Federal Reserve Chair Candidates: Bessent Announces Interviews

The upcoming selection process for Federal Reserve chair candidates is generating significant interest as the White House prepares to interview an impressive lineup of contenders. Currently, there are 11 potential successors to Jerome Powell, each bringing unique expertise in shaping Fed monetary policy. Treasury Secretary Scott Bessent highlighted the administration’s eagerness for interest rate reductions, emphasizing the impact on the struggling U.S. housing market. Among the candidates are seasoned governors and renowned economists, indicating a diverse range of perspectives that could influence the future direction of the central bank. As these interviews kick off after Labor Day, the focus will undoubtedly be on selecting a leader who can effectively navigate the complexities of the economy in the years leading up to the 2025 Federal Reserve candidates’ crucial decision-making period.

As the search for the next leader of the Federal Reserve heats up, various contenders are emerging to potentially fill the influential role left by Jerome Powell. With a blend of capability and experience, these contenders include central bank officials and economic experts who will be scrutinized for their views on crucial issues like interest rate adjustments and monetary easing. The administration is particularly attentive to how these selections will impact key economic areas, especially amid pressures for fiscal reform and housing market revitalization. With interviews slated to start after Labor Day, anticipation grows regarding who will emerge as the frontrunner for this pivotal position. The selection of a new Fed chair is integral not only for monetary policy but also for broader economic health as the nation prepares for the challenges of 2025.

Candidates for the Federal Reserve Chair Position

As the search for viable Federal Reserve chair candidates heats up, Treasury Secretary Scott Bessent is set to begin interviews with a remarkable group of 11 contenders. This diverse pool includes current and former central bank officials, prominent economists, and experts with deep ties to Wall Street. The administration is responding to market pressures and the ongoing challenges faced by the U.S. economy, particularly within the housing market. This call for effective leadership comes at a pivotal time as the Federal Reserve prepares to navigate interest rate reductions that could impact both national inflation and economic growth.

Among the potential Fed chair candidates are names like Michelle Bowman, Christopher Waller, and Lorie Logan — individuals who bring a wealth of experience from within the institution. Additionally, White House economist Kevin Hassett and figures like Kevin Warsh are also in the mix. Their backgrounds suggest a balance of traditional monetary policy knowledge and fresh perspectives, which could be vital for adapting to the current economic landscape. The selection process is not merely about filling a position; it is about choosing a leader who aligns with the administration’s objectives of easing monetary policy to stimulate growth.

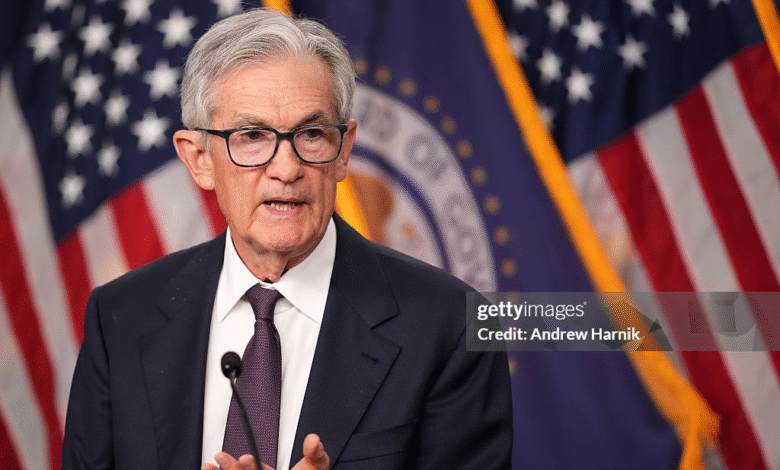

Jerome Powell’s Leadership and the Search for a Successor

Jerome Powell, the current Federal Reserve chair, has had a significant impact on U.S. monetary policy and economic direction since taking office. As his term approaches its end in May 2026, the search for his successor takes on urgent importance amidst calls for interest rate reductions. These reductions are seen as critical for alleviating pressures in the housing market and supporting broader economic recovery. The administration is eager to expedite this process, emphasizing the need for a candidate who not only understands the nuances of the Federal Reserve’s role but also can engage effectively in the shifting economic narrative.

Bessent’s comments regarding the selection process highlight the urgency to find a successor who can navigate the complexities of post-pandemic economic policies. The upcoming interviews will scrutinize candidates’ past experiences and their ability to devise strategies that support growth while contending with inflationary pressures. As Powell prepares for his final keynote address, many will be looking at how his legacy influences the qualities sought in candidates. The goal remains clear: to appoint a chair who is innovative yet prudent and capable of steering the Federal Reserve through a critical transitional period.

