Figma AI Future: Co-Founder Declares No Imminent Threat

Figma AI Future is poised to reshape the landscape of design software as the company, co-founded by Dylan Field, ventures into public trading. As Figma prepares to launch on the stock market under the ticker symbol “FIG,” discussions around the impact of artificial intelligence have become increasingly relevant. Field reassured investors that while the potential for superintelligence in design exists, it poses no immediate threat to Figma’s innovative offerings. With a market valuation soaring to $19.3 billion, the eye on Figma stock market performance amplifies interest in how AI will influence software design in the years to come. Amidst this landscape, the dialogue about the relationship between AI and creativity remains essential as designers and developers navigate this evolving frontier, balancing automation with artistic integrity.

The evolution of design technology is currently undergoing a significant transformation as Figma embraces the integration of AI into its core operations. Dylan Field, Figma’s visionary leader, indicates that the concerns around advanced AI do not overshadow the company’s capabilities or future outlook. As Figma initiates trading under the symbol “FIG,” it enters the spotlight, attracting attention from investors and tech enthusiasts alike. Speculations about the interplay of artificial intelligence and design are increasingly common, with discussions surrounding how these technologies can enhance creativity without undermining the designer’s role. The trajectory of Figma in the realm of software innovation raises intriguing questions about the future of design under the influence of intelligent systems.

The Future of Figma: Navigating the AI Landscape

Figma, under the leadership of CEO Dylan Field, is preparing to make a significant mark in the software industry as it plans to begin trading publicly. As concerns about artificial intelligence surging into the mainstream conversation, Field assures stakeholders that AI, including concepts of superintelligence, is not an imminent threat to Figma’s innovative design capabilities. This is particularly critical as the company looks to establish its presence in the stock market, trading under the ticker symbol ‘FIG’. Investors and users alike are hopeful that Figma’s unique technologies will keep it secure against the vulnerabilities that AI may eventually introduce.

Field’s insights emphasize the complexity of Figma’s technology, which he believes cannot be easily replicated by AI models, even as advancements in superintelligence loom on the horizon. His optimistic stance not only reassures the design community but also serves to solidify investor confidence amid changing market trends. By aligning the company’s value with its robust technology and creative solutions, Figma is poised to navigate the intricacies of the stock market while managing the evolving AI landscape.

Dylan Field’s Vision: AI and Software Design

Dylan Field’s perspective on artificial intelligence underscores a broader conversation about its impact on software design. The CEO asserts that while AI holds immense potential, its role in Figma’s workflow is not as dire as some predict. He remarked that AI and superintelligence will augment rather than completely disrupt design processes. This viewpoint is essential as companies like Figma aim to leverage AI for enhancing user experiences without sacrificing the creative elements that define their products.

In this light, Figma stands at the intersection of technology and creativity, suggesting that the synergy between human intuition and AI capabilities may lead to unprecedented advancements in design tools. As software evolves, Figma’s commitment to maintaining its core design principles while integrating AI technologies positions it favorably in a rapidly changing digital landscape.

Stock Market Entry: Figma’s Strategic Move

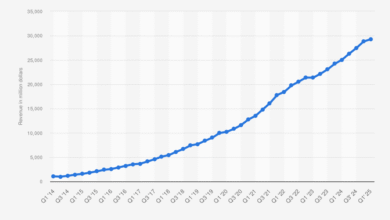

Figma’s entry into the stock market under the ticker ‘FIG’ signifies an important milestone for the company. Pricing shares higher than initially anticipated, at $33, not only reflects the confidence investors have in Figma but also its staggering market valuation of $19.3 billion. The background of this transition is notable, especially considering that the company was once on the verge of an acquisition by Adobe, a deal that was thwarted by regulatory concerns. As the company redefines its trajectory in the public domain, maintaining a clear communication strategy about their technology and its potential impact on the design industry will be crucial.

The excitement surrounding Figma’s public offering cannot be overstated. By capitalizing on its established user base and strong market position, the company looks to harness the momentum of its IPO to invest further in innovation. This step not only provides capital but also enhances visibility in the industry, crucial for competing against other tech giants curious about the viability of AI in software development.

