Federal Open Market Committee Comparison: Key Highlights

The Federal Open Market Committee comparison provides crucial insights into the evolving landscape of U.S. monetary policy. By analyzing the recent FOMC statement, we can uncover significant changes made to the monetary policy outlook since the prior meeting in May. This analysis will delve into key economic indicators that have influenced these decisions and highlight various adjustments that reflect the Fed’s response to the current economic climate. Notably, reviewing the Fed meeting summary alongside Chair Jerome Powell’s upcoming press conference offers a comprehensive understanding of these insights. As we unpack the latest findings, it becomes clear how these regulatory shifts aim to ensure market stability in an ever-changing financial environment.

Exploring the nuances of the Federal Open Market Committee’s recent announcement reveals critical shifts in the nation’s approach to monetary policy governance. A detailed evaluation of the latest FOMC statement compared to previous communications allows for a better understanding of the economic metrics that have guided these revisions. As we examine the Fed meeting details and the implications of Chair Jerome Powell’s discussions, it’s essential to consider how these decisions impact broader economic strategies. The comparative results shed light on the Fed’s efforts to respond dynamically to fluctuating economic conditions. Overall, such analyses underscore the importance of scrutinizing the financial landscape and the Fed’s influential role within it.

Understanding the Federal Open Market Committee Statement

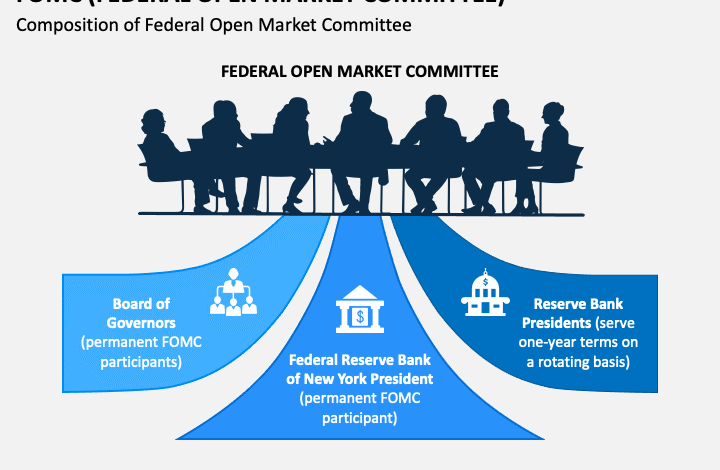

The Federal Open Market Committee (FOMC) statement serves as a crucial tool for understanding the current stance of monetary policy in the United States. Following the recent FOMC meeting, this year’s statement highlights key metrics that influence economic policy-making, including inflation rates, employment figures, and other vital economic indicators. By assessing these elements, we gain insights into how the Federal Reserve is responding to ongoing economic challenges.

Comparing the latest FOMC statement with the previous one from May reveals significant shifts in policy perspectives. These changes indicate a more aggressive approach to managing the economy, which is reflected in the modified language regarding monetary policy adjustments. The FOMC’s ability to adapt its communication is vital for guiding market expectations and maintaining stability amid fluctuating economic conditions.

Key Economic Indicators Influencing Policy Changes

Key economic indicators play a pivotal role in shaping the decisions made by the Federal Open Market Committee. Metrics such as unemployment rates, Gross Domestic Product (GDP) growth, and consumer price index movements are meticulously analyzed to determine the appropriate course of action for monetary policy. Recent data has shown shifts in these indicators, prompting the FOMC to adjust its outlook in the latest statement.

Additionally, the FOMC monitors external factors such as global market trends and geopolitical developments, which can exert pressure on domestic economic performance. The interplay of these economic indicators has resulted in the Fed’s recent policy shifts, firmly establishing a responsive and adaptive monetary strategy. Stakeholders, including investors and consumers, must stay informed about these changes, as they dictate the trajectory of economic conditions and interest rates.

Highlights of Monetary Policy Changes

The latest Federal Open Market Committee statements have introduced a variety of notable changes to the monetary policy framework. Highlighted in the document are adjustments that reflect a significant response to current economic conditions, aiming to ensure market stability while promoting sustainable economic growth. These policy changes reveal the Fed’s commitment to recalibrating its strategies in light of recent economic challenges.

Furthermore, these adjustments underscore the FOMC’s proactive stance in navigating the complexities of the economy. As emerging risks are acknowledged through the statement, the committee is positioned to act decisively to support economic recovery. Observers of monetary policy must pay attention to these highlights, as they signal potential implications for interest rates and overall market conditions.

FOMC Statement Analysis: Key Comparisons

Analyzing the FOMC statement in comparison to past documents provides a clearer perspective on the Fed’s evolving stance on monetary policy. The recent revisions indicate a shift towards a more cautious approach, taking into account rising inflation and supply chain disruptions. By juxtaposing the current statement with May’s version, we can grasp the nuances of the Fed’s strategies and how they aim to achieve economic stability.

One significant change includes the Fed’s language surrounding inflationary pressures. In the latest statement, the FOMC has emphasized vigilance regarding future inflation trends, in contrast to the previous statements, which might have projected more confidence in ongoing economic recovery. This contrast not only illustrates the Fed’s current focus but also highlights their willingness to amend their strategies based on prevailing economic conditions.

Fed Meeting Summary: What’s Next?

