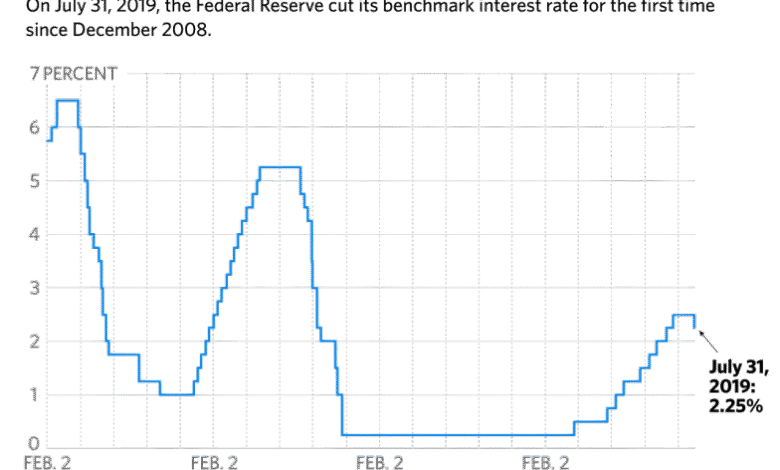

Federal Reserve Interest Rate Cuts: What to Expect Next

Federal Reserve interest rate cuts are a hot topic right now, as market participants anticipate the Federal Open Market Committee’s (FOMC) next meeting. With speculation swirling about potential interest rate decisions, analysts are paying close attention to the evolving landscape. Fed Chair Jerome Powell’s commentary on interest rates will heavily influence expectations, especially as the CME Fedwatch tool indicates fluctuating chances for adjustments in the upcoming months. Predictions suggest that while immediate cuts are unlikely, the odds of a decrease in rates rise substantially later in the year. This ongoing uncertainty highlights the pivotal role that the central bank plays in shaping economic conditions and monetary policy.

As global financial markets brace for impending changes, central bank rate cuts are under intense scrutiny, particularly in the context of the upcoming Federal Open Market Committee (FOMC) meeting. Investors and analysts are keenly observing the decisions of key monetary authorities, with Fed Chair Powell’s insights on interest rate forecasts garnering significant attention. Projections derived from various prediction markets indicate a cautious approach towards any immediate reductions, yet the outlook hints at potential shifts in monetary policy in the latter half of the year. The CME Fedwatch tool is instrumental in gauging market sentiment, reflecting the intricacies of monetary policy adjustments. Understanding these dynamics is crucial for anyone invested in or analyzing the economy’s trajectory.

Understanding Federal Reserve Interest Rate Cuts

Federal Reserve interest rate cuts play a crucial role in shaping economic conditions across the United States. As the central bank adjusts rates, it aims to influence inflation, employment levels, and overall economic growth. When the Fed cuts rates, consumer borrowing becomes cheaper, thereby encouraging spending and investment. This, in turn, can help stimulate economic activity in periods of slowed growth or recession. Investors and economists closely monitor these changes, as they can signal broader shifts in the economic landscape.

In the current climate, the anticipation of Federal Reserve interest rate cuts is palpable among market watchers. As we wait for the Federal Open Market Committee (FOMC) to meet in September, many analysts are already weighing the potential impacts of such cuts on various sectors. The decisions made during these meetings are influenced by macroeconomic indicators, including inflation rates, job growth, and overall economic performance, which keep global markets on edge.

Frequently Asked Questions

What are the current FOMC predictions regarding Federal Reserve interest rate cuts?

As of now, the FOMC has indicated a low probability of immediate Federal Reserve interest rate cuts. Current projections suggest that any cuts may not materialize until the upcoming meetings later in the year, with odds for a July cut standing at only 14.5% according to the CME Fedwatch tool.

How does the CME Fedwatch tool inform us about future Federal Reserve interest rate decisions?

The CME Fedwatch tool provides valuable insights into market expectations regarding Federal Reserve interest rate cuts. Currently, it shows a 57.6% chance for a quarter-point cut by the September meeting, reflecting traders’ forecasts based on economic conditions and Federal Reserve guidance.

What role does Fed Chair Jerome Powell play in Federal Reserve interest rate decisions?

Fed Chair Jerome Powell is instrumental in shaping Federal Reserve interest rate decisions, as he leads discussions during FOMC meetings. His statements and outlook on the economy significantly influence market expectations and the potential for rate cuts.

Are traders expecting any Federal Reserve interest rate cuts in October?

Yes, there are expectations for Federal Reserve interest rate cuts in October. The CME Fedwatch tool currently estimates a 45.3% probability of a quarter-point cut, reflecting the market’s ongoing assessment of economic data and the central bank’s position.

What factors are influencing FOMC’s approach to Federal Reserve interest rate cuts this year?

FOMC’s approach to Federal Reserve interest rate cuts is influenced by various factors, including inflation trends, economic growth forecasts, and global market conditions. Traders are currently cautious, with prediction markets indicating uncertainty about imminent cuts.

How do market predictions affect Federal Reserve interest rate cuts?

Market predictions, particularly those from tools like CME Fedwatch and platforms such as Polymarket, directly affect perceptions of Federal Reserve interest rate cuts. These predictions signal trader sentiment and can inform the FOMC’s decisions based on economic indicators.

What is the likelihood of a half-point Federal Reserve interest rate cut in 2023?

As of June 16, the chances of a half-point Federal Reserve interest rate cut stand at 33.8%, according to the CME Fedwatch tool. Although it remains a possibility, it reflects a somewhat cautious market outlook compared to the probability of a quarter-point cut.

| Key Point | Details |

|---|---|

| FOMC Meeting Date | June 18, 2023 |

| Current Interest Rate Cut Odds | Odds of a quarter-point cut this month are at 0.1%. |

| Predicted Rate Cut in July 2025 | 14.5% chance of a quarter-point decrease. |

| September Rate Cut Probabilities | 57.6% chance of a 25 bps cut; 8.8% for half-point adjustment. |

| October Rate Cut Chances | 45.3% chance of a quarter-point cut; 33.8% for a 50 bps cut. |

| Market Sentiment | Majority expect no change in September meeting (55%), with 40% expecting a cut. |

| Traders on Polymarket | Doubling down on low odds for rate cuts, with a mere 1% expecting an increase. |

| Fed Chair’s Future | 10% chance of dismissal for Jerome Powell this year. |

Summary

Federal Reserve interest rate cuts are a significant focus as markets brace for the FOMC meeting on June 18, 2023. With current odds indicating minimal chances of a rate cut this month, attention shifts to the growing probabilities of cuts in the upcoming months, particularly in September. Market predictions suggest a 57.6% likelihood of a quarter-point cut, signaling potential shifts in monetary policy. As traders speculate on the Federal Reserve’s next moves, it remains crucial to monitor these developments closely for their broader implications on the economy.