Generation Z Financial Planning: Unlocking Future Success

Generation Z financial planning is crucial as young adults navigate an uncertain economic landscape. With nearly half feeling that planning for their future is pointless, this demographic faces unique challenges that require a proactive approach to financial literacy. Understanding debt management, cultivating healthy money habits, and investing can significantly enhance their financial well-being. As they confront rising living costs and economic pressures, financial success tips for Gen Z are more vital than ever. By embracing these strategies, members of Generation Z can transform their financial future and overcome the malaise of economic uncertainty.

Young people today, often referred to as Generation Z, represent a unique cohort facing significant hurdles in their fiscal journeys. This group, born roughly between 1997 and 2012, is grappling with issues such as student debt, uncertain job prospects, and a shifting financial landscape that can feel daunting. Despite these challenges, there are effective money management strategies that can help harness their potential for wealth building. Navigating topics like financial literacy, planning for investments, and debt oversight is essential for establishing a stable financial foundation. As they begin to confront the realities of adulthood, adopting smart financial practices will be key to securing their economic future.

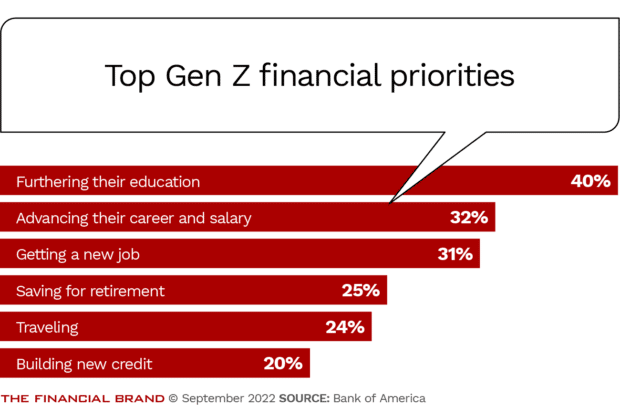

Understanding Generation Z’s Financial Mentality

Generation Z’s financial outlook is often characterized by a pervasive sense of disillusionment and frustration, particularly when it comes to their economic prospects. Many express feelings that planning for the future feels futile, citing the challenging job market and mounting debt as significant barriers. With nearly half of young adults reporting feelings of financial despair, it is essential to understand their unique mindset that accompanies these challenges. This mentality not only affects their spending and saving behaviors but significantly impacts their long-term financial literacy and readiness.

In addition to the high unemployment rates faced by young graduates, many Gen Z individuals also grapple with uncertainty regarding the value of their education in the face of technological disruptions. As they observe the rapid advances in artificial intelligence, concerns about job security and debt weigh heavily on their decision-making processes. The insights reveal an urgent need for tailored financial literacy initiatives aimed at three distinct areas: managing expenses, understanding investment opportunities, and addressing debt management strategies to cultivate a healthier economic mindset.

Financial Literacy: A Crucial Skill for Gen Z

Improving financial literacy among Generation Z is vital for their confidence in money management and decision-making. With a growing awareness of financial concepts, this generation must learn to navigate budgeting, saving, and investing effectively. By understanding how to budget their finances and establish responsible spending habits, Gen Z will be better equipped to tackle their financial challenges and avoid the pitfalls of debt accumulation.

Moreover, investing forGen Z is an essential skill that can greatly influence their financial future. As expert recommendations encourage early investment—even in modest amounts—understanding financial markets, stocks, and retirement accounts becomes fundamental. Educational resources such as online courses, seminars, and financial apps can empower them to make informed choices, ensuring that they harness the benefits of compound interest over time. With firm knowledge in hand, they can confidently navigate their financial journeys.

Overcoming Debt and Financial Anxiety

Addressing debt management is critical for Generation Z as they often wrestle with the anxiety of student loans and credit card debt. In fact, reports show that approximately half of Gen Z graduates carry an average student debt burden, leading to feelings of hopelessness regarding their financial futures. By learning effective debt repayment strategies, such as the snowball or avalanche methods, young adults can better manage their financial obligations and reduce their unease surrounding debt.