The Role of Superintelligence in Design Innovation

As discussions regarding superintelligence in design gain traction, it becomes vital to understand its implications for firms like Figma. Field admitted that while the subject is often romanticized in tech narratives, significant challenges remain before AI can replicate sophisticated systems like Figma’s. This complexity illustrates the inherent value that human designers bring to the table, fostering a balance between collaboration and dependency on AI tools.

The apprehension surrounding superintelligence also translates into a call for responsible innovation within the tech industry. Stakeholders, including emerging startups, must consider ethical guidelines as they integrate AI features into their design processes. Figma is strategically focusing on its strengths while remaining alert to the transformative nature of AI, ensuring that it leads the way in responsible design innovation.

Figma’s Share Price Surge: Understanding Market Dynamics

Figma’s decision to price its shares at $33—a significant jump from the previously estimated $25 to $28—highlights market confidence in the company’s potential for growth. This excitement can largely be attributed to Dylan Field’s leadership and the innovative technologies that Figma offers, which continue to push the boundaries of design software. Investors are not just buying shares; they’re betting on the future that Field envisions, where Figma remains at the forefront of design evolution.

Market dynamics are often influenced by perceptions of value, especially in tech stocks, which tend to exhibit volatility. Figma’s strategy of utilizing its strong market position while exploring AI—without falling into the trap of over-reliance—demonstrates a methodical approach to maintaining its valuation. Stakeholders should keep an eye on how Figma navigates these waters as they seek long-term sustainability in an ever-changing market environment.

AI’s Impact on the Design Software Landscape

The integration of artificial intelligence within design software presents both opportunities and challenges for companies like Figma. While AI capabilities can enhance design efficiency and accuracy, they also raise questions about the displacement of creative roles traditionally held by human designers. Dylan Field’s assurances regarding the safety of Figma in this AI driven environment reflect a broader sentiment that technology should serve to enhance human creativity rather than replace it.

As Figma continues to innovate and implement AI features, the industry will closely monitor how these changes impact the design software landscape. The potential for AI to streamline workflows and assist designers will be critical in sustaining Figma’s appeal, ultimately reshaping how professionals approach design tasks. The balance of leveraging AI while preserving the artistry in design will determine the trajectory of Figma’s future endeavors.

Balancing AI and Human Creativity in Design

In his discussions about the future of design and artificial intelligence, Dylan Field emphasizes the importance of balancing AI integration with the inherent creativity of human designers. He acknowledges that while AI can process vast amounts of data and facilitate design tasks, the unique touch of a human designer—intuition, emotion, and creativity—remains irreplaceable. This philosophy positions Figma not merely as a software tool but as a partner that enhances the creator’s capabilities without overshadowing their artistry.

The vision Field has for Figma suggests that rather than being seen as competitors, AI and human designers can evolve together. By fostering this synergy, Figma can offer cutting-edge design solutions while enriching the creative process, ensuring that both technology and creativity flourish. The journey ahead for Figma in maintaining this balance will not only define its market position but also influence how the design community perceives the role of AI in their craft.

Figma’s Competitive Edge in the Era of AI

In an increasingly competitive market, Figma’s ability to adapt and respond to the rise of artificial intelligence grants it a distinct advantage. As companies vie for market share in software design, Figma’s dedication to its unique technology and proactive approach to AI integration position it as a leader. The intricate graphics engine that Field describes acts as a foundation upon which Figma can build further innovations that leverage AI without compromising its core values.

Competitors may rely heavily on automation and AI to drive their design solutions, but Figma’s approach focuses on enhancing the designer’s experience. By positioning itself as a solution that celebrates both technology and creativity, Figma solidifies its role in the industry. Understanding its competitive edge lies in preserving the human aspect of design will guide Figma’s strategic decisions in the evolving landscape of software development.

