Federal Reserve Rate Cut: Insights from Rick Rieder

The prospect of a Federal Reserve rate cut is becoming increasingly likely, especially in light of recent economic indicators. Rick Rieder, BlackRock’s chief investment officer for global fixed income, highlighted how July’s disappointing jobs report has set the stage for possible rate adjustments. According to Rieder, the evidence needed for the Fed to justify a cut in September has finally emerged, as job growth has fallen below expectations. This change could signal a pivotal shift in U.S. monetary policy, mirroring the significant rate actions taken by the Fed in September 2024. As investors and economists closely monitor these developments, understanding the implications of the Fed’s decisions on interest rates becomes crucial for future financial strategies.

Recent discussions surrounding shifts in monetary policy have centered on the likelihood of a modification to the interest rate set by the Federal Reserve. Insights from market analysts like Rick Rieder indicate that with sluggish employment figures and downward revisions in job growth, we might witness a strategic easing in September. The current landscape, marked by low job creation in the U.S. and potential adjustments in rates, suggests a period of significant economic recalibration. Movement toward lower interest rates could reshape investment strategies and reflect broader economic trends. As stakeholders evaluate these indicators, the focus will likely remain on how the Fed adapts its policies to support job stability and financial health.

Understanding the Current Labor Market Dynamics

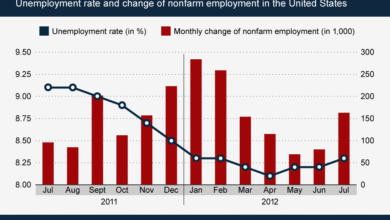

The U.S. labor market has shown signs of significant slowing, as highlighted by the recent July jobs report, which recorded only 73,000 payroll additions compared to the expected 100,000. This underperformance signifies potential economic challenges that could influence future monetary policy decisions by the Federal Reserve. The downward revisions of nearly 260,000 jobs in prior months further underscore the fragility of the current job landscape. According to Rick Rieder of BlackRock, if this trend continues, the Federal Reserve may be compelled to take decisive action to stimulate the economy.

Amid this backdrop of sluggish job growth, the notion of interest rate adjustments becomes increasingly pertinent. Economists and market analysts are closely monitoring how prolonged weak job numbers could translate into broader economic repercussions, including consumer spending and investment sentiment. The potential for a Federal Reserve rate cut becomes a focal point, as the policymakers assess the implications of the labor market on overall economic stability.

Implications of Federal Reserve Rate Cuts

A Federal Reserve rate cut is often viewed as a tool for revitalizing an underperforming economy, and the current indicators suggest that such a move could be imminent. Rieder posits that the poor job performance in July might offer the Fed the justification needed to lower interest rates substantially in September. This intervention could lower borrowing costs, thereby encouraging spending and investment, which is essential for economic recovery in a sluggish job market.

Moreover, the impact of rate cuts extends beyond immediate economic relief; they influence financial markets and investor behavior significantly. As BlackRock manages over $3.1 trillion in fixed income assets, the firm’s investments are deeply intertwined with interest rate policies. A shift in rates not only affects asset valuations but also guides strategic decision-making and future investment strategies within the firm.

BlackRock’s Investment Strategy Amid Rate Uncertainty

Rick Rieder’s insights into the labor market dynamics and potential Federal Reserve actions reflect a keen awareness of the current economic landscape. BlackRock’s investment strategy is likely to evolve in response to rate changes that the Fed may implement. In scenarios where interest rates are lowered, investment in fixed income securities might become more favorable, providing stable returns in a fluctuating market. The firm will need to calibrate its portfolio strategies to enhance resilience against potential economic headwinds.

Additionally, BlackRock’s strategies must align with broader market expectations and evolving economic indicators such as the U.S. job growth metrics. The potential for rate cuts can shift market balances and influence asset flows, making it crucial for investment firms to remain agile. By leveraging insights into labor statistics and the interest rate environment, BlackRock can navigate the complexities of the investment landscape, ultimately positioning for long-term success.

The Fed’s September Meeting: Key Considerations

As the Federal Reserve approaches its September meeting, several factors come into play regarding economic assessments and potential interest rate adjustments. The recent jobs report serves as a pivotal consideration, prompting discussions among Fed officials about the appropriate course of action. Rick Rieder’s analysis emphasizes the importance of ongoing job growth trends, suggesting that sustained slack in the labor market could necessitate a more substantial rate cut than currently anticipated.

Moreover, the Fed’s decision-making processes involve examining a myriad of economic indicators, from inflation metrics to international trade conditions. The interplay of factors such as rising tariffs and their effects on economic performance will also weigh heavily on the discussions within the Federal Reserve. As these dynamics unfold, market participants will remain vigilant, gauging how the Fed’s decisions could shape economic momentum and investment opportunities in the months ahead.

Market Reactions to Job Growth Data

In response to the lackluster job growth data, market sentiment has shifted significantly, with futures traders adjusting their expectations regarding Federal Reserve policy. The rapid increase in the perceived likelihood of a rate cut—from 40% to 83%—following the jobs report illustrates how sensitive markets are to labor statistics and economic forecasts. This growing anticipation among traders showcases the crucial role that economic data plays in shaping monetary policy expectations.

Additionally, the marked revisions to prior job figures have amplified concerns regarding economic health. Such adjustments signal potential weaknesses in the labor market that could prompt the Fed to act more decisively. As stakeholders weigh their investment strategies, understanding the implications of these revisions and their potential to trigger a Federal Reserve rate cut will be essential to navigate the upcoming economic landscape.

