GameStop Bitcoin Investment to Boost Corporate Strategy

In a bold move that taps into the growing interest in digital assets, GameStop has announced its intentions to invest corporate cash in bitcoin, following the successful path set by MicroStrategy’s Bitcoin strategy. This significant decision aligns with the ongoing trend of corporate adoption of cryptocurrency, fueling excitement in the market as GameStop cryptocurrency news continues to make headlines. Shares of the meme stock surged over 6% in after-hours trading, reflecting investor optimism surrounding this innovative venture. The company plans to allocate a portion of its substantial $4.8 billion cash reserves towards acquiring bitcoin and stablecoins, marking a pivotal shift in its financial strategy. As GameStop navigates this new terrain, all eyes are on the potential impact of this GameStop Bitcoin investment on its stock value and long-term profitability.

GameStop’s latest strategy to funnel corporate funds into cryptocurrencies represents a calculated embrace of digital finance innovations. By expanding its portfolio to include leading digital currencies like bitcoin, the video game retailer is attempting to pivot away from its traditional brick-and-mortar business model. This move mirrors actions taken by other companies, notably MicroStrategy, who have successfully integrated cryptocurrency as a core component of their investment strategies. The growing trend of corporate entities investing in digital assets underscores a significant transformation in finance, as organizations look to diversify and mitigate risks. As discussions around GameStop’s cryptocurrency initiatives unfold, investors remain keenly interested in how these developments may reshape the company’s financial landscape.

GameStop’s Bold Move: Investing Corporate Cash in Bitcoin

GameStop’s decision to allocate corporate cash towards bitcoin is a significant development in the gaming and retail industry, signaling a shift towards cryptocurrency investment among corporations. By opting to follow the example set by MicroStrategy, GameStop aims to leverage the potential benefits of digital assets and enhance its financial strategy. This move could not only stabilize the company during challenging times but also position it as a forward-thinking player in the rapidly evolving financial landscape of cryptocurrencies.

As GameStop moves towards adopting a Bitcoin corporate strategy, it reflects a growing trend of corporate adoption of cryptocurrencies. The company’s financial health is bolstered by the substantial cash reserves it holds, which stand at nearly $4.8 billion. This solid financial footing allows GameStop to navigate the volatility associated with cryptocurrencies while exploring potential new revenue streams. The announcement has already been met with enthusiasm from investors, showcasing a growing confidence in GameStop’s strategic direction.

MicroStrategy’s Influence on GameStop’s Cryptocurrency Strategy

GameStop’s venture into cryptocurrency investment is notably inspired by MicroStrategy’s successful Bitcoin acquisition strategy. MicroStrategy has established itself as a pioneering force in corporate Bitcoin investment, having accumulated billions of dollars in bitcoin on its balance sheet. This successful approach showcases the potential for significant returns, and GameStop appears eager to replicate that success to strengthen its financial standing amidst a competitive market.

By directly referencing MicroStrategy’s Bitcoin strategy, GameStop not only signals a commitment to innovation but also aligns itself with a growing community of corporations recognizing the value of digital currencies. This strategic alignment may also enhance GameStop’s credibility and appeal among investors who are increasingly looking for companies that embrace modern financial trends. As GameStop delves deeper into bitcoin and other cryptocurrencies, it could unlock opportunities that reshape its business model.

The Impact of GameStop Cryptocurrency News on Investors

The recent GameStop cryptocurrency news has caught the attention of investors, igniting excitement about the company’s future possibilities. By investing in bitcoin, GameStop is not just exploring a new asset class; it’s also signaling a transformation within the company aimed at regaining market confidence. Investors have responded positively, as reflected in the increased stock price following the announcement. This upward movement indicates renewed interest and alignments in the eyes of the market.

Moreover, the implications of GameStop’s decision extend beyond immediate stock fluctuations. By integrating cryptocurrency into its financial framework, GameStop may well attract a demographic of investors who favor technology and innovation, particularly in finance. The combination of GameStop’s unique market position as a retail giant and its foray into the volatile world of cryptocurrencies could yield substantial dividends as the sector matures.

Understanding Bitcoin Corporate Adoption Through GameStop’s Lens

Bitcoin corporate adoption is steadily gaining traction as more companies recognize the potential for growth and innovation within the sector. GameStop’s recent decision to invest corporate cash in bitcoin not only reflects this broader trend but also emphasizes the challenges and opportunities that lie ahead. The move positions GameStop alongside other major firms that have successfully incorporated cryptocurrencies into their financial strategies, fostering a sense of community and shared goals among like-minded corporations.

