Federal Reserve Policy Impact on Markets Next Week

Federal Reserve policy will take center stage next week as market participants keenly await insights from the annual Jackson Hole Symposium. This pivotal gathering will bring together central bank officials to dissect crucial economic policies, with Fed Chair Jerome Powell’s remarks scrutinized for potential signals on forthcoming interest rate cuts. The current economic landscape has sparked optimism, prompting a bullish rally in sectors like small and mid-cap stocks, which have historically lagged behind large-cap equities. Notably, the anticipation of rate cuts is seen as a catalyst supporting the turnaround in both healthcare and other underperforming sectors amidst rising market volatility. As investors brace for Powell’s address, the implications of these monetary strategies on overall economic policy remain paramount, especially in a market that has relied heavily on just a few major players for its gains in recent times.

As discussions unfold in the realm of central banking, the focus moves towards monetary strategies and their influence on market dynamics. In the upcoming weeks, analysts will closely evaluate the Federal Reserve’s economic direction, particularly in light of anticipated adjustments to interest rates and their cascading effects on various market segments. The spotlight on the Jackson Hole gathering is not just a mere event; it’s a crucial opportunity for insights that could impact the performance of small and mid-cap stocks alongside major financial indices. With the backdrop of ongoing discussions about economic stability and investor sentiment, the importance of prudent economic policy cannot be overstated. Observers will be vigilant for hints at the Fed’s future trajectory, especially given the current climate of market uncertainty.

Understanding the Federal Reserve’s Role in Economic Policy

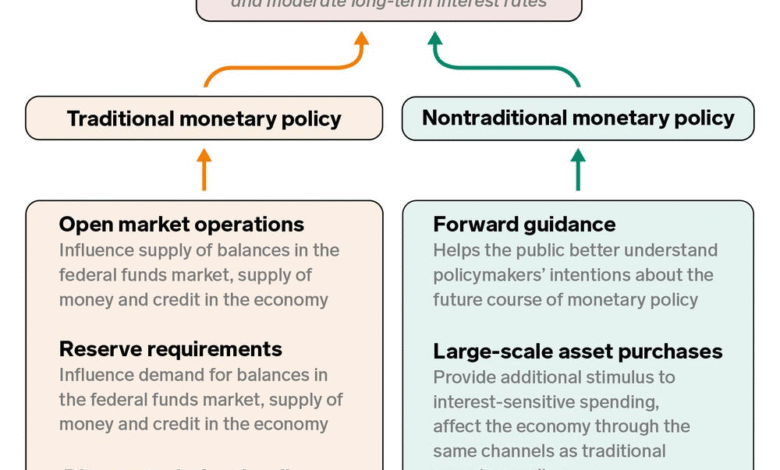

The Federal Reserve plays a pivotal role in shaping the economic landscape of the United States through its monetary policy decisions. By adjusting interest rates, the Fed influences lending and investment in the economy. With the annual Jackson Hole Symposium approaching, market participants are keenly awaiting insights from Fed Chair Jerome Powell. Analysts speculate that Powell’s remarks could signal upcoming shifts in policy, particularly concerning interest rate cuts which are anticipated to support economic growth and bolster overall market performance.

This year’s symposium is particularly significant as it marks a period of uncertainty in economic policy. With inflationary pressures being a key concern, the Fed’s approach to interest rates will affect various market sectors, including small and mid-cap stocks. Historically, when the Fed signals potential rate cuts, it can lead to a surge in these stocks, especially if investors anticipate an economic environment that favors growth. The discussions at Jackson Hole could provide a roadmap for how the Fed plans to navigate the delicate balance between curtailing inflation and fostering an environment conducive to investment.

The Implications of Interest Rate Cuts on Market Sectors

Interest rate cuts have a profound impact on various market sectors, particularly small and mid-cap stocks that often rely on accessible capital for growth. When rates are lowered, borrowing costs decrease, stimulating investment in expansion for these companies. As evidenced by the recent performance of the Russell 2000, which rose over 3% ahead of the Jackson Hole Symposium, markets are responding positively to the speculation of rate cuts. This uptick not only reflects confidence in the economic policy but also highlights market participants’ expectations for future growth.

