Federal Reserve Review: Scott Bessent Proposes Changes

The ongoing **Federal Reserve review** has sparked a significant conversation regarding the role and effectiveness of the central bank in shaping the nation’s economy. In a recent CNBC interview with Treasury Secretary Scott Bessent, he emphasized the necessity of examining not just superficial issues, such as building renovations, but also the underlying functions of the Federal Reserve. These comments arise from escalating tensions between the White House and the Fed, particularly about monetary policy and interest rates. Bessent’s assertion that the Fed should consider easing its monetary policy points to a shift in the conversation about how the central bank responds to inflation and economic challenges. As discussions unfold, understanding the Federal Reserve’s functions and its interactions with governmental authority will remain crucial to the public and economic stakeholders alike.

The proposal for a thorough examination of the Federal Reserve, often referred to as the central banking system, is becoming increasingly relevant in today’s political climate. Treasury Secretary Scott Bessent’s call for a detailed analysis suggests a need to look beyond current controversies and inspect the institution’s overall mission and effectiveness. In light of rising tensions with the administration regarding interest rate policy, this initiative could lead to significant changes in how monetary policy is approached. The discussions surrounding this review not only reflect on the integrity and purpose of the Federal Reserve but also illustrate the complex dynamics between federal governance and economic regulation. As the dialogue continues, the influence of these perspectives on financial stability and inflation control will be noteworthy.

Comprehensive Review of the Federal Reserve

The recent call for a comprehensive review of the Federal Reserve by Treasury Secretary Scott Bessent highlights the need for a thorough evaluation of its overall functions and effectiveness. In a landscape marked by volatility in financial markets and public scrutiny, Bessent’s remarks resonate with growing concerns about the Fed’s responses to economic challenges. This review is expected to transcend mere operational critiques concerning renovations, pushing deeper into the heart of the Fed’s monetary policy and procedures. The idea is not only to assess the Fed’s performance but also to contemplate its foundational mission: maintaining stable prices and maximizing employment.

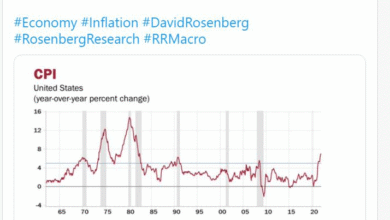

Given the complexities surrounding monetary policy and economic indicators, such a review could shine a light on the Fed’s responsiveness to evolving market conditions. Stakeholders might consider whether the Federal Reserve has adequately adapted its strategies in the face of criticism about its interest rate policies and inflationary controls. For instance, as inflation recalibrates, many are questioning if the Fed’s decisions still align with contemporary economic realities. A structural assessment might also include scrutiny on how effective the Federal Reserve has been in employing its tools amidst conflicting political narratives.

Interest Rates and Inflation Dynamics

In light of the current economic environment, Treasury Secretary Bessent’s comments regarding the need for the Fed to reconsider its stance on interest rates are particularly significant. With his assessment that inflation has largely been tempered, proponents of easing monetary policy rally around the notion that lower interest rates could not only stimulate economic growth but also support ongoing recovery efforts. The argument rests on the assertion that the Fed seems reluctant to pivot from its established path, possibly despite improvement in inflation metrics. The implication here is that a more agile monetary policy approach may be prudent.

Moreover, the relationship between interest rates and inflation is crucial as the market anticipates the Fed’s next moves. Market experts suggest that further reductions in rates could be on the horizon, reflecting broader economic indicators and easing pressures on consumers and businesses alike. As stakeholders evaluate market forecasts, the discussion turns to whether upcoming decisions from the Fed will integrate insights from various economic sectors, especially amidst critiques of past performance. It is a time for reassessment, and all eyes will remain peeled for significant policy shifts.

The White House and Federal Reserve Tension

The ongoing tension between the White House and the Federal Reserve has been brought to the forefront, as exemplified by Scott Bessent’s critique and calls for a review. This conflict reflects a deeper, systemic issue involving the independence of the Federal Reserve and the presidential administration’s influence over monetary policy. As details about President Trump’s potential actions against Fed Chairman Jerome Powell circulated, they fueled discussions about the integrity and autonomy of the Fed in crafting and implementing monetary policy. Such political pressures raise questions about how external pressures might distort the Fed’s mission of maintaining economic stability.

The situation underscores how the interplay between fiscal and monetary authorities can shape economic outcomes. Secretary Bessent’s role as a potential mediator demonstrates the complexities of this relationship, as he navigates between advocating for effective monetary policy and addressing White House concerns. The need for a harmonious relationship without infringing upon the independence of the central bank is paramount. As we observe these dynamics unfold, stakeholders must consider the implications of this conflict on public trust and the overall effectiveness of the Federal Reserve.