As GameStop embarks on this journey, it may influence other companies to reconsider their investment strategies regarding cryptocurrencies. The corporate world is watching closely to see how GameStop manages this new endeavor, observing if it can mitigate risks associated with price volatility while leveraging the potential benefits of increased market visibility and investor attraction. The outcome of this strategy is likely to set a precedent for other retailers contemplating a similar path.

The Volatility of Bitcoin: Risks and Rewards for GameStop

Investing in bitcoin inherently comes with a host of risks due to its notorious price volatility. GameStop acknowledges these risks in its corporate strategy, highlighting that while the potential rewards of entering the cryptocurrency market are significant, they are accompanied by substantial challenges. The rapid fluctuations in bitcoin’s value can profoundly impact the company’s financial health, indicating a need for prudent management and real-time strategy adjustments.

Despite these challenges, the allure of potential high returns can be compelling. GameStop’s management, guided by CEO Ryan Cohen, understands that with great risk comes the possibility of great reward, especially in a market that is continuously evolving. By balancing risk management with aggressive capital deployment into bitcoin, GameStop aims to position itself not just as a reactive player but as a proactive innovator capable of thriving in the competitive landscape of cryptocurrencies.

GameStop Stock Performance Post-Crypto Investment Announcement

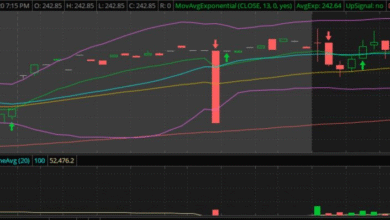

The announcement of GameStop’s investment in bitcoin has already had a noticeable impact on its stock performance, with a notable 6% rise in extended trading. This positive reaction from investors suggests strong confidence in the company’s new direction and symbolizes a successful initial step in its cryptocurrency strategy. The correlation between the news and stock performance illustrates how market sentiment can swiftly shift in response to corporate decisions that align with emerging trends.

As the market continues to absorb the implications of GameStop’s foray into the cryptocurrency space, analysts will likely scrutinize subsequent stock performance to gauge the effectiveness of this bold strategy. Investors are keenly interested in how this approach will translate into long-term viability. Continued positive performance may further bolster GameStop’s reputation as an adaptive retailer, ultimately reshaping its identity in the competitive market.

Future Prospects: GameStop’s Strategy in the Cryptocurrency Realm

Looking forward, GameStop’s strategy in the cryptocurrency realm presents a blend of optimism and caution. As the company charts its course through the fluctuations of the cryptocurrency landscape, it must simultaneously focus on broader operational improvements. By balancing its investment in bitcoin with efforts to optimize its traditional business model, GameStop can create a sustainable path forward that capitalizes on both its legacy and innovation.

The future success of GameStop’s cryptocurrency strategy will largely depend on the execution of its plan and its ability to adapt to the rapidly changing market conditions. With the backing of steady cash reserves and a visionary leadership team, GameStop is well-positioned to emerge as a player in the digital asset space. As corporate adoption of bitcoin grows, the company is poised to attract new investors and partnerships, potentially diversifying its revenue streams and strengthening its market position.

Exploring the Regulatory Landscape for GameStop’s Bitcoin Plans

As GameStop embarks on its journey into bitcoin investment, navigating the regulatory landscape surrounding cryptocurrencies will be crucial. The company must stay abreast of various regulations that govern digital assets, which can vary significantly across different jurisdictions. By engaging with financial regulatory bodies, GameStop can ensure compliance and mitigate potential risks associated with its investment strategy.

Furthermore, understanding regulatory developments in the cryptocurrency space would provide GameStop with an opportunity to advocate for more supportive legislation, potentially influencing the wider industry landscape. By leading the charge in regulatory discussions, GameStop could position itself not only as a market innovator but also as a responsible corporate stakeholder in the evolving dialogue surrounding cryptocurrency adoption.

GameStop and the Future of Retail in a Cryptocurrency-Driven Economy

The intersection of cryptocurrency and retail is increasingly becoming a focal point for companies seeking innovative growth avenues. GameStop’s decision to invest in bitcoin reflects a transformative shift in how traditional retail businesses can evolve in response to changing consumer behaviors and technological advancements. This investment could set a precedent for retailers, encouraging them to adopt similar strategies and rethink their financial operational models.

