Humanoid Robots: Unlocking Growth for Auto Parts Suppliers

Humanoid robots are quickly becoming a prominent focus in the intersection of robotics and automotive industries, signaling an exciting frontier for innovation. As analysts at Morgan Stanley noted, these sophisticated machines could pave the way for significant growth in the humanoid market, much like the rise of electric vehicles transformed traditional auto manufacturing. In fact, major auto parts suppliers such as Sanhua Tuopu Xusheng are strategically positioning themselves to capitalize on this burgeoning field, anticipating a considerable share of the anticipated $800 billion market in China by 2050. With advancements in robotic technology driving the design and functionality of these robots, companies are racing to develop components specifically tailored for humanoids. These developments not only highlight the importance of the robotics sector but also underscore the intricate relationships between automotive advancements and electricity propulsion, fueling wider electric vehicle adoption.

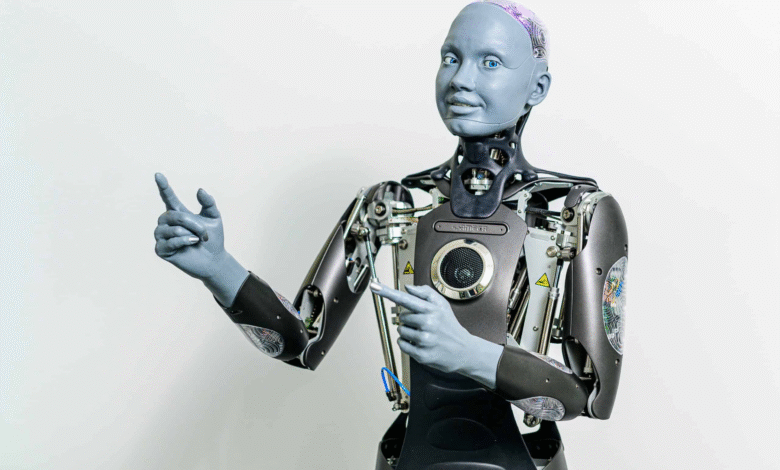

The emergence of human-like machines is revolutionizing various sectors within technology and manufacturing. Often referred to as anthropomorphic robots, these intelligent machines are designed to replicate human appearance and behavior, sharing similarities with advancements in autonomous vehicles. As the automation landscape evolves, industry leaders are increasingly exploring robotic assistance, leveraging the capabilities of these robot models. In this dynamic environment, producers and suppliers are collaborating to meet the challenges and opportunities presented by the growing need for advanced technological components. This synergy between robotics and mobility is not just reshaping our understanding of machines but also encouraging a reevaluation of manufacturing and innovation strategies across multiple industries.

The Rising Demand for Humanoid Robots in the Auto Industry

Humanoid robots are increasingly being recognized as pivotal in the evolution of the automotive sector. As renowned analysts from Morgan Stanley highlight, the integration of humanoids represents a significant growth opportunity for auto parts suppliers, echoing the earlier growth witnessed during the rise of electric vehicles. Notably, with companies like Tesla and Xpeng venturing into humanoid robotics, the market is bracing for an influx of demand for specialized parts that drive these innovations. This movement signals a broader trend towards robotics in manufacturing processes, creating an avenue for auto parts suppliers to diversify their offerings and strengthen their market presence.

The potential impact of humanoid robots on the automotive landscape is profound, with projections indicating a market expansion that could reach $800 billion in China alone by 2050. This growth trajectory offers auto parts suppliers an opportunity to secure a significant share of the manufacturing and assembly processes for these advanced machines. As such, investing in robotic technology is not just a matter of keeping pace; it’s a strategic necessity for suppliers looking to maintain competitiveness in an increasingly automated world.

Understanding the Humanoid Market Potential

The humanoid market is still in its nascent stages, but forecasts indicate that by 2050 it could balloon to a staggering $5 trillion worldwide. According to Morgan Stanley’s predictions, auto parts suppliers stand to gain considerable revenue from this burgeoning sector. Notably, each humanoid robot has an estimated production cost of about $15,000 attributed to components supplied by auto parts manufacturers. This insight underscores the potential financial windfall that lies ahead for suppliers who pivot and adapt their product lines to meet the demands of the humanoid robotics market.

