Federal Reserve Ends Crypto Crackdown with New Oversight

In a pivotal move for the cryptocurrency landscape, the Federal Reserve Ends Crypto Crackdown as it announces the termination of its Novel Activities Supervision Program. This significant policy shift allows banks to re-engage with digital assets under a more simplified regulatory framework, facilitating growth in fintech advancements nationwide. As the Fed reverts to its traditional approach to banking oversight, the implications of this change resonate widely within cryptocurrency news circles and among advocates for crypto regulations. By integrating its increased understanding of the unique risks associated with digital asset activities into its standard supervisory processes, the Federal Reserve is paving the way for a more balanced environment for banks and digital assets alike. The decision has already garnered praise from lawmakers and industry leaders, emphasizing the potential for a fairer financial ecosystem that encourages innovative developments in the crypto sector.

In recent developments, the Federal Reserve’s decision to end its stringent oversight on digital currencies marks a significant change in the landscape of financial technology and banking. This shift signifies a move away from intense supervision of crypto-related activities and a return to traditional regulatory practices, which may bolster the integration of cryptocurrencies within the broader financial system. Advocates for digital currency regulations see this as a vital step towards fostering an equitable environment for digital assets, while concerns about banking oversight and financial innovation remain present. As the industry evolves, the interplay between fintech advancements and traditional banking models will be key in shaping the future of cryptocurrency and its regulation. The recent announcement is not only a milestone for financial regulators but also reflects the growing acceptance of digital assets in mainstream finance.

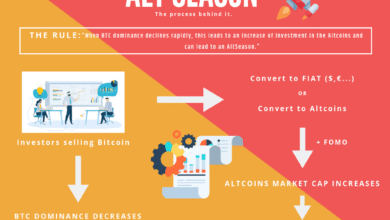

Impact of Fed Ending Crypto Crackdown Program

The decision by the Federal Reserve to end its Novel Activities Supervision Program has significant implications for the cryptocurrency market and banking sector. This shift back to customary supervisory processes aims to reintegrate digital asset supervision without compromising the understanding of associated risks. By terminating the targeted scrutiny of banks’ involvement with digital assets, the Fed is signaling a more welcoming approach to innovation within financial services. This could lead to increased participation from traditional banks in the crypto space, which previously faced tighter restrictions and oversight.

Industry proponents argue that this change will not only facilitate fintech advancements but also promote a healthier competitive environment for cryptocurrencies. With banks no longer facing stringent regulations specifically for digital assets, they can more freely establish services like crypto custody and stablecoin issuance. This could potentially lead to greater consumer access to digital assets while ensuring that regulatory frameworks remain effective in managing the unique risks associated with these innovations.

The Role of Banking Oversight in Crypto Regulations

Banking oversight plays a crucial role in regulating cryptocurrencies and ensuring that the financial system remains stable. As the Fed shifts its approach, the implications for existing and future crypto regulations are profound. The decision to revert to standard supervisory processes means that any new fintech advancements will be incorporated into the broader regulatory framework, ensuring that banks maintain adequate risk management practices. This change is expected to foster a proactive environment for innovation in digital assets while still providing a supervisory safety net.

Furthermore, integrating digital asset supervision within traditional banking oversight can foster greater alignment between regulatory expectations and industry practices. It allows regulators to leverage their existing knowledge and tools while monitoring banks’ digital asset activities. By streamlining the oversight process, the Federal Reserve aims to maintain regulatory equality among financial institutions, addressing concerns raised by lawmakers and ensuring that the evolving landscape of digital assets is adequately managed.

Fintech Advancements Amid Easing Crypto Regulations

With the Federal Reserve’s recent decision to ease its oversight of cryptocurrencies, fintech companies stand to gain significantly. The removal of heightened scrutiny implies that these firms can now collaborate more readily with banks to develop cryptocurrency-based services that enhance customer experiences. This collaboration could pave the way for innovative applications, including decentralized finance platforms, tokenized assets, and improved payment systems that integrate digital currencies.

Moreover, easing regulations can attract new investments into the fintech sector, as businesses seeking to enter the digital asset market may find it easier to establish partnerships with traditional banks. The potential for growth in this sector not only benefits financial institutions but also provides consumers with more options and access to digital financial services. This mutually beneficial relationship between banks and fintech firms can foster a more vibrant ecosystem for cryptocurrency activities.