Furthermore, this generation’s inclination toward buy now, pay later (BNPL) schemes has exacerbated their financial dilemmas. While BNPL offers convenience, it also encourages overspending and leads to increased debt accumulation. Financial experts advocate for mindfulness in spending and suggest creating budgets that prioritize necessary expenses. By fostering a more disciplined approach, Generation Z can cultivate financial stability, reduce their debt load, and alleviate the anxiety that often accompanies their financial situations.

Building Healthy Money Habits for Financial Success

For Generation Z, establishing healthy money habits is crucial for achieving long-term financial success. Amid the challenges posed by a demanding job market, cultivating behaviors such as mindful spending, savings contributions, and consistent budgeting can pave the way for a secure financial future. Setting aside even a small amount regularly into savings or investment accounts helps them capitalize on the advantages of compounding growth.

Moreover, the practice of pausing before making non-essential purchases is a simple yet effective strategy to combat impulse buying. Financial experts recommend a waiting period of at least 24 hours to reflect on whether the purchase aligns with their long-term goals. By fostering these mindful money habits, Generation Z can not only reduce unnecessary expenditures but also build a more resilient financial foundation that prioritizes both their present and future needs.

Investment Strategies Tailored for Generation Z

Investing for Gen Z is not just a means to build wealth; it’s a powerful way to secure their financial futures. Experts recommend leveraging available investment opportunities as early as possible, particularly in retirement accounts like Roth IRAs and 401(k)s. The significance of starting early can’t be overstated, as even small contributions have the potential to grow significantly over time due to compound interest.

Additionally, using technology to their advantage can facilitate investment decisions and create diverse portfolios. Apps that allow for micro-investing or robo-advisors can make investing accessible and manageable for young adults navigating their financial landscapes. By integrating investment strategies into their financial planning process, Generation Z can increase their financial literacy and strategize effectively for achieving long-term financial goals.

The Role of Financial Education for Young Adults

Financial education is fundamental to equip Generation Z with the tools necessary for making informed financial decisions. Schools and institutions have a pivotal role in enhancing financial literacy programs that target key areas such as budgeting, savings, investments, and responsible credit use. Given that many students graduate without a solid understanding of finances, it is essential to implement comprehensive educational initiatives that prepare them for real-world financial situations.

Moreover, the rise of financial technology gives Generation Z access to a plethora of resources that were previously unavailable. Online courses, webinars, and interactive applications can help enhance their understanding of economic concepts and improve their financial skills. When educational institutions partner with technology platforms, they create innovative solutions that meet the unique needs of young adults striving for financial success.

Navigating Financial Challenges During Economic Hardships

Generation Z faces unprecedented economic challenges, making it imperative to develop resilience and adaptability in their financial strategies. Understanding macroeconomic indicators, such as inflation and employment trends, can help them anticipate potential financial hardships and make informed choices. Engaging with professional financial advisors and attending financial literacy workshops can provide valuable insights, preparing them to navigate through uncertain economic landscapes.

Furthermore, cultivating a proactive approach to financial management empowers Generation Z to identify opportunities even in adverse situations. For instance, seeking out part-time work, remote jobs, or internships can provide valuable experience while helping them maintain a stable income. By remaining proactive and adaptable, they can lay the groundwork for financial stability and success, regardless of external economic influences.

The Importance of Saving for Future Goals

Establishing specific savings goals is vital for Generation Z in steering their financial journey towards success. Whether it’s saving for a car, a home, or paying off student debt, having clear objectives helps individuals stay motivated and disciplined in their financial habits. Young adults should consider utilizing high-yield savings accounts, which can offer better interest rates than traditional savings accounts, thus maximizing their savings efforts.

Additionally, young adults can utilize techniques like setting up automatic transfers from checking to savings accounts to ensure consistent progress toward their goals. This approach creates a ‘pay yourself first’ mindset, making savings an integral part of their financial routine. By prioritizing their savings and consistently working towards their goals, Generation Z can build a more secure and promising financial future.