The Impact of Fed Monetary Policy on the Housing Market

The Federal Reserve’s monetary policy has profound implications for the U.S. housing market, particularly during economic downturns. Recent discussions led by Treasury Secretary Bessent emphasize the urgent need for easing measures to revitalise the sluggish housing sector. The ongoing low inventory of homes has driven prices up, straining affordability for potential buyers. A significant reduction in interest rates could facilitate new construction, thus increasing the supply and potentially stabilizing or lowering home prices.

Bessent’s observation about the long-term inflation risks associated with restrictive home building presents a critical argument for monetary easing. As inventory constraints become more pronounced, policymakers at the Fed may need to act decisively in favoring housing growth. A proactive approach to interest rate reductions could not only boost housing construction but also promote higher consumer spending, further invigorating the broader economy. The relation between Fed policy and housing outcomes will be pivotal as new candidates for chair are evaluated for their vision on balancing these economic elements.

Why Interest Rate Reduction is Essential According to Analysts

Market analysts widely agree that a strategic reduction in interest rates is essential for fostering economic activity, particularly in the housing market. With the recent sluggishness in housing sales and construction, experts argue that lower rates could ease credit strains on potential homebuyers, ultimately stimulating both demand and supply in the market. Bessent’s commitment to pursuing easier monetary policy signals a clear recognition of these challenges and the need for sustainable solutions that support economic growth.

Moreover, lowering interest rates could enhance market liquidity and reduce borrowing costs for consumers and businesses alike. Analysts are primarily focused on the interplay between fiscal policy and the Fed’s monetary stance, indicating that timely actions could significantly influence market conditions. The anticipated quarter-point reduction at the next policy meeting would be essential not only for housing but for promoting a more robust economic recovery that could potentially bring inflation under control.

Bessent’s Plan for Interviewing Fed Chair Candidates

Treasury Secretary Scott Bessent has detailed his upcoming plan to interview a diverse array of Federal Reserve chair candidates, slated to start shortly after Labor Day. This structured approach aims to critically assess potential successors and ensure the selection aligns with the administration’s monetary policy goals. Bessent’s commitment to an extensive interview process emphasizes the significance of each candidate’s understanding of the economic landscape, especially in the context of monetary easing strategies designed to support the ailing housing market.

With a pool of robust candidates featuring backgrounds from both traditional and innovative economic spheres, Bessent’s evaluation will focus on their readiness to tackle the challenges presented by the current economic climate. The chosen candidate will likely play a pivotal role in shaping the Fed’s response to evolving market conditions and reinforcing public confidence in the institution’s capacity to manage inflation while fostering growth. As the interviews unfold, expectations will hinge on who can best articulate a vision that meets the demands set forth by a recovering economy.

The Future of Fed Policy Post-Powell

As the Federal Reserve prepares to undergo a leadership transition with the impending end of Jerome Powell’s term, discussions about the future direction of Fed policy are growing more urgent. The selection of a new chair could signal a shift in monetary policy priorities, particularly regarding interest rate strategies and their implications for inflation management. With several identified candidates presenting a wide variety of views, the discussions surrounding their potential appointments are crucial in preparing for the next sensible steps in U.S. monetary policy.

Given the pressing need for interest rate reductions as articulated by Bessent, it is clear that the incoming Fed chair will need to prioritize economic recovery while managing inflationary concerns. The future leader must be equipped not only with technical monetary policy knowledge but also with a clear strategy for fostering stability in the housing market. Through innovative approaches, the next chair could significantly impact how the Fed balances growth with the challenges associated with achieving a stable economic environment.

Market Reactions to the Potential Chair Candidates

As news of the Federal Reserve chair candidates emerges, market reactions are becoming increasingly pronounced. Investors are particularly attuned to how the potential new chair might influence monetary policy, especially regarding interest rates and market stability. The prospect of a new chair steering the Fed towards a more easing-friendly standpoint has led to positive speculation in the housing and stock markets, anticipating that a focus on growth will replace the cautious tightening seen in previous years.

Market participants are closely monitoring statements made by Bessent and other administration officials regarding their priorities for the upcoming chair. Analysts are evaluating which candidates may be more aligned with easing policies that could stimulate borrowing and investment. The sentiment in financial markets suggests an increasingly optimistic outlook, reflecting a belief that effective leadership at the Fed can significantly foster an improved economic climate.

Timeline for Federal Reserve Chair Selection

The timeline for selecting the next Federal Reserve chair is critical, especially as Jerome Powell’s term comes to an end in May 2026. Bessent’s intention to begin interviews soon after Labor Day indicates a concerted effort to expedite the decision-making process. As the White House seeks to identify a candidate who can facilitate necessary interest rate reductions, the timeline becomes even more essential, tying closely to the forthcoming policy meeting scheduled for September.

