Hedera Price Analysis: Signs of Stabilization for HBAR

In this Hedera price analysis, we delve into the current state of HBAR and its potential for recovery in the volatile crypto market. Recently, Hedera has shown signs of stabilization, particularly as it has repeatedly defended crucial support levels. This analysis will also touch on HBAR price predictions, highlighting key support and resistance points that could impact future price movements. As market trends evolve, understanding these dynamics becomes essential for developing effective crypto trading strategies. With a close look at the price action and macroeconomic factors, we aim to uncover what lies ahead for HBAR and its journey through the market.

Exploring the dynamics of Hedera’s cryptocurrency landscape, we focus on the analysis of HBAR’s market behavior and the implications for traders and investors alike. By examining vital support levels and resistance structures, we aim to decipher the underlying trends that could guide future trading decisions. Through this lens, we will assess HBAR recovery movements while contemplating broader market trends and their influence. With a sharp emphasis on upcoming price patterns, we will also evaluate HBAR price forecasts and the strategies traders might employ to navigate this environment. As we unfold this narrative, the goal is to equip readers with insights necessary for making informed decisions in the evolving crypto arena.

Hedera Price Analysis: Technical Overview

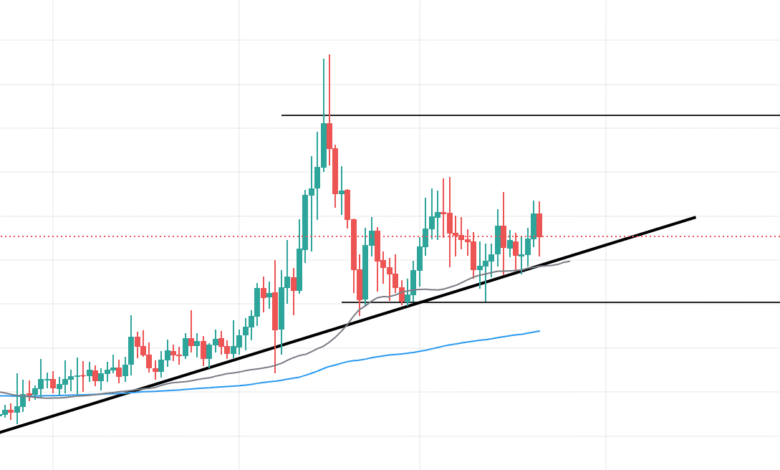

The current price analysis of Hedera (HBAR) reveals signs of stabilization on the daily chart. The asset appears to be finding a solid base within the green-marked support zone, which has been tested multiple times, establishing it as a key area for potential upward momentum. As HBAR navigates through this support, the formation of an upper liquidity zone indicates that there may be short-term bullish sentiment gaining traction. However, traders should remain cautious as the price encounters a complex structure of resistance that could hinder significant bullish movements.

Within this context, it is crucial to consider HBAR’s interaction with the moving averages, particularly the 50 EMA and the 200 EMA. These two lines converge where formidable resistance exists, highlighting the importance of this price level for traders. A confirmed breakout above this confluence area could serve as a catalyst for a more sustainable recovery in HBAR’s price. Conversely, failure to breach this resistance while maintaining the green support zone could result in stagnation or further corrective movements.

Understanding Hedera Support and Resistance Levels

Hedera’s recent price movements have effectively illustrated the significance of the support and resistance levels within crypto trading strategies. The green support zone is not only visually significant but functionally crucial, serving as a reliable backstop against downward pressure. Traders must watch how HBAR interacts with this level, as the potential for a price rebound increases when identified support holds strong. A bounce back from this area could also trigger new buying opportunities for those looking to capitalize on HBAR’s recovery chances.

On the flip side, the resistance levels above the current price action are complex, with diagonal and horizontal structures creating a layered barrier to upward movement. Understanding these levels is pivotal for forecasting potential price action. If HBAR is able to break above these resistances, particularly through the confluence of the moving averages, it could signal the onset of a more decisive shift in market momentum, potentially leading to higher price targets and renewed interest from traders.

