Gamestop Bitcoin Speculation After $1.75B Note Sale

The recent announcement by Gamestop regarding a $1.75 billion private offering of convertible notes has ignited a wave of Gamestop Bitcoin speculation, raising eyebrows among investors and cryptocurrency enthusiasts alike. As social media buzz intensifies, many are wondering whether part of this capital will be allocated towards further bitcoin acquisitions, especially after the company previously acquired 4,710 bitcoins worth approximately $509 million. This intriguing intersection between traditional retail strategies and cryptocurrency investment raises questions about the potential impact on Gamestop’s stock price. With a vague commitment to support investments in alignment with their investment policy, the possibility of Gamestop adopting a blockchain investment strategy becomes even more enticing. As investors keep a keen eye on these developments, the dialogue around Gamestop’s financial maneuvers is likely to shape future trends within both the gaming and cryptocurrency sectors.

The recent developments surrounding Gamestop’s financial strategies have led to notable discussions, particularly regarding the intersection of traditional retail operations and the dynamic world of digital currency. After announcing a sizeable private offering of convertible senior notes, experts are speculating whether these funds could bolster investments not only in bitcoin but also in various cryptocurrency ventures. Investors are particularly keen on observing how the company’s moves could affect its stock trajectory and overall market positioning. As Gamestop hints at a broader corporate evolution, there’s a real possibility that its future could encompass diverse blockchain-related acquisitions. This pivot from pure retail to a comprehensive investment strategy could signify a major shift in the gaming industry landscape.

The Implications of Gamestop’s Convertible Notes Offering

Gamestop’s recent announcement to offer $1.75 billion in convertible notes has not only caught the attention of investors but also reignited discussions about its strategic direction. This offering, consisting of 0.00% Convertible Senior Notes due in 2032, is expected to attract qualified institutional buyers, allowing Gamestop to raise significant capital without immediate interest liabilities. The potential for investors to convert these notes into cash or equity opens the door for further speculation regarding Gamestop’s long-term investment strategy, particularly in the realm of cryptocurrencies.

With a clear mention of ‘general corporate purposes’ and potential acquisitions in their strategy, Gamestop is positioning itself to become more than just a gaming retailer. The wording itself cultivates an air of mystery, inviting speculation about how the company intends to allocate the influx of capital. This vagueness feeds into the broader conversation about Gamestop’s evolving identity, with investors and analysts keenly observing how this convertible note offering could lead to expanded holdings in cryptocurrency, especially bitcoin.

Gamestop Bitcoin Speculation: What Lies Ahead?

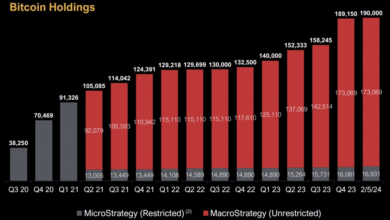

The speculation surrounding Gamestop’s intentions regarding bitcoin acquisitions is palpable across various social media platforms. Investors are eager to see how this new capital will be utilized, especially after the company’s previous investment in 4,710 bitcoins earlier this year, valued at approximately $509 million. By linking the announcement of the convertible notes to potential bitcoin purchases, enthusiasts are crafting narratives that could align with a broader cryptocurrency acquisition strategy. This speculation is bolstered by Gamestop’s previous moves into the cryptocurrency space, suggesting a strategic pivot.

Moreover, discussions on platforms like X (formerly Twitter) highlight the community’s anticipation of Gamestop establishing itself as a multifaceted holding corporation. The conversations indicate a belief that Gamestop could leverage its convertible notes not only for its existing bitcoin interests but also to diversify into varied blockchain investments. Such a pivot might align with Gamestop’s articulation of potential acquisitions, which could create new opportunities for engaging in innovative cryptocurrency ventures, enhancing its total stock price and market position.

Understanding Gamestop’s Investment Policy

Gamestop’s distinct investment policy could serve as a guiding framework for how the funds from its convertible notes offering will be deployed. The mention of making investments consistent with this policy suggests that the company is looking to ensure that new ventures align with its long-term vision. This is particularly crucial in an evolving market landscape characterized by rapid cryptocurrency growth and adoption, influencing how traditional companies like Gamestop interact with digital assets.

Additionally, the policy promises potential acquisitions, yet the lack of detailed capital allocation plans raises eyebrows. Investors are left to speculate whether these acquisitions will involve more cryptocurrency holdings, or if the focus will shift towards other sectors, diversifying Gamestop’s portfolio significantly. This uncertainty reflects the unpredictable nature of markets, especially in the case of a company that is redefining its operational strategies in response to the blockchain revolution.