Evaluating Economic Signals for Future Rate Cuts

As the Federal Reserve evaluates upcoming economic signals, the July jobs report underscores a pressing need for analysis. The slowdown in U.S. job growth and subsequent revisions bolster the case for a recalibration of interest rates, raising questions about the viability of maintaining current policies. Rieder’s insights hint at the importance of interpreting labor market data not only in isolation but also in conjunction with other economic metrics, creating a comprehensive view of potential Fed actions.

Considering potential future rate cuts, analysts will scrutinize additional indicators that may arise before the Fed’s September meeting, including inflation trends and consumer confidence levels. The holistic assessment of these metrics will determine whether the Fed feels compelled to adjust rates further in response to economic conditions—critical for investors looking to align their portfolios with emerging trends in fixed income and beyond.

Long-Term Perspectives on Interest Rate Adjustments

Taking a long-term perspective on interest rate adjustments, it’s essential to understand the broader implications for economic growth and stability. Rieder’s caution regarding sustained job growth below 100,000 emphasizes the need for a proactive approach in monetary policy. If the labor market continues to stagnate, a series of rate cuts may be necessary, influencing various sectors and financial assets profoundly.

Investment strategies will need to adapt in light of long-term implications of these adjustments. For instance, enduring low-interest rates could prompt significant shifts in fixed income investments, requiring detailed risk assessments and diversification strategies. BlackRock’s position within this evolving landscape will leverage Rieder’s insights to inform decisions, ensuring portfolio resilience amid fluctuating rates and economic uncertainties.

The Role of Inflation in Interest Rate Decisions

Inflation plays a critical role in shaping Federal Reserve decisions regarding interest rates, acting as a counterbalance to job growth indicators. As the Fed considers potential cuts, inflationary pressures could complicate their actions, prompting a cautious approach. Rieder highlights that while job growth may dictate the urge to lower rates, persistent inflation could restrict the central bank’s ability to do so freely.

It’s essential for investors to monitor inflation trends closely, as these rates can greatly influence the decision-making of the Fed for upcoming meetings. The interplay between job growth, inflation expectations, and future rates will create a complex environment for investment strategies. Understanding this dynamic is vital for stakeholders who seek to remain competitive in a rapidly changing economic landscape.

Preparations for Market Volatility Post-Rate Cut

As anticipation builds for a potential Federal Reserve rate cut, market volatility may become increasingly prevalent. Investors must prepare for fluctuations in asset values and changes in market sentiment that often accompany monetary policy shifts. Rieder’s insights indicate that the probability of such cuts can create waves of investor reaction, necessitating strategic adjustments to capital allocations.

The key for investors and asset managers will be to remain agile in their strategies, potentially reallocating assets in response to changing interest rates and economic indicators. By anticipating market reactions to a Federal Reserve rate cut, firms like BlackRock can navigate challenges effectively, safeguarding their portfolios against volatility while capitalizing on emerging opportunities within the fixed income space.

Frequently Asked Questions

What is the significance of the Federal Reserve rate cut according to Rick Rieder’s insights?

Rick Rieder, Chief Investment Officer at BlackRock, believes that the recent disappointing jobs report lays the groundwork for a substantial Federal Reserve rate cut. He argues that the Fed now has the evidence it requires to justify this adjustment, potentially leading to a 50-basis point cut in September.

How does U.S. job growth impact the Federal Reserve’s decision on rate cuts?

The slowdown in U.S. job growth, with payrolls increasing by only 73,000 in July, significantly influences the Federal Reserve’s rate cut decisions. If job growth continues to lag, especially below 100,000, as indicated by Rick Rieder, it may prompt the Fed to lower interest rates in September.

What is the current outlook for September interest rates and potential Federal Reserve rate cuts?

The outlook for September interest rates is leaning towards a potential cut, with futures traders estimating an 83% likelihood of a rate cut at the Fed’s September meeting. This is a significant increase from previous estimates, driven by recent disappointing job growth metrics.

How does BlackRock’s investment strategy align with Federal Reserve rate cuts?

BlackRock’s investment strategy, particularly in fixed income, is closely tied to Federal Reserve rate cuts. As Rick Rieder suggests, anticipated rate cuts can lead to favorable conditions for bond investments, especially during periods of sluggish job growth and economic uncertainty.

What does Rick Rieder predict about the Fed’s interest rate adjustments in response to labor market data?

Rick Rieder predicts that the Federal Reserve will likely adjust interest rates based on ongoing labor market data. If the trend of weak job growth continues, Rieder anticipates a half-point rate cut in September, which indicates how closely the Fed monitors employment statistics for its monetary policy decisions.

| Key Points |

|---|

| Rick Rieder comments on July jobs report opening door for Fed rate cut in September. |

| Labor market slowdown evident with July payrolls up by only 73,000, below expectations. |

| Job figures revised down significantly by 260,000 for past two months, heightening rate cut speculation. |

| Futures market now indicates 83% chance of a September rate cut due to weak job report. |

| Rieder suggests a possible 50-basis point cut in September if trends continue. |

| Current Fed rate is between 4.25% and 4.50% with decisions pending regarding tariffs’ effects. |

| BlackRock oversees $3.1 trillion in fixed income assets. |

Summary

The Federal Reserve rate cut is increasingly likely following a disappointing jobs report in July, which revealed a significant lag in job growth. According to BlackRock’s chief investment officer, Rick Rieder, the conditions necessary for the Fed to consider a substantial interest rate reduction are now evident. With the labor market showing persistent weakness and expectations for a rate cut rising sharply, all eyes will be on the upcoming September meeting for clarity on the Fed’s next moves.