Federal Reserve Interest Rates: What You Need to Know Now

Federal Reserve interest rates play a crucial role in shaping the economic landscape, influencing everything from consumer spending to investment decisions. Recently, Federal Reserve Chair Jerome Powell has signaled that there will be no quick cuts to these benchmark rates, despite pressures from high inflation and credit card debt. As rates remain elevated, individuals are seeking ways to maximize their savings through high-yield savings accounts and money market accounts. Understanding the implications of these rates can help consumers make informed financial choices and navigate their obligations effectively. In a time where interest rate cuts don’t seem imminent, learning how to adapt to the Fed’s monetary policy is essential for managing finances wisely.

In discussions surrounding the Federal Reserve’s monetary policy and economic strategies, interest rates serve as pivotal indicators of financial health. Chair Jerome Powell’s stance on maintaining high benchmark rates reflects a cautious approach amid fluctuating economic conditions, and it directly impacts borrowers who grapple with escalating credit card interest. Exploring alternatives like attractive savings vehicles or risk mitigation strategies can empower consumers facing the consequences of protracted high rates. The ongoing dialogue about rate adjustments underscores the need for financial literacy in understanding the dynamics of borrowing and saving. As the Federal Reserve evaluates its next steps, being agile in managing personal finance becomes increasingly important for navigating the current economic climate.

Understanding Federal Reserve Interest Rates and Their Impact

Federal Reserve interest rates play a crucial role in shaping the financial landscape of the American economy. When the Fed adjusts its benchmark interest rate, it influences everything from consumer loans to savings deposits. Currently, Federal Reserve Chair Jerome Powell has indicated that interest rates will likely remain elevated for an extended period. As a result, consumers may experience higher costs of borrowing, leading to increased interest rates on credit cards, auto loans, and mortgages. This environment can create challenges for those looking to manage their finances effectively, especially individuals with existing debts.

As the Fed holds off on any imminent cuts to the interest rate, borrowers need to be proactive in addressing their financial situations. Keeping an eye on Federal Reserve announcements is wise, as shifts in monetary policy directly impact market conditions. While waiting for a rate cut might seem ideal, consumers could deprive themselves of opportunities to save on interest costs by not taking immediate action. In essence, understanding Federal Reserve interest rates is vital for making informed financial decisions, especially during uncertain economic times.

Strategies to Manage High Credit Card Debt

With average credit card interest rates hovering above 20%, managing high credit card debt has become increasingly crucial. Experts suggest that rather than waiting for the Federal Reserve to cut interest rates, consumers should focus on eliminating their high-interest debts. One effective strategy is to consider transferring balances to a 0% interest credit card. This approach can help reduce the financial burden significantly, allowing borrowers to pay down their principal without accruing further interest.

Moreover, consolidating credit card debt through a lower-rate personal loan is another viable option for those struggling with high interest. Taking proactive measures can lead to substantial savings in interest payments over time, thus improving one’s overall financial health. While it might be tempting to rely on projections of future rate cuts by the Federal Reserve, taking action now can prevent further accumulation of debt and encourage a healthier credit score.

Taking Advantage of High-Yield Savings Accounts

As interest rates remain high, consumers should consider maximizing their returns by investing in high-yield savings accounts and money market accounts. With Federal Reserve interest rates expected to eventually decrease, now is the optimal time to lock in better returns on savings. By opening a high-yield account today, individuals can benefit from higher interest earnings, which can provide a stronger financial cushion for the future.

Experts warn that once the Federal Reserve does cut rates, the yield on these savings vehicles could drop significantly. Therefore, making a move to secure a favorable interest rate now is crucial for anyone looking to enhance their savings. This proactive approach not only helps in accumulating wealth but also instills disciplined saving habits that can yield long-term financial stability.

Improving Your Credit Score During Economic Uncertainty

In times of high-interest rates, having a solid credit score is more important than ever. Higher credit scores typically lead to better loan terms and reduced interest rates. However, recent trends indicate that many consumers may see their credit scores decline due to increasing debt levels and missed payments. Focusing on strategies to improve credit scores can provide significant benefits, especially in a high-rate environment where every percentage point in interest can make a difference.