During this period, the chosen candidate will need to quickly understand the urgency of implementing measures that support not only fiscal stability but also the recovery of the housing market. The implications of the decision will extend beyond mere personal qualifications; strategies concerning Fed monetary policy will need to align with evolving economic circumstances to safeguard future growth. Consequently, the upcoming weeks will be pivotal in shaping the monetary landscape as we look toward new leadership.

The Role of the Fed in Economic Recovery

The Federal Reserve has a crucial role in driving the U.S. economy toward recovery, especially in light of recent challenges faced by various sectors, including housing. With discussions about easing monetary policies taking center stage, the Fed’s approach under the new chair will be instrumental in shaping the trajectory of economic recovery efforts. By reducing interest rates, the Fed could facilitate increased spending and borrowing, essential aspects for stimulating growth.

Moreover, the Fed’s policies directly influence not only macroeconomic stability but also household financial health. As potential chair candidates are evaluated, the focus remains on selecting a leader who recognizes the interconnectedness of monetary policy and economic infrastructure. The incoming chair will have the responsibility of ensuring that the Fed’s actions support both recovery and long-term stability — a critical challenge as the country navigates the complexities of the post-pandemic economy.

Frequently Asked Questions

Who are the potential candidates for the Federal Reserve chair position in 2025?

The 2025 Federal Reserve chair candidates include a notable group of 11 individuals, featuring current governors like Michelle Bowman and Christopher Waller, Dallas Fed President Lorie Logan, and White House economist Kevin Hassett. Additionally, former governors such as Kevin Warsh and Larry Lindsey, along with market strategists Rick Rieder and David Zervos, also make the list.

What is the timeline for selecting a successor to Jerome Powell as Federal Reserve chair?

The selection process for Jerome Powell’s successor as Federal Reserve chair is set to begin shortly after Labor Day 2025. Treasury Secretary Scott Bessent has indicated that interviews will take place soon as the White House narrows the candidates down from the current pool of 11 potential nominees.

How might the new Federal Reserve chair influence monetary policy?

The incoming Federal Reserve chair will significantly impact Fed monetary policy, particularly in relation to interest rate reductions. With the administration’s push for easing measures to support the housing market, the new chair’s approach to interest rates will be critical in shaping economic conditions.

What role do interest rate reductions play in the Federal Reserve’s strategy?

Interest rate reductions are a central part of the Federal Reserve’s strategy to stimulate economic growth, especially in response to sluggish housing market conditions. Lowering rates can encourage borrowing and investing, which could help alleviate inflationary pressures in the long term.

What factors are influencing the decision for a new Federal Reserve chair?

The decision for a new Federal Reserve chair is influenced by several factors, including the need for interest rate reductions to boost the housing market and overall economic performance. The current administration is eager to expedite the selection process due to these pressing economic challenges.

What can we expect from Jerome Powell’s final address before the Federal Reserve chair transition?

In his final address before the transition of the Federal Reserve chair, Jerome Powell is expected to deliver insights during the Fed’s annual symposium, potentially discussing the outcomes of a five-year policy review and signaling intentions related to upcoming interest rate decisions.

How does the selection of the Federal Reserve chair affect the U.S. housing market?

The selection of the Federal Reserve chair can significantly impact the U.S. housing market through decisions on monetary policy and interest rates. A chair who advocates for easing measures could lead to lower borrowing costs, fostering increased home construction and sales, thus supporting the housing market.

| Key Points | Details |

|---|---|

| Interview Process | Starting after Labor Day with 11 candidates. |

| Treasury Secretary | Scott Bessent leads the candidate vetting process. |

| Candidate Pool | Includes current and former Fed officials, economists, and experts, such as Michelle Bowman and Kevin Warsh. |

| Monetary Easing | Administration seeks easing measures to boost the housing market. |

| Interest Rate Discussions | Upcoming Fed meeting expected to discuss first quarter-point reduction since December 2024. |

| Current Fed Chair’s Term | Jerome Powell’s term ends in May 2026, but the selection process is expedited. |

Summary

Federal Reserve chair candidates are being evaluated as the selection process gains momentum. Treasury Secretary Scott Bessent has confirmed plans to interview an impressive lineup of candidates, reflecting the urgency of monetary policy adaptations. With a total of 11 viable contenders, the administration emphasizes the necessity for monetary easing, which is deemed essential for reviving the stagnant housing market. As market conditions evolve, the anticipated outcomes of these interviews are critical in shaping the future of the Federal Reserve.