Additionally, with the rising electric vehicle adoption and smart car technologies, the demand for specialized parts like actuator modules—integral for both vehicles and humanoid robots—is expected to expand significantly. The report signals a favorable outlook for tier-1 suppliers such as Sanhua and Tuopu, who are positioned to capture a large share of this market due to their capabilities in providing essential robotic components. As the industry evolves, these companies must leverage their expertise to maintain leadership in the competitive landscape.

Tier-1 vs. Tier-2 Suppliers in Humanoid Robotics

In the humanoid robotics landscape, understanding the differentiation between tier-1 and tier-2 suppliers is crucial for stakeholders. Tier-1 suppliers like Sanhua and Tuopu are well-positioned to capitalize on emerging technologies, as they are already integral to vehicle production and have the capability to pivot towards humanoid component manufacturing. Their established relationships with major automakers provide them with a channel for securing assembly orders, regardless of the technological path chosen by customers. This adaptability illustrates their critical role in the industry’s transformation.

Conversely, tier-2 suppliers, which include companies specialized in lidar or chip production, may face challenges as they seek to enter the humanoid market. While their components are essential, they lack the direct connection to the manufacturing processes that tier-1 suppliers enjoy. As the humanoid market grows, the ability of these suppliers to pivot their offerings will be tested, particularly as more automotive companies explore the integration of robotics into their operations. The competitive edge will lie in who can most effectively transition and innovate to meet the forthcoming demands of the market.

The Impact of Electric Vehicle Growth on Auto Parts Suppliers

The surge in electric vehicle (EV) adoption has laid the groundwork for significant changes in the automotive industry, creating opportunities for auto parts suppliers to evolve alongside these trends. Companies like Sanhua have already begun capitalizing on the intersection of electric and robotic technology, integrating their production capabilities to cater to both markets. This dual-focus approach allows suppliers to leverage existing infrastructure while tapping into the burgeoning humanoid market.

Analysts suggest that the lessons learned from the EV market are directly applicable to the development of components for humanoid robots. For instance, the efficiency and technological advancements companies have adopted for electric vehicles can translate into quicker production cycles and enhanced quality for robotic parts. As manufacturers push for more smart features in vehicles and robots alike, the ability to produce high-quality parts at scale becomes increasingly vital for suppliers striving to maintain competitive advantage.

Challenges and Opportunities in Humanoid Component Production

The transition for auto parts suppliers towards producing humanoid components is fraught with challenges, yet it is accompanied by substantial opportunities. For many suppliers, there is still uncertainty regarding how swiftly and to what extent the human-like robotics industry will expand. Logistics, manufacturing processes, and the ability to source appropriate materials will all play key roles in determining success factors as suppliers venture into this new domain.

Despite the challenges, the integrated approach to manufacturing—drawing from automotive knowledge to create robotic parts—could yield transformative results. Analysts indicate that the demand for components like screws and bearings may not traditionally align with automotive needs, yet they are critical for humanoid robotics. This emerging requirement presents a unique opportunity for machinery companies to diversify and adapt their manufacturing processes, aligning with the anticipated growth in the humanoid robotics sector.

Sanhua’s Strategic Expansion in Thailand

Sanhua’s move to establish a manufacturing facility in Thailand exemplifies a strategic maneuver to mitigate geopolitical risks while positioning itself advantageously within the humanoid robot market. By establishing operations in Southeast Asia, Sanhua aims not only to secure additional production capacity but also to enhance its market presence amidst increasing global competition. This expansion is anticipated to bolster their capabilities in supplying parts for both electric vehicles and humanoid robots, reflecting a comprehensive growth strategy.

Furthermore, this strategic relocation aligns with the rising global expectations for electric vehicle adoption, creating synergies between the two burgeoning sectors. The establishment of the new plant is expected to provide Sanhua with increased agility in response to market demands, allowing them to rapidly scale production and innovate in the humanoid space. Analysts predict that this foresight could yield significant returns, as the company seeks to secure a prominent position in both automotive and robotic technology industries.

The Role of Tuopu in the Humanoid Market

Tuopu’s expertise in manufacturing actuators positions the company as a crucial player in the humanoid robotics landscape. Actuators serve as the joints and muscles that enable movement, making them essential components not only for vehicles but also for humanoid robots. Morgan Stanley projects a sharp growth in demand for actuator modules, highlighting their importance as suppliers vie to capture a sizeable share of this emerging market.

Although Tuopu has adjusted its price target due to fluctuating orders from Tesla, analysts maintain an optimistic outlook based on Tuopu’s potential to innovate and adapt their product lines. The capacity to provide a range of actuator models, including those specifically designed for humanoid applications, underscores Tuopu’s pivotal role in bridging the gap between existing automotive technology and future robotic innovations.