Gamestop’s Stock Price: A Reflection of Market Sentiment

As Gamestop prepares to roll out its offering, the sentiment surrounding its stock price will be increasingly influenced by investor perceptions regarding its investment strategies, particularly in cryptocurrency. The company’s decision to hold bitcoin has created a dual interest among investors: those intrigued by its traditional retail model and others captivated by its potential in the crypto space. As speculation grows about how the latest convertible notes will support further bitcoin purchases, fluctuations in Gamestop’s stock may effectively mirror these sentiments.

Gamestop’s stock price dynamics also highlight the volatility often associated with companies engaged in cryptocurrency. Market reactions can shift rapidly based on prevailing narratives—from skepticism about its ability to execute a cohesive strategy to excitement over the prospect of expanding into foundational blockchain investment strategies. Investors should remain vigilant as the landscape continues to evolve, anticipating how news and market movements could shape Gamestop’s future valuations and crypto endeavors.

Potential Acquisitions: Broadening Horizons Beyond Bitcoin

As Gamestop looks to utilize its convertible notes, the speculation around potential acquisitions reveals an intention to broaden its investment horizons beyond mere bitcoin purchases. With discussions around building a diversified portfolio, there’s a growing expectation that Gamestop may venture into realms like gaming technology or multifaceted blockchain solutions. Such moves could position the company as a leader not only in retail but in innovative technology spheres, creating synergy between its traditional business and emerging sectors.

Moreover, the excitement around acquisitions becomes pivotal in understanding Gamestop’s potential evolution. By considering acquisitions that align with both gaming and cryptocurrency, Gamestop could harness growth opportunities that leverage its brand and community influence. This multifaceted approach illustrates a strategic response to consumer trends, particularly as the gaming industry increasingly dovetails with digital assets, potentially giving rise to a unique gaming-crypto nexus.

The Role of Cryptocurrency in Corporate Strategies

The integration of cryptocurrency into corporate strategies is becoming a significant talking point across various industries, with Gamestop leading the conversation within the retail sector. By engaging in bitcoin speculation and exploring blockchain investments, Gamestop is setting a precedent for how modern companies can adopt digital currencies to enhance value. The company’s proactive engagement in the cryptocurrency market reflects a broader shift among corporations that view digital assets as viable investment vehicles rather than just speculative endeavors.

In this light, Gamestop’s intent to utilize proceeds from its convertible notes to potentially acquire bitcoin is not merely an isolated event; it signifies an evolving mindset toward cryptocurrency within corporate finance. As organizations like Gamestop begin to integrate digital currencies into their operational framework, it will mark a new chapter in corporate strategy, where blockchain investments become commonplace and critical to business growth.

Market Reactions to Gamestop’s Financial Strategies

Market reactions to Gamestop’s financial strategies, particularly its offering of convertible notes, will be pivotal in shaping investor confidence. As financial analysts dissect the implications of this move, reactions are likely to fluctuate based on the perceived viability of supporting bitcoin acquisitions and other investments. The excitement around potential returns could drive increased buy interest in Gamestop’s stock; conversely, skepticism regarding its execution strategy may lead to short-term downward pressure.

Additionally, how market participants interpret Gamestop’s messaging regarding its investment policy and future acquisitions will influence overall market sentiment. Should Gamestop’s notes successfully garner interest from institutional buyers and lead to fruitful investment opportunities in cryptocurrency or related domains, it could well bolster confidence and stabilize its market position. However, lingering uncertainties may perpetuate volatility, serving as a reminder of the risks inherent in aligning traditional retail systems with rapidly evolving digital asset markets.

Exploring the Dynamics of Gamestop Stock and Bitcoin

Exploring the interplay between Gamestop stock and bitcoin reveals intriguing dynamics that can significantly impact investor sentiment. With Gamestop’s decision to invest in bitcoin, the stock has become somewhat correlated with fluctuations in cryptocurrency markets. This creates an interesting scenario where investors not only look at Gamestop’s performance as a retailer but also consider broader crypto market trends, leading to varied trading strategies and increased market volatility.

As Gamestop continues to evolve, understanding the correlation between its stock price and bitcoin trends will be essential for effective investment strategies. Investors must remain cognizant of how shifts in bitcoin valuation can affect Gamestop’s market perception and stock price stability. This dynamic could further underscore the interconnectedness of traditional finance markets with the emerging world of cryptocurrencies, highlighting the necessity for investors to adapt their approaches accordingly.