Scott Bessent’s Position on Fed Policy

As discussions around the Federal Reserve’s policies continue, Scott Bessent’s positioning within this dialogue is critical. His influence is compounded by the dual role he plays as both Treasury Secretary and a contender for leadership at the Fed. Bessent’s insights offer a valuable perspective on the intersection of economic theory and practical policy implementation. His assertion that the Fed should consider easing monetary policy reflects a growing sentiment among some economists that current interest rates may be too high in the context of stabilizing inflation. This viewpoint emphasizes a push towards revitalizing economic growth through more accessible borrowing.

However, Bessent’s suggestions also raise vital questions about the Fed’s decision-making processes and its reliance on academic models that may not align with current realities. His comments imply skepticism about whether the Fed’s leadership is adequately responsive to the challenges of modern economic indicators. As he navigates his potential future with the Fed, Bessent’s influence on the discourse surrounding interest rates and monetary policy is pivotal to fostering a cooperative relationship between the Treasury and the central bank.

Public Scrutiny of the Federal Reserve’s Operations

The scrutiny surrounding the Federal Reserve’s operations has intensified, especially amid controversies linked to cost overruns and infrastructural changes. The recent $2.5 billion renovations have drawn criticism from the White House, revealing deeper concerns about transparency and the effectiveness of funds allocated for essential functions. Such criticisms invite a broader discussion about the Federal Reserve’s accountability, particularly regarding expenditure decisions and the perceived disconnect between operational activities and economic performance.

Moreover, public perceptions of the Fed’s operational efficacy are vital. As calls for a review emerge, stakeholders advocate for a clear evaluation of the agency’s activities to restore confidence in its capacity to navigate economic challenges. The proposed review must encompass how well the Federal Reserve communicates its actions and decisions to the public, alongside its broader mandate. By addressing these operations critically, the Fed can enhance its legitimacy and public trust, crucial for a central banking institution tasked with stabilizing the economy.

Navigating Monetary Policy Under Political Pressure

As political winds shift, navigating through monetary policy becomes increasingly complex for the Federal Reserve. The pressure from the White House, especially concerning interest rates and economic growth, poses questions about the independence and decision-making integrity of the Fed. Secretary Bessent’s statements serve as both an analysis and a potential call to action for the central bank to articulate its strategies clearly, ensuring decisions are driven by economic data rather than political expedience.

In this climate of scrutiny, the Fed’s ability to maintain autonomy while addressing the needs of the administration is paramount. The challenge lies in balancing the expectations of government officials with sound economic principles that govern effective monetary policy. As Bessent navigates this delicate interplay, the upcoming review could illuminate whether the Fed’s policies are adaptable and equipped to respond to the evolving economic landscape, ultimately influencing public perception and confidence in the institution.

Implications of Federal Reserve’s Monetary Policy Changes

The implications of potential changes to the Federal Reserve’s monetary policy are far-reaching and warrant close examination. An adjustment in interest rates not only influences borrowing costs for consumers and businesses but also sets the tone for long-term economic growth. Secretary Bessent’s insights suggest that easing monetary policy might be beneficial given the current inflation climate, which can result in a more favorable economic environment for spending and investment. Investors and economists alike are keenly attuned to these developments, seeking to understand how shifts in policy could reshape the economic landscape.

Furthermore, the reactions of financial markets to Federal Reserve decisions emphasize the critical nature of a resilient and data-informed policy approach. The long-term success of the Fed’s strategies hinges on its ability to balance immediate market reactions with sustainable economic growth targets. As the market continues to anticipate possible rate cuts, it is essential for the Federal Reserve to prepare for potential repercussions and to be transparent about its decision-making process. This transparency could also serve to mitigate political pressures and enhance institutional credibility.

Expectations for Federal Reserve’s Future Actions

As market expectations build around the Federal Reserve’s next moves, the anticipation of rate cuts signifies a pivotal moment in monetary policy response. Observers are keenly analyzing economic indicators to gauge the necessity for the Fed to ease its stance on interest rates amidst signals of tempered inflation. With opinions diverging on the right course of action, Secretary Bessent’s recent comments resonate with advocates for a more accommodative approach in light of improving economic conditions. Potential shifts in policy fundamentally influence both consumer sentiment and business investment decisions.

Looking ahead, the ramifications of the Fed’s decisions will undoubtedly shape the broader economic narrative. Analysts stress the importance of monitoring how effectively the central bank can adapt to external pressures while maintaining its core mission of fostering economic stability. If the Fed embraces a forward-thinking strategy that acknowledges public and political sentiments, it may enhance its credibility and further secure its independence. The ongoing discourse will continue to define expectations for future actions, setting the stage for how U.S. monetary policy evolves in an increasingly dynamic economic environment.