As the economy trends towards digital currencies, GameStop may also find itself at the helm of this retail evolution, combining its gaming legacy with groundbreaking financial strategies. By embracing the future of digital assets, GameStop is not only enhancing its own prospects but also contributing to the wider acceptance of cryptocurrency within the retail sector, paving the way for others to follow.

Frequently Asked Questions

How is GameStop’s Bitcoin investment strategy similar to MicroStrategy’s?

GameStop’s Bitcoin investment strategy mirrors MicroStrategy’s approach, as both companies are allocating a portion of their corporate cash to acquire Bitcoin. This move follows MicroStrategy’s path of investing billions in Bitcoin, making it a significant corporate holder of the cryptocurrency.

What does GameStop’s cryptocurrency investment mean for the company?

GameStop’s cryptocurrency investment signifies a strategic shift aimed at revitalizing its business amidst financial challenges. By incorporating Bitcoin and other cryptocurrencies into its balance sheet, GameStop hopes to enhance its asset base, similar to trends seen in Bitcoin corporate adoption.

What are the risks associated with GameStop’s Bitcoin corporate strategy?

GameStop’s Bitcoin corporate strategy carries inherent risks, primarily due to Bitcoin’s volatility. The company recognizes that investing in Bitcoin exposes it to price fluctuations, which could impact its financial stability.

Will GameStop’s investment in Bitcoin affect the stock price?

Investors reacted positively to GameStop’s Bitcoin investment news, reflected by a 6% rise in its stock value following the announcement. However, the long-term impact on GameStop’s stock price will depend on how well the cryptocurrency strategy performs.

What are the potential benefits of GameStop’s Bitcoin investment for shareholders?

If GameStop’s Bitcoin investment strategy succeeds, it could lead to increased asset value and profitability, benefiting shareholders. Additionally, following MicroStrategy’s Bitcoin strategy could position GameStop as a leader in cryptocurrency adoption among retail firms.

What is the significance of GameStop’s announcement regarding Bitcoin and cryptocurrency news?

GameStop’s announcement is significant as it represents a broader trend of traditional companies exploring Bitcoin and cryptocurrency investments. This move may signal an increased acceptance of digital assets in the corporate world, aligning with the growing narrative of Bitcoin corporate adoption.

How much Bitcoin is GameStop planning to buy?

GameStop has not set a limit on the amount of Bitcoin it may acquire, indicating an openness to invest significantly as part of its corporate strategy. The company plans to use a portion of its considerable cash reserves or future debt and equity to fund these purchases.

What was the market reaction to GameStop’s cryptocurrency investment decision?

Following the announcement of its Bitcoin investment strategy, GameStop’s stock rose over 6% in after-hours trading, suggesting investor optimism about the company’s forward-looking plans and alignment with trends in the cryptocurrency space.

| Key Point | Details |

|---|---|

| GameStop’s Investment Announcement | GameStop’s board has approved a plan to invest corporate cash in bitcoin. |

| Amount Allocated | Part of its cash or future debt and equity may also be used for U.S. dollar-denominated stablecoins. |

| Comparison with MicroStrategy | GameStop follows MicroStrategy’s approach of acquiring large amounts of bitcoin. |

| Current Cash Holdings | As of February 1, 2025, GameStop had nearly $4.8 billion in cash. |

| Volatility Warning | GameStop acknowledges the volatility of cryptocurrency, stating their strategy remains untested. |

| Recent Stock Performance | Following the announcement, GameStop’s stock rose more than 6%. |

| Financial Results | GameStop reported a net income of $131.3 million for the fourth quarter. |

Summary

GameStop’s recent decision to invest corporate cash in bitcoin marks a significant shift in its financial strategy, aligning it with trends set by other notable companies like MicroStrategy. By entering the world of cryptocurrencies, GameStop aims to breathe new life into its operations amidst ongoing challenges. This move reflects a bold attempt to leverage its substantial cash reserves while navigating the inherent risks associated with such volatile investments. With hopes of revitalization under CEO Ryan Cohen, GameStop’s focus on digital currencies and cost management could pave the way for an exciting chapter in its corporate journey, though it remains to be seen how this gamble will play out in the long term.