Engaging with Financial Advisors: A Path to Financial Empowerment

Engaging with financial advisors can significantly benefit Generation Z as they navigate their financial journeys. Advisors can help demystify complex financial topics, assist in creating personalized financial plans, and provide ongoing support as economic conditions change. With personalized guidance, young adults can make strategic investment decisions and prioritize their financial goals more effectively.

Additionally, many financial advisors offer engaging and interactive workshops aimed specifically at Generation Z. These sessions focus on enhancing their financial knowledge while providing hands-on experiences in budgeting, investing, and money management. By fostering relationships with financial professionals, Generation Z can unlock valuable resources and knowledge that will empower them to take control of their financial futures.

Frequently Asked Questions

What are some effective financial literacy tips for Gen Z?

To enhance financial literacy for Gen Z, start by educating yourself on budgeting, saving, and investing basics. Utilize online resources, financial podcasts, and apps to track spending. Furthermore, explore topics like debt management and the importance of building an emergency fund to become financially savvy.

How can Generation Z effectively manage their debt?

Gen Z can manage debt by creating a budget that prioritizes debt repayment. Focus on high-interest debts first and consider using debt repayment strategies like the snowball or avalanche method. Additionally, avoid accumulating more debt by minimizing unnecessary expenses and utilizing financial literacy resources to make informed choices.

What are the best investing strategies for Gen Z?

Gen Z should start investing early to take advantage of compound interest. Begin with small, manageable amounts through tax-advantaged accounts like Roth IRAs or 401(k)s, potentially maximizing employer match contributions. Diversifying investments in stocks, bonds, or ETFs can also help build a balanced portfolio over time.

What money habits should Generation Z adopt for financial success?

For financial success, Gen Z should adopt habits such as budgeting, tracking expenses, saving regularly, and avoiding impulsive purchases. Implementing a 24-hour waiting period for non-essential purchases can help curb unnecessary spending. Aim to establish an emergency fund and prioritize paying down high-interest debts to cultivate a healthier financial future.

How does the current job market impact Generation Z’s financial planning?

The current job market poses challenges for Generation Z, with rising unemployment rates for young adults affecting their financial planning. To mitigate this, focus on building transferable skills, networking, and exploring side hustles to increase income. Understanding market dynamics can assist in making informed decisions regarding career paths and financial stability.

What are some key financial success tips for Gen Z?

Key financial success tips for Gen Z include starting to invest early, understanding credit scores, managing debts wisely, and cultivating disciplined spending habits. Establish clear financial goals, seek professional advice when necessary, and continually educate yourself on personal finance topics to adapt to changes in the economic landscape.

How can Generation Z overcome feelings of hopelessness regarding financial planning?

Generation Z can overcome feelings of hopelessness by redefining their financial mindset. Embrace the power of small, consistent actions like saving or investing a little each month. Surround yourself with positivity and support, seek guidance from financial mentors, and remember that it’s never too late to start building a solid financial future.

| Key Points | Details |

|---|---|

| Disillusionment with Economic Prospects | 49% of Generation Z feels that planning for the future is pointless due to a challenging job market and debt concerns. |

| YOLO Mindset | Many Gen Z adults have adopted a carefree spending attitude, risking high-interest debts and delaying important life milestones. |

| Debt Burdens | Nearly 50% of recent grads have significant student debt, with uncertainties about the job market exacerbating financial worries. |

| Instant Gratification Dangers | Buy Now, Pay Later services lead 77% of Gen Z users to spend beyond their means. |

| Financial Planning Solutions | Experts recommend starting to invest early, managing debts wisely, and developing mindful spending approaches to secure financial futures. |

Summary

Generation Z financial planning is critical as this demographic grapples with economic challenges that can feel overwhelming. With nearly half of young adults feeling that planning for the future is pointless, it’s essential for them to adopt a proactive financial mindset. By introducing simple steps such as early investing, mindful spending, and effective debt management, Generation Z can overcome financial malaise and build a more secure financial future. Engaging in these practices not only provides immediate benefits but also sets the groundwork for long-term wealth accumulation through the power of compound interest.