Key Recommendations for Federal Reserve Improvement

The recommendations for improving the Federal Reserve’s functions outlined by Secretary Bessent focus on a critical examination of its operational efficacy. A comprehensive review could offer insights into optimizing the current framework that governs decision-making processes, particularly concerning interest rates and monetary policy. As economic dynamics continue to evolve, a more transparent approach could facilitate better communication with the public and stave off political repercussions that might compromise the Fed’s independence.

Ultimately, by regaining trust through demonstrable improvements and accountability, the Federal Reserve can position itself as a stabilizing force in the economy. Encouraging constructive dialogue between the central bank and the administration may yield better alignment with economic objectives while enhancing the Fed’s ability to navigate crises effectively. Bessent’s advocacy for reform serves as a timely reminder that ongoing assessments are vital for an institution tasked with safeguarding the economic well-being of the nation.

Frequently Asked Questions

What is the purpose of a Federal Reserve review as suggested by Scott Bessent?

The purpose of the Federal Reserve review suggested by Treasury Secretary Scott Bessent is to evaluate the overall effectiveness and functions of the Federal Reserve beyond current controversies, such as its building renovations. Bessent emphasizes the need to examine if the Fed has been successful in fulfilling its monetary policy objectives, similar to an investigation one might expect from other government agencies during times of significant mistakes.

How does Scott Bessent view the current monetary policy of the Federal Reserve?

Scott Bessent believes that the current monetary policy of the Federal Reserve may need to shift towards easing, as he points out that inflation appears to be under control. During a CNBC interview, he noted that fears over tariffs have not translated into significant inflation, suggesting a reconsideration of interest rates is warranted.

What are the implications of the White House conflict with the Federal Reserve?

The conflict between the White House and the Federal Reserve could have significant implications for monetary policy. This tension stems from President Trump’s criticism of the Fed, especially regarding interest rates. As proposed by Bessent, a comprehensive review of the Fed might aim to address these conflicts and assess whether the central bank is effectively meeting its mandates.

What are the potential outcomes of a Federal Reserve review led by Scott Bessent?

A potential outcome of the Federal Reserve review advocated by Scott Bessent could be an assessment of the Fed’s overall impact on the economy and its response to monetary policy challenges. This could lead to changes in leadership, policy adjustments, or reforms aimed at enhancing the Fed’s ability to manage interest rates and inflation effectively.

Why is there controversy surrounding the Federal Reserve’s recent renovations?

The controversy surrounding the Federal Reserve’s recent renovations, which have reportedly exceeded $2.5 billion, underscores broader concerns about the institution’s spending practices and efficiency. This issue has been brought to the forefront amidst mounting criticism from the White House, which is also linked to the suggested Federal Reserve review by Treasury Secretary Scott Bessent.

What does the latest market forecast suggest about future interest rates?

The latest market forecasts suggest that the Federal Reserve may consider cutting interest rates again in September. This aligns with Scott Bessent’s view that easing monetary policy could be appropriate given the current inflation trends, contrasting with the Fed’s last rate reduction that took place in December.

How does Scott Bessent relate the Federal Reserve’s operations to other government agencies?

Scott Bessent draws a parallel between the Federal Reserve’s operations and that of other government agencies, such as the Federal Aviation Administration. He argues that if the Fed were experiencing as many operational mistakes as the FAA does, it would warrant a rigorous investigation into its effectiveness and functionality.

| Key Point | Details |

|---|---|

| Proposed Review of the Federal Reserve | Treasury Secretary Scott Bessent suggested a review that extends beyond building renovations to assess the Fed’s overall function and effectiveness. |

| Conflict Between White House and Fed | Comments arise amid a growing conflict regarding monetary policy and potential actions against Fed Chair Jerome Powell. |

| Monetary Policy Recommendations | Bessent believes the Fed should ease monetary policy as inflation remains largely under control. |

| Current Interest Rate Situation | The Fed last decreased rates in December, with forecasts indicating potential future cuts. |

| Administration Criticism | The administration has criticized the Fed for cost overruns related to renovations amidst broader policy issues. |

Summary

In the context of a Federal Reserve review, Treasury Secretary Scott Bessent has called for a comprehensive evaluation of the Fed’s effectiveness that goes beyond its current building renovation issues. His remarks underscore the existing tension between the central bank and the White House, particularly concerning monetary policy and interest rates. With inflation largely under control, Bessent advocates for a reevaluation of the Fed’s approach to rate adjustments, emphasizing the need for a forward-thinking strategy that aligns more closely with current economic indicators. This review highlights the critical importance of assessing the Fed’s performance in fulfilling its mandate, especially in light of the complexities of the current economic environment.