Support from Lawmakers and Financial Services Committee

The Federal Reserve’s decision to conclude its specialized oversight program has garnered significant support from lawmakers and industry advocates alike. U.S. Senator Cynthia Lummis expressed her approval, stating that it marks a victory for creating a more favorable environment for cryptocurrencies. Her comments underscore a growing bipartisan consensus that emphasizes the importance of recognizing the role of digital assets in the financial landscape. This support is crucial as it reflects the desire within Congress to balance innovation with regulatory oversight.

Additionally, the House Financial Services Committee echoed these sentiments, commending the Fed’s decision. They acknowledged concerns regarding the potential drawbacks of heightened surveillance and expressed optimism for a more integrated approach to digital asset supervision. This backing from legislative bodies indicates a strategic shift towards fostering a digitial asset-friendly regulatory environment that aligns with the evolving nature of finance.

Concerns Over Consumer Protections in Digital Assets

While the end of the crypto crackdown program is widely praised, some regulatory experts caution that it could lead to potential gaps in consumer protections. With fintech advancements on the rise, there is legitimate concern regarding the oversight of innovative banking practices associated with digital assets. Critics argue that reverting to a standard supervision framework might not provide sufficient safeguards against risks unique to cryptocurrency trading and investment, potentially exposing consumers to unforeseen vulnerabilities.

These concerns highlight the delicate balance regulators must strike between promoting innovation and ensuring adequate consumer protection. While advocates believe that unified regulation will promote equality, experts warn that without specific oversight tailored to the unique characteristics of digital assets, consumers may be left without the necessary safeguards in an increasingly complex financial landscape.

Regulatory Equality in the Evolving Crypto Landscape

The Federal Reserve’s decision to rescind the focused supervision of cryptocurrency marks a pivotal moment for regulatory equality in financial services. By incorporating crypto oversight back into standard banking processes, the Fed aims to ensure that all institutions engage with digital assets on a more level playing field. This approach is anticipated to mitigate risks while allowing banks to innovate without unnecessary burdens, thus aligning with the overall goal of fostering a thriving digital asset ecosystem.

Furthermore, achieving regulatory equality is essential for maintaining consumer trust and stability within the market. As banks and fintech companies expand their digital offerings, establishing clear and consistent regulations will help eliminate confusion among consumers regarding the safety of their investments in cryptocurrencies. Through this unified oversight, the Federal Reserve seeks to create an environment where innovation can flourish alongside robust protective measures.

Future Outlook for Cryptocurrency Supervision

Looking ahead, the future of cryptocurrency supervision appears poised for significant evolution in light of the Federal Reserve’s recent changes. As digital assets continue to integrate further into mainstream finance, regulatory frameworks will need to adapt to accommodate these changes. The Fed’s shift to standard supervision suggests an intent to cultivate a more dynamic regulatory environment, one that is responsive to the rapidly evolving nature of digital currencies and associated technologies.

The ongoing dialogue among policymakers, regulatory bodies, and industry stakeholders will play a crucial role in shaping the future landscape of cryptocurrency regulations. Continuous engagement will be necessary to address emerging challenges while supporting innovation. As fintech advancements accelerate, it is imperative that regulatory frameworks evolve in tandem to protect consumers and nurture a thriving environment for digital assets.

The Importance of Collaboration Between Regulators and Industry

As the Federal Reserve transitions away from specialized crypto oversight, the importance of collaboration between regulators and industry players cannot be overstated. Close cooperation will enable regulators to better understand the unique risks associated with digital assets while allowing fintech companies to voice their concerns and insights. This partnership can facilitate the development of forward-thinking regulations that promote innovation without compromising consumer protections.

Furthermore, fostering an open dialogue enhances the potential for shared solutions to common challenges faced by the industry. By working together, regulators and financial institutions can identify best practices in managing the risks inherent to cryptocurrencies and devise strategies to ensure a stable and secure financial environment. Ultimately, such collaboration will create a more sustainable framework for the growth and development of digital asset markets.

Evolving Trends in Cryptocurrency Adoption and Regulations

As the Federal Reserve’s initiatives continue to reshape the regulatory landscape, evolving trends in cryptocurrency adoption are increasingly evident. The loosened regulations are likely to spur greater interest from both consumers and institutional investors, creating an environment conducive to broader societal acceptance of digital assets. The significant shift back to standard supervision suggests that regulatory bodies recognize the importance of adapting to the evolving nature of financial technologies.