HBAR Recovery Movement: Market Dynamics and Predictions

The ongoing recovery movement in HBAR must be interpreted within the broader context of market dynamics, particularly considering the interplay of macroeconomic factors. As external economic conditions influence market sentiment, HBAR’s trajectory could be swayed by developments in Bitcoin’s pricing and any emergent regulatory news. The overall bullish outlook suggested by the current stabilization could provide room for renewed upward movement if supported by positive developments in the crypto landscape.

In examining HBAR’s market trends and potential recovery, traders should utilize predictive tools such as the RSI and MACD indicators. These tools assess momentum and price strength, offering deeper insights into whether HBAR can sustain its upward trend. A sustained position above crucial resistance levels would reinforce a bullish HBAR price prediction, encouraging traders to consider entering the market as part of their long-term crypto strategies.

HBAR Market Trends: Overview and Strategic Insights

Keeping abreast of HBAR market trends is essential for any trader looking to derive actionable insights from recent price movements. The cryptocurrency market is notorious for its volatility, and HBAR is no exception, exhibiting sharp fluctuations that can present both risks and opportunities. By analyzing the latest trends, traders can position themselves to either leverage potential breakouts or safeguard against downturns, employing sound crypto trading strategies in the process.

Additionally, the prevailing market sentiment around HBAR plays a crucial role in shaping price expectations. If positive news cycles and successful use cases for Hedera begin to proliferate, this can significantly bolster trader confidence, fostering an environment conducive to upward price movements. Monitoring such sentiment shifts will provide a clearer window into HBAR’s future trajectory, allowing traders to adapt their strategies accordingly.

Crypto Trading Strategies for HBAR Investors

Adopting effective crypto trading strategies is essential for investors dealing in HBAR. New traders, in particular, should focus on understanding technical indicators alongside market fundamentals. This dual approach allows for a more informed decision-making process, especially when entering or exiting positions. As HBAR demonstrates signs of stabilizing, investors must develop personalized strategies that factor in both the price charts and broader market sentiments.

Moreover, implementing stop-loss orders can help manage risk—especially in a volatile market like crypto. For HBAR traders, setting these limits just below critical support zones allows for protection from unforeseen downward movements while enabling participation in potential recoveries. By combining analytical insights with strategic safeguards, crypto investors can enhance their trading performance while minimizing exposure to market shocks.

Analyzing Hedera: The Role of Market Indicators

Market indicators serve as valuable tools in assessing the performance of Hedera (HBAR) and other cryptocurrencies. Economic indicators, such as trading volume and volatility, provide insight into current market conditions and leverage this data to predict future movements. For instance, observing an increase in trading volume alongside rising prices could signal strong bullish momentum, suggesting that HBAR might be entering a favorable trading phase.

In addition, sentiment indicators like the Fear and Greed Index can gauge overall market sentiment towards cryptocurrencies, which may directly impact HBAR’s price fluctuations. Understanding these indicators can help traders make more informed predictions, especially during volatile market conditions, allowing them to seize opportunities when they arise.

HBAR Price Forecasts: What Traders Should Know

As traders consider HBAR price forecasts, they must analyze both technical signals and external economic factors. Currently, the dual EMA convergence presents a major resistance that may dictate HBAR’s ability to trend positively in the coming periods. A successful breakout above this resistance could indicate a strong bullish movement, potentially leading to new price highs. Conversely, monitoring the green support zone remains critical; if this level fails, we could witness a bearish reversal.

Furthermore, HBAR’s performance can be influenced by macroeconomic trends and Bitcoin price movements. Traders focusing on HBAR should keep an eye on these dynamics, as they can swiftly alter sentiment and market conditions. Understanding these predictions in the context of historical performance will equip traders with the necessary knowledge to navigate HBAR effectively.

