Hyperbridge Launch Boosts Hyperliquid Open Interest to $5.6B

Hyperbridge is set to revolutionize the decentralized trading landscape by connecting external blockchain assets to Hyperliquid’s rapidly expanding ecosystem. Recently, Hyperliquid reached an impressive open interest high of $5.6 billion, underscoring the platform’s growing significance in the realm of decentralized exchanges (DEX). Powered by Layerzero’s cutting-edge interoperability solutions, Hyperbridge allows for seamless cross-chain trading, enabling users to transfer assets like USDT0 and USDe with ease. This innovative tool not only enhances user experience but also encourages a broader participation in decentralized derivatives trading. As more developers and issuers recognize the potential of Hyperbridge, the future of asset trading in the DeFi sector looks increasingly promising.

Introducing Hyperbridge, an innovative interoperability solution that aims to facilitate asset transfers across various blockchain networks and integrate them within Hyperliquid’s innovative trading framework. This groundbreaking mechanism simplifies cross-network exchanges, allowing users to seamlessly engage in decentralized trading without operational barriers. By harnessing Layerzero’s advanced protocols, Hyperbridge serves as a dynamic bridge for users and developers, fostering a more efficient decentralized exchange environment. High-speed trading on platforms like Hyperliquid is being transformed through this technology, as it enhances asset liquidity and promotes greater participation in decentralized finance (DeFi). With the recent surge in open interest, Hyperbridge is positioned at the forefront of the evolving landscape of asset trading and decentralized derivatives.

Understanding Hyperbridge: A Game-Changer in Cross-Chain Trading

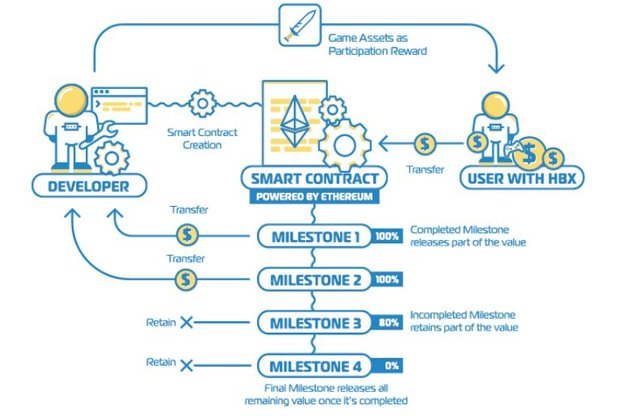

Hyperbridge, launched by Layerzero, is a revolutionary solution that enhances cross-chain trading by seamlessly connecting assets across different blockchain networks and the Hyperliquid platform. With the increase in blockchain usage and the diversification of assets, the need for interoperability has never been more critical. Hyperbridge leverages advanced technology to enable swift, efficient transfers between Layerzero-supported chains, making decentralized trading easier and more accessible for traders and developers alike.

For decentralized exchanges (DEXs) like Hyperliquid, Hyperbridge represents a significant advancement, allowing instant asset transfers and fostering a more integrated trading environment. This interoperability is crucial in a landscape where trading often depends on multiple platforms. Hyperbridge serves as a bridge between these platforms, allowing users to conduct cross-chain transactions without the typical delays and complexities associated with traditional methods.

Layerzero Protocol: Enhancing Decentralized Trading with Hyperbridge

The Layerzero protocol facilitates a smooth communication channel between various blockchain networks, allowing Hyperbridge to function effectively. By employing Ultra Light Nodes and decentralized oracles, Layerzero ensures that data integrity and transaction reliability are maintained across different blockchains. This is particularly beneficial for users engaged in decentralized trading, as it minimizes the risk of errors and optimizes transaction speed.

With Hyperbridge integrated into Hyperliquid’s decentralized ecosystem, traders can now enjoy the advantages of cross-chain trading without sacrificing efficiency. Layerzero’s advanced technology supports a high throughput of transactions, empowering traders to act swiftly in the fast-paced world of decentralized finance (DeFi). The ability to transfer assets like USDT0, USDe, and PLUME directly to Hyperliquid not only enhances liquidity but also expands market opportunities for traders.

Hyperliquid’s Record Open Interest: What It Means for Traders

The recent surge in Hyperliquid’s open interest to $5.6 billion is a telling sign of its growing reputation in the decentralized trading space. This record high indicates increased confidence from both institutional and retail investors in using Hyperliquid for futures trading. As more participants flock to the platform, it solidifies Hyperliquid’s position as a leader in decentralized exchanges, particularly in derivatives trading.

