reactions to Waller’s Remarks and Rate Speculations

The financial markets reacted positively to Governor Waller’s insights, as evidenced by the uptick in stock futures. Waller’s emphasis on the Fed’s readiness to pivot based on economic conditions has increased speculation about potential rate cuts in the near future. Investors are closely watching these developments, as lower interest rates could stimulate the economy by making borrowing cheaper, which is essential for sustaining growth.

In particular, the CME Group’s FedWatch tool suggests that current expectations for a rate cut are limited, yet the market remains sensitive to shifts in policy sentiment. The interplay between Waller’s public comments, market performance, and investor sentiment underscores the critical nature of effective communication from the Fed. How these themes evolve in the context of future FOMC meetings will be vital in shaping market expectations and economic outcomes.

The Role of Fed Rate Cuts in Economic Stimulus

Fed rate cuts are often viewed as a critical tool for stimulating economic growth during times of uncertainty. By lowering interest rates, the Fed can encourage borrowing and spending, which are significant drivers of economic activity. Christopher Waller’s advocacy for considering rate cuts signifies recognition of the need for proactive measures to support the labor market against potential downturns. Historical data shows that timely rate cuts can mitigate recession impacts and foster recovery.

However, the decision to cut rates is not without its challenges. It requires a careful analysis of inflationary pressures, market conditions, and the overarching economic landscape. Waller’s call for a gradual approach, even as economic signals evolve, reflects a prudent stance to avoid overstimulating the economy, which could lead to further inflation down the line. Balancing economic stimulus with sustainable growth emerges as a crucial theme in ongoing Fed discussions.

Navigating Inflationary Pressures in a Tariff Context

Inflationary pressures can be exacerbated by tariffs, which create additional costs for imported goods. However, Waller’s assessment indicates that the anticipated inflationary consequences of recent tariffs may not materialize as initially expected. By analyzing the connection between tariffs and inflation, the Fed can better prepare its strategies for interest rate adjustments. This situation calls for enhanced scrutiny of economic indicators as policymakers adapt to changing realities.

Furthermore, as international trade policies evolve, understanding their implications for inflation becomes paramount. If tariffs do not significantly alter the inflation trajectory, the Fed may have more room to maneuver regarding interest rate cuts. Waller’s insights suggest a need for careful evaluation of both domestic and international economic factors when considering monetary policy changes. This nuanced approach can ultimately lead to more informed decisions that foster economic stability.

Understanding the Future of Fed Interest Rates

As the Federal Reserve navigates the complex landscape of economic indicators, understanding the future of Fed interest rates becomes critical for various stakeholders, including businesses and consumers. Waller’s forward-looking statements suggest that the Fed may become more aggressive in its rate-cutting strategies should economic concerns persist, particularly in the labor market. This evolving narrative is shaping the dialogue around monetary policy and its broader implications.

Moreover, the ongoing discourse within the FOMC highlights differing perspectives on the urgency and scale of potential rate cuts. As economic conditions fluctuate, stakeholders must remain vigilant and responsive to these changes, as they could significantly affect everything from borrowing costs to investment strategies. The interplay of these factors will dictate the future trajectory of interest rates and their impact on the economy as a whole.

Final Thoughts on Rate Changes and Economic Stability

In conclusion, the dialogue surrounding Fed interest rates and economic conditions reflects the central bank’s efforts to balance stability and growth. Governor Christopher Waller’s proactive recommendations for potential rate cuts emphasize the Fed’s adaptive approach to the challenges posed by changing economic landscapes. This careful consideration of labor market dynamics and inflation trends reaffirms the importance of responsive monetary policy.

Looking ahead, the decisions made by the Fed at upcoming meetings will likely have far-reaching implications for inflation, tariffs, and overall economic health. Stakeholders must prepare for a range of outcomes as policymakers respond strategically to data and market conditions. Ultimately, the effectiveness of future rate adjustments will hinge on the Fed’s ability to navigate these complexities while fostering a sustainable economic environment.

Frequently Asked Questions

What did Fed Governor Christopher Waller say about interest rates and inflation?

Fed Governor Christopher Waller indicated that he doesn’t expect tariffs to significantly drive inflation, suggesting that interest rates may need to be lowered soon. He encouraged policymakers to act proactively to avoid negative impacts on the labor market.

How have recent FOMC meeting updates impacted the Fed interest rates decision?

The recent FOMC meeting concluded with the decision to keep Fed interest rates unchanged at 4.25%-4.5%. The meeting revealed internal divisions among participants regarding potential rate cuts, with some advocating for lower rates as economic conditions evolve.

Why has President Trump urged the Fed to implement Fed rate cuts?

President Trump has been pushing for Fed rate cuts to lower borrowing costs associated with the national debt of $36 trillion. He believes that significant rate reductions of 2 to 2.5 percentage points are necessary to stimulate economic growth.

How does inflation and tariffs relate to future Fed interest rate decisions?

Inflation and tariffs are critical factors in shaping future Fed interest rate decisions. Waller mentioned that the anticipated inflationary effects of Trump’s tariffs have not materialized, prompting a reassessment of their impact on monetary policy and interest rates.

What are Christopher Waller’s views on proactive interest rate adjustments?

Christopher Waller advocates for a proactive approach to interest rate adjustments, arguing that if there are concerns about the labor market’s downside risks, the Fed should act now rather than waiting for clearer signals.

What potential changes to interest rates can we expect in light of recent economic data?

Waller has suggested that the Fed should start considering interest rate cuts as economic data unfolds, although he favors a cautious, gradual approach. The market shows some optimism, but the immediate expectation for rate cuts remains limited.

How do Waller’s remarks impact the market’s outlook on Fed interest rates?

Waller’s comments regarding the potential for interest rate cuts contributed to a positive market response, with stock futures showing gains. However, an immediate rate cut remains uncertain based on predictions from CME Group’s FedWatch tool.

| Key Point | Details |

|---|---|

| Fed’s Position on Inflation | Governor Christopher Waller believes that tariffs will not significantly affect inflation and may not necessitate a rate hike. |

| Potential Interest Rate Cuts | Waller suggests policymakers may need to lower interest rates soon due to labor market risks. |

| FOMC Decision | The FOMC recently decided to keep interest rates steady at 4.25%-4.5%, being cautious amid inflation uncertainty. |

| Trump’s Influence | President Trump advocates for significantly lower rates to reduce national debt-related borrowing costs. |

| Internal FOMC Opinions | There’s division within the FOMC regarding rate cuts, with varying optimism among members. |

| Approach to Rate Cuts | Waller favors a gradual approach to potential rate cuts while emphasizing timely response to economic data. |

| Market Response | Following Waller’s comments, stock futures reacted positively, indicating market optimism. |

Summary

Fed interest rates are currently under scrutiny as Governor Christopher Waller emphasizes the need for potential cuts in response to labor market concerns. With no significant inflation pressures on the horizon, adapting the monetary policy proactively could be crucial for maintaining economic stability. The Federal Open Market Committee’s internal debate and the influence of political leaders like President Trump add further complexity to the decision-making process surrounding interest rates, ensuring that any future adjustments will be guided by careful analysis of economic indicators.