Understanding the Impact of Regulatory News on HBAR

Regulatory news can have a profound impact on cryptocurrency prices, including Hedera (HBAR). As the regulatory landscape surrounding cryptos continues to evolve, anticipating these changes can be crucial for traders. Positive regulatory developments tend to enhance market credibility, potentially driving prices higher. In contrast, restrictive measures can result in sharp downturns. HBAR investors must remain vigilant to such news and navigate their strategies accordingly.

In recent months, heightened regulatory scrutiny has generated apprehension across the entire crypto market. As they formulate their trading strategies, HBAR investors should account for potential upcoming regulations that could dictate market conditions. By staying informed about regulatory changes and their implications, traders can better position their portfolios in anticipation of market shifts, ultimately enhancing their trading outcomes.

The Future of HBAR: Recovery Potential and Trading Outlook

Looking ahead, the future of HBAR appears to hinge on several critical factors, including its ability to maintain support levels and successfully navigate through ongoing resistance structures. As signs of recovery manifest, traders should focus on the implications this has for long-term price stability. The current technical setup hints at future bullish movements; however, sustained growth is contingent on external factors such as macroeconomic stability and positive regulatory environments.

Moreover, the potential for HBAR to recover and stabilize among robust market conditions will largely depend on dynamics within the larger cryptocurrency market. Price correlational analysis with Bitcoin and trending altcoins can offer insights into HBAR’s positioning. By continuously monitoring these factors, traders can more effectively adjust their strategies, ensuring they are prepared for evolving market trends and price movements.

Frequently Asked Questions

What are the latest Hedera (HBAR) price predictions based on price analysis?

Current Hedera price analysis suggests a moderate recovery movement as HBAR has shown initial signs of stabilization. If it can break above the complex resistance structure, including the 50 EMA and 200 EMA confluence zone, we may see bullish price predictions in the near future.

How does Hedera support and resistance impact HBAR’s price movements?

Hedera’s support and resistance levels play a critical role in price analysis. The green support zone has been defended multiple times, indicating robust buying interest. Conversely, the descending trendline and the EMA confluence act as resistance, complicating breakout scenarios for HBAR.

What are the current market trends for Hedera (HBAR) based on recent charts?

Recent Hedera market trends indicate a potential consolidation pattern where HBAR is forming a local bottom within a significant support area. The positive indicators on the 4-hour chart, such as the RSI above 50 and MACD momentum, hint at potential upward price actions.

What crypto trading strategies can be employed with HBAR price movement?

Given the current HBAR price analysis, traders may consider strategies such as waiting for a confirmed breakout above major resistances, or utilizing short-covering opportunities if HBAR breaches resistance levels, potentially triggering further upward momentum.

Will HBAR’s price recovery be influenced by macroeconomic factors?

Yes, HBAR’s recovery movement is heavily influenced by macroeconomic conditions, including Bitcoin’s dynamics and any regulatory news. Traders should keep an eye on these factors, as they could significantly impact the price direction of Hedera.

| Key Points |

|---|

| Hedera (HBAR) shows signs of stabilization, with a defended green support zone. |

| An upper liquidity zone presents a potential short-term bullish signal. |

| Current price is facing complex resistance from a descending trendline and a horizontal resistance area. |

| The 50 EMA and 200 EMA intersect in the horizontal resistance zone, indicating significant technical importance. |

| Market dynamics, particularly Bitcoin movements and regulatory news, may influence short-term price action. |

| The 4-hour chart shows a small W-pattern within the support zone indicating potential for a trend reversal. |

| A close above the 50 EMA could signal further upward momentum, supported by RSI and MACD indicators. |

| Short liquidations may occur if resistance levels are broken, potentially boosting upward momentum. |

Summary

Hedera price analysis indicates that HBAR shows initial signs of stabilization, with key support levels being tested and defended, creating a critical foundation for potential recovery. While resistance levels persist, particularly around the 50 and 200 EMA intersect, the emerging patterns on both the daily and 4-hour charts suggest a possible bullish outlook if these barriers can be breached. Macroeconomic factors and market sentiment play crucial roles as price movements evolve, determining the overall trend and potential for a sustainable upward trajectory.