Germany Inflation May 2025: Key Insights and Trends

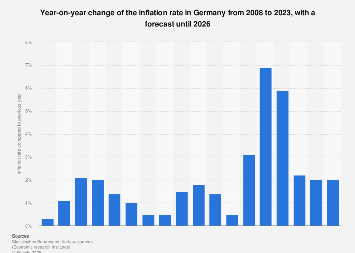

In May 2025, Germany experienced a notable shift in its economic landscape as inflation rates showed a promising decrease to 2.1%, nearing the European Central Bank’s target of 2%. This figure, although slightly above analysts’ predictions, aligns with ongoing discussions about consumer inflation in Germany and its implications for the broader Eurozone economy. With the Germany CPI for May 2025 highlighting a decline from previous months, many economists are closely monitoring the trends that may influence interest rate decisions in Germany. As energy prices fall and core inflation rates stabilize, the German economic outlook seems cautiously optimistic, suggesting that consumers might soon enjoy greater price stability. The development of inflation trends in Germany will be essential for the ECB, as it navigates monetary policy amidst a complex economic environment.

As we delve into the financial situation in Germany during May 2025, it’s essential to recognize the broader context of rising living costs and economic measures shaping the country’s financial environment. The recent consumer price index outcomes indicate a carefully calibrated balance towards achieving the European Central Bank’s inflation goals, with official projections suggesting a possible stabilization in prices. Observers of Germany’s economic climate are attentive to signs of adjustment in spending habits and wage pressures that could redefine future inflation scenarios. With the central bank’s impending interest rate decisions looming, stakeholders are eager to gauge the impacts of both domestic and global challenges on Germany’s financial stability. Thus, the evolving economic picture reflects both resilience and caution as policymakers strive to navigate the complexities of inflation and growth.

Overview of Germany’s Inflation Trends in May 2025

Germany’s harmonized consumer inflation rate has shown a notable decrease to 2.1% in May 2025. This figure is significant as it comes close to the European Central Bank’s target of 2%, indicating a slowdown in consumer inflation dynamics. Analysts had previously predicted an inflation reading of 2%, but the actual results reveal a minor discrepancy. The decline from April’s rate of 2.2% suggests that the inflationary pressures in Germany are beginning to stabilize, an encouraging sign for both policymakers and consumers alike.

The latest data from Destatis highlights that core inflation—the measure excluding food and energy—slightly ticked up to 2.9% from 2.8% in the previous month. This increase in core inflation suggests a slight uptick in certain fixed costs, but the overall trend remains on course for easing. As Germany approaches the European Central Bank’s inflation target, it raises questions about future fiscal measures and their impact on the German economic outlook.

Frequently Asked Questions

What is the consumer inflation rate in Germany for May 2025?

Germany’s consumer inflation rate for May 2025 stands at 2.1%, approaching the European Central Bank’s target of 2%. This figure slightly exceeds analysts’ predictions, which estimated the rate to be at 2%.

How does Germany’s CPI in May 2025 compare to previous months?

In May 2025, Germany’s consumer price index (CPI) fell to 2.1% from 2.2% in April, reflecting a gradual decrease in inflation, a trend that aligns with the European Central Bank’s inflation target.

How might the interest rate decision in Germany affect inflation?

The upcoming interest rate decision in Germany, set for June 5, 2025, may influence inflation patterns. With expectations of a potential quarter-point rate cut, analysts suggest it could further facilitate disinflation towards the ECB’s target.

What is the outlook for German inflation in the coming months?

The outlook for German inflation indicates a potential continuation of the downward trend, with expectations that inflation may drop below 2% as cooling labor market dynamics and falling energy prices exert disinflationary pressure.

What are the implications of the ECB’s inflation target for Germany’s economy?

The European Central Bank’s inflation target of 2% serves as a benchmark for Germany’s economic stability. Achieving this target indicates a healthy economic environment and guides monetary policy, including possible interest rate adjustments.

What factors are currently influencing Germany’s inflation in May 2025?

Germany’s inflation in May 2025 is influenced by several factors, including declining energy prices, service sector inflation decreasing from 3.9% to 3.4%, and potential government fiscal stimulus affecting overall inflation trends.

How significant is the recent German inflation data for the European Central Bank?

The recent German inflation data, showing a disinflationary trend, is significant for the European Central Bank as it suggests a stronger case for potential interest rate cuts, supporting measures aimed at achieving stable inflation in the Eurozone.

What challenges does Germany face in terms of inflation and economic growth?

Germany faces challenges such as external tariffs impacting its export-driven economy, labor market shifts that could alter wage pressures, and uncertainties from the new government’s fiscal policies on future inflation and economic growth.

How do current economic conditions affect the German economic outlook?

Current economic conditions, including inflation rates stabilizing around the ECB’s target and global trade uncertainties, present a cautious yet optimistic outlook for Germany’s economy, with analysts monitoring evolving domestic and international factors.

What did analysts predict regarding Germany’s inflation trend?

Analysts predict that Germany’s inflation will likely continue its downward trend, potentially stabilizing around the 2% mark throughout the second half of 2025, influenced by market conditions and government policy responses.

| Key Point | Details |

|---|---|

| Inflation Rate | Germany’s harmonized consumer inflation fell to 2.1% in May 2025, nearing the ECB’s target. |

| Comparison to Previous Rates | Inflation rate was 2.2% in April 2025 and compared to a forecast of 2% by analysts. |

| Core Inflation | Core inflation rose slightly to 2.9%, up from 2.8% in April, while service inflation dropped to 3.4%. |

| Energy Prices | Energy prices decreased by 4.6% in May, impacting overall inflation. |

| Outlook | Inflation is expected to hover around 2% in the latter half of 2025 due to mixed economic factors. |

| Government Fiscal Policies | Government actions may increase inflationary pressures towards the end of 2025. |

| ECB Interest Rate Decision | The ECB’s next interest rate decision is due on June 5, with expectations for a quarter-point cut. |

Summary

Germany inflation for May 2025 has decreased to 2.1%, indicating a potential closer alignment with the European Central Bank’s target of 2%. As we analyze future trends, it is crucial to monitor several factors, including core inflation fluctuations and the impact of government policies. Efforts to manage inflationary pressures will play a significant role in shaping the economic landscape moving forward.