This milestone also highlights the impact of technologies like Hyperbridge, which facilitate easier access to decentralized trading platforms. With the combination of Hyperliquid’s advanced trading features and Hyperbridge’s interoperability, users can capitalize on extensive trading opportunities while enjoying the benefits of a secure and efficient trading environment.

Decentralized Finance Trends: The Rise of Interoperability

As the Decentralized Finance (DeFi) landscape evolves, interoperability becomes a critical trend shaping the future of financial trading. Platforms like Hyperliquid are at the forefront of this movement, demonstrating how cross-chain capabilities can enhance user experience and broaden market reach. By facilitating asset transfers through Hyperbridge, Hyperliquid positions itself as a major player in the DeFi revolution.

The push for interoperability is not just about connecting different blockchains; it’s about creating a seamless trading experience for users. Hyperliquid’s approach to integrating Hyperbridge simplifies the process of token deployment and provides developers with the necessary tools to list new assets with ease. This encourages innovation within the DeFi space, allowing developers to focus on creating value-added services rather than grappling with the technical challenges of connecting disparate blockchain networks.

How Hyperbridge Empowers Developers in the DeFi Space

Hyperbridge represents a significant leap forward for developers seeking to create innovative solutions within the DeFi ecosystem. The Layerzero protocol’s OFT standard allows developers to deploy tokens on Hyperliquid with minimal friction, tapping into a robust liquidity pool. This one-click process not only reduces technical barriers but also facilitates a quicker go-to-market strategy for new projects.

As Hyperliquid continues to grow its comprehensive ecosystem, developers using Hyperbridge can focus on building unique financial applications while enjoying access to millions of potential users. This synergy paves the way for the next generation of DeFi tools that can effectively compete with traditional centralized exchanges, thereby transforming how trading is conducted in the digital asset space.

The Future of Decentralized Exchanges: Why Hyperliquid Leads the Way

In the ever-evolving world of finance, decentralized exchanges are becoming increasingly prominent, and Hyperliquid is leading this charge. With advances such as Hyperbridge, which facilitate cross-chain trading, the platform is redefining what a DEX can achieve. This future-oriented design allows Hyperliquid to attract a diverse range of traders looking for speed, efficiency, and trustless transactions.

Hyperliquid not only enhances trading capabilities with features like zero gas fees and an on-chain order book, but it also integrates important technological innovations that keep pace with market demands. The platform’s commitment to providing a non-custodial trading experience ensures that users maintain control of their assets while enjoying the benefits of high transaction efficiency, making it a bright beacon in the transformative landscape of decentralized finance.

Increasing Adoption of DeFi Platforms: The Role of Hyperbridge

The integration of Hyperbridge within Hyperliquid serves as a testament to the increasing adoption of decentralized finance platforms. As more users recognize the benefits of decentralized trading—such as transparency, lower fees, and reduced reliance on intermediaries—tools like Hyperbridge become vital. They simplify the process of entering the DeFi space and increase overall participation.

With the demand for DeFi platforms growing, Hyperbridge’s ability to streamline asset transfers paves the way for more user-friendly experiences, encouraging both novice and seasoned traders to explore decentralized exchanges. By lowering the barriers to entry and enhancing the trading experience, Hyperbridge can help accelerate the mainstream acceptance of decentralized finance.

Expanding Accessibility: Token Listings on Hyperbridge

Hyperbridge is not just about transferring assets; it also facilitates the listing of new tokens on Hyperliquid’s platform through an accessible one-click interface. This functionality ensures that more projects can gain exposure to a larger audience without the complex technical processes that typically hinder token launches. As a result, the liquidity of the exchange increases, making it more appealing to traders.

Furthermore, the ability for developers to easily list tokens means that the ecosystem can adapt and evolve rapidly to meet the changing demands and trends of the market. Hyperbridge plays a critical role in democratizing access to trading opportunities, allowing any asset issuer to tap into Hyperliquid’s extensive trading volume and user base.

The Synergy of Technology and Trading in Hyperliquid’s Future

As technology continues to advance, the synergy between trading platforms like Hyperliquid and innovative solutions such as Hyperbridge heralds a new era in decentralized finance. The emphasis on creating a fast, efficient, and user-friendly trading experience presents unprecedented opportunities for growth and engagement within the crypto community. Hyperliquid’s unique features are designed to attract diverse user groups while maintaining the principles of decentralization.