To elevate your credit score, individuals should begin by paying off outstanding debts, ensuring timely payments, and reviewing their credit reports for inaccuracies. Regularly monitoring one’s credit score and taking small, consistent actions can lead to improvement over time. By enhancing their credit profiles, consumers not only open doors to lower interest rates but also gain more favorable access to various financial products, which is especially valuable during a period of high borrowing costs.

The Future of Interest Rate Cuts and Economic Indicators

The debate around future interest rate cuts has gained traction among economists and consumers alike. With economic indicators such as inflation and employment rates fluctuating, the Federal Reserve’s approach remains cautious. Market experts suggest that a rate cut is unlikely in the immediate future, especially with the current uncertainty surrounding trade policies and fiscal strategies. Understanding these dynamics can help consumers prepare for potential changes in borrowing costs.

As the Federal Reserve observes various economic indicators, it remains committed to ensuring that monetary policy is aligned with the overall health of the economy. This proactive stance means that while consumers can hope for rate cuts, they should simultaneously prepare for continuing high rates that may impact their borrowing decisions. By staying informed and adaptable, individuals can navigate this landscape more effectively.

Leveraging Financial Tools Amidst High Rates

In a high-interest rate environment, consumers need to leverage financial tools effectively to optimize their financial situation. Creating a budget that accounts for higher borrowing costs is essential. Individuals can use budgeting apps or financial software to track their spending and allocate funds towards paying off debts, especially those with high interest.

Additionally, exploring various investment opportunities, including stocks or bonds, can prove beneficial even when interest rates remain elevated. This diversification not only helps mitigate risks associated with borrowing but may also provide additional revenue streams to assist in credit card payments and savings goals.

Maximizing Returns Through Savings Investments

With the market anticipating a future cut in Federal Reserve interest rates, now is the time to maximize returns through savings investments. High yield savings accounts and money market accounts are particularly appealing when the interest rates offered are favorable. These savings vehicles provide opportunities to earn substantial interest compared to traditional savings accounts, making them ideal for those looking to grow their finances.

Investing in certificates of deposit (CDs) can also offer competitive rates, allowing consumers to secure higher returns on their savings. By committing to longer terms, individuals can take advantage of elevated rates without fear of a downturn in earnings due to future Fed cuts. Striking a balance between liquidity and interest gains is essential, particularly in an ever-changing economic climate where financial stability is paramount.

Strategic Planning for Financial Health with High Rates

Planning financial strategies in an environment of high interest rates requires consideration of various aspects of an individual’s financial health. Creating a comprehensive financial plan should include analyzing income sources, expenses, and outstanding debts. With guidance from financial advisors, individuals can formulate actionable steps to improve their financial standing without waiting for favorable conditions to be set by the Federal Reserve.

Moreover, education around personal finance tools and debt repayment strategies helps individuals feel more empowered in difficult economic climate. Understanding the implications of high interest rates—and taking informed decisions around personal spending, saving, and borrowing—will lead to improved stability and preparedness for future market changes, all while prioritizing financial wellness.

Navigating the Challenges of High Borrowing Costs

Navigating the challenges that come with high borrowing costs requires diligence and strategy. As consumers face elevated interest rates, particularly on credit cards and loans, it is crucial to reassess financial commitments and prioritize paying off high-interest debts. Developing a payment plan that focuses on the most expensive debts first can lead to savings on interest in the long run.

Additionally, understanding the diverse options available in the financial market can help consumers make informed choices about refinancing existing debt or switching to lower-rate loans. Maintaining communication with lenders to negotiate more favorable terms is another step that can alleviate some of the pressure during high-rate periods. By staying proactive and informed, consumers can better manage the impacts of these economic challenges.

Frequently Asked Questions

What is the current position of Federal Reserve Chair Jerome Powell on interest rate cuts?

Federal Reserve Chair Jerome Powell has stated that the Fed is not in a hurry to cut its benchmark interest rates. Current economic data suggests that interest rate cuts are not imminent, especially with many economic indicators displaying mixed signals.

How do Federal Reserve interest rates impact credit card debt?

The Federal Reserve’s interest rates directly influence borrowing costs, including credit card debt. With average credit card interest rates currently above 20%, higher rates mean that carrying a balance can become very expensive. Borrowers are advised to reduce credit card debt now before potential economic changes affect rates further.

How can I leverage high yield savings accounts with current Federal Reserve interest rates?