The summary of the recent FOMC meeting offers a glimpse into the Federal Reserve’s upcoming agenda. As the committee navigates through the latest economic data and discusses prospective policy shifts, stakeholders are keenly awaiting the outcomes. Future meetings will likely center around the impact of inflation and growth trends, assessing how these factors affect monetary policy decisions.

Moreover, as Fed Chair Jerome Powell discusses these topics during his press conferences, the insights shared can influence market perceptions significantly. Understanding the context behind the Fed’s statements enhances our grasp on potential future actions and their implications for both short-term and long-term economic strategies. Investors should stay tuned to these developments to align their decisions with evolving economic landscapes.

Jerome Powell’s Press Conference Insights

Jerome Powell’s press conferences following FOMC meetings are critical for interpreting the committee’s decisions on monetary policy. These sessions provide an invaluable platform for the Fed Chair to elaborate on the reasoning behind policy adjustments, addressing any concerns raised by the market. Observers often await his comments on economic indicators and their implications for growth, inflation, and employment.

In the latest press conference, Powell emphasized the Fed’s rigorous approach to monitoring economic conditions and readying for possible adjustments in response to unexpected changes. This commitment to transparency fosters trust in the Fed’s policy decisions, reinforcing the idea that the economy’s trajectory remains adaptable to real-time data.

The Role of Economic Indicators in FOMC Decisions

Economic indicators fundamentally shape the landscape of monetary policy, guiding the FOMC’s deliberations and conclusions. These indicators, from job growth to consumer spending patterns, serve as benchmarks that inform policymakers on the health of the economy. In their recent statements, FOMC members have referenced specific indicators that signaled the need for adjustments in their monetary stance.

With inflation rates climbing and employment figures fluctuating, the emphasis on economic indicators remains paramount. The FOMC is tasked with balancing the dual mandate of promoting maximum employment while ensuring stable prices. Keeping a close eye on these indicators allows the committee to maintain an informed perspective, ultimately benefiting economic stability.

Conclusion: The Future of Monetary Policy Evolution

The Federal Open Market Committee’s ongoing adjustments to monetary policy reflect an adaptive approach in response to changing economic conditions. As highlighted in the recent statements, the committee’s use of economic indicators serves as a foundation for informed decision-making. This proactive lifestyle ultimately dictates the future path of the U.S. economy.

Moreover, observing how these policies evolve will be key for investors and financial analysts alike. The intersection of FOMC statements, economic metrics, and Jerome Powell’s communications dictates a roadmap for navigating future economic challenges. Staying informed on these changes and understanding their implications will be vital for anticipating shifts in the marketplace.

Frequently Asked Questions

What are the key differences in the FOMC statement analysis between the recent and previous meetings?

The recent FOMC statement analysis reveals significant adjustments in the monetary policy outlook compared to the May meeting. Notable changes reflect the Fed’s response to new economic indicators, demonstrating their proactive approach. The differences in wording highlight these shifts, ensuring market stability.

How did economic indicators influence monetary policy changes in the latest FOMC meeting?

Economic indicators played a crucial role in the monetary policy changes outlined in the latest FOMC statement. By comparing the new statement to the previous one, we see how the Fed adjusted its strategies based on updated economic data, emphasizing their responsiveness to market conditions.

What insights can be gained from the Fed meeting summary related to the FOMC statement comparison?

The Fed meeting summary provides essential insights into the FOMC statement comparison. It highlights the Fed’s adjustments in its monetary policy, the rationale behind these changes, and the economic indicators that guided their decisions, showcasing the Fed’s commitment to maintaining market stability.

How does Jerome Powell’s press conference relate to the FOMC statement comparison?

Jerome Powell’s press conference after the FOMC meeting offers critical context to the statement comparison. It allows for a deeper understanding of the Fed’s monetary policy changes and provides clarity on how recent economic indicators influenced their decisions, giving investors and analysts important insights into future policy directions.

What is the significance of the adjustments in monetary policy outlook reflected in the FOMC statement comparison?

The adjustments in the monetary policy outlook reflected in the FOMC statement comparison are significant as they signal the Fed’s responsiveness to changing economic indicators. These changes indicate a strategic approach to ensure market stability while adapting to current economic conditions, highlighting the Fed’s proactive stance.

In what ways do the recent changes in the FOMC statement affect market perceptions?

The recent changes in the FOMC statement affect market perceptions by providing a clearer understanding of the Fed’s monetary policy trajectory. As investors analyze this statement comparison, they gauge the Fed’s intentions based on economic indicators and adjustments made, influencing their strategies and market confidence.

| Key Points | May Statement | Current Statement |

|---|---|---|

| Monetary Policy Outlook | Adjusted language concerning inflation risks and growth prospects | More cautious tone regarding inflation pressures and growth stabilization |

| Economic Indicators | Highlighted robust job growth and inflation steadying | Pointed to cooling inflation and shifting labor market conditions |

| Market Stability Reassurance | Mentioned previous confidence in market resilience | Emphasized ongoing monitoring for future adjustments |

Summary

The Federal Open Market Committee comparison reveals critical shifts in the language and focus of policy statements, illustrating the Fed’s response to evolving economic indicators. The adjustments made highlight a careful consideration of future monetary policy as the economy continues to present varied challenges and opportunities. With this proactive approach, stakeholders are encouraged to keep abreast of these developments through official communications, particularly from Fed Chair Jerome Powell.