The Strategic Importance of Figma’s IPO

Figma’s strategic move to go public has immense significance in the current tech climate. As emerging trends in software design intertwine with advances in AI, the IPO provides Figma with a platform to further its ambitions toward innovation and growth. Investors view this as an opportune moment to engage with a company that is setting benchmarks for the industry’s future and seeking to redefine how design software is developed and utilized.

Going public under the FIG ticker symbolizes Figma’s readiness to embrace the challenges and opportunities that come with being a publicly traded company. It not only increases visibility but also invites scrutiny that may ultimately lead to enhanced accountability and transparency. As Figma continues on this path, maintaining a clear understanding of its technological advantages and commitment to creativity will solidify its position in the competitive landscape of software design.

Frequently Asked Questions

How does Dylan Field view the role of artificial intelligence in Figma’s future?

Dylan Field, CEO of Figma, believes that artificial intelligence does not pose an immediate threat to the company’s future. He suggests that while superintelligence in design might eventually evolve, it will be challenging for AI to replicate Figma’s sophisticated technology and unique offerings.

What insights did Dylan Field provide about superintelligence in design?

Dylan Field discussed superintelligence in design during a CNBC interview, expressing skepticism about achieving such advanced AI capabilities soon. He highlighted that Figma’s complex graphics engine makes it difficult for superintelligence to replace their innovative technology.

What are Figma’s stock market plans and how does AI factor into this?

Figma plans to go public with the ticker symbol ‘FIG’ on the New York Stock Exchange. As the company prepares for this financial milestone, Dylan Field emphasizes that AI, despite its evolving capabilities, will not undermine Figma’s business model or technological foundation.

Why is Figma’s market valuation significant in relation to AI developments?

Figma is expected to have a market valuation of $19.3 billion upon its public offering, especially after a failed acquisition by Adobe and amid rising discussions on AI impact on software design. This highlights the company’s strong position in a competitive market influenced by advancements in artificial intelligence.

What challenges does superintelligence pose to Figma’s technology according to Field?

Dylan Field asserts that superintelligence could eventually influence design fields, but Figma’s proprietary technology and intricate graphics systems create substantial barriers to being overtaken by simple AI advancements.

How does the potential of superintelligence relate to Figma’s innovations?

Field believes that the potential of superintelligence raises intriguing possibilities, but he argues that Figma’s innovative approach and technology make it difficult for AI to fully replicate or surpass what they offer in design solutions.

What is the expected share pricing for Figma as it enters the stock market?

Figma is projected to start trading with shares priced between $25 and $28, ultimately pricing at $33 ahead of its debut, reflecting investor confidence even as discussions on the AI impact on software design continue.

How does the tech industry perceive the future of AI and its integration in platforms like Figma?

The tech industry is actively debating the implications of AI and superintelligence, with leaders like Dylan Field and Mark Zuckerberg advocating for a balance between leveraging AI for productivity and maintaining the unique creative aspects of design software like Figma.

| Key Point | Details |

|---|---|

| AI Threat Level | Figma CEO Dylan Field asserts that AI does not currently pose an imminent threat to Figma’s future. |

| Public Trading Start | Figma will begin trading publicly under the ticker ‘FIG’ on the New York Stock Exchange. |

| Share Price and Valuation | Shares were initially projected to be priced at $25-$28 but were later priced at $33, leading to a valuation of $19.3 billion. |

| Regulatory Issues | An intended acquisition by Adobe for $20 billion fell through due to regulatory constraints. |

| Superintelligence Commentary | Field believes that superintelligence is not a near-term reality and cannot easily replicate Figma’s technology. |

| Zuckerberg’s View | Meta’s CEO emphasizes superintelligence should empower individuals, not just automate tasks, and has invested in a dedicated lab for AI. |

Summary

Figma AI Future looks promising, as CEO Dylan Field reassures stakeholders about the safety and viability of the company amid rising AI influences. While superintelligence remains a topic of discussion, its threats seem distant, according to Field. With Figma transitioning to a public market, the company is poised to harness its unique technological strengths while remaining vigilant about the evolving AI landscape. As the interest in superintelligence grows, Field’s insights and the company’s strategic advances set a course for Figma’s sustained innovation.