Moreover, sectors that have historically lagged, such as healthcare, have begun to show resilience in anticipation of these policy changes. With healthcare being the top-performing S&P 500 sector, increasing nearly 5%, it’s clear that investors are reassessing their strategies in light of potential Fed actions. If the Fed continues to signal a dovish stance on interest rates, it could lead to a broader recovery in underperforming sectors, enhancing the overall market sentiment and reducing volatility.

Frequently Asked Questions

What is the significance of the Jackson Hole Symposium for Federal Reserve policy?

The Jackson Hole Symposium is a pivotal event for Federal Reserve policy, where central bank officials gather to discuss economic strategies. Fed Chair Jerome Powell’s insights during this symposium can provide clues about future interest rate moves, which can influence market expectations and economic policy.

How might interest rate cuts affect small and mid-cap stocks according to Federal Reserve policy forecasts?

Anticipation of interest rate cuts generally boosts small and mid-cap stocks, as these sectors often benefit from lower borrowing costs. According to recent Federal Reserve policy discussions, if interest rate cuts are confirmed, they can help small and mid-cap stocks outperform large-cap counterparts, especially during economic recovery phases.

What role does economic policy play in market volatility as per Federal Reserve announcements?

Federal Reserve economic policy significantly influences market volatility. When the Fed announces changes to interest rates, it can lead to uncertainty and fluctuations in stock prices. The markets tend to react strongly to any hints regarding future economic policy from the Fed, as seen during events like the Jackson Hole Symposium.

What insights can be drawn from market performance leading up to the Federal Reserve’s meetings on interest rate policy?

Leading up to the Federal Reserve’s meetings, particularly following the Jackson Hole Symposium, markets may show increased performance in sectors like healthcare and small-cap stocks if interest rate cuts are anticipated. This reflects investor sentiment that economic policies may favor growth and stability.

Why is the independence of the Federal Reserve important in shaping economic policy?

The independence of the Federal Reserve is crucial for maintaining unbiased and effective economic policy. It helps in making decisions free from political pressures, thus ensuring that interest rate decisions are based on economic needs rather than external influences, a topic of debate especially with evolving leadership discussions.

How do the Fed’s communications at events like Jackson Hole affect investor strategies?

Communications from the Fed at events like Jackson Hole directly impact investor strategies by providing insights into future interest rate direction and economic policy. Investors adjust their portfolios based on these clues, which can lead to increased market activity and shifts in stock preferences.

What implications do anticipated Federal Reserve interest rate cuts have for economic growth?

Anticipated interest rate cuts from the Federal Reserve can stimulate economic growth by making borrowing cheaper, thereby encouraging spending and investing. Such cuts signal to the market that the Fed is focused on supporting economic expansion, which can lead to improved performance, especially in small and mid-cap sectors.

How does market volatility evolve with changing Federal Reserve policy announcements?

Market volatility often escalates with changing Federal Reserve policy announcements, particularly regarding interest rates. Investors react to positive or negative signals regarding the economy, leading to fluctuations in stock prices, especially during significant events like the Jackson Hole Symposium.

| Key Points | Details |

|---|---|

| Federal Reserve Policy Focus | The Federal Reserve policy will be a major focus next week as officials gather for the annual economic symposium in Jackson Hole. |

| Market Performance | The Russell 2000 has risen over 3%, and the healthcare sector leads S&P 500 with nearly 5% growth. |

| Interest Rate Expectations | Anticipation of interest rate cuts could continue the turnaround of underperforming sectors. |

| Market Outlook | Market performance may vary, with speculation over small and mid-cap stocks potentially outperforming large-cap stocks. |

| Upcoming Events | Fed minutes and earnings reports from major retailers will provide insights into consumer spending. |

| Governor’s Remarks | Analysts expect Powell to be cautious about interest rate discussions due to macroeconomic challenges. |

| Potential Candidates for Fed Chair | Discussions about Fed independence arise as some candidates advocate for aggressive rate cuts. |

| Economic Events Calendar | Key events include Kansas City Fed’s Economic Policy Symposium next week. |

Summary

Federal Reserve policy will take center stage next week with the annual economic symposium in Jackson Hole, where market participants are eager for insights that could shape the future of interest rates. As the market navigates ongoing economic uncertainties, traders are keen to understand how the Fed’s decisions will influence stock performance and sectors that have lagged in recent months. The outcomes of this event may have lasting implications for market direction as investors closely monitor the comments from Fed Chair Jerome Powell and other officials.