By harnessing cutting-edge blockchain technology, Hyperliquid is poised to not only sustain its competitive advantage but also expand the possibilities of what decentralized trading can achieve. As the platform evolves, it will likely integrate further enhancements that make trading more accessible, efficient, and secure for users across the globe.

Frequently Asked Questions

What is Hyperbridge and how does it enhance cross-chain trading on Hyperliquid?

Hyperbridge is an interoperability solution developed by Layerzero that connects external blockchain assets to Hyperliquid’s decentralized trading ecosystem. It facilitates seamless asset transfers, allowing users to engage in cross-chain trading effortlessly. This integration plays a crucial role in boosting trading volumes by simplifying the process of managing assets across different blockchains.

How does Layerzero’s Hyperbridge contribute to decentralized trading?

Layerzero’s Hyperbridge enhances decentralized trading by enabling users to easily bridge assets from over 50 supported blockchains directly into Hyperliquid’s DEX. This increased interoperability empowers traders with more options and flexibility, facilitating more inclusive and accessible decentralized trading experiences.

What makes Hyperliquid a significant platform for decentralized derivatives trading?

Hyperliquid stands out as a significant platform for decentralized derivatives trading due to its innovative use of Hyperbridge, which allows rapid asset transfers and supports high transaction speeds. The integration of Layerzero’s technology also enables the platform to process up to 100,000 orders per second with zero gas fees, making it highly efficient and competitive in the decentralized trading landscape.

What assets can be bridged using Hyperbridge to Hyperliquid?

With Hyperbridge, users can bridge various assets such as USDT0, USDe, and PLUME from any Layerzero-supported blockchain directly into the Hyperliquid ecosystem. This functionality not only simplifies trading but also enhances liquidity for users participating in decentralized exchanges.

How does Hyperbridge simplify token deployment for developers?

Hyperbridge simplifies token deployment for developers by utilizing Layerzero’s OFT standard, which allows projects to access Hyperliquid’s liquidity without facing technical complexities. This streamlined process encourages more token issuers to join the platform and expands the availability of diverse trading options for users.

What advantages does Hyperliquid offer compared to traditional centralized exchanges?

Hyperliquid combines the speed associated with centralized exchanges with the transparency of decentralized finance (DeFi). Through Hyperbridge, it ensures efficient asset transfers and a non-custodial trading environment, which fosters user control and confidence while providing the benefits of a high-frequency trading platform.

How is Hyperbridge impacting the overall DeFi landscape?

The launch of Hyperbridge is significantly impacting the DeFi landscape by prioritizing interoperability among decentralized exchanges. This development aligns with the increasing demand for seamless asset management across multiple networks, positioning Hyperliquid as a leader in enhancing decentralized trading capabilities within the broader crypto market.

Where can users find more information about Hyperbridge and its features?

Users can find more information about Hyperbridge and its features by visiting the official website at hyperbridge.xyz. The site provides comprehensive details on asset bridging, supported tokens, and how developers can participate in listing new tokens within the Hyperliquid ecosystem.

| Key Point | Description |

|---|---|

| Hyperbridge Launch | Layerzero has launched Hyperbridge to enhance interoperability between blockchains and Hyperliquid’s ecosystem. |

| Open Interest Highs | Hyperliquid achieved an all-time high open interest of $5.6 billion, indicating significant growth in decentralized trading. |

| Cross-Chain Trading | Hyperbridge facilitates easy transfers of assets like USDT0, USDe, and PLUME across Layerzero-supported chains. |

| High-Speed Trading | Hyperliquid runs on HyperEVM, capable of processing up to 100,000 orders per second with no gas fees and efficient order book features. |

| OFT Standard | Developers can use Layerzero’s OFT standard for simplified token deployments on Hyperbridge. |

| DeFi Interoperability | The launch of Hyperbridge is a response to the growing need for interoperability in DeFi, aligning with Hyperliquid’s transparency goals. |

| Asset Listing | Token issuers can list new assets seamlessly on Hyperbridge, broadening access to Hyperliquid’s extensive liquidity. |

Summary

Hyperbridge is a groundbreaking interoperability solution that enables seamless connection between external blockchain assets and Hyperliquid’s decentralized trading ecosystem. With its recent achievement of $5.6 billion in open interest, Hyperliquid continues to solidify its position as a leader in the decentralized derivatives market. By leveraging Hyperbridge, users can easily transfer a variety of assets, enhancing cross-chain trading while maintaining the platform’s renowned efficiency and transparency. As decentralized finance evolves, Hyperbridge stands out as an essential tool that aligns with the industry’s growing emphasis on interoperability.