With Federal Reserve interest rates remaining high, now is a good time to secure a high-yield savings account. Once rates are cut by the Fed, returns on savings accounts and money market accounts are expected to decrease, so locking in better rates now is advisable.

What are the prospects for interest rate cuts by the Federal Reserve according to the CME Group’s FedWatch tool?

The CME Group’s FedWatch tool indicates that there is virtually no chance of an interest rate cut at the next Federal Reserve meeting, with less than a 25% probability for a cut in July 2024. This suggests that rates are likely to stay high for an extended period.

What impact does the Federal Reserve’s benchmark rate have on personal loans?

The Federal Reserve’s benchmark interest rate significantly influences personal loan rates. As the Fed maintains high rates, borrowers may face elevated costs for personal loans, making it essential to explore options like consolidation or balance transfers to manage expenses.

How can consumers reduce their credit card debt with high Federal Reserve interest rates?

Consumers can actively reduce their credit card debt by opting for 0% interest balance transfer cards or consolidating their debts with lower-rate personal loans. This mitigation is crucial, especially when Federal Reserve interest rates are elevated and unlikely to decrease soon.

Why is it important to enhance your credit score amid high Federal Reserve interest rates?

Enhancing your credit score is crucial during times of high Federal Reserve interest rates because those with higher scores are more likely to qualify for lower loan rates. A strong credit profile can provide significant savings on borrowing costs across various credit products.

When is the Federal Reserve’s next meeting regarding interest rates?

The next Federal Reserve meeting regarding interest rates is scheduled for September 2024, and many analysts predict that rate cuts will not be considered until there is greater clarity in the economic outlook.

What alternatives exist for saving with high interest rates from the Federal Reserve?

Consumers looking for alternatives to traditional savings accounts can explore high-yield savings accounts and money market accounts, which currently offer better returns due to the elevated Federal Reserve interest rates.

How do high Federal Reserve interest rates affect mortgage costs?

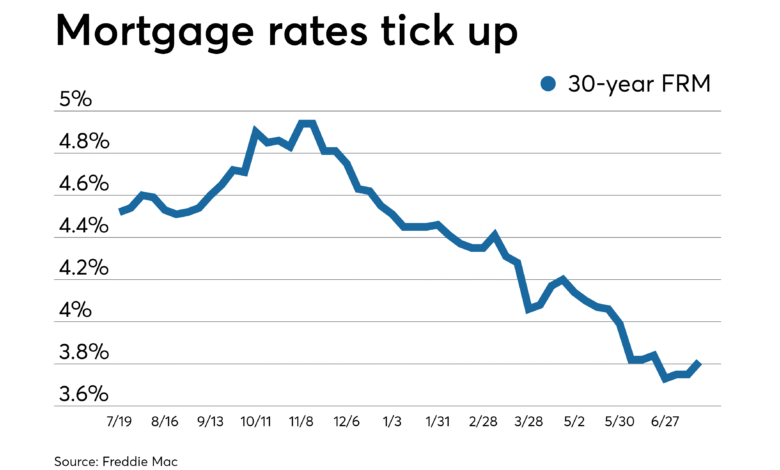

High Federal Reserve interest rates can lead to increased mortgage costs. This means current homeowners looking to refinance may face higher rates, making it vital to act before the Fed adjusts its rates downward.

| Key Point | Details |

|---|---|

| Federal Reserve’s Position | Fed Chair Jerome Powell has indicated that cuts to benchmark interest rates are not expected soon. |

| Economic Conditions | Policymakers are awaiting more clarity on fiscal and trade policies before considering rate changes. |

| Current Federal Funds Rate | Targeted between 4.25%-4.5% since December 2024, with no imminent cuts expected. |

| Interest Rate Impact | High rates affect borrowing costs for consumers, impacting loans, credit cards, and savings rates. |

| Consumer Recommendations | 1. Pay off credit card debt. 2. Secure a high-yield savings rate. 3. Enhance your credit score. |

Summary

Federal Reserve interest rates play a crucial role in the economy, influencing everything from consumer loans to credit card costs. Currently, the Federal Reserve’s stance reflects a careful evaluation of economic conditions, with no immediate interest rate cuts expected. Consumers are advised to take proactive measures to manage their finances amid these high rates, such as paying down credit debt and securing better savings rates. As the economic landscape evolves, staying informed about the Federal Reserve’s policies will be key to navigating personal finance decisions.