Additionally, the intertwining of cryptocurrency with traditional banking practices highlights a trend towards convergence, where financial technologies and regulatory standards become more integrated. As banks begin to embrace innovation in the realm of digital assets, regulatory authorities must remain vigilant to ensure they adequately address potential risks while encouraging growth. This delicate balance will be pivotal in determining the trajectory of cryptocurrency’s place in the global economy.

Frequently Asked Questions

What does the ending of the Federal Reserve’s crypto crackdown mean for digital assets supervision?

The Federal Reserve’s decision to end its Novel Activities Supervision Program signifies a shift back to standard banking oversight for cryptocurrency activities. This change allows banks to engage more freely with digital assets, promoting fintech advancements while still ensuring that risks are properly managed under familiar regulatory frameworks.

How will the Federal Reserve’s termination of the crypto crackdown impact fintech advancements?

By dismantling its crypto crackdown, the Federal Reserve is fostering an environment conducive to fintech advancements. Banks can now innovate with digital assets without the stringent oversight previously imposed, which encourages new technologies and services that can enhance the financial ecosystem.

What are the implications of the Federal Reserve’s move on cryptocurrency news?

The Federal Reserve’s conclusion of the crypto crackdown is a pivotal moment in cryptocurrency news. It signals a more open regulatory approach that could boost investor confidence and increase market participation, as banks can now more readily explore opportunities in the digital asset space.

Does the Federal Reserve’s end of the crypto crackdown indicate changes in crypto regulations?

Yes, the Federal Reserve’s decision to end its targeted oversight of crypto indicates a shift in crypto regulations. The transition back to standard supervisory processes aims to create a balanced regulatory environment that supports innovation while maintaining adequate risk management.

What does the shift in Federal Reserve banking oversight mean for the future of cryptocurrency?

The shift in Federal Reserve banking oversight from a focused crypto crackdown to standard supervision could enhance the future of cryptocurrency by allowing banks to develop innovative digital asset solutions without heavy regulatory burdens, fostering a more dynamic and competitive market.

How might this change affect banks’ involvement in cryptocurrency activities?

With the Federal Reserve ending the crypto crackdown, banks are expected to increase their involvement in cryptocurrency activities. The simplified regulatory framework will likely encourage more financial institutions to innovate with digital assets, leading to a more integrated digital economy.

What do lawmakers say about the Federal Reserve ending the crypto crackdown?

Lawmakers have generally praised the Federal Reserve’s decision to end the crypto crackdown. For instance, Senator Cynthia Lummis highlighted it as a victory for transitioning to a fair regulatory environment for digital assets, while the House Financial Services Committee commended the move as a step towards supporting a vibrant digital asset ecosystem.

Are there any concerns related to the end of the Federal Reserve’s crypto crackdown?

Yes, some regulatory experts express concerns that ending the specific oversight might weaken consumer protections as fintech adoption increases. They argue that while fostering innovation is crucial, it is equally important to ensure that adequate regulatory safeguards remain in place for digital assets.

| Key Point | Details |

|---|---|

| End of Crypto Crackdown | The Federal Reserve has terminated its Novel Activities Supervision Program, ending the focused oversight on cryptocurrency. |

| Shift in Oversight | The Fed will revert oversight of cryptocurrency banking activities back to its standard supervisory processes, simplifying regulations. |

| Support from Lawmakers | The decision received support from U.S. Senator Cynthia Lummis and the House Financial Services Committee, viewing it as a means to foster a fair digital asset environment. |

| Concerns Raised | Regulatory experts worry that relaxing oversight may weaken protections as fintech adoption increases. |

| Potential for Growth | Supporters believe that unified regulation under standard supervision is essential for growth and ensuring fairness in the regulatory landscape. |

Summary

The Federal Reserve ends crypto crackdown, marking a significant shift in the regulatory landscape for digital assets. This decision not only allows banks to re-engage with cryptocurrency under less stringent oversight but also symbolizes a broader acceptance of fintech innovations. While there are concerns regarding the potential for weakened protections, the overarching sentiment is one of optimism as advocates push for a thriving digital asset ecosystem. The move aims to streamline banking activities involving cryptocurrencies, enhance efficiency, and support the integration of digital assets within the traditional financial framework.