Xusheng’s Adaptation to Emerging Trends

Xusheng’s proactive approach to adapting to the changing landscape of the automotive market is essential as the demand for both electric vehicles and humanoid robots continues to rise. Despite recent challenges regarding revenue from key clients, the company is well-positioned to supply structural components crucial for humanoid robotics. Their ability to pivot and produce quality parts indicates a willingness to embrace industry changes, which may prove advantageous in the long run.

Moreover, as Xusheng navigates the complexities of market demands, the company’s focus on structural integrity in robotics aligns with overall trends in manufacturing advancements. With the integration of robotics into factories, suppliers like Xusheng will likely see increased relevance and demand for their components. By committing to continuous innovation and adapting their offerings, Xusheng can carve out a niche in the evolving market landscape.

Navigating U.S.-China Relations in Robotics Manufacturing

As the global landscape shifts towards increased automation and robotics, U.S.-China relations pose significant challenges for auto parts suppliers looking to enter the humanoid market. Heightened geopolitical tensions may lead firms to reconsider sourcing strategies, potentially favoring more costly alternatives over Chinese parts. This circumstantial shift not only affects pricing but also the availability of components that are integral to the production of humanoid robots.

However, this situation also presents opportunities for innovation and strategic partnerships within the industry. Companies that can mitigate risks and maintain quality may find themselves at a competitive advantage. As suppliers navigate these complex dynamics, fostering relationships with international clients while remaining adaptable will be key to thriving in the face of uncertainty in global trade.

Frequently Asked Questions

What role do humanoid robots play in the growth of auto parts suppliers?

Humanoid robots are expected to bring significant growth to auto parts suppliers, with analysts estimating that these suppliers could capture 47% to 60% of spending on parts and materials for humanoid production. This mirrors the advantages that auto parts suppliers gained from the electric vehicle adoption and smart cars market, creating new revenue streams in the humanoid market.

How is the humanoid market expected to impact robotic technology by 2050?

The humanoid market is projected to expand significantly by 2050, reaching $800 billion in China and $5 trillion globally. This growth indicates a strong future for robotic technology, driven by advancements in humanoid robots that could revolutionize various industries by integrating them into everyday applications.

What are the expected benefits for companies like Sanhua and Tuopu in the humanoid market?

Sanhua and Tuopu stand to benefit greatly in the humanoid market, as their components like actuator modules and other mechanical parts are crucial for humanoid robots. Analysts predict substantial revenue potential, with Tuopu anticipated to supply actuator models that are essential to the movement of humanoids, while Sanhua is set to capture a significant market share of humanoid actuator modules.

How do auto parts suppliers transition from electric vehicles to humanoid robots?

Transitioning from electric vehicles to humanoid robots requires auto parts suppliers to adapt their production lines and focus on components that are unique to humanoid designs, such as actuators and structural parts. Suppliers like Xusheng are already exploring the production of torso structural parts specifically for humanoid robots, indicating a shift in manufacturing priorities.

What challenges do auto parts suppliers face in the humanoid robotics industry?

Auto parts suppliers face challenges such as the complexity of humanoid robotics production, the speed at which the market is growing, and potential geopolitical risks. There are concerns about maintaining competitiveness against international firms and adapting to the unique needs of humanoid robots while navigating U.S.-China tensions that may affect supply chains.

| Key Points |

|---|

| Humanoid robots represent a new growth opportunity for auto parts suppliers, projected to significantly increase demand and market share. |

| Morgan Stanley analysts predict that the humanoid market could reach $800 billion in China and $5 trillion globally by 2050. |

| Actuators are crucial components for humanoid robots, similar to their functions in vehicles, with significant revenue potential for suppliers like Tuopu and Sanhua. |

| Two self-identified Chinese suppliers to Tesla, Tuopu and Sanhua, have been upgraded by analysts, highlighting anticipated growth in this area. |

| Challenges include competition from international suppliers and potential geopolitical issues that could affect cost structures. |

Summary

Humanoid robots are set to play a transformative role in the future of automotive technology. With auto parts suppliers positioned to gain substantially from the rise of humanoid robots, the industry is bracing for significant growth in both demand and market share. Analysts estimate a promising future, with market valuations soaring to unprecedented levels. As such, the sector’s evolution will be crucial for both innovation and economic expansion in the coming decades.