Future Outlook: Gamestop’s Position in a Crypto-Driven Market

The future outlook for Gamestop will hinge on its ability to navigate a crypto-driven market landscape successfully. As it stands, the company’s forward-thinking approach regarding convertible notes and bitcoin acquisition signals a readiness to embrace innovative financial practices. If managed effectively, these strategies could yield significant advantages in an increasingly digital investment environment, positioning Gamestop as a trendsetter in aligning retail with technology.

As Gamestop strengthens its ties to cryptocurrency, it may set the stage for broader acceptance of digital currencies within mainstream business sectors. The anticipation surrounding its potential acquisitions suggests a pivot towards a more diversified business model—a move that may resonate with investors who are keen to venture into blockchain investment strategies. Ultimately, Gamestop’s success will depend on its adaptability to market changes and its execution of a coherent investment strategy that capitalizes on both retail opportunities and the burgeoning crypto market.

Frequently Asked Questions

What does Gamestop’s $1.75 billion convertible note sale mean for Bitcoin speculation?

Gamestop’s announcement of a $1.75 billion private offering of convertible notes has sparked speculation that part of these funds could be allocated towards bitcoin investments. Given their previous purchase of 4,710 bitcoins, investors are curious if Gamestop will continue to add to their cryptocurrency acquisitions, aligning with their broad investment strategy.

How might Gamestop’s investment policy influence Bitcoin speculation?

Gamestop’s investment policy clearly includes potential cryptocurrency acquisitions, leading to speculation regarding the company’s future bitcoin purchases. Observers believe that with the new funds from their convertible notes, Gamestop could significantly increase its bitcoin holdings or diversify further into the cryptocurrency market.

What are the implications of Gamestop’s convertible notes on their stock price and Bitcoin investments?

The issuance of convertible notes may influence Gamestop’s stock price by signaling to the market how the company plans to leverage these funds for bitcoin investments or acquisitions. Investors are closely monitoring developments as they could shape market perceptions of Gamestop’s role in the cryptocurrency investment space.

Could Gamestop transition into a multi-faceted holding company impacting Bitcoin investments?

There is speculation that Gamestop could evolve into a multi-faceted holding company, not just focusing on bitcoin procurement. This potential shift could lead to a diverse range of investments beyond cryptocurrency, altering the landscape for their bitcoin speculation strategy and impacting overall investor sentiment.

What does Gamestop’s recent behavior indicate about the future of cryptocurrency investments?

Gamestop’s recent activities, including the sale of convertible notes aimed at funding potential investments, indicate a serious interest in cryptocurrency investments like bitcoin. This reinforces the notion of Gamestop as a significant player in the market, with future moves likely to impact bitcoin speculation and overall market trends.

How does Gamestop’s current financial strategy affect cryptocurrency acquisitions?

Gamestop’s current financial strategy, supported by their convertible note offering, is key in shaping their approach to cryptocurrency acquisitions. The intent to use proceeds for general corporate purposes, including bitcoin investments, suggests that Gamestop is positioning itself to enhance its portfolio with cryptocurrency, signaling a proactive approach to blockchain investment strategies.

| Key Point | Details |

|---|---|

| Convertible Note Offering | Gamestop plans to raise $1.75B through a private offering of convertible notes. |

| Interest Rate | The notes offered have a 0.00% interest rate and mature in 2032. |

| Potential Bitcoin Purchases | Speculation that part of the raised capital may be used for additional bitcoin investments. |

| Current Bitcoin Holdings | Gamestop currently holds 4,710 bitcoins, valued at approximately $509 million. |

| Investment Policy | Gamestop’s stated use of proceeds includes investments aligned with their Investment Policy. |

| Rumored Corporate Strategy | There is speculation about Gamestop becoming a multi-faceted holding company, not just focused on bitcoin. |

Summary

Gamestop Bitcoin speculation has been ignited by the company’s recent announcement of a $1.75 billion convertible note offering. This significant financial maneuver is sparking discussions within the crypto community on whether Gamestop will utilize part of these funds to increase its bitcoin holdings. With existing investments in bitcoin and a vague investment strategy that allows for diverse acquisitions, the speculation suggests Gamestop may be diversifying its asset portfolio to transform into a broader holding entity. Investors and analysts alike are keenly observing how this development could impact both Gamestop’s corporate strategy and the future of bitcoin investments.